Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

No meaningful u-turn for stocks any time soon

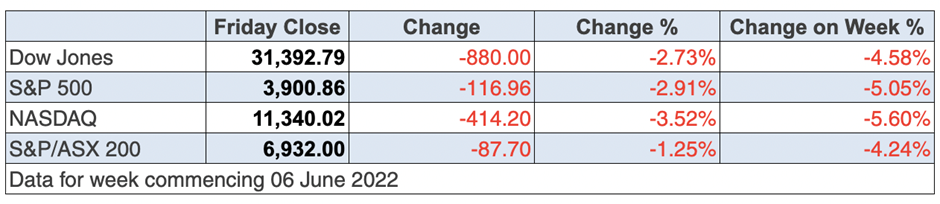

Those praying for a turnaround of sentiment didn’t have their prayers answered by the latest US inflation reading, with the CPI coming in at its biggest reading in 40 years! This coincided with the closely watched University of Michigan consumer sentiment index that printed below expectations. In fact, it hit a record low.

The May CPI was a big 8.6%!

Not surprisingly, the Dow slumped over 700 points in early trade and the Nasdaq gave up over 3%, as interest rate guessers now tip the September Fed decision will result in another 0.5% rise. July was already a done deal with the Fed seemingly committed to it, but September was thought to be a 0.25% rise or maybe no change, linked to a mindset of ‘wait-and-see what’s happening to inflation’.

This has dashed the hopes of those who saw indicators that inflation was peaking. They’ll have to reassess what they’re watching. Of course, these signs of inflation peaking could be real but they don’t mean they translate to lower inflation stats immediately.

I’ve done a lot of reading about economics since my days as lecturer-in-charge of Applied Macroeconomics at the University of NSW, and then over three decades of covering the economy for some of the country’s most prominent news outlets in the country. My history of economic readings tells me that one month’s numbers don’t mean a real lot.

Even before the Ukraine war and China’s re-entry into lockdowns, I told you that inflation wouldn’t be dissipating until September or October, so having high hopes for a June number was exactly that — high hopes.

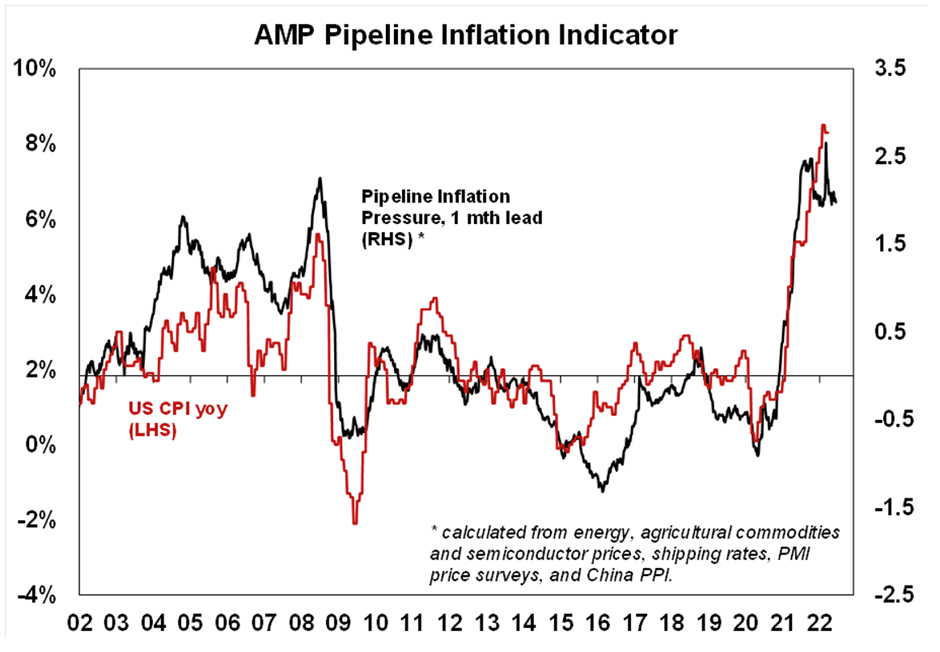

In contrast, I like what AMP’s Pipeline Inflation Indicator is saying about future inflation. Here’s the related chart:

And this is what AMP economist Diana Mousina sees: “The market is still grappling with the question as to whether inflation has peaked (in annual terms) or not. Some signs are improving: container freight costs are down 27% from late 2021 levels, fertiliser prices are 30% below March highs, lumber prices are 61% below March levels and metals prices have fallen generally. This is in line with the continued moderation in our inflation pipeline indicator”.

I’m writing this from Antibes in the south of France and the guy who runs the restaurant we went to last Thursday evening said tourism numbers now are even better than in pre-pandemic times. Anyone trying to book an overseas flight knows that airlines are packed. Normalisation is creeping up on us and with it, inflation will also normalise. It will remain high for a while as unions and workers with power angle for (and get) pay raises, but inflation will fall, interest rate fears will lessen and stock prices will take off again.

Right now, the S&P 500 is off about 18% year-to-date, while our S&P/ASX 200 is down 8.67%. Remember that 4.2% of that fall came when the RBA shocked the market with a 0.5% hike last Tuesday.

We’re in the hands of central bankers and can only hope they play their interest rate rise strategies correctly. Right now, the market is betting they’ll screw up and create a recession, but I trust the market’s judgement on these matters less than central bankers, who haven’t always covered themselves in glory.

That said, the stock market is happy with the worst-case scenario narrative, which is driving stock prices down, creating buying opportunities with some quality companies.

It will take time but I bet I’m right, and it could show up before year’s end. My next story will address optimistic possibilities for the end of this year. I have to do it because everyone else is locked into doomsday scenarios that may well be way too excessive.

To the local story, and as I said above, the S&P/ASX 200 lost 306 points (or 4.2%) this week to finish at 6932. It was heavily driven by the banks that were tipped to face rising bad debts because of the RBA’s 0.5% rate rise. This rise is bound to be followed by a few more hikes that could result in some borrowers getting into repayment trouble.

Of course, this is pessimistic speculation based on best guesses, and in coming months we’ll see how accurate these guesses are. CBA lost 10.77% to finish the week at $93.78, NAB gave up 10.09% to $28.06, ANZ dropped 7.61% to $23.07 and Westpac slumped 12.83% to $20.85. I’m sure the bank CEOs used expletives as they assessed the market’s over-the-top reaction.

Think about this: what if the RBA’s bold move results in fewer rate rises because it shocks and awes consumers to help ease inflation? Then these sell-offs are excessive, so do with that what you will.

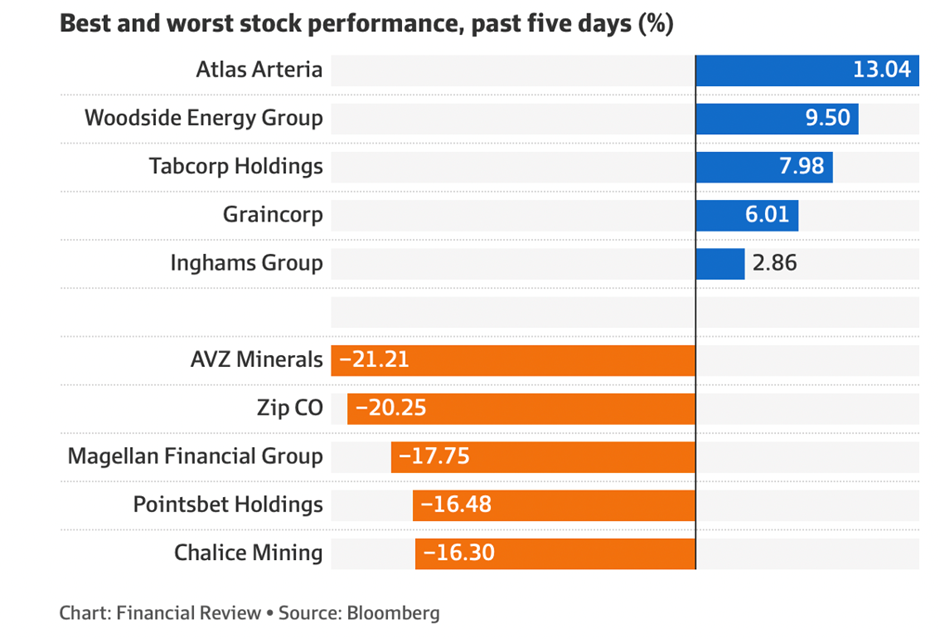

Tech stocks copped it and Magellan didn’t get an uplift out of the story that Hamish Douglas was returning as a consultant to the operation.

In no way am I ignoring the possible worst-case scenarios that could keep stocks down for longer than I’m predicting, but, after sell-offs, markets rebound. And since 1987 the average duration of a correction is about 155 days. The US hit correction territory about mid-February so we have a couple of months to go before we hit that average. And it’s three and two-thirds months before September ends. That’s a positive for my “I can’t wait for September” scenario.

All prices and analysis at 11 June 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.