Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Nabtraders have been waiting for this sell off

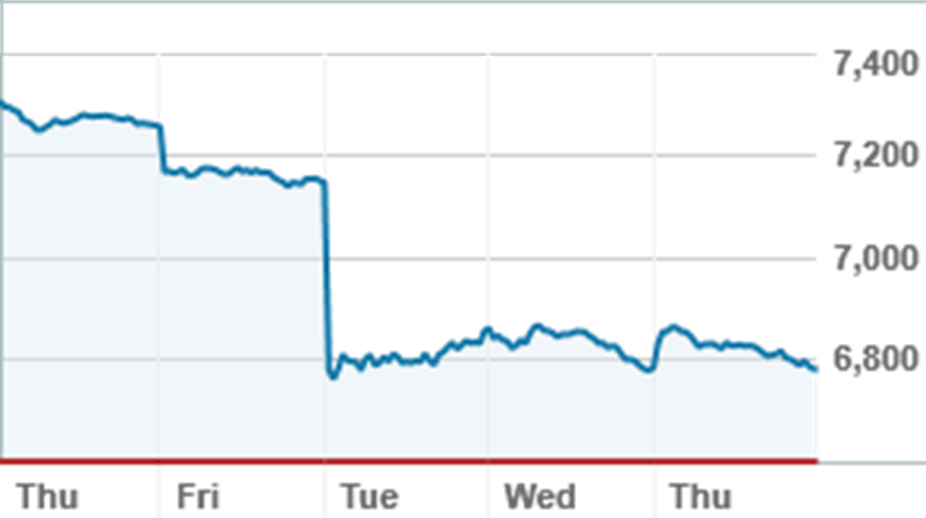

The oft-misquoted Hemmingway ‘slowly, and then all at once’ reference seems to apply to the markets’ reaction to rising rates this year – while cash futures have priced in rate hikes far higher and faster than central banks were willing to acknowledge, and bond markets have fractured, the ASX had only fallen 5% from its highs until last week. Inflation figures in the US, however, have finally shaken investors out of their complacency – the S&P500 has fallen more than 20% year to date despite a 1.5% rally after the Federal Reserve raised rates by 75bpts, the Nasdaq100 is down 28% over the same timeframe and the ASX200 is down more than 6% over five days. Such is the sudden concern that rising rates will tip the economy into recession, that the ASX200 lost more than 5% at the open on Tuesday. (It was closed for the Queens Birthday public holiday on Monday).

S&P ASX200 over five days

Source: nabtrade

nabtrade investors have clearly been waiting for the sell off – while cash balances have climbed over the last twelve months, they have fallen over the last week as investors have enthusiastically bought the dip. The biggest enthusiasm has been saved for the banks, with Westpac (WBC) still the favourite. Volumes in all four have been enormous, with WBC out in front, ANZ (ANZ), National Australia Bank (NAB) and Commonwealth Bank (CBA) all finding buyers.

Westpac (WBC) shares over twelve months

Source: nabtrade

Interestingly, the buy/sell split was not as strong as previous ‘dips’, with buys less than 80% over total value, and less than 70% in some cases, suggesting some investors are concerned that the market has further to fall.

Macquarie Group (MQG) has been a popular buy under $180 in recent months; the investment bank is a favourite of long term holders who like to pick up more when the opportunity presents itself. In this sell off, as the price has fallen to $165, some holders have been selling, leaving the overall trading mixed.

Resources have featured heavily after financials, with Fortescue Metals Group (FMG) still a high value traders’ favourite, and BHP (BHP) a modest buy. Lithium stocks, particularly Pilbara Minerals (PLS) and Core Lithium (CXO), still under pressure despite a small bounce on Thursday, have been popular buys, in reasonable volumes given the overall frenzy.

Finally, accumulators are buying exchange traded funds (ETFs) – the most popular is a simple ASX200 (VAS), but the Nasdaq 100 index (NDQ) and gold (GOLDA) have also featured heavily.

In international trading, trends were similar. The ever popular Tesla (TSLA.US) saw a small number of buys, albeit in small trades, while Amazon (AMZN.US), Apple (APPL.US) and Microsoft (MSFT.US) were all sold. Even Berkshire Hathaway (BRK.US) saw selling, while one brave buyer took a position in Microstrategy (MSTR.US), the US company with the entirety of its assets invested in Bitcoin. The Bitcoin price has fallen 25% in five days.

Analysis as at 16 June 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.