Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Is the worst of this stocks sell-off over?

There is a no more important question for any investor to ask right now than this: Have we seen the bottom of this stock market sell-off?

Earlier last week (before the big bounce-back of the Nasdaq late in the week, which racked up a 6.45% gain over the five trading days) legendary bear Michael Burry, who was the star of the book and movie The Big Short said this was like 2008 and we’re “watching a plane crash!”.

Burry could be right but from Tuesday last week, the Nasdaq actually rose 9%, so could the ‘pilot’ of Burry’s ‘plane’ be pulling out of its dive? And some big beaten-up tech companies had a very promising week, which makes you think that smart money is saying the sell-off has been overdone.

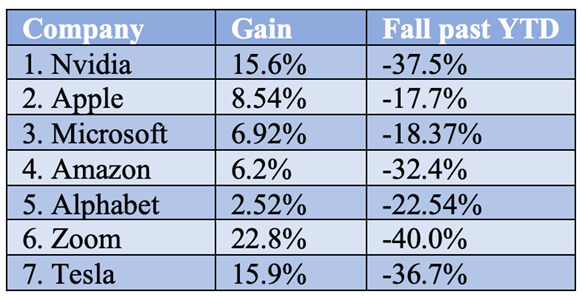

Here was the week-to-date showing:

Source: nabtrade

Of course, it’s worth reminding you that if Zoom has fallen 40% then it needs to rise 67% to get back to the $184 it was when we kicked off 2022. That said, it’s been a promising comeback. Really helping was the better-than-expected April inflation number out on Friday, with the headline number rising by 0.2%.

What I’m talking about is the Fed’s preferred inflation indicator called the Personal Consumption Price Index (or PCE). The core PCE rose by a tame 0.3% for the third month in a row, adding to the arguments of the bulls that inflation might have peaked. And the annual core PCE has dropped from 5.2% to 4.9%, which was the second month in a row that this has happened.

It’s why bond yields fell this week signalling that this improving inflation data (if it’s sustained) might make the Fed less aggressive with its interest rate rises, and that’s what the stock market yearned to hear, especially tech stock buyers.

But let’s be real, it’s still early days, though the signs are looking promising.

Here are some facts that demand comprehension:

- The S&P 500 Index has had five rallies of 5%+ since January 3, when the nightmare on Wall Street began.

- Using the recent intraday low, the Index has bounced 8%.

- The bounce over the past three days was broad-based, which is a good sign.

- This could be a bear market rally, though the Index has not actually gone down 20% or worse, so technically we could be in a bull market correction. Of course, it’s in a bear market for the Nasdaq.

- The US jobs might be softening faster than the Fed thinks, with data from Indeed (which is more up-to-date than the Jolts job data that the Fed looks at) indicating the labour market is losing its tightness, which could be a signal that the Fed’s efforts to slow the US economy down is working faster than expected.

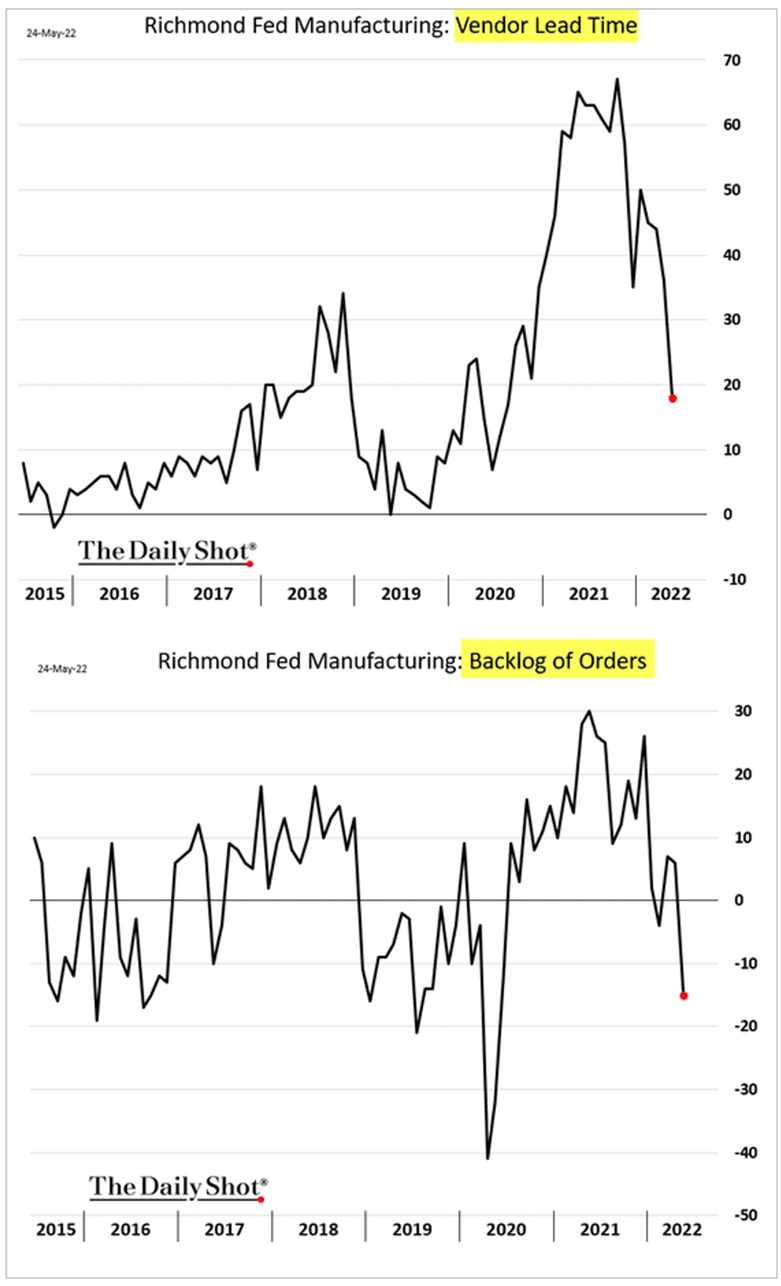

- This observation from Percy Allan after the US-based Richmond Manufacturing Lead Time chart came out positive: “Supply bottlenecks are disappearing, which means suppliers will have a tough time raising or even maintaining prices.”

Also, the falling backlog orders chart was saying things are on the mend compared to late 2021 and early 2022.

Source: The Daily Shot

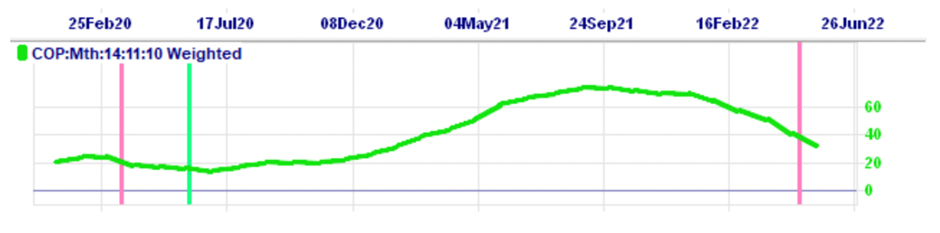

Here’s the latest chart for the US stock market:

Source: nabtrade

Percy says: “The S&P500’s long-term Coppock momentum indicator never went negative during the flash crash of February/March 2020. Indeed, the Coppock reached its highest level on record in August 2021 but has since fallen sharply though remains remarkably strong”.

Investopedia says: “The Coppock Curve is a long-term price momentum indicator used primarily to recognize major downturns and upturns in a stock market index”.

In addition: “The zero line of the Coppock Curve acts as a trade trigger; buy when the CC moves above zero, and sell when the CC moves below zero. Investors can use the sell signal to close out their long positions and then re-initiate long positions when CC crosses back above zero.”

While this is a nice positive to see, ultimately the future for stocks will rest on the course of inflation and how the Fed in particular raises interest rates. The bond market this week virtually said that its own call on future interest rates was too full-on, as I’ve been predicting/hoping.

As a consequence, I like the following from AMP’s Shane Oliver on inflation. “There are some positive signs that inflationary pressures may be cooling:

- Business surveys are reporting improving delivery times, reduced backlogs and some topping in input and output price pressures.

- US retailers have seen an increase in inventories presumably as spending rebalances back to services and production catches up.

- There are some signs of a slowing in hiring in the US with initial jobless claims starting to trend up.

- Amazon saying it has gone from understaffed to overstaffed and giving up space, and Lyft is pausing hiring.

- Wages growth in the US looks to have peaked late last year.

- US core private final consumption (PCE) inflation fell in April to 4.9% YoY from 5.2% and it has increased by 0.3% MoM for three months in a row, which is well down from last year’s highs.

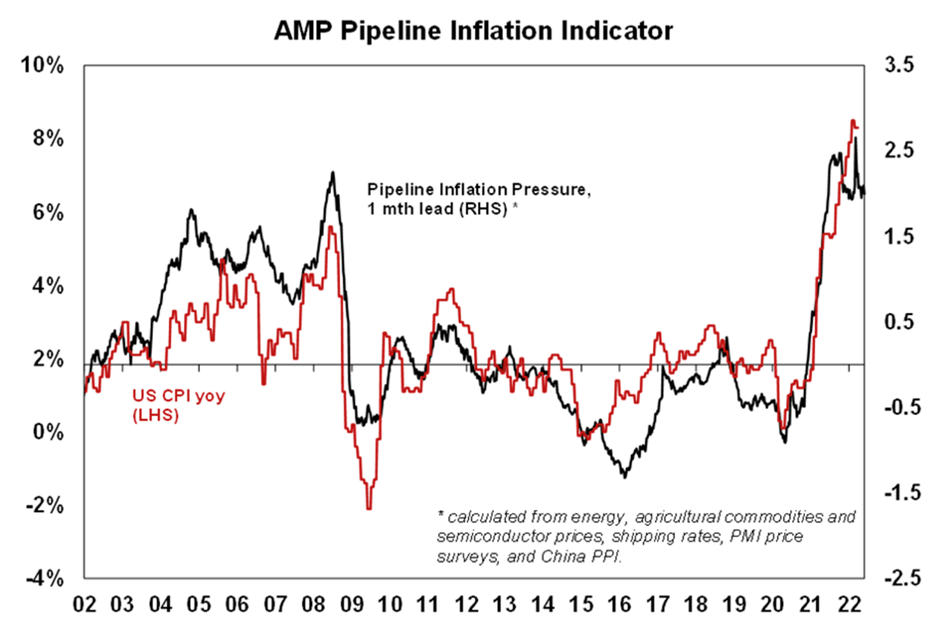

- And AMP’s Pipeline Inflation Indicator continues to point to peaking in US inflation. The rollover in core US inflation does little to change the outlook for Fed tightening at its next two meetings, as inflation is still too high. But at least it no longer needs to keep getting more hawkish, which in turn has seen market expectations for the Fed Funds rate for year-end fall from 2.75% to 2.64% over the last week.

Source: AMP

All this positive news about inflation and what it might mean for interest rates powered stocks up last week. Now the market will look to more economic data and comments from the Fed to either keep on buying stocks or make this rally the fifth that has failed to go the distance since the start of 2022.

I can’t tell you to start buying but I do know when China is seriously out of lockdown and then the Ukraine war ends, there will be a huge global economic rebound that will reward the patient long-term investor.

As an Aussie, I’m keen to see the March quarter economic growth number, which might come in at 2.3% YoY. But I reckon Friday’s US jobs report will prove to be far more important for what stocks do, not this week, but next. If the US jobs market shows itself to be softening, bond yields will drop again and tech stocks will go for another ride higher.

This week could see some profit-taking in tech stocks because that’s what short-term players often do, but I wouldn’t be surprised if we’ve seen the worst of this sell-off.

All prices and analysis at 30 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.