Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Investment markets & key developments: reliable indicators yet to signal imminent recession

Share markets tumbled again over the last week as markets moved to anticipate even more aggressive rate hikes from central banks after the release of higher-than-expected US inflation data.

For the week (so far) global shares are down about 6% and Australian shares are down about 7%. The fall in the Australian share market was led by IT stocks which have been under pressure all year, but also resources, retailers and financials as worries increased about the economic outlook. The rising risk of global recession also led to falls in oil, metal and iron ore prices. Bond yields generally rose to new highs with the Australian 10-year bond yield rising above 4% for the first time since 2014. While the AUD initially plunged below $US0.69, it clawed back above $US0.70 as the USD fell.

From their all-time highs last year or early this year US shares have now fallen 24%, global shares have fallen 21% and Australian shares have fallen 15.5%.

As always the most speculative “assets” are getting hit the hardest including the pandemic winners of tech stocks (with the Nasdaq down 34%) and cryptocurrencies (with Bitcoin down 70% from its high last year). Cryptocurrencies surged with semi-religious fervour around the marvels of blockchain, decentralised finance, NFTs, freedom from government, promises that it's an inflation hedge, etc, only to become a bandwagon fuelled by speculative extrapolation on the back of easy money and low interest rates. Trying to disentangle its true fundamental value from the speculative mania becomes next to impossible. And now that the easy money and low rates are reversing, the rug is being pulled out from under the mania.

We remain of the view that a global recession can be avoided but with central banks now hiking rates aggressively the risks have increased to the point that its now close to 50/50. Either way, it’s still too early to say that shares have bottomed.

First, the bad news:

- Despite widespread expectations to the contrary, US inflation has gone to a new high and other countries including Australia (with its partly home-grown electricity crisis) are still likely to see higher inflation ahead too. Energy prices – particularly for oil - are yet to put in a decisive top and it's hard to be confident that the worst is over for inflation until they decisively stop rising.

- The Fed has now stepped up rate hikes to 0.75%. While Fed Chair Powell said he doesn’t expect 0.75% hikes to be “common” and that the Fed will be “flexible”, the Fed is now signalling (via its so-called dot plot of Fed officials’ rate hike expectations) more than 1% higher rates this year and next than it was just 3 months ago and still needs to see “clear and convincing” evidence of falling inflation.

Source: US Federal Reserve, Bloomberg, AMP

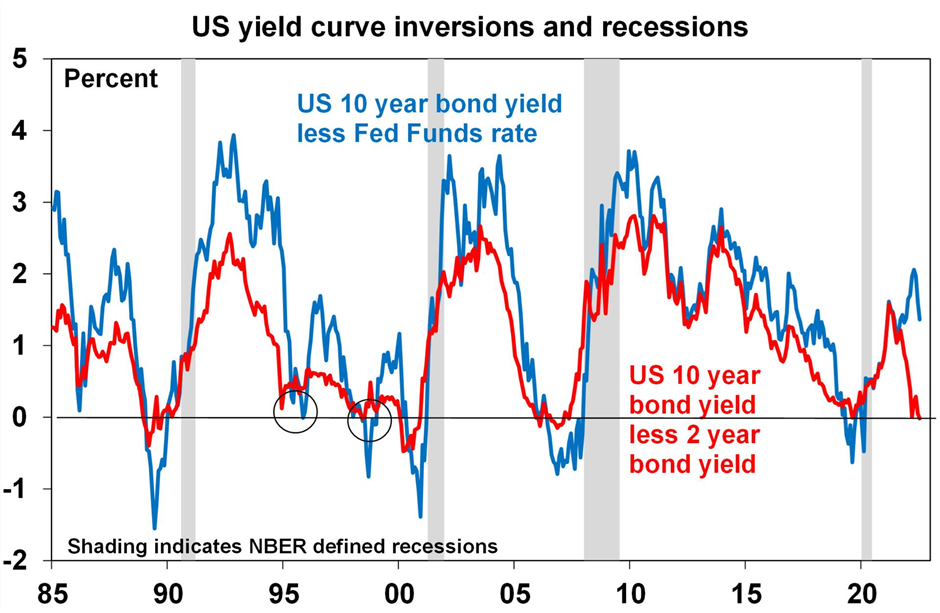

- Ever more Fed tightening is boosting the risk of a US recession with parts of its yield curve flirting with inverting (ie short-term rates above 10-year bond yields) again.

Source: Bloomberg, AMP

- While the ECB has announced measures to combat “fragmentation” (or a blowout in bond yields in countries like Italy relative to Germany as we saw in the Eurozone debt crisis) – with the flexible reinvestment of funds from maturing bonds and the development of a mechanism to combat spread blowout – this really just clears the way for more aggressive ECB rate hikes.

- The Bank of England raised its policy rate by another 0.25% to 1.25% and now expects inflation to peak slightly above 11% this year and remained hawkish, indicating it's prepared to act more forcefully if necessary, despite expecting the economy to contract this quarter.

- The Swiss National Bank hiked rates by an unexpected 0.5% taking them to -0.25%. Taiwan’s central bank also raised its policy rate albeit by less than expected.

- RBA Governor Lowe in a TV interview indicated that the Bank now sees inflation rising to 7%, that it “will do what is necessary” to bring it back to 2-3% and reiterated that “it's reasonable … the cash rate gets to 2.5%”. Taken together with another strong jobs report for May it leaves the RBA on track to hike again at its July meeting by another 0.5%.

While the move by the Fed to hike by 0.75% at its June meeting suggests a risk that the RBA may do the same as it faces similar pressures, we lean toward the view that it will stick to 0.5% moves given the RBA meets monthly whereas the Fed meets 6-weekly, with inflation and wages pressures not as strong here as they are in the US.

We continue to see the peak in the cash rate being about 2.5%, but it could come earlier given the RBA’s shift towards a more aggressive approach.

Market expectations for the cash rate to rise to nearly 4% by year-end and above 4% next year still look too hawkish though.

A rise to 4% for the cash rate would see average discounted variable mortgage rates rise to about 7.5% (from about 3.5% in April). When combined with the surge in fixed mortgage rates (which have already gone from about 2% to about 5%) it would likely cause real problems for consumer spending, a big spike in mortgage stress (as debt interest payments will more than double from earlier this year) and push property prices down by 20-30%. This indicates it's unlikely to happen as it would crash the economy and ultimately push inflation back well below the RBA’s target.

On the positive side though:

- Major central banks are serious about controlling inflation and while this comes with short-term risks, given the 1970s experience it's arguably positive for the longer-term both from an economic perspective (as high inflation is ultimately bad for productivity and unemployment) and for investment markets.

- There are more indications that the US jobs market may be starting to cool a bit – with jobless claims drifting up and indications that wages growth may have peaked. This may take pressure off services inflation which has been picking up.

- Our Pipeline Inflation Indicator continues to point to a peaking in US inflation. Of course, the process of peaking can always be messy and drawn out.

The Inflation Pipeline Indicator is based on commodity prices, shipping rates and PMI price components. Source: Macrobond, AMP

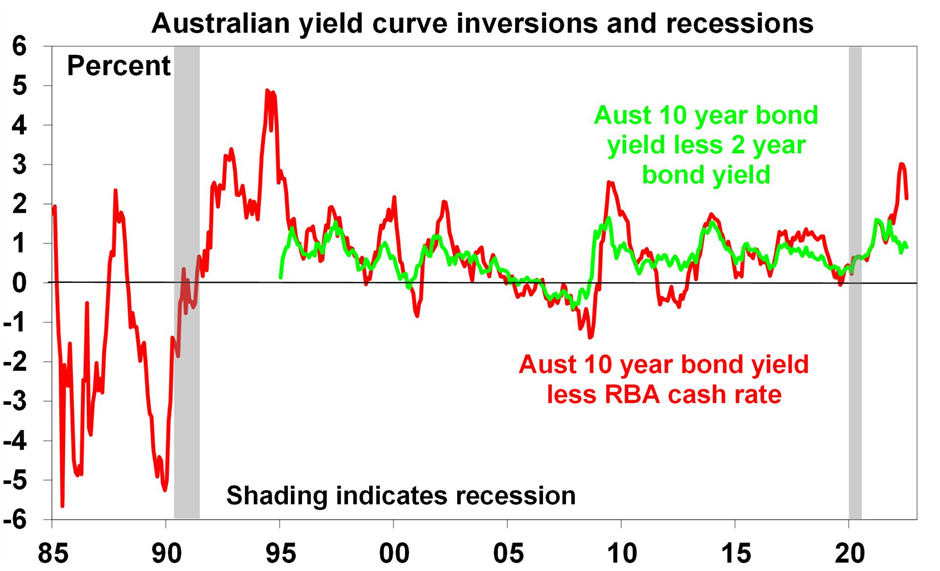

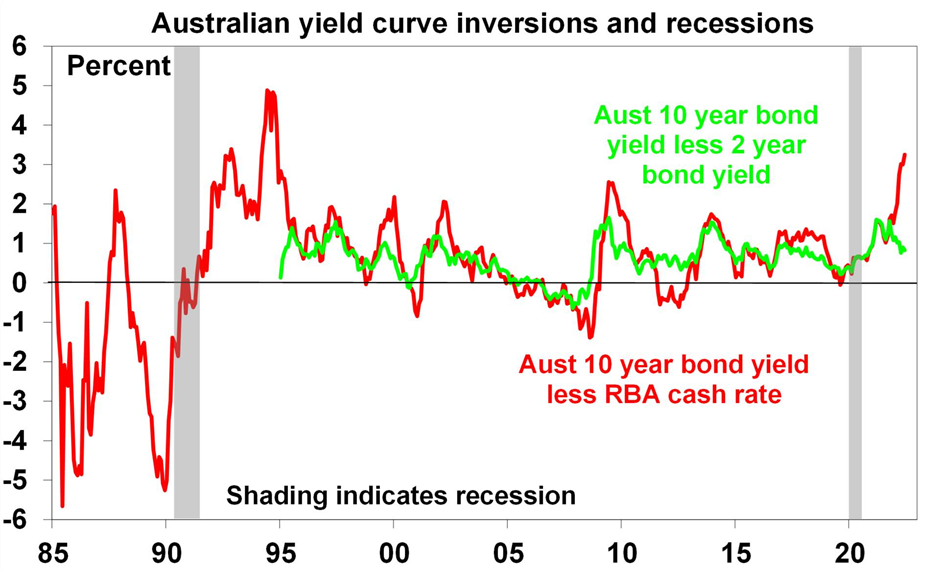

- Reliable indicators of recession have yet to signal one is on the way – e.g. the gap between the 10-year bond yield and Fed Funds rate (which has always preceded recessions since 1970) is yet to come close to inverting. See the second chart in this report above. And the Fed Funds rate is still less than nominal GDP growth. It’s the same in Australia.

Source: Bloomberg, AMP

- Some leading economic indicators like consumer confidence including in Australia are now weak suggesting that central banks shouldn’t have to raise rates too far to get a desired slowing in demand and hence inflation. (Of course, this also brings with it the risk that they miscalculate and overtighten).

- Forward price to earnings multiples have fallen sharply since the start of the year – down from 22 times to 16 times now in the US and down from 19 times to 14 times in global and Australian shares – making shares cheaper. This has been due to falling share prices and still rising earnings.

- Signs of capitulation are becoming more evident, e.g. more indiscriminate selling of shares, and this is positive from a contrarian perspective.

While the bottom line remains that shares are likely to be higher on a 6-12 month horizon, it's still too early to be confident that we have seen the highs for bond yields and the lows for shares in the near term.

Australian minimum wages to rise 5.2%, with minimum award wages to rise 4.6% from 1 July.

Given this will directly impact about 22% of the workforce it will add about 0.5% to wages growth compared to the last financial year. The risk is that this will add to broader wage claims in the economy, hence to inflation expectations and the risk of a wage-price spiral putting even more pressure on the RBA to raise rates further. However, there is a danger in exaggerating the impact as the tight labour market – with labour market underutilisation (unemployment plus underemployment) now back to levels last seen in 1982 – suggests that wages will go up anyway including for many of those on minimum rates.

What to watch over the next week?

Monetary policy in the US and Australia is likely to dominate in the week ahead. The US Fed Chair Powell's Congressional testimony (Wednesday and Thursday) is likely to be hawkish, reiterating the Fed's commitment to continue tightening until there is “clear and convincing” evidence that inflation is falling. This is unlikely to reduce market expectations for a rise in the Fed Funds rate to 3.5% by year-end and to well above 4% by mid-next year.

Similarly in Australia, the minutes from the RBA's last meeting (Tuesday), a speech by RBA Governor Lowe (also Tuesday) and his participation in a panel discussion (Friday) are all likely to be hawkish, reiterating the RBA's desire to keep inflation expectations down and commitment to bring inflation back to target. The focus is likely to be on any indications as to how high the RBA thinks it may need to raise interest rates.

Business conditions PMIs (Thursday) for the US, Europe, Japan and Australia will provide a guide as to how much global monetary tightening and supply constraints are impacting the growth outlook and price and cost components will be watched for further evidence of peaking.

US existing home sales data (Tuesday) are likely to fall but new home sales (Friday) are likely to rebound.

Japanese core inflation for May (Friday) is likely to edge slightly higher to 0.9%yoy.

The NSW State budget (Tuesday) may contain measures on housing affordability and stamp duty reform.

All prices and analysis at 20 June 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.