Formula is back, baby

The S&P/ASX200 lost 0.8% on Thursday, closing at 7175 points. If it feels like the market is trading sideways, you are not mistaken; despite the volatility and the headlines, the ASX200 has added a tiny 0.3% in the last quarter, as investors come to terms with persistent inflation, higher interest rates and a buoyant but vulnerable economy. US markets struggled after San Francisco Fed Chair Daly said of a 2.5% ‘neutral’ funds rate “Let’s get there as quickly as we can”.

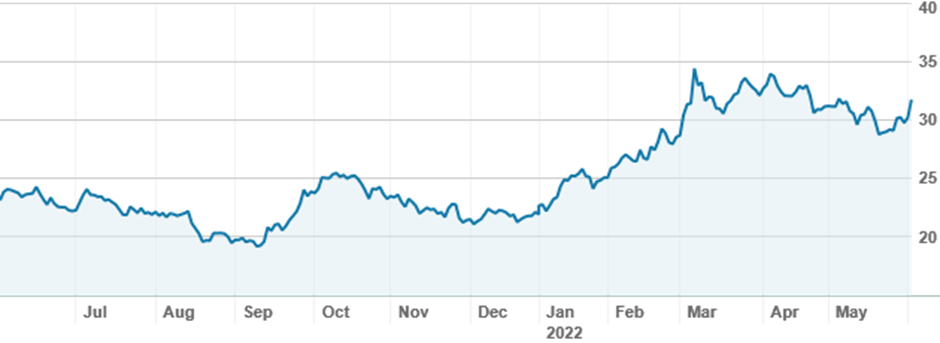

The big news on Thursday was Woodside Energy’s (WDS, formerly WPL) first day of trading after finalising the deal to buy out BHP’s (BHP) oil and gas assets. The new entity closed up more than 5% on the day, giving nabtrade holders an opportunity to exit the stock on a high note; there was huge selling from the base. Many had anticipated the price pop, as the larger entity will need to be held in greater quantities by passive fund managers and others who are ‘benchmark aware’, with 30 June a key date for institutional investor rebalancing. BHP shares ended the day largely unchanged and were traded in smaller volumes.

Woodside share price over twelve months (WPL/WDS)

Source: nabtrade

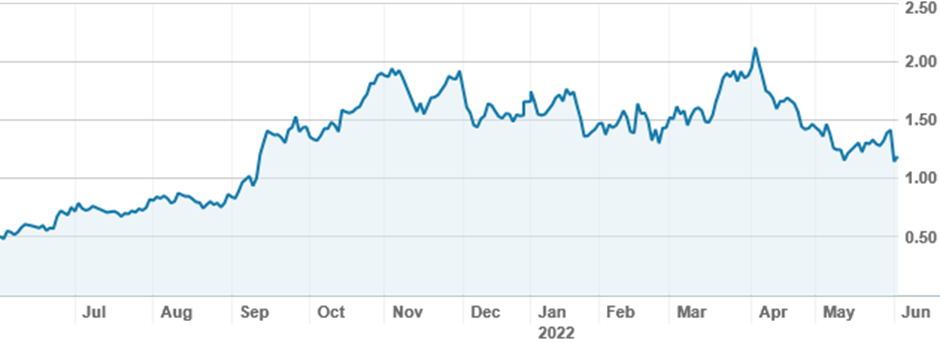

While volumes remain subdued, any news in the lithium sector is sure to bring out both traders and investors, and Wednesday’s rout saw huge trading in the sector from those with an interest. A brutal sell off was sparked by reports that Argentina had set a reference price for lithium exports, and a broker report from Goldman Sachs suggesting that the market for battery materials was overbought. Pilbara Minerals (PLS) fell an astonishing 22%, and was a 91% buy; it was the most traded stock on nabtrade, turning over five times the value of BHP. Liontown (LTR), a mid cap stock that has somehow crept into nabtrade’s top 20 holdings, fell 19% and was actively traded; a buy by number of trades but a sell by value. Core Lithium (CXO) and Allkem (AKE) were also hit hard, and saw enthusiastic buying and trading.

Liontown Resources shares over twelve months (LTR)

Source: nabtrade

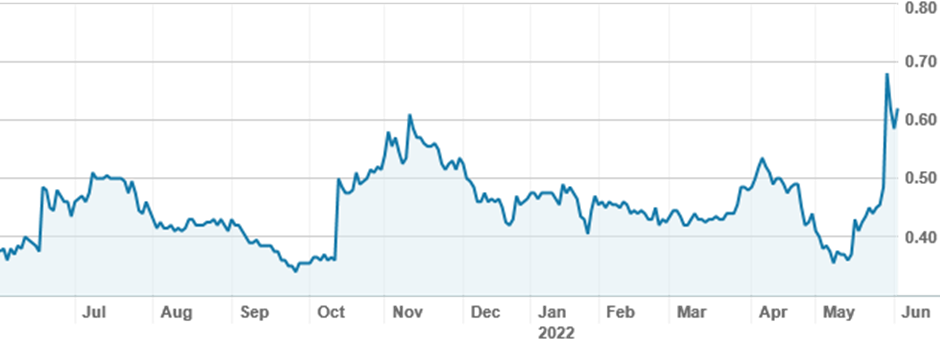

Outside the materials and energy sectors, investors remain largely indifferent, although news that contamination concerns are resulting in undersupply of US baby formula, a tightly controlled market that has largely eschewed foreign providers. Bubs Australia (BUB) has been given the green light to export to fill the shortage, and is scaling up production of more than 1million tins, resulting in a 35% increase in the share price over the last 5 days. nabtraders were unsure whether to take profits or add to their holdings; trade was mixed.

Bubs Australia shares over twelve months (BUB)

Source: nabtrade

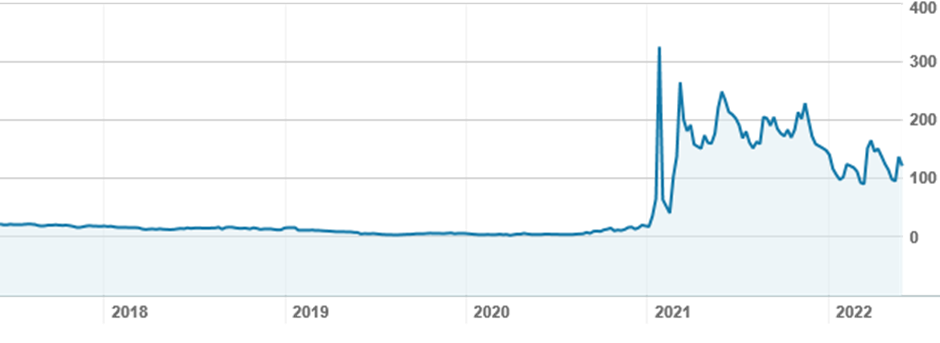

On international markets, former meme stocks GameStop (GME.NYS) and AMC Entertainment (AMC.NYS) have seen small numbers of trades. While the heady days of Robinhood and Reddit trade gains may be over, many have done surprisingly well. GameStop shares are down 55% over twelve months and yet well up from their lows prior to the hype.

GameStop shares over twelve months (GME.NYS)

Source: nabtrade

Analysis as at 2 June 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.