Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

View from the sidelines – why nabtraders are cashed up and sitting pretty

It may not feel like it, after a 4% rout on the S&P500 on Wednesday night and a fall in the ASX200 of more than 1.5% on Thursday, but the ASX is actually up nearly 2% over five days – a healthy bounce after the previous week’s falls. On international markets, US retailers are suffering as investors contemplate the prospect of a hard landing and potential recession; mortgage holders have already seen interest rates increase from 2.7% to more than 5% over the last twelve months, putting pressure on the consumer. Domestically, wage growth figures remained benign, at just 2.7% annually – well below the current inflation rate of more than 5%, while employment data looked positive but ultimately revealed just 4,000 full time jobs added, which may take some heat off the RBA as it looks to raise rates.

In recent years, even a modest sell off has attracted enthusiastic ‘buy the dip’ behaviour from nabtrade investors, young and old. Recent weakness has not prompted the same enthusiasm – cash balances continue to rise and trade volumes have softened considerably. Interestingly the first quarter of 2022 saw quite a bit of selling from old hands, clearly concerned about market valuations; most of the gains taken are yet to be reinvested in the market.

The biggest buy on Thursday was Wesfarmers (WES), a top ten holding that was down nearly 8%. The domestic retail sector on the ASX fell hard following leads from the US; Target’s disappointing numbers led to a 25% fall in the share price overnight. While Wesfarmers owns the Target brand in Australia, it is unrelated to the US company and shouldn’t have been materially affected by any downgrade in the US company’s fortunes. Clearly nabtrade investors were aware of the difference between the two businesses – and Wesfarmers’ far more diversified business model, given it has lithium exposure through its Mt Holland project, as well as Kmart, Bunnings and others – and bought with alacrity.

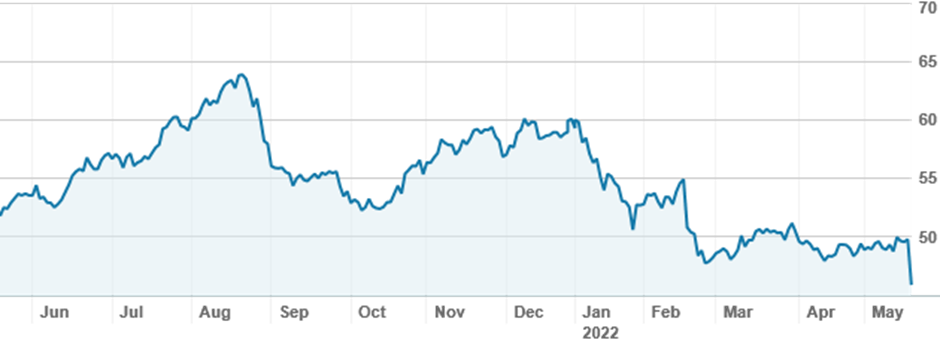

Wesfarmers (WES) shares over twelve months

Source: nabtrade

Woolworths (WOW) and Coles (COL) shares were also down, 5.6% and 3.4% respectively, and were also on the buy list, while JBHifi (JBH), down 6.6%, Temple and Webster (TPW), down 7.8%, Adore Beauty (ADY), down 7.8%, and Harvey Norman (HVN), down 5.4%, attracted little to no interest.

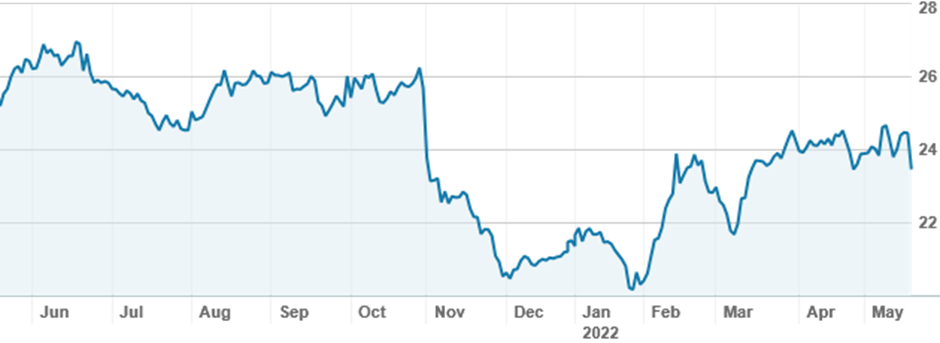

Top of the buy list was Westpac (WBC), which fell 4% as it went ex dividend. Westpac remains the most popular of the banks, but all four were bought as the market came off on Thursday. Despite nabtrade investors’ confidence, Westpac is down nearly 8% over twelve months, and has been outperformed by both nab (NAB), up 17%, and Commonwealth Bank (CBA), up 6%, and only marginally ahead of ANZ (ANZ), which is down 8.7%. Macquarie Group (MQG) also remains a buy, as investors hope to see a return to its highs. Magellan Financial Group (MFG) suffered another heavy one day loss and saw some buying on Wednesday.

Westpac (WBC) shares over twelve months

Source: nabtrade

Despite the subdued trading, commodities remain popular, with Fortescue Metals Group (FMG) and BHP (BHP) still traded in large volumes. Both stocks are broadly a buy and are most favoured by high net worth investors.

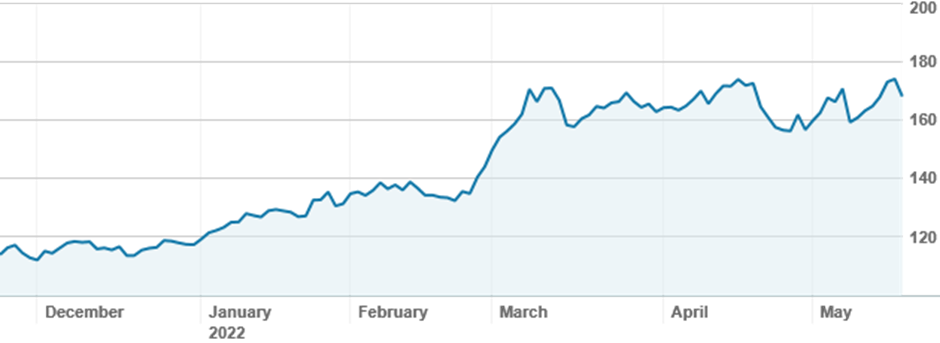

On international markets, the ongoing falls on Wall Street are not rattling investors too greatly. The Nasdaq 100 is now down 27% year to date at the time of writing, and remains highly volatile, but investors continue to buy Tesla (TSLA.US) and Apple (APPL.US) shares, with a greater preference for the former. One high value investor took a sizeable position in Chevron (CVX.US); the energy giant’s share price is up 50% in the last six months.

Chevron (CVX.US) shares over twelve months

Source: nabtrade

Analysis as at 19 May 2022. This information has been provided by WealthHub Securities Ltd the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.