Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Overview: The universe of financial hyrbids

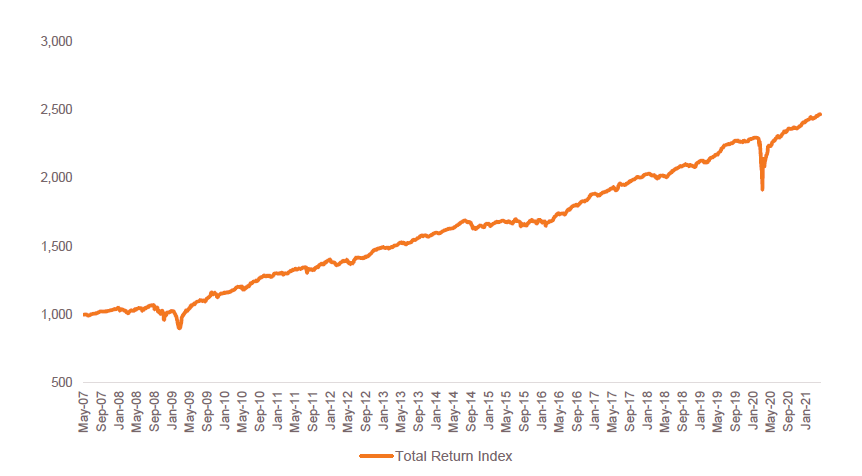

BondAdviser runs a series of indices to calculate the performance and risk of specific classes of debt and hybrid securities.

The BA Financials All AT1 Index (BAAUAT1DFTR)measures the performance of all bank and financial institution issued, AUD, ASX listed and OTC Additional Tier 1 (AT1) instruments with terms to call/conversion greater than six months.

Index Definition Details

Rebalancing Frequency: Daily.

Weighting Type: Market Capitalisation.

Aggregate Index Value Type/s: Total Return / Accumulation.

Start Date: 16/05/2007.

Entity/Entities: Financial Institutions.

Structural Position/s: Tier 1 Regulated Capital or Equivalent.

Eligible Currencies: AUD.

Amount Outstanding: No minimum.

| 3 months | 1 year | 3 year | 5 year | Inception | |

| Index Total Return | 1.9% | 12.3% | 22.4% | 42.6% | 147.1% |

| Ave Trading Margin | 2.64% | 5.00% | 3.43% | 4.28% | 0.50% |

Source: BondAdviser

Model portfolio characteristics

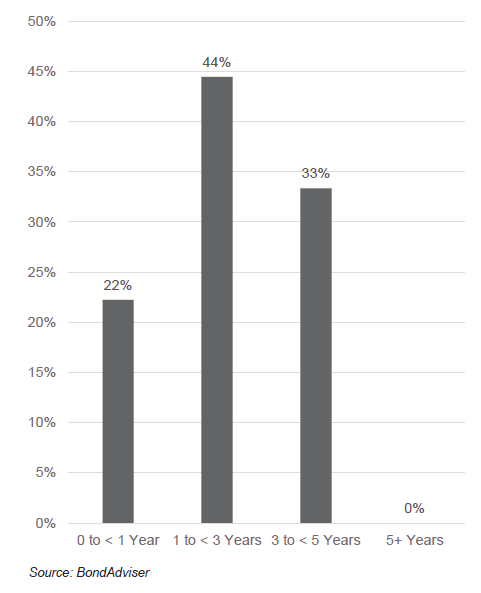

- Strategy: A conservative, concentrated, passive managed portfolio invested in ASX listed Additional Tier 1 Hybrid securities issued by financial institutions. The portfolio has a low turnover with a medium-long term investment horizon and aims to provide investors with regular income via investment in AT1 instruments issued by rated financial issuers.

- Security Selection Criteria: The securities are selected on a quarterly basis from constituents of the BondAdviser Financials AT1 Index based on valuation utlilising the BondAdviser Relative Value Curve.

- Number of securities: 8-10.

- Security Weighting: Equal-weighted.

- Portfolio Rebalancing: Quarterly (31 March, 30 June, 30 September, 31 December).

- Reporting: Quarterly.

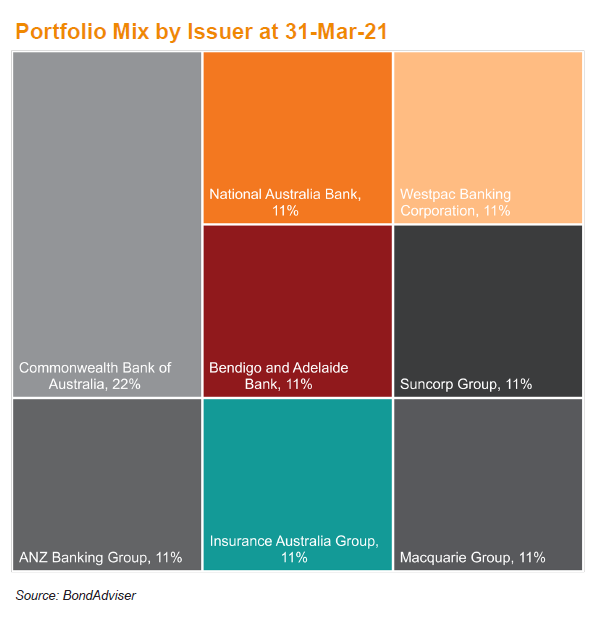

Portfolio Composition as at 28 April 2021

(ASX Code - Security Name)

- ANZPE – ANZ Capital Notes 2

- BENPG – Bendigo Converting Pref Shares 4

- CBAPD – CBA PERLS VII

- CBAPF – CBA PERLS IX

- IAGPD – IAG Capital Notes

- MQGPC – Macquarie Group Capital Notes 3

- NABPD – NAB Capital Notes 2

- SUNPG – Suncorp Capital Notes 2

- WBCPE – Westpac Capital Notes 2

Source: BondAdviser

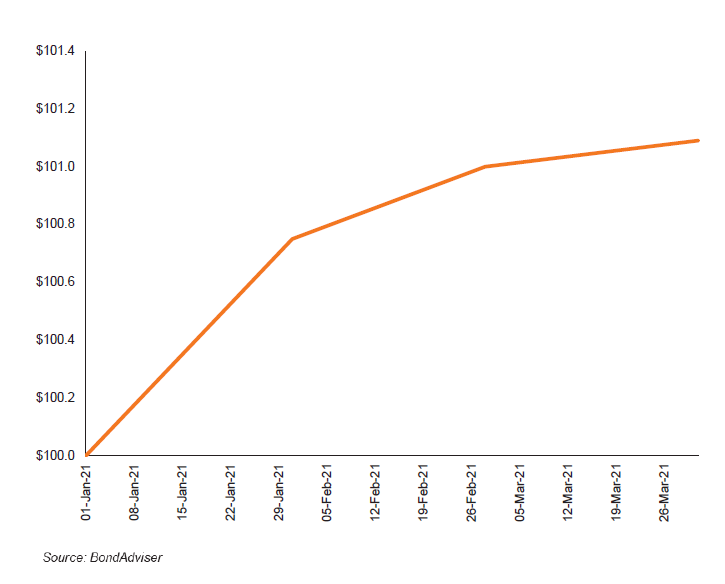

Portfolio commentary (example only)

Performance:

- Total Return for the 3 months to 31 March 2021: 1.09%.

- The key drivers of the quarterly included major bank issued AT1 securities that were buoyed by improved economic conditions that have improved their earnings outlook. Issuances by insurers were impacted by concerns about insurance claims from storms and flooding that recently hit Northern NSW and South-East Queensland. More broadly hybrid performance has benefitted from tighter credit spreads as investors do further up the risk curve in the search for yield in an almost zero rate interest environment.

- Average Yield to Reset: 2.52% as at 28 April 2021.

Portfolio Changes:

- Removed: XYZPB –XYZ Bank Capital Notes 2 after this security was called by XYZ Bank on xx Xxx 2021.

- Added: ABCPA –ABC Bank Capital Notes 1 as it was attractively priced trading above the BA Financials AT1 one curve.

Market Commentary

- Volatility continued in March, but the S&P/ASX200 Accumulation Index finished the quarter 4.26% higher.

- On the domestic front, generally solid economic data, the vaccine rollout along with all-time low interest rates helped drive the market higher. Offshore, the US$1.9 trillion US stimulus package was well received. However, lockdowns in Europe as the third wave of COVID-19 hits, the blow up of hedge fund Archegos Capital and blockage of the Suez Canal added volatility along with lingering concerns about inflation.

- Central banks are not overly concerned about inflation and retain an accommodative monetary policy bias. Comments by US Fed Chair Powell suggest the Fed expects a temporary increase. Locally, RBA Governor Lowe indicated the RBA Board is looking at wage growth as the key indicator for a sustainable lift in inflation. Bond markets disagree and are pricing in higher inflation premised on expectations of stronger economic growth.

- Investor demand for yield saw trading margins of AT1 and Tier 2 securities tighten further, though not as much as seen during the first two months of 2021.

Quarterly portfolio review (example only)

Contact BondAdviser

Email: info@bondadviser.com.au | Phone: +61 (3) 9670 8615

Nicholas Yaxley - Managing Director

Nicholas.Yaxley@bondadviser.com.au

John Likos - Director

John.likos@bondadviser.com.au

Important information

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

The content of this presentation is not intended to provide financial product advice and must not be relied upon as such. The content is not and shall not be construed as financial product advice. The statements and/or recommendations provided are our opinions only. We do not express any opinion on the future or expected value of any security and do not explicitly or implicitly recommend or suggest an investment strategy of any kind.

The content has been prepared based on available data to which we have access. Neither the accuracy of that data nor the methodology used to produce the content can be guaranteed or warranted. Some of the research used to create the content is based on past performance. Past performance is not an indicator of future performance. We have taken all reasonable steps to ensure that any opinion or recommendation are based on reasonable grounds. The data generated is based on methodology that has limitations; and some of the information is based on information from third parties.

We do not guarantee the currency of the content. If you would like to assess the currency, you should compare the content with more recent characteristics and performance of the assets mentioned within it. You acknowledge that investment can give rise to substantial risk and a product mentioned in the presentation may not be suitable to you.

You should obtain independent advice specific to your particular circumstances, make your own enquiries and satisfy yourself before you make any investment decisions or use the content for any purpose. This content is to provide general information only. There has been no regard whatsoever to your own personal or business needs, your individual circumstances, your own financial position or investment objectives in preparing the information and Reports available at this web application.

We do not accept responsibility for any loss or damage, however caused (including through negligence), which you may directly or indirectly suffer in connection with your use of this web application or the Reports, nor do we accept any responsibility for any such loss arising out of your use of, or reliance on, information contained on or accessed through this presentation.

© 2021 Bond Adviser Pty Ltd. All rights reserved