Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Four takeover bets in the ASX gaming sector

Like or loathe it, the gaming sector is a candidate for more takeover activity as private-equity firms or gaming multinationals pounce on weakened companies.

One gaming stock after another has been belted this year. The Star Entertainment Group (SGR), a beleaguered casino operator, is down 28% year-to-date. SkyCity Entertainment Group (SKY), an operator of New Zealand and Adelaide casinos, is down 13%.

Aristocrat Leisure (ALL), a leading pokie-machine manufacturer, is down 23% year-to-date. Ainsworth Game Technology (AGI), a smaller gaming designer, is also down 23%.

In lotteries, the newly spun-off The Lottery Corporation (TLC), which owns lotteries and Keno businesses, is down slightly after the Tabcorp Holdings (TAH) demerger in May. The new Tabcorp business, which has wagering and media operations, has rallied this month.

Among smaller gaming firms, Jumbo Interactive (JIN), an online retailer of lottery tickets, has fallen 24% year-to-date. Pointsbet Holdings (PBH), a provider of sports and racing betting products, is off a whopping 61% this year. BetMakers Technology Group (BET), a provider of racing content and wagering tools, has slumped 51% this year.

I could include other gaming stocks in this list. Suffice to say the gaming sector is awash with red ink this year, as are most sharemarket sectors. Smaller gaming companies, in particular, have been belted in the latest market sell-off.

This share-price turmoil will surely attract the attention of private-equity predators. Blackstone Inc’s finalised acquisition in June of Crown Resorts is a portent of things for undervalued gaming companies that have attractive property or technology assets.

As always, never buy companies based on takeover speculation. It’s hard enough picking takeover targets, let alone getting the timing right. Takeover premiums and aggressive bidding wars for listed assets are not what they used to be.

Instead, focus on buying undervalued companies that the market has mispriced – and which have a clear catalyst for a share-price re-rating. In the case of casinos, it could be a recovery in international visitors after COVID-19, the conclusion of regulatory reviews or increased global industry consolidation in casinos and online wagering.

That said, I respect investors who will not buy gambling companies because of Environmental, Social and Governance (ESG) concerns. Poker machines and appalling governance at some casinos are hard to stomach. For investors who are comfortable with the gaming sector, here are two takeover themes and four stocks to watch:

Takeover theme 1: Casinos

Greater rationalisation of the global casino sector seems likely as US and Chinese operators suffer heavy share-price falls. Macau casino stocks, in particular, have been slaughtered due to China’s COVID-19 elimination policy (which has slashed international patronage) and regulatory concerns (which do not seem as bad as the market first feared).

With Crown now acquired, The Star Entertainment Group is the obvious local takeover candidate. Like Crown, The Star’s share price tanked after money-laundering allegations. The Star also lost senior management due to the scandal.

Like Crown, The Star has some fabulous property assets behind it, notably in Sydney, the Gold Coast and at its flagship Queen’s Wharf development in Brisbane. The Star also has less construction risk with Queen’s Wharf expected to open in mid-2023.

The value of underlying property owned by casino operators – often in prime CBD locations and hard to replicate – is a major attraction for private-equity predators.

Casino property assets can underpin stock valuations and reduce risk for private-equity firms that buy these stocks when they are in trouble. Larger private-equity firms must have run their ruler over The Star at its current valuation.

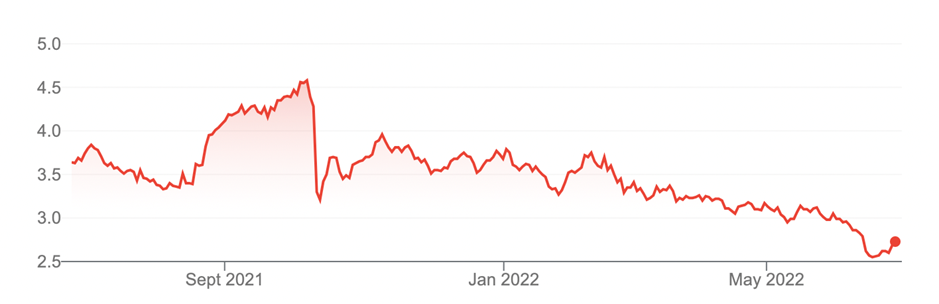

1. The Star Entertainment Group (SGR)

Source: ASX

SkyCity Entertainment Group has had far less attention this year with so much focus on Crown and The Star, its larger rivals. SkyCity has fared relatively better on the market than other casino operators (it’s not down by as much).

At its current valuation, SkyCity looks like it is being priced for COVID-19’s effect on the casino industry to continue indefinitely. SkyCity looks undervalued.

SkyCity has excellent casino properties in New Zealand and the NZ International Convention Centre development. The company is a clear winner from a stronger tourism recovery in NZ after COVID-19 and from rising demand for entertainment experiences. Morningstar values SkyCity at A$3.50 (from recent trades of $2.54).

SkyCity could appeal to a larger casino operator that wants to expand its global reach, or a private-equity predator that can see value in SkyCity at the current price.

With our without takeover, SkyCity looks interesting at the current price.

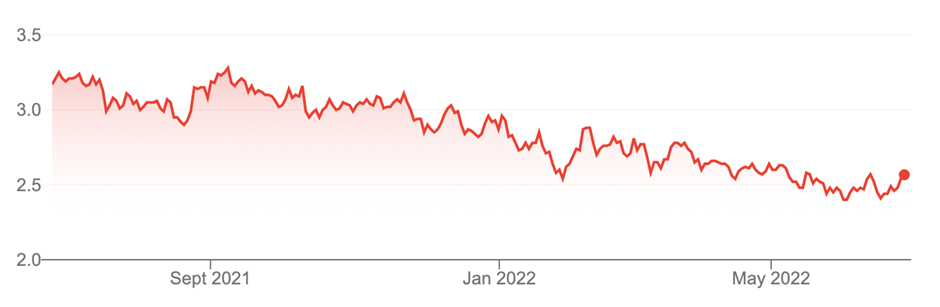

2. SkyCity (SKC)

Source: ASX

Takeover theme 2: Lotteries

It seems odd to suggest The Lottery Corporation (TLC) in a column about takeover targets. TLC was only admitted to ASX in late May after the Tabcorp demerger.

High-profile lotteries are a terrific business and TLC is one of the world’s best-performing lottery operators. TLC brands include The Lott, NSW Lotteries, Golden Casket, Keno, Tatts and SA Lotteries.

TLC is by far Australia’s leading lottery operator with exclusive and/or long-dated licences and approvals (except in Western Australia). It has a national distribution network of thousands of lottery outlets and Keno venues that are hard for competitors to replicate.

TLC is growing its online operations, which provides better margins and higher repeat business. Almost a third of its lotteries business, and 15% of Keno, is done online. TLC has rapidly become an omnichannel lotteries business.

TLC has several attractions for takeover predators, such as private-equity firms or superannuation funds. Its exclusive licences in most States and Territories provide a form of monopoly, something hugely valuable for an acquirer.

TLC has steadily rising revenue and profits and low capital-expenditure needs. The company should be able to grow through product innovation, rising digital sales penetration and higher customer retention and activity through online marketing. Overseas expansion is another possibility, but TLC does need to take huge risks to grow.

In some ways, TLC is more like a utility than a gaming company. We know how much superannuation funds like listed utilities and how few remain on ASX after takeovers.

Moreover, TLC was the stronger part of Tabcorp before the merger. Often with demergers, companies spin off the weak part of the business (or, increasingly, the part that has the fossil-fuel operations, in the case of mining, so they can pollute the planet through a different company structure). The “child” company underperforms because it was often starved of capital before the demerger.

In this case, TLC has come to market in excellent shape. Unlike many demergers, TLC does not have to repair the business after years of management neglect or inability to compete for capital internally.

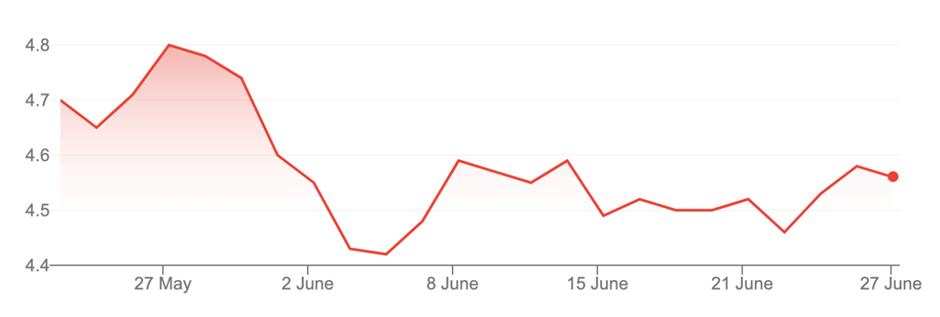

Chart 3: The Lottery Corporation (TLC)

Source: ASX

There’s also a case that the new Tabcorp could be a takeover target. The wagering business has previously attracted interest from a US bookmaking giant. The business has plenty of headwinds as more wagering is done online and competition continues to intensify. Tabcorp’s wagering business has struggled for some time but would arguably be worth more in the hands of a global operator with greater scale.

Faster global consolidation in wagering is underway as a smaller group of online sports-betting giants increase their market share, and after US sports-betting reforms. That could put Tabcorp in the firing line again, but I’ll stick with TLC and lotteries for now.

Chart 4: Tabcorp (TAH)

Source: ASX

Tony Featherstone is a contributor to The Switzer Report and a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 30 June 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.