Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three stocks that will flourish under inflation and rate rise conditions

For years, I’ve bought a takeaway coffee each day from my local convenience store. I love good coffee but prefer to pay $1 than $4.50 for a long black on weekdays.

Lately, I’ve noticed a longer line for the store’s self-service coffee machine. More people, it seems, are trading down to cheaper coffee as living costs rise.

Yes, one anecdote is not a trend. But my guess is more people will trade down to cheaper food, alcohol and experiences as inflation and interest rates bite.

Start with rates. The latest interest-rate hike added an average of $133 to the monthly repayment on a $500,000 mortgage for an owner-occupier.

If market expectations for a 4% cash rate next year are correct – from 0.85% now – homeowners will cut back on more than coffee. Many will stop eating out (or choose cheaper takeaways), avoid pubs and defer or axe their travel plans.

That’s bad for discretionary retailers, tourism and travel stocks, and companies that provide non-essential personal services that are easy to cancel.

There are two main ways to play this trend. The first is owning large-cap, defensive industrial companies that provide essentials and have strong market positions. Think Woolworths (WOW), Coles (COL), Telstra Corporation (TLS) and QBE Insurance (QBE).

The second strategy is owning companies that benefit as consumers trade down for cheaper products and services. Domino’s Pizza Enterprises (DMP) is an example: its $5 value pizzas will appeal to cashed-strapped consumers craving cheaper takeaways.

It’s not just food. I recently bought a round of three craft beers at a trendy pub. After getting little change back from $40, I wondered why I didn’t buy those beers at my local Dan Murphy’s. Drinking out feels more expensive than ever.

Holidays are another example. Will people be as likely to buy air tickets, rent a car (hideously expensive) and pay for hotel accommodation? Or will driving the family car and staying at a cheaper coastal holiday park have more appeal in the next few years?

Of course, it’s dangerous to generalise about consumers. Plenty of people are cashed up after COVID-19 and eager to spend their pandemic savings. With unemployment below 4%, most people have jobs and wages are finally starting to rise.

But the best investment tools are usually your eyes and ears. Some big shopping centres near me seem quieter than they were a few months back.

My hunch is that some food outlets are price gouging – putting their prices up far more than the inflation rate – and hoping customers won’t mind. That is a dumb strategy when more customers are looking to cut back on discretionary spending.

Here are three stocks that will benefit from the “trade down” trend:

1. SCA Property Group (SCP)

This Australian Real Estate Investment Trust (A-REIT) owns a portfolio of neighbourhood and sub-regional shopping centres, mostly on the East Coast.

If you buy your groceries from Woolworths at a small shopping centre that has a liquor outlet, chemist and a few other specialist outlets, chances are it’s an SCA property.

SCA has a strong weighting towards food, health and other non-discretionary retail services in its tenant mix. Woolworths Group (including Big W) and Coles pay 42% of SCP’s gross rent at its shopping centres.

In the retail category, food and liquor are worth 32% of SCA’s rent, pharmacy and health care provide 21% and services give 20%. The main takeaway is that less than a third of SCA’s rent by category is exposed to more discretionary retail products.

Food inflation is good for SCA. Rising living costs will encourage more people to cook at home and eat out less. Rather than go to the local pub, some consumers will buy more of their alcohol at a liquor store next to a supermarket in an SCA property.

Longer-term, population growth is good for SCA. Some of its centres quickly fill up with tenants as new housing estates drive greater foot traffic to its shopping centres.

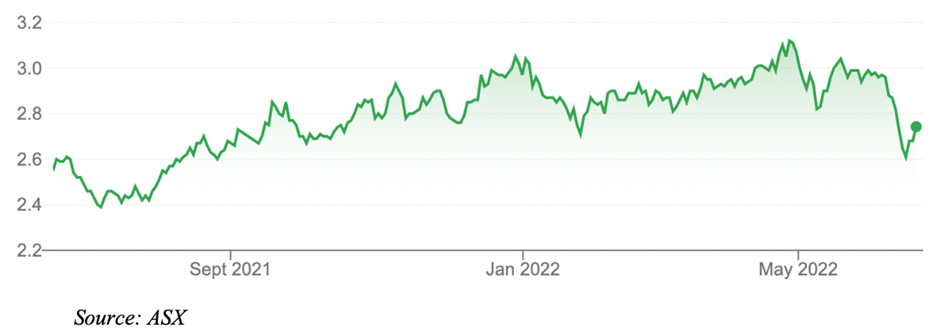

The well-run SCA has fallen from a 52-week high of $3.16 to $2.74, amid expectations of moderating turnover-based rent. Falling property values are another concern for the A-REIT sector, as rising interest rates reduce the Net Tangible Assets of property trusts.

SCA looks modestly undervalued at the current price. Weakness in the A-REIT sector has created an opportunity to buy a steady rather than spectacular performer.

SCA Property Group (SCP)

2. Collins Food (CKF)

I’ve written favourably about the market’s two largest fast-food stocks – Domino’s Pizza Enterprises and Collins Food – for this report over the past few years. Domino’s three-year annualised return is 21%; Collins has returned 2.5% after strong earlier gains.

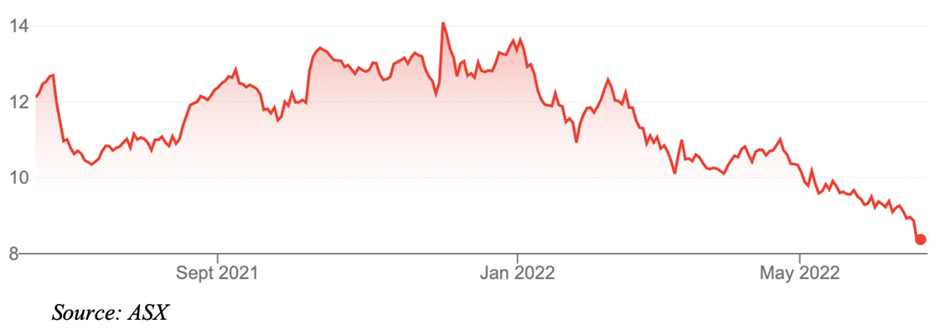

Both stocks have been hammered this year. Domino’s is down from a 52-week high of $167.15 to $63.30. Collins has slumped from $14.30 to $8.38. This is an awful market for small- and mid-cap growth stocks – and an opportunity for contrarians.

I like both stocks at current prices and it’s hard to separate them. I’ll focus on Collins for now, principally because it has far less international exposure.

Collins is a KFC and Taco Bell franchisee in Australia, and a KFC franchisee in The Netherlands and Germany. Collins is best known for its 252 KFC stores in Australia.

KFC is a star fast-food brand. Like or loathe its fried chicken, KFC’s low-cost takeaways are ideal for this market. In its latest earnings result, Collins said it continues to gain market share in the Quick Service Restaurant market in Australia.

Although Collins’ European strategy has been underwhelmed, its conservative growth strategy could work in its favour given the economic woes on that continent.

The Taco Bell Mexican restaurants are small in Collins’ overall store networks and that brand has failed before in Australia. But the ability to leverage operational efficiency and marketing strategies from KFC is a huge advantage this time.

It’s hard to reconcile the extent of Collins Food’s share-price fall with its operational progress. There hasn’t been much news since the company’s half-year results in November 2021. More will be known when Collins reports its full-year FY22 result on June 28.

My hunch is Collins will show its KFC stores are continuing to gain market share in an increasingly cost-conscious takeaway sector. That, in turn, will force the market to reassess if it has over-reacted to Collins in the latest sharemarket sell-off.

Collins Food (CKF)

3. Endeavour Group (EDV)

Among large-cap shares, Endeavour Group looks interesting at the current price. Endeavour owns Australia’s largest retail drinks network through its Dan Murphy’s and BWS stores. It also holds a large portfolio of licensed hospitality venues.

Now a top-50 company by capitalisation, Endeavour de-merged from Woolworths in 2021 and became a standalone company after a long-delayed de-merger process.

Liquor retailing accounts for about 80% of Endeavour’s sales and is the key to its long-term fortunes. Rising in-home consumption of alcohol during the pandemic was a big tailwind for Dan Murphy’s and other Endeavour stores.

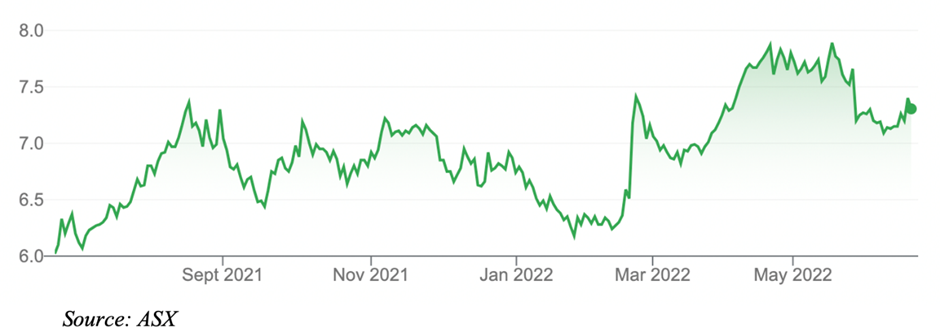

Endeavour has fallen from a 52-week high of $7.92 to $7.31 – a smaller fall than many ASX 50 stocks this year. As life returns to normal during COVID-19, investors expect people will return to pubs and clubs, and hospitality competition to increase. That could dampen Endeavour’s sales growth.

Rising cost inputs from higher commodity and freight charges will affect Endeavour’s profit margins. Rising interest rates might encourage people to drink a little less, pocketing the savings to help pay the mortgage or fund other living costs.

I believe the market is underestimating the substitution effect for liquor as living costs rise. More people will drink at home rather than in pubs or restaurants, to save money. Or visit Dan Murphy’s rather than the local bottle shop, to buy cheaper booze.

Endeavour is no screaming buy. But in a volatile market where discretionary spending is under pressure, the market’s dominant liquor retailer appeals.

Endeavour Group (EDV)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. All prices and analysis at 21 June 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.