Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Four cheap-as-chips mining contractors for your portfolio

With many commodity prices hitting new highs, and the market only just waking up to the scale of mining expansion that will be needed in the “transition to clean energy” – on account of the metals required in all clean energy applications – the global mining industry is an interesting place to look for investment exposure.

But one way to gain this is to step back from the miners and look at the companies that provide services to them.

Despite many mining contractors facing a lot of difficulty through the pandemic, through physical business disruption from COVID and shortages of skilled labour, their prospects are rapidly turning brighter. But it looks like the market hasn’t quite picked up on that – and prices are very cheap.

Here are 4 outstanding-looking bargain buys in the sector.

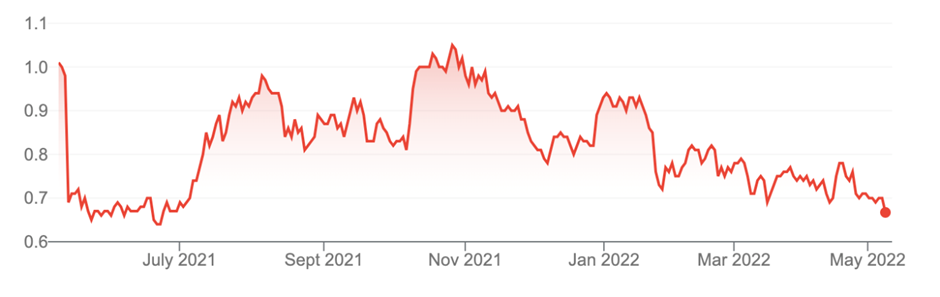

1. Perenti Global (PRN 66.5 cents)

Market capitalisation: $466 million

12-month total return: –31.9%

Three-year total return: –18.8% a year

Analysts’ consensus valuation: $1.00 (Stock Doctor/Thomson Reuters, four analysts); $1.05 (FN Arena, two analysts)

Established in Kalgoorlie in 1987, Perenti Global is a diversified global mining services group with businesses in surface mining, underground mining and mining support services – it has operations across four continents, and is one of the world’s largest companies providing surface and underground mining to its mining-company clients.

Perenti earns 71% of its revenue from underground mining, with surface mining 22%, and investments, 7%. By commodity, gold mining is its biggest workbook, at 65% of revenue, followed by nickel (10%), copper (7%), zinc (4%), coal (3%), iron ore (2%) and other commodities (9%). Geographically, Australia generates 48% of revenue, with Africa at 46%, Canada, 4%, and the rest of the world, 2%.

As with all of its peers, macro-economic and operating conditions have been tough for Perenti, but the company moved back into the black in the December 2021 half-year with a $26.7 million net profit, on the back of an 18% lift in revenue, to $1.19 billion. An expected stronger second half saw the company’s guidance for full-year FY22 revenue raised from a range of $2 billion–$2.2 billion, to $2.2 billion–$2.4 billion. The EBITA (earnings before interest, tax and amortisation of intangibles) guidance remains at $165 million–$185 million.

According to the consensus of analysts’ forecasts collated by Stock Doctor/Thomson Reuters, that should flow-in to a net profit of about $77.6 million, which would be down about 31% on FY21, but the analysts see the work pipeline sending net profit back above $100 million in FY23. With earnings per share (EPS) of 11 cents expected for FY22, Perenti Global is trading at just 6.3 times expected earnings – and is even cheaper on the expected FY23 rebound, at 4.9 times projected FY23 earnings. Perenti has been a dividend-payer, but there was no half-year dividend and Perenti is not expecting to pay one for the year.

Ratings agency Fitch recently upgraded Perenti’s issuer default rating (IDR), saying it expects that the company will derive more than 60% of its revenue and work-in-hand (WIH) from “stable mining jurisdictions” – for example, Australia, the US, Canada and Botswana – which goes some way toward reassuring investors who may be concerned at 46% of revenue coming from Africa. Fitch forecasts “stable operating performance” over the medium term, amid improved commodity diversification, as the company “expects to win new work for commodities that are essential for a green-energy transition, including copper, nickel, lithium and zinc”.

Fitch also comments that the stability of the underground mining division “provides a buffer against cyclical commodity prices, and is underpinned by the low-cost position of the mines that Perenti serves, a focus on production-related services and the higher barriers to entry and lower capital intensity than surface mining”. Fitch expects “steady revenue growth due to new contract wins and the extension of existing contracts”.

Perenti Global (PRN) stock price chart

Source: nabtrade

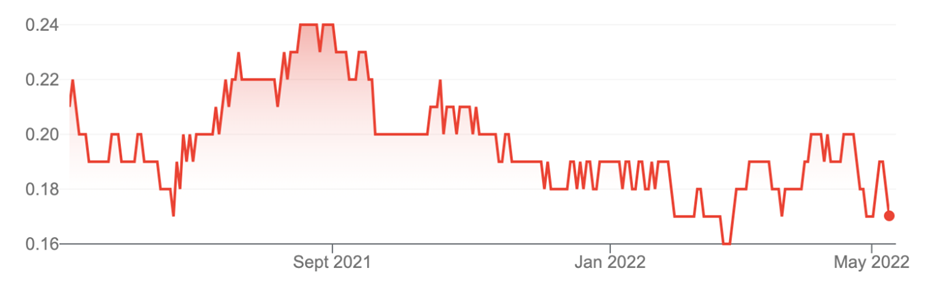

2. Macmahon Holdings (MAH, 17.5 cents)

Market capitalisation: $377 million

12-month total return: –13.7%

Three-year total return: –1% a year

Analysts’ consensus valuation: 27.5 cents (Thomson Reuters, three analysts); 30 cents (FNArena, one analyst)

Contractor Macmahon offers a broad range of integrated mining services in Australia, Africa, South-East Asia and New Zealand – it has an extensive track record in surface, underground mining and mining support services.

In recent years, Macmahon has worked hard to diversify its business: in FY18, surface mining generated 90% of Macmahon’s revenue, with underground mining on 7% and mining support services responsible for 3%. In the first half of FY22, the company had reduced the surface mining component to 70%, boosting underground mining’s contribution to 24% and that from mining support services to 6%. In the current work pipeline, surface mining represents just 41% of work, with underground mining up to 38% and mining support services up to 21%. Most of its assets are deployed on contracts of more than three years’ life. Macmahon is building toward its target revenue mix, of one-third from each of its business units.

On the commodity front, Macmahon is orienting the work that it takes on toward a target mix of bulk commodities – iron ore and metallurgical (steelmaking) coal – as well as precious metals (gold and copper/gold deposits), “battery metals,” which it sees as lithium, nickel and copper, and uranium and mineral sands. At present (December 2021 half-year), gold is 53% of revenue, with copper/gold deposits 25%, and other commodities, 22%. Its client book is also well-diversified, with AngloGold/Regis Resources the biggest, at 17% of revenue: at the Tropicana mine, a joint venture between AngloGold Ashanti Australia Ltd (70% and operator) and Regis Resources Ltd (30%), Macmahon has been providing mining services since open-pit mining started in July 2012 under a life-of-mine contract.

The underlying financial trend in recent years belies the fact that the stock really has not done much. MAH’s revenue has grown since FY18 at a compound annual growth rate (CAGR) of 24%, while underlying EBITDA has grown at 28%.

In the December 2021 half-year, revenue rose by 24%, to $809.7 million, with EBITA (earnings before interest, tax and amortisation of intangibles) up 1% to $46.9 million: Macmahon has given guidance for FY22 revenue to be in the range of $1.6 billion–$1.7 billion, which has been upgraded from $1.4 billion–$1.5 billion (compared to the reported $1.35 billion in FY21) and for FY22 underlying EBITA (earnings before interest, tax and amortisation) be in the range of $95 million–$105 million, compared to the reported $95 million in FY21. The order book stands at $5.2 billion worth of work, up from $5 billion at the end of FY21, with a tender pipeline of $8.7 billion.

Over FY21 and FY22, MAH says it has invested $300 million in growth spending to support strong earnings growth from FY22. At this point, Stock Doctor/Thomson Reuters’ collation of analysts’ forecasts expects earnings per share (EPS) to decline 14% in FY22, to 2.7 cents a share, with the dividend down 5 cents, to 0.6 cents (an interim dividend of 0.3 cents has already been paid). That would put MAH shares on a prospective FY22 price/earnings (P/E) ratio of 6.5 times earnings, and a yield of 3.2%, unfranked. In FY23 analysts see a 0.7-cent dividend pushing that unfranked yield to 4%. That represents excellent potential value.

Macmahon Holdings (MAH) stock price chart

Source: nabtrade

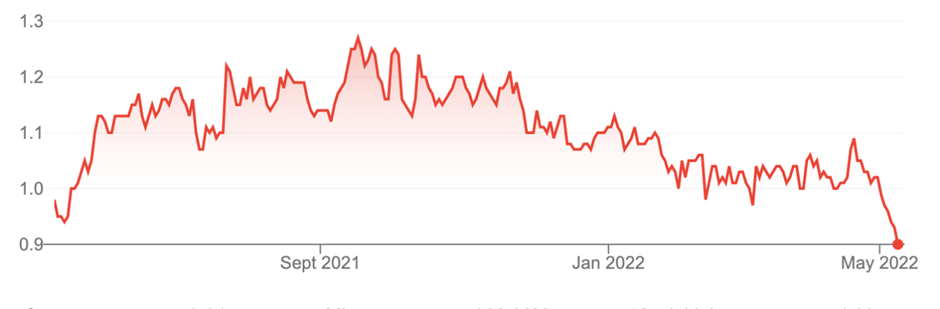

3. DDH1 (DDH, 90.5 cents)

Market capitalisation: $375 million

12-month total return: –5.2%

Three-year total return: n/a

Analysts’ consensus valuation: $1.565 (Thomson Reuters, four analysts)

Drilling companies are reaping the rewards of growing mineral exploration activity, and DDH1 – following its $115 million takeover of fellow ASX-listed drilling contractor Swick Mining Services in December – is right in the thick of global activity.

The merger with Swick – which DDH1 calls “transformative” – was a logical one. DDH1, which came to the ASX in March 2021 in a $150 million listing at $1.10 a share, was a specialised surface driller, while Swick was the leading underground diamond driller in Australia. The takeover created a mineral driller with a combined drill fleet of more than 170 drill rigs, becoming Australia’s largest fleet, and the fifth-largest in the world. DDH1 had 179 rigs at the end of March and has told the market that it has a target of 185 rigs by 30 June 2022, however with current supply delays, it says four of those rigs may be commissioned in July.

In the six months to December 31, 2021, DDH1 saw a 19% jump in revenue to $169 million, with operating EBITDA (earnings before interest, tax, depreciation and amortisation) of $43 million, up almost 30%. Annualised revenue per rig rose by 10%, to $3.3 million. After a statutory net profit after tax of $19.7 million, the driller ended the year with net cash of $6.5 million. With Swick, it would have delivered a profit of $25 million, and without COVID-19, the company said its earnings would have been about $3 million higher.

DDH1’s strategy is to focus on the resource definition, mine development and production phases, which are less cyclical than exploration drilling – the company will take selective exposure to highly-prospective earlier-stage “greenfields” exploration drilling, but exploration is only 13 per cent of DDH1’s revenue. Geographical exposure is broad, but still heavily weighted to WA – at 68% of revenue – and Australia at 92%, versus international at 8%. On a commodity basis, DDH1’s largest exposure is gold, at 34% of revenue, followed by iron ore (19%), nickel (16%), copper (12%), combined gold/copper (15%) and other commodities at 4% – however, there is no exposure to coal.

The company says its strategy is based on tapping into the sustained growth in exploration and production drilling that will be driven by the energy transition, which requires commodities “that DDH1 drills for and which are found in abundance in Australia”. It is also based on extending the company’s services to existing customers, who often have multiple mine sites – surface and underground – and “leveraging existing experience and understanding of site geology,” to provide drilling efficiencies to mine operators.

Meanwhile, drilling companies are benefiting as exploration budgets rise in Australia’s rebound from COVID-19. According to S&P Global Market Intelligence, exploration budgets in 2021 increased 35% to $11 billion compared to 2020 – the highest level since 2013.

Year-to-date, DDH1 says revenue is running almost 15% higher than at the same stage of FY21, with annualised revenue per rig up 9.3%. Macquarie Equities regards the medium-term growth outlook for DDH1 as positive, underpinned by strong industry conditions, expansion of the drill rig fleet, higher utilisation and improving rates. Macquarie’s price target for the stock is $1.65.

Stock Doctor/Thomson Reuters’ collation of analysts’ forecasts have DDH1 earning 12.6 cents a share for the full FY22 year, meaning the stock trades at 7.3 times forecast FY22 earnings, and 6 times expected FY23 earnings. With a 5-cent fully franked dividend expected – an interim payout of 2.51 cents has been paid – the stock trades on a 5.4 expected gross yield in FY22, equivalent to 7.7% with franking. That is a very attractive total-return proposition.

DDH1 (DDH) stock price chart

Source: nabtrade

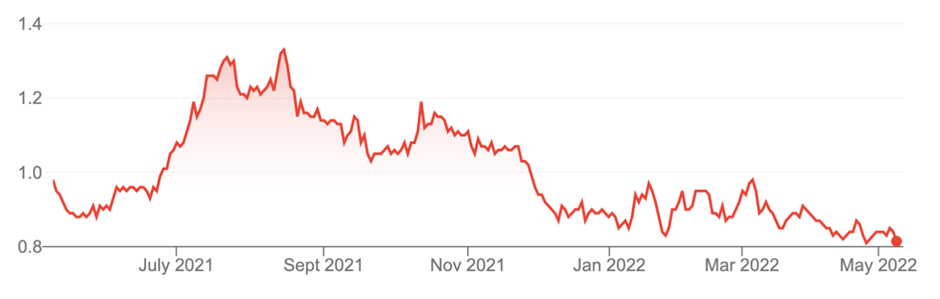

4. Emeco (EHL, 81.5 cents)

Market capitalisation: $437 million

12-month total return: –15.6%

Three-year total return: –22.6% a year

Analysts’ consensus valuation: $1.42 (Thomson Reuters, seven analysts)

Established in 1972, Emeco is one of the leading mining equipment rental businesses in Australian mining, renting-out equipment from brands such as Caterpillar, Hitachi, Liebherr and Komatsu, on a range of timeframes and rental bases, from fully maintained fleet to customer-maintained fleet.

And Emeco does not simply rent-out the equipment: its Emeco Operating System (EOS) fleet management and mining technology platform harnesses “big data” to provide insights for the operators on the equipment to make more accurate decisions and predictions on operational performance. EOS tracks shift performance in real-time, enabling underperformance to be fixed immediately: it measures payload, dig rates, shift efficiency and machine utilisation so operators can drive productivity harder and strip costs from their operations.

Emeco listed in 2006, but has had a poor stock price performance history for most of that time; however, the company has changed a great deal over the last five years, through two transformational acquisitions. In 2017 Emeco bought Force Equipment, a national equipment rental and maintenance business, for $70 million; and in 2020, it bought hard rock underground mining services company Pit N Portal in a deal worth $72 million. Force brought improved scale in earthmoving rental, a highly complementary fleet, and diversified Emeco’s customer exposure, particularly in the iron ore market in Western Australia through its workshop in the Pilbara. Pit N Portal brought Emeco the largest hard-rock underground mining rental business in Australia, particularly in Western Australian-based gold, nickel and base metals projects.

These acquisitions have made Emeco a much more diversified company. Four years ago, about 64% of revenue came from clients in coal mining, two-thirds of that from thermal coal used for energy production. That preponderance had obvious ESG issues in store, with all that implies potential difficulties in cost of capital, but Emeco has been able to move more into areas such as gold, copper, bauxite and iron ore. Growing gold and base metals revenue has lifted metals revenue to 62% of group revenue, and Emeco expects further growth in hard rock and metals revenues to bring its coal revenues down toward 30% of total revenue. From 40% of revenue in the first half of FY19, exposure to thermal coal is down to just 13% of revenue.

In the December 2021 half-year, revenue lifted 25%, to $372.8 million, with net profit up more than nine times, from $3.3 million to $30.2 million. Emeco has also announced an on-market buyback of its shares with up to 10% of its issued capital to be executed over the next 12 months.

Stock Doctor/Thomson Reuters’ collation of analysts’ forecasts sees Emeco earning 12.9 cents a share in FY22, up almost three-fold from FY21, and rising to 15.3 cents in FY23. That prices Emeco, at 82.5 cents, at 6.4 times prospective FY22 earnings and 5.4 times forecast FY23 earnings. That looks to be cheap as chips: a fully franked dividend of 3.5 cents is expected for FY22 – a fully franked interim dividend of 1.25 cents has already been paid – which prices EHL on a prospective yield of 4.3% (grossed-up, 6.1%). On the 5-cent dividend that analysts expect in FY23, the prospective yield is 6.1% (grossed-up, 8.8%). That represents attractive total-return buying in anyone’s book.

Emeco (EHL) stock price chart

Source: nabtrade

All prices and analysis at 9 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.