Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Five defensive stocks that could withstand a potential bear market

It is certainly that kind of time in the markets when investors look to defensive investments. But what does that really mean, and how difficult is it to achieve?

To some investors, “defensive” means a stock that should be able to provide more reliable returns than the index, in a market fall. For some, the definition revolves more around an economic downturn, and which stocks are best placed to be less affected by that. More recently, the resurgence of inflation has many investors looking for stocks that have attributes that could maybe hold up better than others, in an inflationary environment – such as perceived pricing power.

The ASX has many stocks that are billed as defensive investments.

Perhaps the most direct is the “inverse” or “bear” exchange-traded funds (ETFs) that are structured to benefit from a market fall. On the ASX, ETF issuer BetaShares offers the BEAR fund (that is the ASX code), which simply targets a return that is negatively correlated with the return of the Australian share market, in a roughly one-to-one relationship.

In effect, if the fund’s benchmark index — the S&P/ASX 200 Accumulation index, which includes dividends — falls by 1%, the fund should rise by somewhere in the range of 0.9% to 1.1%. (The reverse is also true — if the S&P/ASX 200 Accumulation Index rises by 1%, the BEAR fund should fall by 0.9% to 1.1%.)

The other Australian bear fund, BBOZ (ASX code), is also designed to be negatively correlated with the return of the S&P/ASX 200 Accumulation index, but in a magnified way: it uses internal leverage (that is, BetaShares borrows money to put on a larger position) to try to achieve a return of 2% to 2.75% for every 1% fall in the S&P/ASX 200 Accumulation index. And, of course, the opposite reaction in the event of a 1% rise in the index.

The third BetaShares product, the US Equities Strong Bear Hedge Fund — Currency Hedged (ASX code: BBUS) is designed to generate magnified positive returns when the US market (as represented by the S&P 500 Total Return index, which includes dividends) goes down, and vice versa. BBUS is structured to deliver a 2-2.75% increase in the value of the fund’s units for every 1% fall in the benchmark index (and vice versa).

Similarly, ETF issuer ETF Securities offers the ETFS Ultra Short Nasdaq 100 Hedge Fund (ASX code: SNAS) that aims to generate returns that are inversely related to movements in the Nasdaq 100 Index, through a negatively geared exposure. Over a short interval of time, for every 1% movement in the Nasdaq-100 Index, the value of an investment in the fund is expected to move between 2–2.75% in the opposite direction as the movement in the Nasdaq 100 Index (either up or down), depending on the degree of leverage deployed by the fund manager over that time interval. The fund is hedged to the Australian dollar.

How have these funds performed in 2022?

BEAR’s benchmark, the S&P/ASX 200 Total Return Index (which counts dividends), has fallen by 1.9%, year-to-date. BEAR is up 2.5%. That’s a tick.

BBOZ, which is also designed to be negatively correlated with the return of the S&P/ASX 200 Accumulation (now called Total Return) index, is down 7.4%. That’s not so good.

BBUS, which is designed to generate magnified positive returns when the US market (as represented by the S&P 500 Total Return index, which includes dividends) falls, has seen its benchmark plunge 17.6% this year. BBUS, however, is up 19.5%. It has done its job well.

ETF Securities’ SNAS has seen its performance benchmark, the Nasdaq 100 Index, fall by 28.3%. Meanwhile, SNAS has racked up a 38.5% gain. That is doing what it says on the tin!

Then there is gold, long seen as the most reliable defensive asset because it has tended, over very long timeframes, to hold its value well in both market downturns and tough economic times. While the S&P 500 of the US share market is down 18.7% year-to-date, and its Australian counterpart the S&P/ASX 200 has lost 5.6%, gold has added 1.1% in US$ terms, and in A$ terms, it’s up 4.9%.

On the ASX, each unit in ETF Securities’ ETF Physical Gold (ASX code: GOLD) exchange-traded product (ETP) gives the investor ownership of one-tenth of an ounce of gold bullion, held in the London vaults of custodian bank JP Morgan, while the Perth Mint Gold Quoted Product, or PMG (ASX code: PMGOLD) is a security (technically a warrant) that gives the investor the right to own one-hundredth of an ounce of gold.

Year-to-date, GOLD is trading 6.2% higher and PMGOLD is up 4.1%. Again, this pair of ETPs has done the job they are supposed to do, although PMGOLD is slightly lagging the actual gold price.

The healthcare industry is considered to be another defensive exposure, because of the major demographic and economic trends of ageing populations globally, and the increasing health spending driven by that, and also, the fact that the global pandemic (and potential variations thereof) is still very much with us.

On this theme, a broad global healthcare exposure, such as the BetaShares Global Healthcare ETF (ASX code: DRUG) is increasingly viewed as a defensive holding because its constituent companies are the logical beneficiaries of these tailwinds. The DRUG ETF invests in a broad range of international healthcare companies, with about 45% of the portfolio by weighting involved in pharmaceuticals, with 19% operating in healthcare equipment and about 11% in the biotechnology world. At present, DRUG’s top five holdings are: Johnson & Johnson (8%), UnitedHealth Group Inc. (7.9%), Pfizer (5%), AbbVie Inc. (4.7%) and Merck & Co. (4.1%). With the share market indices in the red year-to-date, DRUG is also down, by 5% – arguably holding up well against the S&P 500, which is its best comparison.

Another broad global healthcare ETF is the iShares Global Healthcare ETF (ASX: IXJ), which also invests in a range of the world’s biggest pharmaceutical, biotechnology, and medical device companies. Its top holdings at present are very similar to that of DRUG: Johnson & Johnson is the top holding, at 6.7%, followed by UnitedHealth Group (6.6%), Pfizer (4.3%), AbbVie (3.9%) and Eli Lilly (3.4%). IXJ is also down by 5% for 2022 so far.

It is a similar story for BetaShares’ Global Agriculture Companies ETF (ASX: FOOD), which offers investors exposure to the performance of the largest agricultural companies in the world (excluding Australia), hedged into Australian dollars. With the world facing rising demand for food, this “thematic” is highly defensive against economic and market fluctuations. FOOD’s top holdings at present are: Nutrien (9.3%), Corteva (9%), Archer-Daniels Midland (8.5%), Deere & Co. (8%) and Tyson Foods Inc. (5.5%). Year-to-date, FOOD is up 5.8%, versus the S&P/ASX 200’s 5.6% fall, so it’s doing a good defensive job.

Then there are the stocks that are defensive because of their businesses, which might have cash flows based on necessary and non-discretionary spending, or have investments relatively isolated from economic ups and downs.

Here are my top five of such stocks.

BHP Group (BHP, $48.07)

Market capitalisation: $338.5 billion

12-month total return: 8.9%

3-year total return: 15.2% a year

Estimated FY23 yield: 8.1%, fully franked (grossed-up, 11.6%)

Analysts’ consensus price target: $52.29 (Stock Doctor/Thomson Reuters, 17 analysts), $52.66 (FN Arena, six analysts)

BHP produces iron ore and metallurgical (steelmaking) coal, both essential for steel production; as well as copper and nickel, which are essential metals for the transition to electric vehicles (EVs) and renewable energy, and has very long-term plans for potash, an essential fertiliser for the projected rise in global food demand. BHP is also generating massive amounts of cash, as all of its commodity prices are very strong – and is offering an unbeatable trifecta of defensive cashflows, eye-popping fully franked yield and, on analysts’ consensus forecasts, a still-cheap stock.

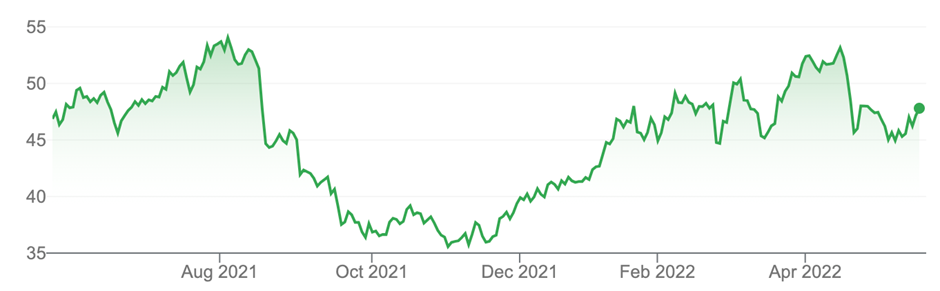

BHP Group Limited (BHP) stock price chart

Source: nabtrade

Wesfarmers (WES, $46.28)

Market capitalisation: $53 billion

12-month total return: –8.1%

3-year total return: 13.5% a year

Estimated FY23 yield: 3.9%, fully franked (grossed-up, 5.5%)

Analysts’ consensus price target: $53.25 (Stock Doctor/Thomson Reuters, 15 analysts), $52.76 (FN Arena, six analysts)

Wesfarmers has market-leading businesses in essential consumer spending, such as Kmart (discount department stores) Bunnings (DIY, tradies and hardware) space, Officeworks (office supplies), and its Catch online retail hub is growing strongly. Target is struggling, but Wesfarmers has made significant changes and says it’s on the improve. Wesfarmers has several other industrial businesses and investments that also generate reasonable cash flow, and its mining operation recently sold its coal assets and invested in the Mt Holland lithium project in Western Australia: Wesfarmers and its joint venture partner (SQM of Chile) expect to be producing lithium hydroxide for the growing EV industry by the end of 2024. WES has been hammered in 2022, losing 22.3%, but at these levels, it looks very over-sold for its defensive positioning, and it offers a solid fully franked yield.

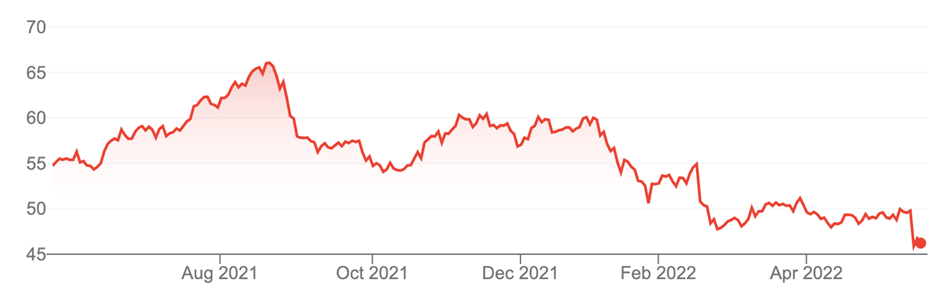

Wesfarmers Limited (WES) stock price chart

Source: nabtrade

Rural Funds Group (RFF, $2.97)

Market capitalisation: $1.1 billion

12-month total return: 32.2%

3-year total return: 16.2% a year

Estimated FY23 yield: 4%, unfranked

Analysts’ consensus price target: $2.94 (Stock Doctor/Thomson Reuters, four analysts)

As an agricultural landlord, REIT Rural Funds is very well-placed to benefit from increasing food demand. It gives investors exposure to some of Australia’s major agricultural sectors, including cattle, vineyards, almonds, macadamias, cropping (sugar and cotton), and water entitlements. The property portfolio offers good geographical (and thus, climatic) diversification. And it’s the landlord – it collects rent from the producers that grow things on its land, with RFF’s leases on long-term agreements, which have fixed rental increases built into them. Because of this, RFF aims to increase its payout by 4% a year. It’s a great defensive ASX share – unfortunately, analysts don’t see much capital gain in the unit price from this point.

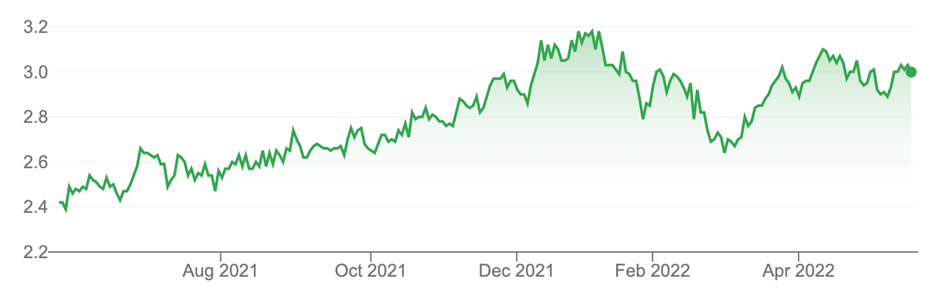

Rural Funds Group (RFF) stock price chart

Source: nabtrade

InvoCare (IVC, $11.77)

Market capitalisation: $1.7 billion

12-month total return: 21.9%

3-year total return: –6.7% a year

Estimated FY23 yield: 2.7%, fully franked (grossed-up, 3.8%)

Analysts’ consensus price target: $13.00 (Stock Doctor/Thomson Reuters, eight analysts)

No matter what happens in the financial markets, or in the economy, people still pass away. InvoCare owns and operates funeral homes, cemeteries and crematoria around Australia, New Zealand and Singapore, under its major brands of White Lady Funerals, Simplicity Funerals and Singapore Casket. All up, IVC operates more than 290 funeral locations and 16 cemeteries and crematoria – it also runs private memorial parks and the Australian Pet Cremations business and produces memorialisation products. Funerals generate almost 60% of revenue. You might be forgiven for thinking that COVID-19 was a good thing for InvoCare, but COVID restrictions hit the company hard – with the numbers of mourners restricted, more people in its markets opted for lower-margin cremations than traditional funeral services. The mortality rate in Australia actually dropped because of COVID: as social distancing became the new normal, along with much greater attention to personal hygiene, influenza and pneumonia diagnoses plummeted during COVID – flu death numbers fell dramatically – while workplace deaths fell because more people were working from home or were made redundant because of the impacts of COVID. But InvoCare says it sees evidence of mortality rates “tracking back to long-term trends,” and growing and ageing populations, as well as expansion into high-growth segments, support its future growth. IVC is flat for 2022 (down 0.3% to date) and looks cheap at these levels.

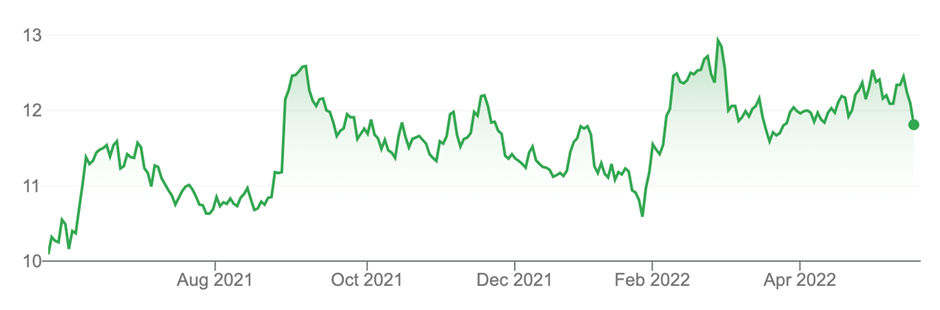

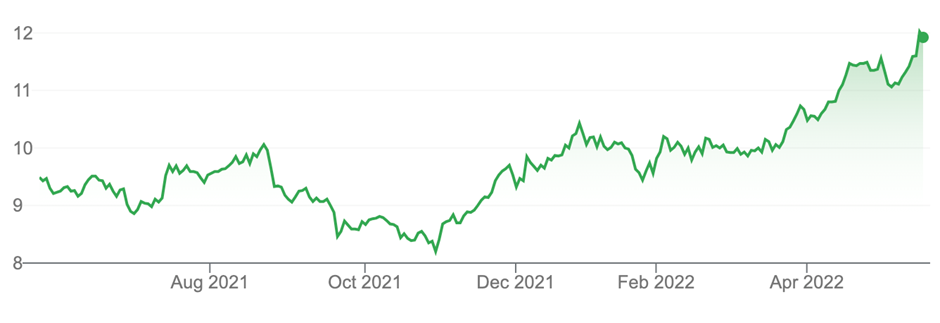

InvoCare Limited (IVC) stock price chart

Source: nabtrade

APA Group (APA, $11.88)

Market capitalisation: $14.2 billion

12-month total return: 36.1%

3-year total return: 10.1% a year

Estimated FY23 yield: 4.7%, 18.1% franked (grossed-up, 5.1%)

Analysts’ consensus price target: $10.00 (Stock Doctor/Thomson Reuters, 11 analysts), $9.92 (FN Arena, four analysts)

I really wanted to add energy infrastructure stock APA to this list – but unfortunately, analysts see it as significantly over-priced. There just isn’t the value in the stock at the moment.

But as a defensive business, APA Group is a standout – it supplies about half of Australia, business and household customers alike, with natural gas. APA is always investing in new pipelines to extend its network, and thus its cash flow and earnings. It also invests in gas storage and gas energy generation, and for ESG-conscious investors, it also has investments in renewable energy (wind and solar) – and its gas pipelines could one day carry hydrogen around the country.

APA Group (APA) stock price chart

Source: nabtrade

All prices and analysis at 23 May 2022. This information was produced by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. This article does not reflect the views of WealthHub Securities Limited.