Basics of the Australian stock market

Investing for the first time can seem overwhelming, and often it can be hard to know where to start. Getting an overview of the how the share market works and some of the market basics is an important first step towards making you a confident investor.

Let’s begin by getting out heads around the basics. The Australian share market is home to some of the world’s leading resource, finance and healthcare companies. More than 2,200 companies are listed on our main stock exchange, the Australian Securities Exchange (ASX).

The total value of companies in our stock market adds up to over $1.5 trillion and is ranked around 15th in the world by market size. To give you an idea of how active our market is, each trading day around $5 billion of shares are traded on the ASX and a second exchange, Chi-X.

Share investing is accessible to almost anyone: individuals, superannuation funds, companies, institutions and large offshore investors.

It is estimated that around 31% of adult Australians own shares, according to the ASX Australian Investor Study 2017.

Market indexes

When people refer to the share market rising or falling, they’re generally referring to one of the major market indexes.

A market index basically tracks the performance of a group of shares. These can be as simple as those that track the performance of broad Australian and US companies, to specific sectors and themes like technology and global healthcare.

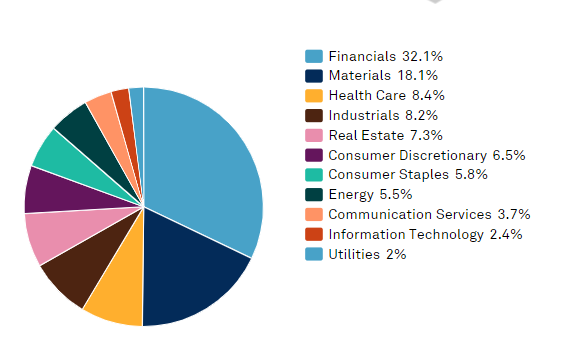

For a start, you’re most likely to hear about the S&P/ASX 200 Index. This index comprises several sectors (Table 1) and is made up of Australia’s 200 biggest companies (the biggest 10 are shown on Table 2).

Table 1 – S&P/ASX 200 sector breakdown

Source: S&P Dow Jones Indices (as at April 2019)

Table 2 – Ten biggest companies on the S&P/ASX 200 Index

Source: S&P Dow Jones Indices (as at April 2019)

Indexes are very useful because they provide a pattern of whether the share market is rising or falling over time, and can be used to benchmark the performance of your portfolio and make decisions.

How do I invest?

Buying and selling shares isn’t exactly like going to the supermarket and buying groceries.

Firstly, you’ll need to open an account with a stockbroker, such as nabtrade. The stockbroker will act as your agent, making your transaction to buy or sell a stock happen and arranging electronic settlement or payment.

You can start investing with as little as $500. This is the minimum amount of shares you can initially purchase in any listed company. Share prices vary enormously, from over $200 a share to just a few cents. Therefore, the number of shares in any company you buy depends on how much you have to invest and its share price. You’ll also need to pay brokerage (i.e. a fee to the broker) on each share transaction.

Consider researching various brokers and how they stack up not only on price, but also other features, products and services of interest to you. For online trades, nabtrade charges brokerage at a flat rate of $9.95 for transactions up to $1,000 in value; $14.95 for transactions from $1,001 to $5,000 in value; $19.95 for transactions from $5,001 to $20,000 in value; and 0.11% of the value if that’s over $20,000.

How do shares trade?

The ASX runs an electronic trading platform where brokers lodge orders to buy or sell shares. Each listed company has its own unique stock code, which is usually three letters in length. For example, BHP’s stock code is ‘BHP’, National Australia Bank’s is ‘NAB’ and Woolworths is ‘WOW’. The stock code is also called the “ASX code” or “ticker”.

A trade occurs when a buyer’s price (known as a “bid”) and a seller’s price (known as an “offer”) overlap. If the bid price is $2 and the seller’s offer price is $2.20, then nothing happens. If they match, that stock is sold.

First in, best dressed

Because there are hundreds of participants in the market, there can be several bids or offers at the same price. If the bid price overlaps with the offer price, then as many bids and offers are matched and traded so that the quantity of shares bought is equal to the quantity of shares sold. Orders are arranged on a price/time priority and date stamped. When prices overlap and orders are traded, the earliest order has priority over the next earliest, and is filled in full before the next order is allocated any shares.

The number of buyers and sellers for a security at any time is called market depth. When you search for a security on nabtrade you can view this by selecting the ‘Depth’ tab on any company information page.

What happens if my trade is successful?

Following a transaction, you’ll be sent a contract note from your broker confirming the details of the transaction and settlement arrangements.

In Australia, shares settle on a “transaction date plus 2 working days’ basis” (“T+2”), meaning that settlement occurs 2 working days’ after the transaction date. So, if you trade on a Monday, settlement occurs on the Wednesday.

If you trade on a Thursday, settlement occurs on the following Monday. On the settlement date, buyers pay the proceeds (via their brokers, and their bank accounts are debited), while sellers receive the proceeds. The register of shareholders is updated to record the details of the new owner.

The ASX is open every working day except national public holidays.

How do I place an order?

There are two types of orders: a ‘limit’ order and a ‘market’ order.

- A ‘limit’ order is an instruction to buy or sell at a particular price. If the market never trades at that price, because your buy price is too low or your sell price is too high, then the order will never take place.

- A ’market’ order is an instruction to buy or sell at the best available price. Provided the market is open and trading, it should go through immediately. When your broker receives a ‘market’ buy order, they will (electronically) find the seller at the best available price and purchase the number of shares you want. You will pay the price the seller was offering.

When the market is closed, you can only place ‘limit’ orders. When the market is open you can place ‘limit’ or ‘market’ orders.

You also need to specify the number of shares you want to buy (it can be any number if it amounts to at least $500 in value), or in the case of a sell, the number of shares you want to sell. You can’t sell more shares than you own, but you don’t have to sell your entire holding – you can sell any number.

Alternatively, you can specify a “dollar” amount (for example $2,000) rather than a quantity and the broker will calculate the maximum number of shares you can buy.

An order can be:

- ‘good for day’, which means it will automatically be cancelled if it’s still outstanding at the end of the trading day;

- ‘good till cancelled’, which means it will be in the market until it is executed or you cancel it;

- good until date’, which means it will be in the market until it is executed or automatically cancelled at the close on the date you nominated.

A typical day at the stock market

The market opens each working day at 10am (EDST) and closes each day around 4.10pm (EDST). Between the hours of 10.10am and 4pm, the market trades on a “normal basis” where bids and offers are matched. Provided the bid price equals the offer price, trades occur.

To start trade each day, the market goes through a special “opening” phase, which runs from 10am (EDST) to approximately 10.10am (EDST). This sees the market open in five blocks in alphabetical order by company name, spaced approximately two minutes apart.

It’s important to understand that the opening price of a stock on one day is not directly related to its closing price the day before. Many things can happen overnight to change the price, including movements in offshore markets, which can influence investor sentiment. The following morning, buyers and sellers are prepared to deal at a different price from the previous day.

In nabtrade the ‘Markets Today’ page will show on the top right hand corner what markets are open.

At the close

After 4pm (EDST), the market stops trading and goes into a “closing phase”’. A final auction occurs at around 4.10pm (EDST), where buyers and sellers are matched to determine the closing price.

If you place an order after 4.10pm, it won’t be executed until the next working day. Up until 10am on that day, you can amend or cancel that order.

CHESS: the most important ‘game’ in town

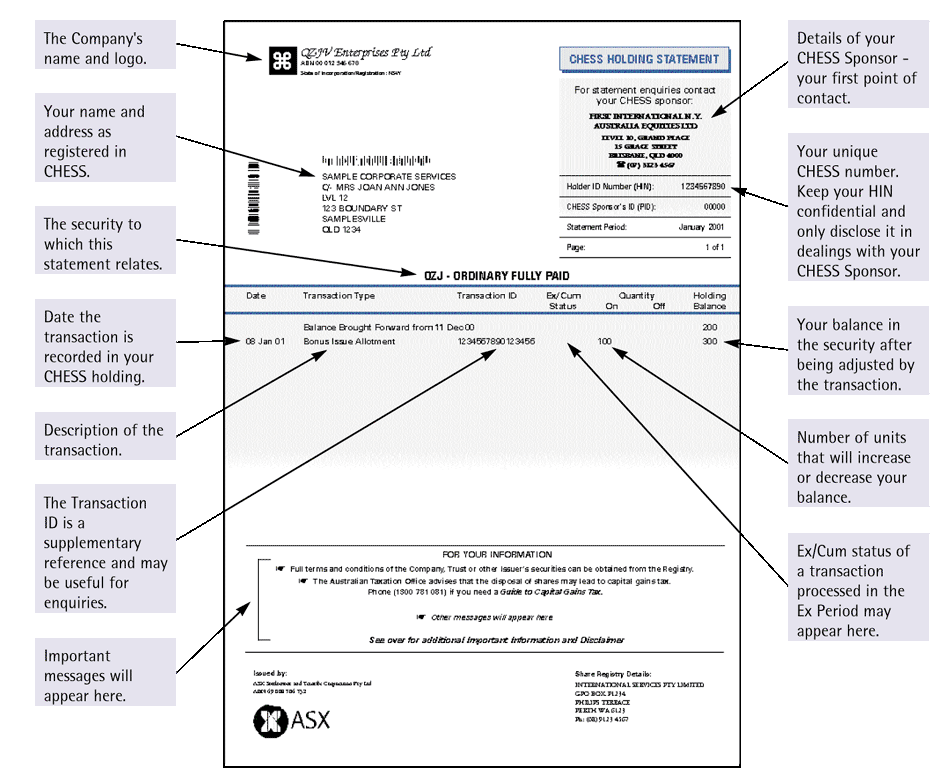

Shareholder records are maintained on a secure, centralised electronic register accessed by brokers and share registries acting on behalf of listed companies. This is operated by the ASX to clear and settle transactions and is known as CHESS.

Shareholders are sponsored into CHESS and receive a unique way of identifying them, known as either a HIN (Holder Identification Number) or SRN (Shareholder Reference Number). Both are 10 digits, with the HIN starting with an ‘X’ and the SRN an ‘I’.

Two ways to see your shares

There are two ways you can see your shares: one is more convenient, the other more complicated.

- If you elect to become sponsored by your broker into CHESS, (most investors choose this as it’s more convenient), you’ll have just one HIN for all your holdings. Your broker (e.g. nabtrade) can then display your portfolio of shares with its current market valuation. You can also provide details of your bank account for dividend payments.

- This is the more complicated way to hold your shares. If you’re sponsored by the company (called issuer sponsorship), you’ll have a different SRN for every holding. Because brokers don’t have access to your SRN, they will need to verify your SRN before accepting a sale order. This can result in a delay between the time you place the order and when it goes to market.

Whenever your shareholding changes or when you first buy shares in a company, you’ll be sent a CHESS Holding Statement at the end of the month. A sample statement for broker sponsored clients, which is sent by the ASX, is shown below. This shows the name of the company, details of your broker sponsor, your registered name and address, your HIN, and how many shares you own.

Source: ASX

What do I receive as a shareholder?

After you complete your first trade, you’ll receive a contract note from your broker, a CHESS holding statement from the ASX, and a welcome pack from the company. The latter will invite you to provide:

- details of a bank account for any dividend payments;

- your tax file number or exemption (which is not compulsory); and

- communication preferences for receiving notices, annual reports and other information from the company.

If the company operates a dividend re-investment plan, you’ll also receive information on the plan and how you can elect to participate.

A dividend re-investment plan means your dividends, rather than being taken as cash, can be used to purchase more shares in the company in question. These shares can be bought at a discount to the market price in some circumstances.

As a shareholder, you’ll be entitled to attend the company’s annual general meeting (and any general meetings) and vote on resolutions, including the election of directors and the remuneration arrangements for key officers. You can also vote electronically ahead of the meeting or appoint a proxy, so someone else can attend and vote on your behalf. You can also choose to receive a copy of the company’s annual report and other important information.

All prices and analysis at 16 April 2019. Peter Switzer is one of Australia’s leading business and financial commentators, launching his own business 20 years ago. This information has been prepared by Switzer Financial Group Pty Ltd (ABN 24 112 294 649), which is an Australian Financial Services Licensee (Licence No. 286 531).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.