Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why invest in shares?

Most investment experts agree that while there’s no right or wrong way to invest, usually you’ll be better off with a mix of the different asset categories, such as shares or property, and then being diversified within that category. The reason for this is that one asset category rarely consistently performs better than all others, and that when blended together, different assets can complement each other and produce a higher overall return, with less risk.

Shares are considered to be a “growth” asset, meaning that a large part of the total return should be generated from an increase in their value. The other part of the return is income through the payment of dividends.

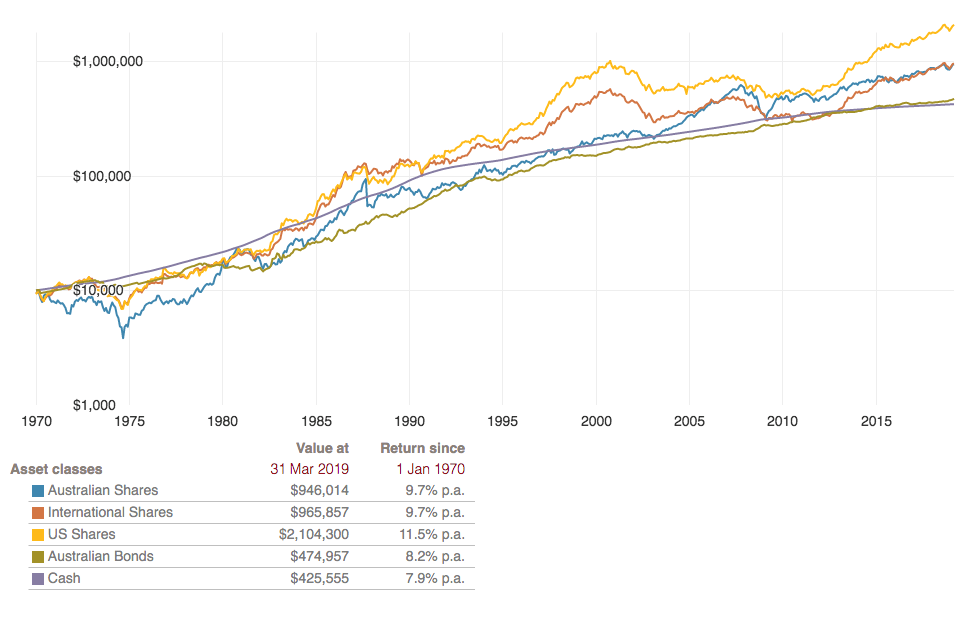

Over the long term, shares have delivered outstanding returns for investors. The following chart from Vanguard shows the accumulated value of $10,000 invested in January 1970 in Australian shares (blue), international shares (red), US shares (yellow), Australian bonds (green) and cash (purple).

By March 2019, $10,000 invested in Australian shares had grown to a staggering $946,014. This assumes that the $10,000 was invested in a representative index, income is re-invested, and is before fees, costs or taxes. That said, turning $10,000 into almost a million dollars is a pretty good outcome, equivalent to an average rate of return of 9.7% a year.

US shares, as measured by the S&P 500 index, have done even better – more than $2 million, while Australian bonds would be worth $474,957 and cash $425,555.

Value of $10,000 invested on 1 January 1970

Note that it hasn’t always been plain sailing for the Aussie share market, with crashes including the 1987 Black Monday crash; the dotcom bust of 2000 and global financial crisis in 2008-09. Importantly, the market has recovered on each occasion.

Over shorter periods, shares can be more volatile than other asset classes such as bonds, cash and sometimes property. This is highlighted in the following table, which shows returns up to 31 December 2018. In the calendar year 2018, the Australian share market suffered a negative return of 3.1%. However, over the 15 years to 31 December 2018, it returned an average of 8.2% a year, higher than the other asset categories.

Typically, shares will perform better than cash over the medium term and should deliver a positive “real” return, that is, higher than inflation.

Asset Sector Performance – returns to 31 December 2018

| 1 year | 3 years | 5 years | 10 years | 15 years |

Australian shares | -3.1% | 6.7% pa | 5.6% pa | 8.9% pa | 8.2% pa |

International shares (unhedged) | 1.5% | 7.5% pa | 9.8% pa | 9.6% pa | 6.6% pa |

Australian listed property | 3.3% | 7.6% pa | 12.5% pa | 10.7% pa | 5.6% pa |

Australian bonds | 4.5% | 3.7% pa | 4.7% pa | 5.2% pa | 5.7% pa |

Cash | 1.9% | 1.9% pa | 2.2% pa | 3.1% pa | 4.1% pa |

Source: Chant West

Of course, the returns above are for the overall asset category, and the share market comprises more than 1,000 companies, each delivering a different return. Even in a bad year, some companies will deliver an outstanding performance for their shareholders. And in really good years, not all companies will deliver positive returns.

The advantages of shares

In addition to the potential for high returns over the medium term, shares offer several advantages compared to other asset classes:

- You can invest as little as $500 in one company to get started and then make additional purchases of any size. You don’t have to be a millionaire to be a share market investor, and while transaction costs will need to be considered, it doesn’t take too much to build a diversified portfolio of stocks;

- Most shares are liquid, which means that they’re easy to sell and you’ll receive your funds within two business days. Unlike an investment property, where you can’t sell the third bedroom, you can sell parcels of shares in any size. So if you need to raise some funds quickly, you should be able to do so;

- Transaction costs are also relatively low. For example nabtrade charges brokerage of just $9.95 on a transaction up to $1,000; $14.95 if the trade value is between $1,000 and $5,000 and then $19.95 if the trade value is between $5,000 and $20,000. There’s no stamp duty or other fees and charges for Australian shares. However, there may be other fees involved in transacting international shares and managed investment products;

- You can see exactly what your shares are worth, second-by second or minute-by-minute if you like. While this can sometimes be a little off-putting, you won’t be left guessing as to how your portfolio is tracking; and

- For Australian shares (dividends), you may be entitled to franking credits depending on the dividends. This may offset tax payable on your tax return.

What about the disadvantages?

Like anything, there are disadvantages:

- The main disadvantage is that as higher risk assets, you can lose your capital. Occasionally, companies go into receivership and you lose all your money. There can be quite a lot of risk relating to an individual company – a change in business circumstance, new competitors, industry disruption, new government regulation, the CEO leaving the company etc – and that’s why investors usually maintain a portfolio of different shares to diversify this risk;

- Then there’s volatility risk, that is the market taking a sudden dive and dropping quickly. This is much harder to manage. When this happens, even great companies will be impacted and their share price will fall. However, as the data clearly shows, share markets tend to recover over time and patient investors in strong companies should be rewarded;

- Like with property, some investors adopt a strategy of buying shares for a reliable income stream. While investors want and would expect companies to increase their dividends over time, there is the risk that companies will cut or eliminate their payments due to various factors including poor management, financial challenges and weak economic conditions; and,

- If you hold or plan to hold international shares, currency risk needs to be considered. Not only would you be exposed to movements in the underlying share price, but swings in the currency would negatively or positively impact the capital gains and value of dividends from your investment depending on if the Australian Dollar rises or falls against that particular currency.

Let’s talk dividends

Companies that make a profit will typically return part of their profit to their shareholders through the payment of a dividend. The dividend will be determined by the company’s directors and is usually paid twice-yearly.

Not all companies make a profit so they don’t pay a dividend. Others choose not to pay a dividend because they want to re-invest the profit in growing the company. The majority do pay a dividend – but will usually retain some of the profits to re-invest in the company. Known as the ‘payout ratio’, the proportion of a company’s profit paid out as dividends is typically in the range of 40% to 75%.

Capital gains & other tax issues

If you buy shares in a company and sell those shares for a profit, you’ll potentially have to pay capital gains tax. You’ll be taxed at your marginal tax rate on the difference between what you sold the shares for and what you paid for them.

However, Individual investors who have owned the shares for more than 12 months are eligible for a discount of 50%, meaning that they only pay tax on half the gain. Superannuation funds get a one-third discount, while company shareholders aren’t eligible at all. Capital losses can be used to offset capital gains, and if not applied, can be carried forward to the following tax year.

Like interest on a bank account or from a term deposit, dividends are taxable. If the dividend is “franked”, this means that the company has paid tax to the Australian Taxation Office (ATO) and the attached franking credits (also called imputation credits) can be applied by the shareholder as a tax offset. If the dividend is “unfranked”, there aren’t any franking credits.

Not all dividends are franked, and some are only partially franked. Companies that earn a lot of their revenue outside Australia will often pay tax to a foreign government. But because they haven’t paid tax to the ATO, they can’t frank their dividends. You can “gross up” the value of the franking credits to compare an unfranked dividend with a franked dividend.

Good reasons to invest in shares

Whether it is the prospect of high returns, the potential benefits of franked dividends, or liquidity, there are good reasons to invest in shares. And with low transaction sizes and costs, it is relatively easy to build a diversified portfolio of shares.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.