Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The various ways to invest your money

The Australian stock market is a marketplace for more than just company shares. In fact, it’s a marketplace for securities and investment products from most of the major asset classes. An asset class is a broad group of investments that behave similarly.

What are the main asset classes?

- Cash and term deposits

- Fixed interest securities, such as bonds.

- Property, which includes Australian real estate investment trusts (A-REITs).

- Australian shares.

- International shares.

- Commodities (gold, precious metals etc).

These assets can be then be categorised as either “income” or “growth” assets.

Income assets include cash, bank term deposits, bonds, debentures, hybrid securities and other fixed interest securities. As the name implies, most of an investor’s return should be earned from the income that the asset pays. Simply, the income from a bank term deposit is interest.

On the other hand, with growth assets, most of an investor’s return is expected to come from an increase in the price of the asset. Growth assets include Australian shares, international shares, property and commodities. For example, I invest $7,500 to buy 500 BHP shares at $15 a share in 2016. They go up in value after three years to $40 a share, so they are now worth $20,000. The growth (or gain) on this asset is $25 a share or $12,500.

Some growth assets also pay income (for example, BHP shares also pay a dividend). Even so, most of the return is expected to come from an increase in the value of the asset.

Of course, any of these growth assets mentioned above can also go down in value, so they’re typically considered to be “riskier” than income assets.

Investors who primarily seek income and require their capital to be preserved largely invest in income assets. Those investors who want their capital to grow (and are prepared to take more risk to do so) will mainly invest in growth assets.

The ASX supports the needs of both groups of investors and offers a variety of products to do this.

What types of listed products are there?

Listed products are either issued by a company (and investors are owners (or creditors) of that company), or they use a unit trust structure (you may have heard of managed funds) and investors are issued with units.

There are a number of listed products:

1. Shares

- Ordinary shares are the most common listed product. These are the basic form of shareholding, entitling the owner to attend general meetings of the company, elect the Directors, vote on material matters and receive dividends. Each ordinary share carries with it one vote, so if you own 100 shares, you have 100 votes. Accordingly, a person or entity that owns more than 50% of the ordinary shares effectively controls that company. If you buy shares in BHP or Woolworths, you’re buying ordinary shares.

- Some companies issue preference shares. They are called ‘preference’ shares because they rank higher than ‘ordinary’ shares. If a company is wound up and, after paying its creditors in full, has any monies left over, preference shareholders will be paid out before any return of capital is made to ordinary shareholders. Unlike ordinary shares, preference shares don’t carry any general voting rights and because they are sometimes issued with a fixed dividend or nominal term, considered to be more of a debt security than an equity security.

- Companies may also issue options over their shares, allowing option holders the right but not the obligation, to exercise the option and subscribe for new ordinary shares at a fixed pre-determined price. Options usually have a fixed expiry date and are traded separately to the ordinary shares on the ASX.

2. Corporate bonds

Many large companies also borrow money by issuing corporate bonds, which can be listed on the ASX. They typically pay investors a fixed rate of interest or a fixed margin over a benchmark interest rate, and have a fixed maturity date – that is, the date when the investor will receive their money back. Governments, Federal and State, also issue bonds and many of these can be traded on the ASX.

3. Unit trusts: property trusts, exchange traded funds & managed funds

A unit trust is a different form of legal entity, generally established for investors to pool together to own and operate large investment assets. Investors purchase units in a trust that can then be traded on the ASX. The biggest unit trusts are property trusts, which own and lease commercial buildings, shopping centres and industrial parks. These trusts are managed on behalf of the unitholders by professional investment managers. Exchange traded funds and managed funds (see below) are also unit trusts.

Let’s explore some of these products more.

1. Shares

More than 1,000 companies have their ordinary shares quoted on the ASX. By international standards, the market is relatively concentrated, with the biggest 20 companies accounting for approximately 40% of the whole market’s capitalisation. The top 200 companies, whose performance is tracked by the S&P/ASX 200 index, account for approximately 80%.

Each company is classified into one of 11 broad industry sectors. These are shown in the table below, together with the largest stocks in each sector. The biggest sector by market capitalisation, the financials sector, comprises the major banks, regional banks, insurance companies and wealth managers and makes up 32% of the weighting of the benchmark S&P/ASX 200 index. The smallest sector, utilities (such as gas companies) makes up just 1.9% of the index.

Sector | S&P ASX 200 Weight | Largest Stocks and ASX Code |

Communication Services | 3.9% | Telstra (TLS) REA Group (REA) |

Consumer Discretionary

| 6.4% | Wesfarmers (WES) Aristocrat (ALL) Tabcorp (TAH) |

Consumer Staples | 5.5% | Woolworths (WOW) Coles (COL) Treasury Wines (TWE) A2 Milk (A2M) |

Energy | 5.3% | Woodside Petroleum (WPL) Santos (STO) Origin Energy (ORG) |

Financials | 32.0% | Commonwealth Bank (CBA) Westpac Banking Corp (WBC) ANZ Banking Group (ANZ) National Australia Bank (NAB)AMP Macquarie Group (MQG) QBE Insurance (QBE) |

Health Care | 8.4% | CSL (CSL) Ramsay Health Care (RHC) Sonic Health Care (SHL) |

Industrials | 8.2% | Transurban (TCL) Brambles (BXB) Sydney Airport (SYD) |

Information Technology | 2.3% | Computershare (CPU) Wisetech Global (WTC) |

Materials | 18.5% | BHP Group (BHP) RIO Tinto (RIO) Fortescue (FMG) Newcrest Mining (NCM) Amcor (AMC) |

Real Estate | 7.5% | Goodman Group (GMC) Scentre Group (SCG) Dexus (DXS) GPT |

Utilities | 1.9% | AGL (AGL) APA Group (APA) |

As at 31 May 2019. Source: S&P Dow Jones

2. Managed investments – ETFs, LICs/LITs, mFunds

An alternative to investing directly in shares is to invest in managed investments. Some investors choose to do both, recognising that a manager can facilitate access to a market or asset class, or add particular investment expertise.

What are the various types of managed investments?

There are three types:

1. Exchange traded funds (ETFs)

These are managed funds traded on the ASX. They are “open-ended”, meaning that they can grow in size as more investors seek to invest. Instead of shares, investors are issued with units.

Most ETFs are passively managed and track an index such as the S&P/ASX 200 or the USA equivalent, the S&P 500. Issued by global investment giants such as Blackrock (iShares), Vanguard or State Street, these funds aim to replicate the performance of the underlying index by investing exactly in accordance with construct of that index. If the underlying index goes up by 2%, the ETF should go up by 2%, and if the index falls by 2%, the ETF should also go down by 2%. Because they are almost on “auto-pilot”, ETFs of this nature charge very low management fees, sometimes as low as 0.10% pa.

Index tracking ETFs are available over a wide array of assets and markets, including local shares, share market sectors, small and mid-caps. overseas shares, bonds, commercial property and commodities such as gold.

There are also actively managed funds (called quoted managed funds) that operate the same way as an ETF, except the investment manager is using his or her skills to select the investments.

The following resources can help you learn more:

|

2. Listed investment companies (LICs) and listed investment trusts (LITs)

LICs use a company structure and are “close-ended” investments. Investors are shareholders, with the company either managing the investments internally or appointing an external manager to do this.

There are LICs that invest broadly across the Australian share market, such as Argo (ARG:ASX) or AFIC (AFI:ASX), LICs that invest in small/mid-caps, such as WAM Capital (WAM:ASX), LICs that invest in particular industry sectors and others that invest in overseas shares.

Listed investment trusts (LITs) are also “closed-ended” investments.

An advantage of a LIC or LIT over an ETF is that the investment manager has a finite pool of money to invest and doesn’t have to worry about inflows or outflows. A disadvantage is that the LIC or LIT can trade at a discount or premium to its NTA (net tangible asset value).

The following resources can help you learn more:Watch nabtrade’s LICs and LITs 101 video

3. mFunds

Investors can also invest in hundreds of unlisted managed funds through the ASX mFunds service, which provides access to Australian shares, overseas shares, property, fixed income and infrastructure funds.

You can see the range of mFunds available on nabtrade, along with videos from some of our mFund managers by logging in, hovering over Insight Centre and selecting Managed Funds from the drop down menu.

Diversification: it’s the name of the game

One issue to consider when investing is the level of diversification. As the old adage goes “don’t put all your eggs in one basket”, so It’s important to think about:

- How much capital you want to spread across different asset classes

- Within each asset class, investing across different industries

- Whether you have the expertise and knowledge about picking securities in each asset class

By diversifying across different asset classes and spreading your investments in each category, you can reduce your portfolio’s volatility. It also means that poor returns from one asset class in any given time period can be offset by higher returns in others. For example, when the share market a bad year and delivers negative returns, bonds tend to deliver a positive return.

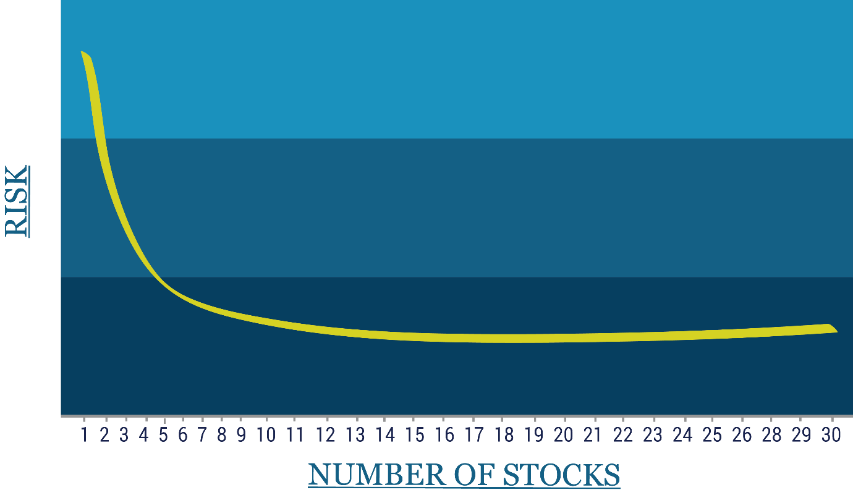

For shares in particular, adding different companies to a portfolio to minimise the impact of specific company risks, can be readily achieved, as the graph below shows. While you can never eliminate the impact of individual company risk, a portfolio of 10-15 stocks materially reduces the overall risk.

Source: Switzer Report

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.