Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why doesn’t the market like the earnings from this US tech giant?

Dan Romanoff | Morningstar

Microsoft’s second-quarter results topped the high end of guidance. Revenue increased 15% year over year in constant currency to $81.3 billion, compared with the high end of guidance of $80.6 billion. The operating margin was 47.1%, compared with the high end of guidance at 45.8%.

Why it matters: Results look good as headline numbers came in ahead of our expectations on both the top and bottom lines. Both PBP and IC came in nicely ahead of the top end of guidance. Critically, we see strength in Azure, in both traditional and artificial intelligence workloads.

- Near-term demand indicators are robust. Commercial bookings grew 228% year over year in constant currency, driven by large Azure deals, including the previously announced $250 billion OpenAI commitment. RPO was up 110% (up 28% without OpenAI) to $625 billion.

- Demand for Azure AI services is surging, which is clearly a long-term positive. While Azure remains capacity-constrained, both traditional and AI workloads were strong. Azure growth was 38% in constant currency for the quarter and exceeded guidance of 37%, versus 89% growth in capital expenditure.

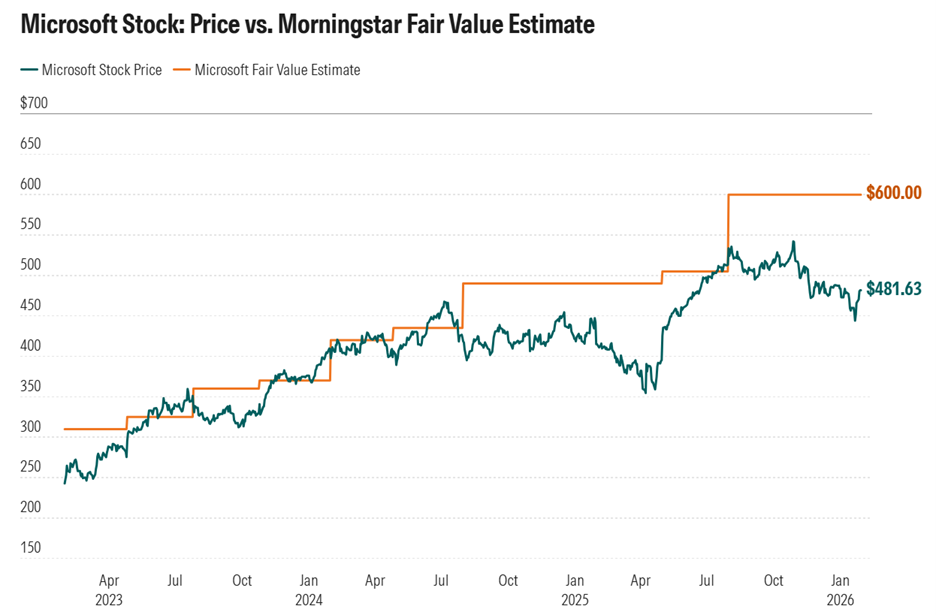

The bottom line: We maintain our fair value estimate for wide-moat Microsoft at $600 per share. We tweaked our model over the medium term, primarily to reflect slightly faster Azure growth and slightly lower margins to account for elevated capex. The stock remains one of our top picks.

Coming up: Third-quarter guidance is largely in line with expectations, although it is officially slightly better than our model and just shy of FactSet consensus estimates, including $81.20 billion in revenue, a 45.3% operating margin, and $3.94 in EPS at the midpoints.

Big picture: We see results as consistent with our long-term thesis, which centers on the expansion of hybrid cloud environments, the proliferation of artificial intelligence, and Azure. We center our growth estimates around Azure, Microsoft 365 E5 migration, and traction with the Power Platform.

Bulls say

- Public cloud is widely considered to be the future of enterprise computing, and Azure is a leading service that benefits the evolution to first to hybrid environments, and then ultimately to public cloud environments.

- Microsoft 365 continues to benefit from upselling into higher-priced stock-keeping units as customers are willing to pay up for better security and Teams Phone, which should continue over the next several years.

- Microsoft has monopoly like positions in various areas (OS, Office) that serve as cash cows to help drive Azure growth.

Bears say

- Momentum is slowing in the ongoing shift to subscriptions, particularly in Office, which is generally considered a mature product.

- Microsoft lacks a meaningful mobile presence.

- Microsoft is not the top player in its key sources of growth, notably Azure and Dynamics.

Source: Morningstar

Source: Morningstar

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 29 January 2026. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.