Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Where to catch the investment waves in 2026

Steve Johnson | Forager Funds

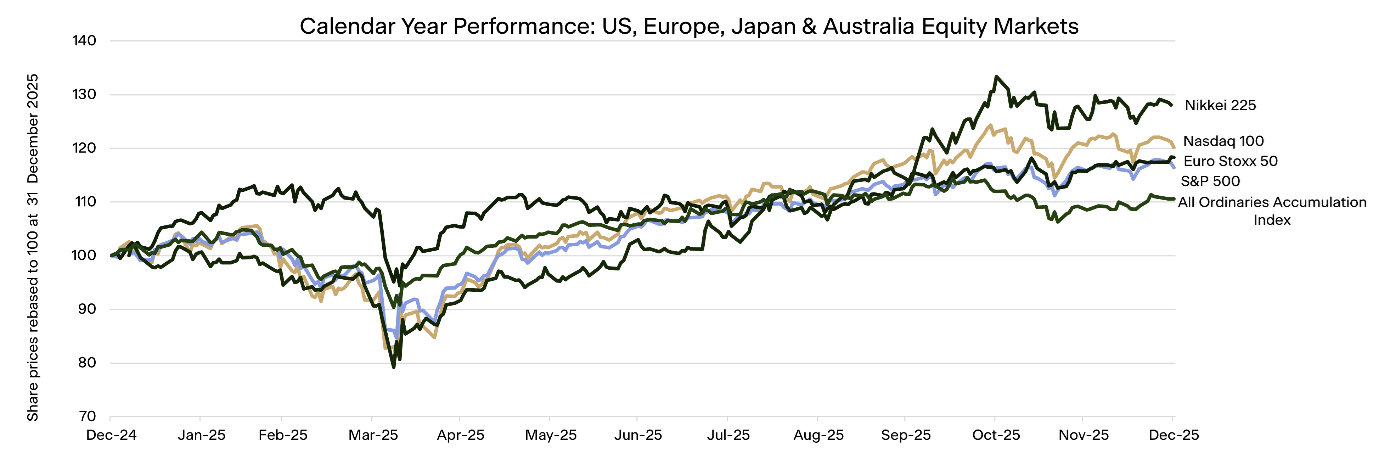

If you look only at the headline index numbers this year, 2025 looks fairly straightforward. The All Ordinaries Accumulation index has returned just over 10% for the year and the MSCI World Index approximately 20%, putting both modestly above long-term equity returns of 7-8% per annum. On the surface it looks like a decent, if unspectacular, year. Under the surface, it was far more eventful.

The Australian market was one of the worst performers globally. While the tech-heavy Nasdaq Index (+20%) outperformed the broader S&P 500 (+16%) for the year on the back of big tech and Artificial Intelligence (AI) enthusiasm, it was a strong year for European markets too, particularly those in the south. Italy’s FTSE MIB rose 32%, Spain’s IBEX 35 added 49% and Greece’s ASE Index a whopping 44%.

Source: Bloomberg

Even within markets, dispersion has been the defining feature of the year. The gap between winners and losers has been wide. Abnormally, that has almost been as true at the larger end of the market as the smaller end. Here in Australia, investors in the likes of CSL (ASX:CSL), CBA (ASX:CBA) and James Hardie (ASX:JHX) learned that size doesn’t protect you from things going wrong. In fact, for the first time in a long time, the Small Ordinaries’ almost 25% return trounced the All Ordinaries for the year, with mining stocks, especially gold-related, posting a bumper calendar year (the ASX Small Ordinaries Resources Index was up 70%). Even in the Nasdaq 100, 20 stocks fell more than 10% in 2025.

Dispersion has always been a feature of financial markets. If it didn’t exist, we wouldn’t have a job. As much as balance sheet analysis and stock valuation matter to Forager’s process, a huge component of our excess returns involves finding unpopular stocks that can one day be popular again. Benjamin Graham quoted Horace almost 100 years ago in his seminal value-investing book Security Analysis and the philosophy is relatively unchanged:

“Many shall be restored that now are fallen, and many shall fall that are now in honour.”

What has changed is that the waves of popularity seem more extreme than ever. We’ve written a lot this year about the structural influences increasing the momentum-driven nature of stock markets. Want to bet on European defence stocks? Here’s the Betashares Global Defence ETF for you (ticker ARMR), available via any Australian broker and up a miserly 44% in 2025.

While it can be painful to miss these waves and even worse to get dumped by one, the opportunities for the patient long-term investor are excellent. The unloved can be a source of great ideas, and the payoff even better than expected if the sentiment changes for the better.

Some nice waves in 2025

With concentrated portfolios and small-cap stocks, there will always be a strong idiosyncratic element to Forager’s returns. The most significant contributor to the Forager International Fund’s 15% return in 2025 was US hospital owner Nutex Health (NASDAQ:NUTX). Its share price rose 420% for the year despite the healthcare sector as a whole struggling. Cuscal (ASX:CCL) was the second biggest contributor to the Australian Fund’s returns despite the payments sector globally having a very difficult year.

But we also managed to catch a few of those big waves that defined the year on stock markets. AI companies’ insatiable demand for data centres and power generation led to 120% and 139% respective returns for heating and cooling system installer Comfort Systems (NYSE:FIX) and solar equipment company Nextpower (NASDAQ:NXT) in the International Fund. And a widespread tech rally in the first nine months of the year led to sensational gains for our once-cheap collection of ASX-listed tech stocks like Bravura (ASX:BVS) and Catapult (ASX:CAT). Both of those companies were added to S&P/ASX indices, boosting their returns, and Comfort Systems and CRH were added to the S&P 500.

The net result was very healthy gains for both funds despite large parts of the market (and our portfolios) not “working”.

Source: Forager

Source: Forager

Past performance is not indicative of future performance and the value of your investments can rise or fall. Performance returns are calculated using exit prices, net of all fees and expenses and assume distributions have been reinvested.

Where to catch a wave in 2026

Looking into the year ahead, the first place to consider is always your local surf break. In 2025, some of our favourite investing sectors became too popular and crowded. As outlined in the September Quarterly Report, we banked profits on the likes of Catapult and Bravura, but they, and many of their peers, are well entrenched on the watchlist. The subsequent three months saw a significant pullback across the whole ASX-listed tech sector. Catapult’s share price fell 40% for the final quarter of 2025 and Bravura was down 27% from its recent high on 10 October. Even market darling Xero (XRO) fell 41% from its highs in June.

Some of them are perceived to be AI losers. The value of software, in a world where anyone can use AI to “vibe code” their way to a new website or app, is significantly diminished. That’s the theory.

It is a theory we are willing to bet against at the right price. Forager is a user of Xero’s product and won’t be vibe coding our accounting software any time soon. Even if we could build an accounting system, software isn’t just about features. Security, backups and constant improvements are at least as important. There is no chance of us taking a risk on any of those in order to save a few thousand dollars a year.

Source: Bloomberg

Source: Bloomberg

Many of these stocks had become expensive. Despite the recent falls, the share prices of most are still up meaningfully for the year and still aren’t cheap enough (including Xero). We haven’t deployed much capital into the Australian stocks yet, but are a lot closer than we were just three months ago. In the International Fund, we have added three technology companies that have each halved and worse over the course of 2025 and hope to add a few more. All three can be substantially higher portfolio weights should we get some thesis-confirming evidence over the next few quarters.

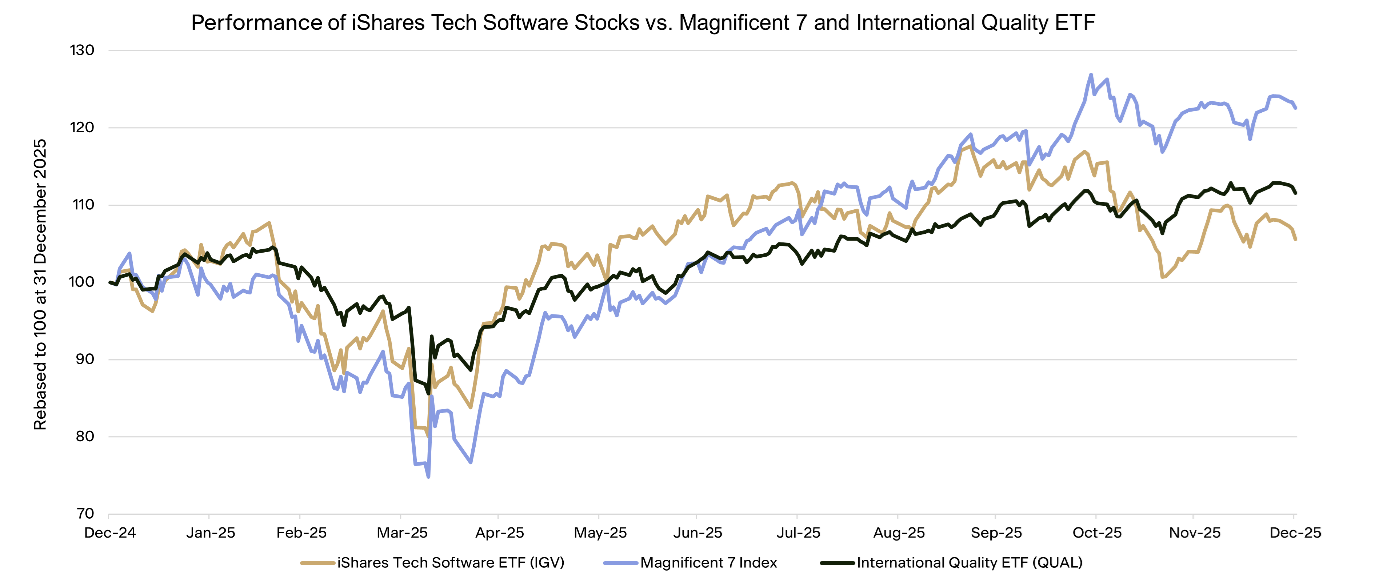

“Quality” has its year in the shade

Who wouldn’t want to buy a business with a strong moat, decades of earnings growth behind it and a great management team? Not only does investing in these “quality” businesses sell well, it has worked well for most of the past 15 years. In 2025, it didn’t. Australian investors in favourites like Carsales (ASX:CAR), Resmed (ASX:RMD), Cochlear (ASX:COH) and CSL suffered the same fate as investors in global equivalents like UK property website Rightmove (LON:RMV) and global insulin and weightloss giant Novo Nordisk (CPH:NOVO-B).

Share prices had been growing faster than earnings for many of these companies and the past year showed that the resultant high multiples can be a problem, even for the best of businesses. The result can be years of no returns while the earnings catch up to the share price. Or a significant derating if the earnings and the multiple come into question. Both Novo Nordisk and CSL suffered the latter fate in 2025. So did Fiserv (NASDAQ:FISV), a long-held investment in our International Fund.

We, too, like these quality attributes when we can buy them for an appropriate price. For Forager, they are inputs into our valuations, rather than a standalone investing strategy. We can and do buy lower quality businesses and invest in riskier situations, managing the risks with portfolio management. That flexibility has been helpful this year—some of our lower quality businesses have generated excellent returns—and the flexibility might also help find some quality opportunities at attractive prices in 2026.

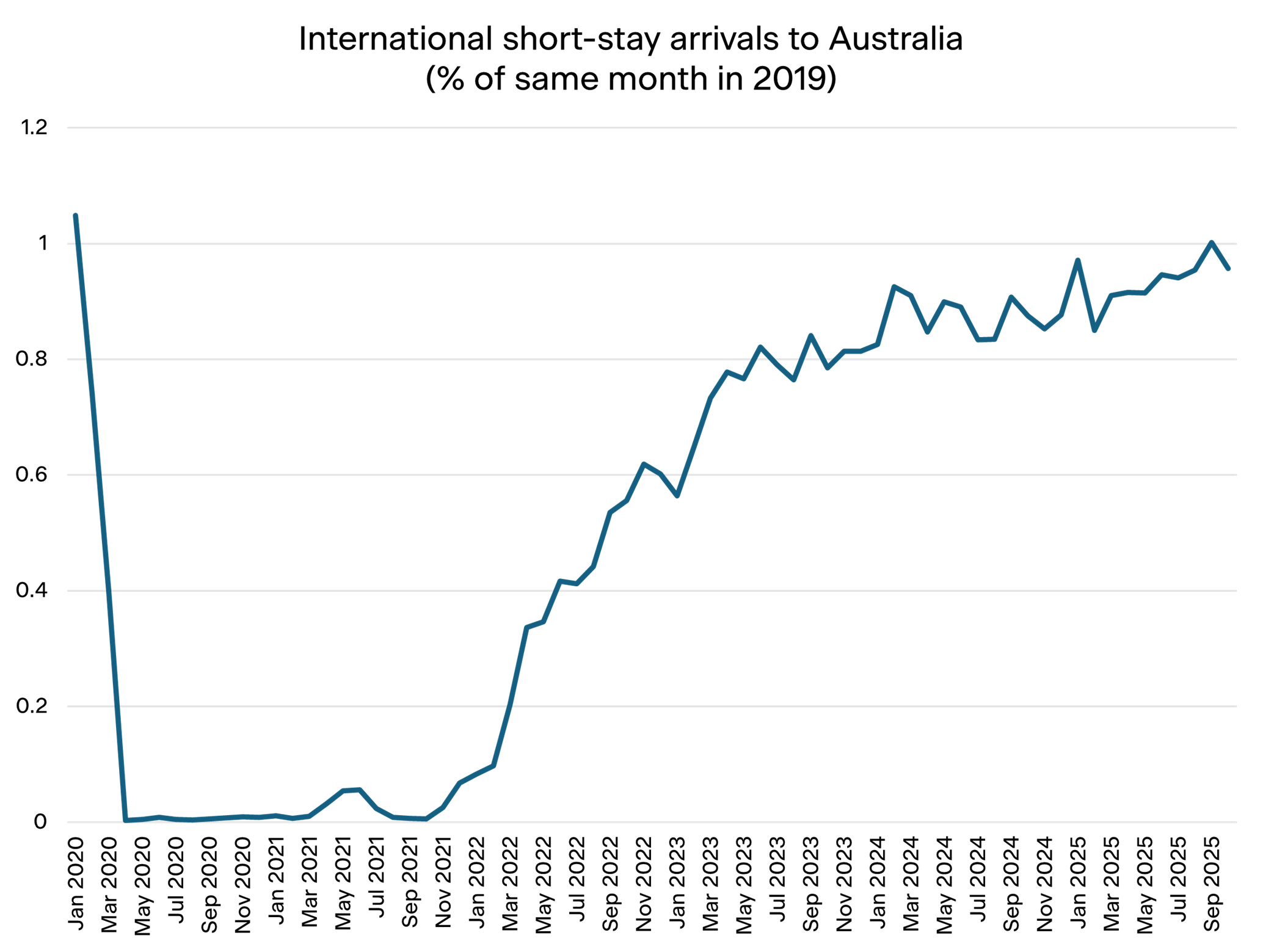

Australian tourism finally recovers?

We’ve been paddling around this beach for four years now, were dumped twice and haven’t caught a wave. But could 2026 be the year Australian tourism finally gets some momentum?

Source: Australian Bureau of Statistics, Overseas Arrivals and Departures, Australia October 2025

Source: Australian Bureau of Statistics, Overseas Arrivals and Departures, Australia October 2025

There are not many great businesses in the tourism sector. There are exceptions, like global travel booking platform Booking Holdings (NASDAQ:BKNG) and scaled, asset-light hotel operators like Accor (EPA:AC) , but the industry is generally characterised by low barriers to entry and wild swings in demand. Stock prices for our two ASX-listed tourism companies, Experience Co (ASX:EXP) and Tourism Holdings (ASX:THL), remain near 2022 levels.

Yet the environment continues to improve. International arrivals into Australia set post-Covid records in the past three months. Relative to 2019, August, September and October combined saw arrivals hit 97% of the equivalent period in the year prior to Covid. It’s been a long time coming, but there is no reason the growth should stop there. Travel has historically grown at a multiple of GDP growth and there is still some catching up to do.

Those two stocks are very cheap on anything like recovered earnings. And we have recently added a Spanish hotel booking platform company to the International Fund. Its earnings have already recovered, but it trades at a multiple of just six times those earnings.

Given the amount of suffering in the sector over the past decade, it’s hard to see others getting too excited. Less pessimism would help, though. And who knows? Our mining services investments spent a decade in the wilderness before doubling and more over the past 12 months (in Perenti’s (ASX:PRN) case, mostly after we sold it). A travel ETF anyone? ASX code FUN, of course.

An environment that should only get better

Forager will likely get off waves far too early. We may well stay on a few too long. We are going to suffer periods where we miss them altogether and others where we paddle around waiting for a wave for years longer than we initially might expect. But the swells creating good investing conditions aren’t going anywhere. Active equity strategies saw record outflows again in 2025. The running total globally is US$3 trillion out of active and US$6 trillion into passive strategies since 2015. It has been another year where we saw multiple active managers liquidate their portfolios and shut up shop in Australia. For those of us fortunate enough to have loyal long-term clients and some good results on the board, that’s all a source of opportunity that’s hard to see going away.

This is an excerpt from Forager’s upcoming December 2025 quarterly report. If you would like to receive the report to your inbox, please subscribe to the Forager investing community here.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 13 January 2026. This document was originally published in Livewire Markets on 13 January 2026. This information has been prepared by Forager Funds Management Pty Ltd and authorised for release by The Trust Company (RE Services) Limited (ABN 45 003 278 831, AFSL No: 235150) as the responsible entity and the issuer of the Forager Australian Shares Fund (ARSN No: 139 641 491) and the Forager International Shares Fund (ARSN No: 161 843 778).. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.