Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The missing ingredient for small-cap outperformance is here

Andrew Mitchell | Ophir Asset Management

The 2025 narrative rollercoaster

With Trump 2.0 at the helm of the world’s largest economy, many investors expected 2025 to be a wild ride and boy, it certainly did not disappoint.

Shifting investor narratives were enough to cause whiplash, turning the morning headline check here in Australia into a real rollercoaster.

Consider just some of the questions that were crammed into a single year:

- Is the U.S. headed for a recession?

- Does Trump want to tank the U.S. economy to drive rates lower?

- Does Trump want to run the economy hot, caring less about returning inflation to target?

- Are we in a market bubble? Or maybe just an AI bubble?

- Will the Fed Chair be fired, or will the Fed lose its independence?

- How high will U.S. tariffs go, and what will that mean for growth and inflation?

- Is rising U.S. imperialism hurting its investability?

- Is World War III about to start?!

- Are all our jobs going to be replaced by AI?

Despite all that, including a -19% drawdown in April after Trump’s Liberation Day tariff announcements, the S&P 500 put on a very healthy +16.4% in 2025. This followed gains of +23.3% and +24.2% in 2024 and 2023, respectively. It has been a very good few years for global share market investors, particularly those exposed to U.S. large caps, more specifically, mega-cap tech companies.

New year, same winners

Perhaps the most surprising thing is that, despite the macro and political volatility dominating headlines, you were better off throwing your crystal ball in the bin at the start of 2025 and simply sticking with what had worked in 2024 and 2023.

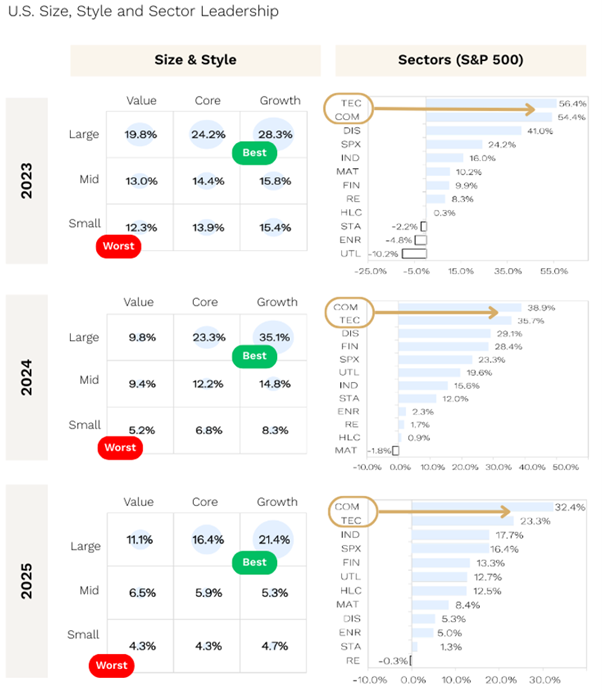

As shown below, U.S. large caps again outperformed mid- and small-caps, while growth-oriented stocks outperformed value.

On a sector basis, the winners were once again familiar, with Technology (think Nvidia, Apple, Microsoft) and Communication Services (think Google & Meta) coming out on top.

Source: Piper Sandler, Ophir.

BUT, we do not see 2026 as a “Connect 4” year where the same large-cap growth playbook delivers a fourth consecutive year of outperformance.

The Missing Ingredient: Earnings

There is no shortage of geopolitical risks for investors to digest, from ICE raids in Minnesota, to the toppling of a dictator in Venezuela, and the prospect of military action involving Iran and Greenland, to name just a few.

From an economic perspective, however, particularly in the U.S. as the world’s primary growth engine, there are several positives supporting ongoing equity market strength:

- The lagged effect of Fed interest rate cuts, with the potential for more to come;

- Falling oil prices, which effectively act as a tax cut for consumers;

- Large tax refunds flowing to U.S. households, alongside accelerated depreciation for capex and R&D expenditure under Trump’s One Big Beautiful Bill;

- Ongoing deregulation, with the likelihood of further stimulus and affordability measures ahead of the U.S. mid term elections in November.

Together, these factors have recently driven outperformance in more cyclical areas of the U.S. share market, such as transport, housing and manufacturing, helping broaden market participation beyond a narrow group of stocks.

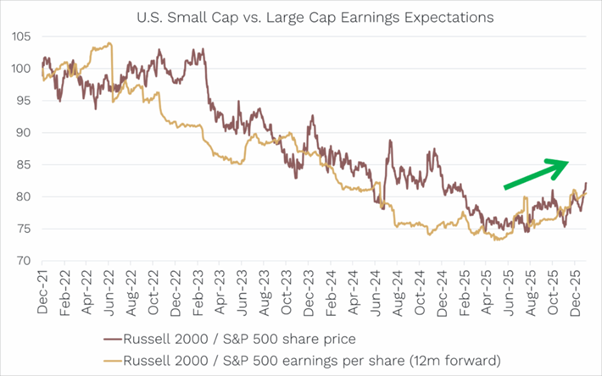

Since the rates-induced sell-off in equity markets in late 2021, small caps, one of the more cyclical and risk-sensitive segments of the market, have underperformed. This is illustrated in the chart below, where the red line shows the Russell 2000 (U.S. small caps) divided by the S&P 500 (U.S. large caps). It’s been heading south for a LONG time, which highlights prolonged small-cap underperformance relative to large caps. While there have been brief rallies lasting days or weeks linked to hopes for lower inflation or interest rates, these moves have not been sustained.

What has been missing is the key catalyst investors expect lower rates to deliver: earnings growth. The gold line in the chart shows small-cap earnings expectations relative to large-cap earnings over the next 12 months.

Source: Bloomberg. Indices indexed to 100.

As with individual stocks, earnings are the primary long-term driver of index performance. From 2022 through to mid 2025, small-cap underperformance closely mirrored their relative earnings underperformance.

There is now compelling evidence that this is changing. When combined with improving momentum in early-cycle sectors, a supportive economic backdrop and broader market participation, this emerging earnings outperformance represents the final ingredient needed to support sustained small-cap outperformance.

It has been a long wait, but as small-cap specialists, we believe this shift sets up a favourable tailwind for the asset class in 2026 and beyond, and ultimately for the Ophir funds.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 22 January 2026. This document was originally published in Livewire Markets on 22 January 2026. This information has been prepared by Ophir Asset Management (ABN 88 156 146 717, AFSL No. 420082). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.