Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Dogs of the ASX 2025: who bit, who limped, and who’s ready to run?

Hugh Dive | Atlas Fund Management

The year just gone has been very volatile for Australian equity investors, though the scoreboard showed a slightly above-average total return, with the ASX 200 up 10%. 2025 saw emotions in the market swing from despair to euphoria, followed by some moderation at the end.

The prospect of Trump's tariffs pushing the global economy into a recession in 2025 saw a steep correction in February and March, dragging the ASX 200 down more than 7% from its January levels.

Confidence gradually returned through mid-year, supported by strong commodity prices and RBA rate cuts, culminating in a rally to October highs where the index touched its strongest point of the year, buoyed by miners and banks.

In January, with some time to reflect before the reporting season kicks off in February, investors have the opportunity to pick through the market's trash of 2025 to find some treasure to drive portfolio returns over the coming year.

Invariably, several bottom-performing stocks will confound market expectations and stage remarkable comebacks, as we saw in 2025.

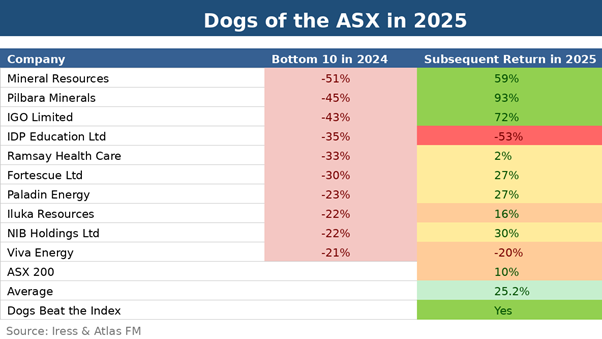

A portfolio comprising the "dogs" of 2025 had a banner year, beating the index by 15% and posting its best year since 2016, which returned +74%.

In this first weekly piece of the year, we will look at the "dogs" of the ASX from 2025, see how 2024 Dogs performed and review Atlas' predictions made 12 months ago in January 2025 Dogs of the ASX: did they bark or bite in 2024?

Dogs of the Dow

Michael O'Higgins popularised a systematic strategy of investing in underperforming companies named "Dogs of the Dow" in his 1991 book "Beating the Dow." This approach draws on the same investment principles as deep value and contrarian investors.

O'Higgins advocated buying the 10 worst-performing stocks in the Dow Jones Industrial Average (DJIA) over the past 12 months at the beginning of the year, but restricting the selection to those still paying dividends.

Restricting the investment universe to a large capitalisation index, such as the DJIA or ASX 100, increases the likelihood that the unloved company has the financial strength or the understanding among capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover over time.

For example, a larger company such as Mineral Resources was able to refinance debt with US bondholders and sell stakes in assets to keep the wolves from their door and live to fight another day.

The strategy then holds these ten stocks over the calendar year and sells them at the end of December. The process then restarts, buying the ten worst performers from the year that has just finished.

Retail investors have an advantage

One reason this strategy persists is that institutional fund managers often report the contents of their portfolios to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the "dogs" in their portfolio towards the end of the year as part of "window dressing" their portfolio before being evaluated.

For example, in early 2025, fund managers owning any of the lithium miners would have faced stern questioning from asset consultants about why they owned these companies with bleak outlooks for the coming year.

Spodumene prices had collapsed to below $700/tonne late in 2024 as African supply increased, flooding the market and making all miners unprofitable.

Mineral Resources (+59%) also faced corporate governance issues, high debt, and issues with its iron ore haulage road. Paladin (+27%) faced declining uranium prices and the slow closure of reactors worldwide, and the trend of big tech companies such as Microsoft and Google unveiling plans to restart nuclear facilities in the US to help power AI infrastructure was not anticipated.

Here, retail investors can have an advantage over institutional investors. Their lack of scrutiny by asset consultants gives them the flexibility to pick up companies whose share prices have been under pressure late in the year, which could rebound when selling pressure stops in December.

Furthermore, retail investors can afford to take a longer-term view of a company's investment merits, even if it has hit a speed bump.

The Dogs of 2025 had a great year!

Over the past year, the average equal-weighted return of Dogs from 2024 was a sensational 25% a long way ahead of the ASX 200.

Over the past decade, the Dogs have either beaten or matched the ASX 200 eight times, a pretty solid record. Solid gains from the lithium miners Mineral Resources, Pilbara, and IGO led the charge in 2025, courtesy of a recovering lithium price, assisted by Paladin Energy (uranium prices recovering as nuclear energy is becoming the choice of power for AI data centres).

Health insurer NIB recovered from a poor 2024, characterised by operational issues, while Fortescue benefited from a better-than-expected iron ore price and cancelled major green energy projects with questionable economics.

Conversely, regulatory uncertainty persisted for international student education company IDP Education amid increasing immigration restrictions in its main markets, the UK, USA, Australia, and Canada. Viva Energy struggled in 2025 due to a refinery shutdown and high debt loads post the OTR acquisition.

Predictions from January 2025

When we went through this exercise twelve months ago, Atlas correctly picked that Mineral Resources would stage a turnaround in 2025, predicated on asset sales that would allow the company to avoid a dilutive equity raise and wait for a recovery in the lithium price.

However, we did have some nervous moments in April when the share price fell below $20 as hedge funds heavily shorted the company's shares on news that their newly completed 150km haulage road was being shut and resurfaced (completed September 2025).

Similarly, we correctly picked that Ramsay Healthcare would not stage a rebound in 2025. The hospital provider faced rising labour costs from its nursing staff, a heavy debt load, and tough negotiations with private health insurers.

Ramsay's share price was unlikely to rebound with the financial press full of negative stories around the challenges private hospital operators face after Healthscope went into voluntary administration in May 2025.

Overall, a pass mark for 2025, though in hindsight we would have liked to have owned a second lithium miner in the Portfolio. However, this is a luxury afforded more to retail investors than to institutional investors running a concentrated portfolio.

Unloved mutts from 2025 in need of a good home in 2026

The list of Dogs of the ASX for 2025 comprises a range of companies generally considered high quality and would feature prominently in the portfolios of many growth-style fund managers, such as WiseTech, James Hardie, CSL, Xero, Telix and REA. What is noticeable is the absence of a group of companies impacted by the falling price of a single commodity.

We discussed many of the above companies in an interview with Livewire last month 5 Dogs of the ASX and their prospects for 2026.

Corporate Travel is included in the above list despite posting a nominal positive return in 2025, up until the company was suspended from trading in August due to its auditors' unwillingness to sign off on the company's financial accounts. When Corporate Travel is eventually relisted on the ASX, it will surely join this list.

The three key themes common to the companies whose share prices struggled in 2025 are:

- Questionable acquisitions: James Hardie, Treasury Wine and Xero

- Regulatory Issues: Telix, ASX

- Weaker US Consumer Demand: Block, Treasury Wine and CSL

- Corporate Governance issues: WiseTech and Corporate Travel

Our picks for 2026

After analysing the Dogs of the ASX 100 each year since 2010, at least three companies from the bottom ten will stage dramatic turnarounds in 2026. However, sitting here in January, picking the candidates for share price rebounds is always very challenging due to recency bias from the previous 12 months of bad news about these stocks.

In selecting a share price recovery candidate for the next year, we generally look at companies whose current woes are company-specific rather than caused by factors outside the control of their management team, such as commodity prices, government policies, or long-term decline in a company's products.

Atlas sees CSL as a candidate for a rebound in 2026. Last year, CSL's share price was under pressure due to a combination of a surprise corporate restructure, a 15% reduction in the company's workforce (an admission that the company lost control of R&D costs), and a sharp decline in flu vaccine sales in the USA and a general negative view towards the healthcare sector due to policy uncertainty in the USA.

2026 should see CSL's margins expand from efficiencies in plasma collection and stronger cost controls.

Additionally, the 2025 flu season is proving to be the worst one in 25 years, with 11 million Americans hospitalised with the flu. This could lead to a late rebound in flu vaccine sales and more substantial take-up in 2026.

While AI could disintermediate REA down the line, it currently has a large platform with up to 13 million users visiting its website each month. This, combined with a net cash position, means REA has plenty of liquidity to invest in growing the platform, even if there is a slowdown in real estate advertising in Australia.

Conversely, it is hard to see a significant turnaround at Treasury Wine, with the company announcing a strategy reset in December that included a profit downgrade and write-offs of inventory and the value of acquisitions in the USA. More concerning is declining wine consumption in key markets of the USA, China and Australia, a trend that may not be quickly reversed.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 6 January 2026. This document was originally published in Livewire Markets on 6 January 2026. This information has been prepared by Atlas Funds Management Pty Ltd ABN 83 612 499 528 | AFSL 491395. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.