Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Which ASX 20 stocks are shaping up for a volatile 2026?

Chris Conway | Livewire Markets

This year, we’ve seen volatility at the top end of the ASX like we haven’t seen in some time – perhaps ever.

After the August reporting season, in which a host of large caps endured heavy falls, Yarra Capital Management’s Joel Fleming said the following about the volatility;

“When you’ve got blue chips behaving like micro caps, it really is something you don’t see all the time.”

Major moves this year have included the following;

- CSL Limited (ASX: CSL) has been the poster child for large-cap volatility this year, suffering not one but two 15%+ beltings. The first occurred on August 19, results day. The stock fell 16.9% - its largest single-session decline since listing - after reporting FY25 earnings and FY26 growth guidance that were well below consensus. CSL also announced plans to spin off its influenza vaccine unit (Seqirus), which compounded investor disappointment. Then, on October 28, CSL cut its guidance for fiscal 2026: revenue growth was revised down to 2-3% (from 4-5%), and profit (NPATA) growth forecast was trimmed to 4-7% (from 7-10%). The reaction? The stock fell another 15.9%.

- James Hardie Industries (ASX: JHX) dropped 28% on August 20, after a first-quarter FY26 profit plunge and downbeat guidance. Results badly missed expectations amid a sharp slowdown in its key North American housing market, and updated FY26 forecasts (e.g. EBITDA guidance ~21% below consensus) rattled investors. The stock lost about $7.7 billion in value within minutes of trading on the news.

- Santos (ASX: STO) dropped 12% on September 18, slumping to a multi-month low after an Abu Dhabi–led consortium (ADNOC’s XRG Group) scrapped its $18.7 billion takeover bid. The collapse of this all-cash offer (at a 28% premium) removed the expected takeover premium and triggered arbitrage funds to sell, marking Santos’ worst day in over five years. This was the third failed takeover attempt for Santos in seven years, fuelling market concern.

- WiseTech Global (ASX: WTC) has endured three sharp share price falls this year, for a host of reasons. On February 24, the stock fell 20%, on August 27, the stock fell 12%, and on October 28, the stock fell 16%. Yikes.

- Block, Inc. (ASX: SQ2) dropped 15.8% on November 7, after posting September-quarter results that missed analyst expectations. This was despite an 18% year-on-year surge in gross profit. Instead, the market focused on the weaker-than-expected earnings figures and outlook. The earnings miss overshadowed a guidance upgrade, prompting a steep sell-off.

Whilst it is often said that volatility is the price of admission (and higher returns than other asset classes) in the stock market, I’m sure we can all agree that avoiding such volatility, particularly in large caps, would be the preferred option.

As such, I’ve gone ahead and done some work on the ASX 20 to see where potential volatility might be hiding. Obviously, I can’t know how things are going to play out for any particular company, but I can observe expectations and subsequent premiums or discounts.

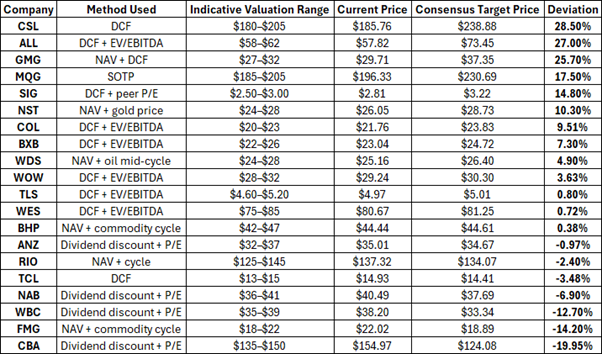

In that vein, I’ve mapped consensus target prices against current market prices (as of yesterday) to see where the most significant differences lie. For a sense check, I’ve also done some back-of-the-envelope valuations with the help of AI. Please don’t rely on these; they were more just to establish a reasonable range, against which to measure the consensus target prices.

Source: Valuation ranges generated using ChatGPT based on the method outlined. Consensus price targets sourced from FactSet, via Halo Technologies.

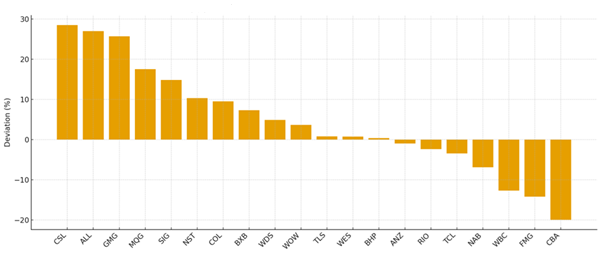

Deviation between current price and consensus price target

Source: Image generated using ChatGPT, based on the data in the table above

So, where could there be volatility hot spots?

- Commonwealth Bank (ASX: CBA) - This should come as little surprise. Many analysts have been saying CBA has been overvalued for some time, and even though the share price has fallen from around $190 in June to circa $155 presently, consensus suggests that the fair price is closer to $125. Will it get there? For the sake of everyone holding, I hope not, but hope is not a strategy. And if you think it can't happen to CBA, just ask the holders of CSL what they thought before the stock tanked more than 15% not once, but twice, within the space of three months.

- Fortescue (ASX: FMG) - This one is a little surprising, especially considering BHP and RIO don't fall into the same camp. Fortescue looks overvalued because analyst models and the market are pricing very different futures. Analysts anchor on mid-cycle iron ore prices of US$70–80/t, not the higher spot prices currently boosting FMG’s earnings and dividends. On normalised assumptions, cash flow falls sharply, especially given FMG’s single-commodity reliance and higher cost base than BHP and Rio. Most analysts also assign little value to its green energy plans, which require heavy spending with uncertain returns. By contrast, the market is trading near-term momentum, China stimulus hopes and high dividends, pushing FMG’s share price well above fundamental valuation.

- Westpac (ASX: WBC) and National Australia Bank (NAB) - Like CBA, most analysts see the banks as ex-growth and overvalued.

It's not all bad news, is it?

Whilst there are certainly some stocks that appear overvalued/priced for perfection, there are also a handful of names that consensus believes offer value at current prices.

- CSL Limited (ASX: CSL) - This one I would take with a grain of salt - perhaps analysts haven't been quick or aggressive enough in lowering their target prices following the two hits the stock took this year. That said, at some point, the share price will be compelling and, as Buffett says, you want to be greedy when others are fearful. On a recent episode of Buy Hold Sell, Atlas Funds Management's Hugh Dive said the following about CSL:

"There's ample opportunities to see them recover in 2026. They sell non-discretionary items and they're trading on 16 times, four or five PE points discount to the market. Probably need about 7% growth. I think they're setting themselves up for a much better 2026".

- Aristocrat Leisure (ASX: ALL) - Aristocrat screens as undervalued because analysts see stronger, more durable earnings than the market is pricing in. Digital remains highly profitable and scalable, yet the market still applies a discount due to perceived volatility. Land-based gaming continues to gain share, backed by a strong product pipeline, and analysts view real-money gaming as a valuable long-term optionality that isn’t reflected in the current price. With solid cash generation and a strong balance sheet, consensus forecasts sit well above market expectations, driving higher target prices. Hamish FitzSimons from AllianceBernstein has this to say about ALL in a July episode of Buy Hold Sell;

"I think it's a lot better business now than it was two or three years ago. They've always been very good at highly regulated gambling, which is a high-return, very hard-to-enter business".

- Goodman Group (ASX: GMG) - Analysts see stronger long-term earnings from its logistics portfolio and a large, high-quality development pipeline. They expect rising rents, more development starts and meaningful upside from Goodman’s growing data-centre strategy. But the market remains cautious. Data centres are capital-intensive, slow to deliver and face execution, regulatory and potential oversupply risks. Investors are also unsure whether Goodman can consistently earn above its cost of capital as competition increases. As a result, the market discounts the data-centre opportunity more heavily than analysts, creating a gap between the share price and higher consensus target prices. On a recent episode of Buy Hold Sell, Atlas Funds Management's Hugh Dive, and Ten Cap's Jun Bei Liu both rated the stock a HOLD, with the former saying;

"It's a very high-quality company, but I think there's still a lot of hot air with that AI and data centres in Goodman. Trading on 24-25 times has come down from 30 times. I don't own it. I wouldn't own it right now, but if it got a little bit cheaper, I'd buy it. The project generation is very high".

Looking ahead

As noted above, no one can know in advance exactly how things will play out for any company. But by being aware of the discounts and/or premiums at which stocks are trading relative to their consensus target prices, one can at least understand where significant volatility might come from.

Remember, big share price moves only occur where reality significantly departs from expectation. If a company is expected to do one thing and it does something else altogether, fireworks will usually follow.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 9 December 2025. This document was originally prepared and published by Livewire Markets Pty Ltd ACN 156 343 501 on 9 December 2025and Livewire is solely responsible for its issue. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.