Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The Holy Grail of investing: How to spot ASX Ten Baggers before the masses pile in

Carl Capolingua | Livewire Markets

In investing folklore, few terms inspire as much excitement, and ex-post regret, as the “Ten Bagger.” It’s slang for a stock that rises by a factor of ten, delivering a ten-fold return to those fortunate — or with the intestinal fortitude — to own it from start to finish.

Ten Baggers are the Holy Grail for ASX investors who are perpetually on the hunt for the next big thing, and for good reason: one genuine Ten Bagger can offset dozens of mediocre ideas or outright mistakes. It’s why investors endlessly scour online chat rooms, subscribe to expert tip sheets, and listen intently to anyone at a weekend barbecue who claims to have a hot stock tip.

But here’s the uncomfortable truth: while most people want to own a Ten Bagger, very few have a reliable way to identify one — and even fewer will hold onto it long enough for the magic to compound.

In this article, I’ll do four things:

- Show you every ASX Ten Bagger of 2025.

- Explore the common traits shared by these extraordinary performers — and why they so rarely resemble the companies most investors feel comfortable owning.

- Explain how my ChartWatch ASX Scans technical analysis model managed to identify every 2025 ASX Ten Bagger at some stage of its astronomical rise — often at a surprisingly early stage.

- Show you where you can potentially find 2026’s ASX Ten Bagger candidates as they emerge.

2025’s ASX Ten Baggers

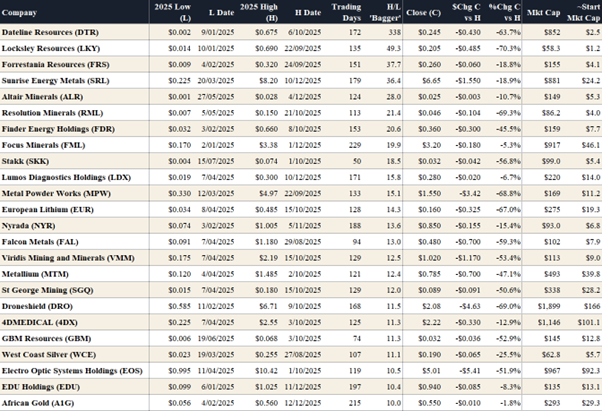

Below is the full list of ASX Ten Baggers for 2025 — 24 in total. These were the stocks that captured Aussie investors’ excitement and attention this year. All data is up to the close of trading on Friday, 12 December.

Source: Livewire

2025 Ten Baggers Table (data covers the period up to and including Friday, 12 December 2025)

Column definitions

- 2025 Low (L): The lowest traded intraday price during 2025 (“L”)

- L Date: The date L occurred

- 2025 High (H): The highest trade intraday price during 2025 (“H”)

- H Date: The date H occurred

- Trading Days: Number of trading sessions between L Date and H Date

- H/L ‘Bagger’: The maximum potential profit factor, i.e., the multiple achieved between L and H (e.g. 10.0 = Ten Bagger)

- Close (C): The closing price on Friday 5 December (“C”)

- Chg C vs H: Absolute price change from H to C

- %Chg C vs H: Percentage change from H to C (i.e., pullback from 2025’s peak)

- Market Cap: Current market capitalisation in millions

- Start Market Cap: An inferred starting market capitalisation in millions. It is Market Cap divided by the profit factor (note: the actual starting market capitalisation may vary due to share issuance since L Date)

The universe and filters

To avoid illiquid micro-cap stocks, the original universe of all ASX-listed securities was filtered by:

- Minimum liquidity (average turnover of at least $250,000 per day)

- Minimum market capitalisation (greater than $50 million at the time of writing, allowing for as little as approximately $5 million at L date)

- Exclusion of options, fixed income securities, and non-ordinary equities

The results

Topping this year’s list of Ten Baggers is critical minerals hopeful Dateline Resources (ASX: DTR). In early May, the stock received a massive jolt after US President Donald Trump stated via his social-media platform that DTR’s Colosseum Mine is “America’s second rare earths mine”, lauding its approval after years of stalled permitting. That endorsement helped trigger a surge in interest and speculative buying around DTR that ultimately led to an eye-watering 338 times L-to-H return.

Critical minerals were certainly a recurring theme among this year’s Ten Baggers. Locksley Resources (ASX: LKY) has openly recast itself as a US–focused critical minerals explorer targeting rare earths and antimony in California. Resolution Minerals (ASX: RML) is positioning its Horse Heaven antimony project squarely inside the new US–Australia critical minerals framework, while Sunrise Energy Metals (ASX: SRL) is advancing a scandium–nickel–cobalt portfolio that now includes a scandium offtake option with Lockheed Martin.

Viridis Mining and Minerals (ASX: VMM) and Metallium (ASX: MTM) are building rare-earths and niobium positions in Brazil and Canada, and St George Mining (ASX: SGQ), Forrestania Resources (ASX: FRS), and European Lithium (ASX: EUR) all sit firmly in the lithium–nickel–battery-metals camp that underpins the global energy transition.

Altair Minerals (ASX: ALR) and GBM Resources (ASX: GBM) straddle the copper–gold–critical-minerals narrative, with projects in districts increasingly being rebranded as strategic, energy-transition-linked provinces.

Running alongside the critical-minerals cohort was a wave of precious-metals interest, and at times, euphoria. African Gold (ASX: A1G), Focus Minerals (ASX: FML), Falcon Metals (ASX: FAL), and GBM all benefited from gold’s break to fresh record highs above US$4,000 an ounce in 2025, as capital poured back into the sector and ASX gold names re-rated aggressively.

West Coast Silver (ASX: WCE) captured the silver side of the precious metals trade: it controls one of Australia’s highest-grade primary silver projects at Elizabeth Hill, and it has been marketed as a leveraged way to play the white metal’s own surge to record territory above US$50–60 an ounce.

Many of the remaining 2025 ASX Ten Baggers came from technology- or growth-oriented sectors. For example, Stakk (ASX: SKK) exploded after landing a deal to supply an embedded-finance platform to US clients including Robinhood — triggering a >300% share-price rally. Meanwhile, Finder Energy Holdings (ASX: FDR) surged on a transformative farm-in agreement with Timor-Leste’s national oil company TIMOR GAP — a reminder that energy explorers, like their mining cousins, remain capable of delivering outsized returns when a major catalyst hits.

But these last two moves were largely associated with single announcements. Other high-flyers in 2025 were beneficiaries of sectoral thematics that rose to prominence during the year. Metal Powder Works (ASX: MPW) — an advanced-materials supplier — joined other defence-tech-linked names such as Droneshield (ASX: DRO) and Electro Optic Systems (ASX: EOS), appealing to investors drawn by rapidly evolving defence-spending tailwinds.

4DMedical (ASX: 4DX), Lumos Diagnostics Holdings (ASX: LDX) and Nyrada (ASX: NYR) follow the “biotech / life-science speculation” playbook: i.e., high upside, high risk. This is a domain where breakthroughs routinely create multiple-baggers.

The only Ten Bagger that doesn’t fit the commodities or tech / biotech mould is education services provider EDU Holdings (ASX: EDU). It’s surprisingly old-school, bricks-and-mortar education — but it still meets a classic Ten Bagger trait: a recent or impending transition from cash burn to profitability. Over the past three years, EDU has delivered strong and consistent revenue growth, expanding margins, and has moved decisively to net cash-flow positive and EPS positive, declaring its maiden dividend in September.

That last shift is critical for Ten Bagger hunters: many fund managers are restricted from investing in pre-cash-flow or non-dividend-paying companies, so EDU ticking these boxes in 2025 likely opened the door to a much larger pool of capital, helping to fuel its rapid share-price re-rating.

The fact that a diversified mix — from education, fintech, biotech, commodities, to industrial materials and defence-tech — all made the 10-bagger list, reinforces that there isn’t a single “right” sector for extreme returns. Rather, it’s about catalysts, timing, and investor sentiment across a range of macro-themes.

Ten Bagger common traits

Despite differing stories, commodities, and catalysts, these and other historical Ten Bagger stocks share a striking set of common traits. First, with the exception of EDU, every 2025 Ten Bagger operated in a segment of the economy with perceived blue-sky potential. This meant that each enjoyed a compelling narrative of rapid future growth.

Second, every Ten Bagger became a focal point of attention. These stocks dominated chat rooms, featured in the financial media, attracted broker research, and in many cases the investor mood surrounding them tipped from excitement into outright hysteria. Price moves fed the narrative — and the narrative fed further price moves.

Third — and this item is crucial — the vast majority were pre-revenue, let alone profitable. That might sound counterintuitive, but it’s entirely consistent with how Ten Baggers actually form. In fact, a strong earnings history is often an impediment to Ten Bagger returns. Why? Because greater research coverage reduces information asymmetry.

Translation: well-understood companies leave little room for positive surprise. Mature businesses that are widely covered by the professional investment community generally offer only incremental growth, not explosive exponential growth. Everyone covers them, and therefore everyone knows about them — so they lack the opportunity for “sudden discovery”.

Ten Baggers require dramatic expectation shifts, not steady execution. Early-stage stories allow imagination — and earnings multiples — to rapidly expand.

Illustrative of this idea that “unknowns” are the best candidates for Ten Bagger greatness, market capitalisation offers another powerful clue. The largest starting market capitalisation on the 2025 list was roughly $150 million (DRO). A staggering 19 of the 24 Ten Baggers began their journeys with market capitalisations below $30 million — including 11 under $10 million — making them genuine microcaps pre-move. In all but three cases, starting market capitalisation was below $50 million.

That’s revealing — particularly when you contrast it with the ASX 200 where the smallest constituent has a market cap of roughly $670 million. Want to find 2026’s Ten Baggers? Statistically speaking, the ASX 200 is a terrible place to look!

How I spotted every ASX Ten Bagger in 2025

Beyond story, hype, and theme, the 2025 Ten Baggers shared something far more revealing: at one point, their charts all looked nearly identical. This is where my technical analysis model enters the picture.

My ChartWatch ASX Scans series — published daily on Market Index — is designed to systematically identify stocks exhibiting the strongest supply–demand imbalances on the ASX. It strips out opinion, emotional bias, and the seductive narratives that often cloud investor judgement. Instead, it focuses entirely on what matters most: is demand overwhelming supply, and is that imbalance strengthening or weakening?

Each scan produces two core watchlists:

- Uptrends Scan List: Stocks exhibiting strong, sustained excess demand

- Downtrends Scan List: Stocks under persistent distribution

From the Uptrends Scan List, I select Feature Uptrend Charts — my highest conviction trend structures at that point in time.

Crucially, every stock on the 2025 Ten Bagger list appeared in my Uptrends Scan List after forming its 2025 low and before reaching its 2025 high. All but one went on to be selected as a Feature Chart, and most appeared multiple times as their trends accelerated. In other words, the model didn’t just “catch a lucky few” — it repeatedly highlighted the entire cohort as their winning characteristics emerged.

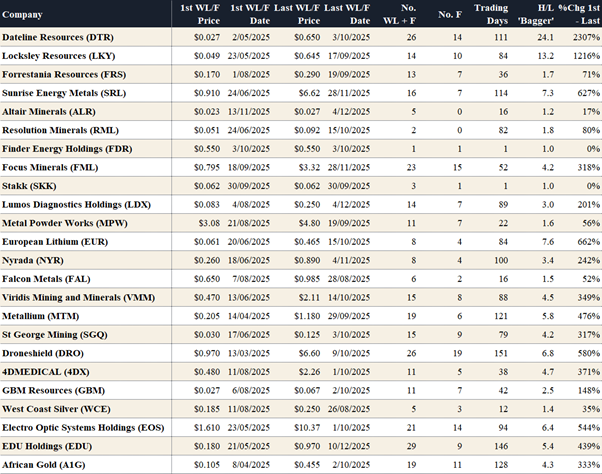

All data from ChartWatch ASX Scans articles published on Market Index. WL = Watch list, i.e. stock appeared in the main Uptrends Scan List, F = Feature Chart. 1st WL/F Price / Date = First WL or F price / date after L Date from 2025 Ten Baggers Table. No. WL + F = Frequency of WL and F appearances. No. F = Frequency of F appearances. Trading Days = Number of trading days between 1st / Last WL/F Dates. H/L Bagger = A hypothetical profit factor assuming 1st WL/F Price as the starting point and Last WL/F price as end point. %Chg 1st – Last = The percentage change between 1st / Last WL/F Prices.

The point isn’t prediction — it’s identification. The model doesn’t know which stock will become a Ten Bagger, but it reliably narrows the field to the small group capable of becoming one.

More importantly, identification means nothing without the willingness to stick with the trend. Too many investors congratulate themselves after banking a quick 10 or 20% gain. The real challenge when it comes to reaping Ten Bagger rewards isn’t finding one — it’s having the discipline to stay with it long enough for the trend, and the mathematics of compounding, to do the heavy lifting.

On this point, I feel it’s instructive to note DTR — 2025’s best Ten Bagger — appeared 26 times in my Uptrends Scan List after its 2025 low. That’s approximately once every four trading days until its final appearance on 3 October. This could be seen as confirmation one’s original position is sound, but some may look at each appearance as an opportunity to potentially pyramid into a growing trend. (Pyramiding is a method used by some investors to supercharge their returns, but it also increases their risk).

Dateline Resources (DTR) versus ChartWatch ASX Scans uptrends appearances (green arrows denote a WL or F appearance)

My technical analysis model doesn't care about price, it cares about signals and the probability associated with them. So, when some investors might think: “it’s too expensive”, “it can’t possibly go up any further” or “if I buy it now, it’s sure to crash!”, my model only knows: Signal = Add Risk.

My model has no emotions; it only cares about: do the trends, price action, candles, and volume reflect that demand is sufficiently greater than supply? If a stock continues to flag as showing strong excess demand, and therefore continues to meet the criteria of my technical model, it will remain in my Uptrends Scan List.

Things to note about my model’s track record on 2025’s Ten Baggers:

Nearly all appeared as Feature Charts — 23 of 24 stocks received at least one Feature Chart designation, demonstrating that the model elevated them from the broader Uptrends universe into high-conviction territory.

Most Ten Baggers were flagged early — for many names, their first Uptrends/Feature appearance occurred only days to weeks after their 2025 low (e.g., DTR 13 days, FML 16 days, EUR 12 days, NYR 17 days), indicating the model detects both early and mature trend structures.

The model often signalled persistent strength, not just a one-off spike — several Ten Baggers accumulated large counts of WL + F signals: EDU 29, DTR 26, DRO 26, FML 23, EOS 21, A1G 19, MTM 19, SRL 16 etc.

However, the model fared far less well against one-off price spikes — such as FDR, SKK, and WCE — and this is consistent with most trend following methodologies.

The model captured roughly one-third to two-thirds of the total trend in most cases. For stocks that began at extremely low prices — such as FRS $0.009, ALR $0.001, SKK $0.004, and GBM $0.006 — trend capture rates were typically lower because the model’s liquidity filter excludes very small, low-turnover names. This exclusion is intentional and enhances overall model stability and performance.

The model “went on holiday” for the candles between 27 June – 1 August inclusive. This is when I spent four wonderful weeks travelling through Europe with my family — blissfully ignorant of markets! Arguably, if I had been publishing my regular updates, I would have been able to effect substantially earlier entries to the trends in FRS, FDR, LDX, FAL, GBM, and WCE.

ChartWatch ASX Scans isn’t a signal or portfolio service — it’s an ideas generator. It won’t tell you what to buy or when to sell. Every 2025 ASX Ten Bagger appeared in its Uptrends Scan List, but the decision to act — or not — always rested with the individual.

Know when to hold ’em, know when to fold ’em…

The data I’ve presented here is completely useless to anyone: i.e., when and at what price ChartWatch ASX Scans first identified 2025’s Ten Baggers.

So what? Granted, each instance could be thought of as a potential entry point to one of 24 of the most incredible performances in recent memory — but nobody ever made any money at their entry point — that happens at their exit point. Just as important as identifying these or any potential Ten Bagger, is knowing when to let it go.

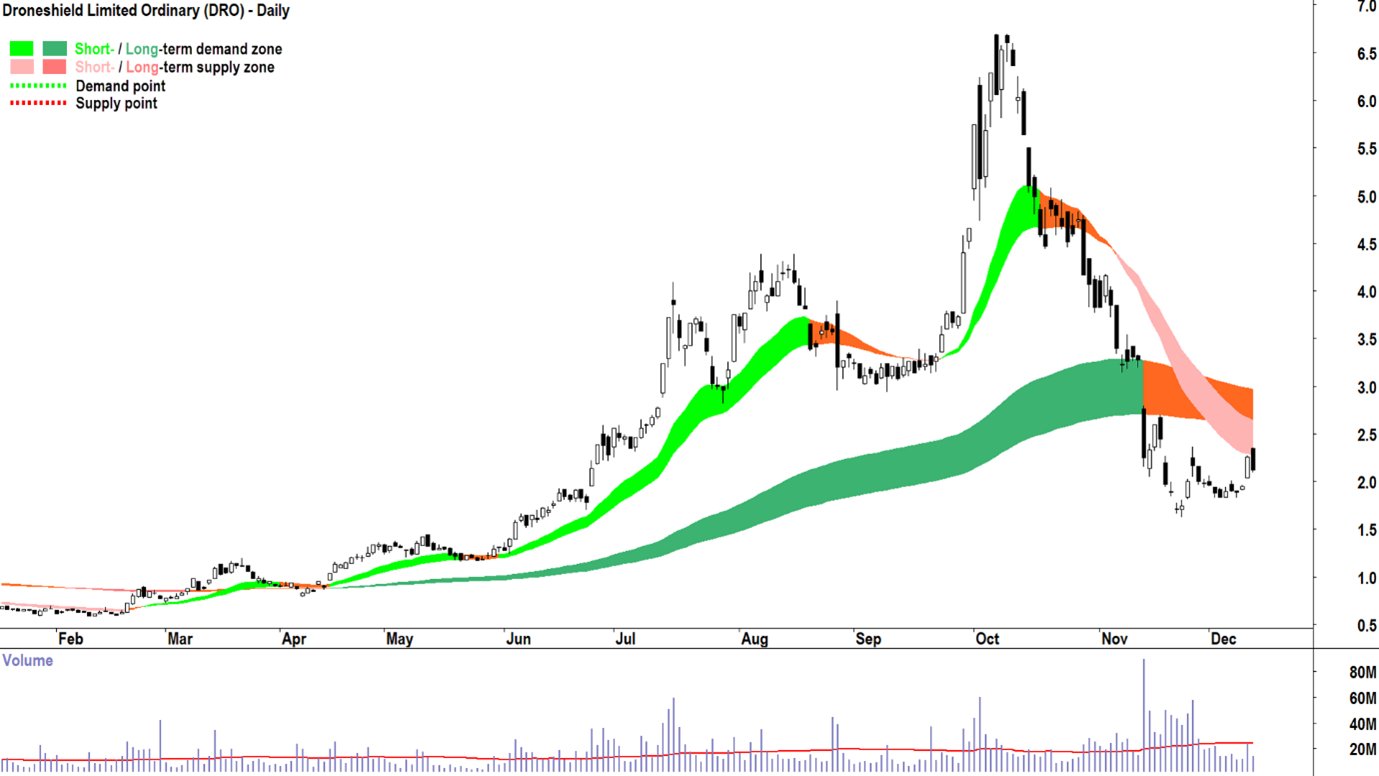

Droneshield (DRO) was one of the best stocks on the ASX in 2025, but if you got in too late, or didn’t get out soon enough – it may have been one of your worst!

For many names on the 2025 Ten Bagger list, their final appearance in ChartWatch ASX Scans came well before their eventual share-price peak. That’s no coincidence. It is entirely consistent with the significant pullbacks most of them have experienced since — in some cases by over 70%.

My model applies the same discipline to exits as it does to entries. There are no favourites, no emotional attachments, and definitely no “maybe it will bounce” excuses. When the trend breaks, the stock leaves the list.

I explore these exit principles — along with how I identify prospective uptrends and downtrends — in far more depth during my ChartWatch *LIVE* Webinars held each Wednesday. It’s where viewers see exactly how my model translates into decision-making under real market conditions. Nothing is held back: I show you exactly how I do it.

Preview of 2026’s Ten Baggers

There are already several charts today that share the same structural traits displayed by the 2025 Ten Baggers — early-stage trends, improving demand, and expanding upside volatility. They’re appearing regularly in my scans, and each day I publish them in my ChartWatch ASX Scans articles.

My model is 100% technical-analysis–based trend following (i.e., zero fundamentals). I believe it’s fair to say that under most circumstances it’s almost impossible for an ASX stock to become a Ten Bagger without featuring at some point in my Uptrends Scan List. I fully expect that when I write the 2026 version of this article, I’ll be quoting a statistic that reflects this reality.

“Almost certainly, I will pick every 2026 ASX Ten Bagger, I just don’t know what they are yet!”

But let me be clear: neither my model nor I can tell the future. I am a trend follower, not a trend prognosticator.

The future is unknown, and anything can happen. My job isn’t to guess outcomes — it’s to identify emerging trends and commit to following them for as long as they remain intact.

That’s the real secret behind owning a Ten Bagger. Not spotting it — but holding it long enough to let the mathematics of compounding work (multiple potential entry points were flagged for the most impactful trends of 2025).

ChartWatch ASX Scans identified dozens of other strong performers — not quite Ten Baggers, but sporting returns most investors would envy. Yet it also identified several that delivered little-to-no return or that likely declined in value.

This is an integral part of trend following. As the old saying goes: “You must kiss a few frogs to find your prince.” Equally important as identification is ruthlessly culling any stock that stops meeting the requirements of a strong uptrend — keeping capital nimble and ready for the next opportunity.

This is the true strength of ChartWatch ASX Scans. It plays no favourites. It doesn’t care whether a stock is considered by the broader investment community to be a “sound fundamental investment”. It only cares about identifying where demand most exceeds supply.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 16 December 2025. This document was originally prepared and published by Livewire Markets Pty Ltd ACN 156 343 501 on 9 December 2025and Livewire is solely responsible for its issue. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.