Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Picking ASX dividend shares in 2026? Here’s where to look

Tyger Fitzpatrick | Morningstar

Finding the right dividend paying stocks can be a difficult task with so much choice in the Aussie market. Dividends play a starring role in many Australian’s investment strategy. This includes both investors relying on the income for spending now and those building a passive income stream for retirement.

Morningstar Analyst Shaun Ler recently authored a report on the Australian Dividend Outlook and our Top Picks in 2025 Q3. Ler highlights the key challenges many Aussie income investors are facing in the current environment. Dividend paying shares often fall within two distinct categories. Shares with high current yields and lower dividend growth prospects and those with lower yields and better growth prospects. Ler identified several opportunities in each category.

I’ve selected 3 stocks from the 23 identified in the report. To help you decide which shares might align with your own investment strategy, I’ve put each pick in one of the two categories of dividend shares. I’ve also broken down the other relevant factors to look at when picking income investments. But first, let’s take a crash course on dividend yields and where to look in 2026 and beyond.

How to consider dividend yields as part of your income strategy

The dividend yield is simply calculated by the dividend per share (annual basis) divided by the share price. Understanding this relationship will help you contextualise different dividend investment options. For example, Company A has a dividend yield of 8% and Company B yields 4%. Although Company A may have a higher yield at face value, there are many reasons an income investor may choose Company B. Poor performance in the share price, volatile earnings and poor visibility of future cash flows are all reasons why Company A’s yield may be inflated and therefore not sustainable.

The economic cycle also plays a significant role in influencing the dividend yield. Recent interest rate cuts make bonds and savings less attractive and conversely shift investor focus to dividends for income. Given this environment we expect to see greater inflows into equity investments putting upward pressure on stock prices. Increasing stock prices relative to company earnings would lower yields. Ler expects this may play a role over the next two years.

Which sectors are attractive?

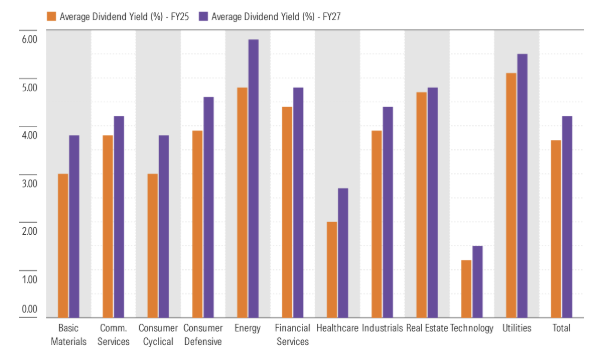

Our analysts expect dividends to grow predominately in three sectors; utilities, consumer and real estate sectors. In contrast, the sectors which are likely to struggle with growing dividends are price takers such as materials and energy.

The highest current dividend yields are observed across the utilities, real estate, energy and financial services sectors. Interestingly, both real estate and utilities have relatively attractive yields now and we forecast growing dividends in FY26/27. Technology and healthcare are relatively less attractive sectors when looking at current yields.

Source: Australian Dividend Outlook and Top Picks 2025 Q3 – Data as of Sept 21. Results include dividend paying stocks only

Woolworths (ASX: WOW)

- Fair Value Estimate: $30.50 (7% discount at time of writing)

- Rating: ★★★★

- Moat: Wide

Woolworths is currently Australia’s largest supermarket operator and has been a staple income investment for many Aussies for over 20 years. Our analyst forecast a 3.5% yield in FY26 and 4% yield in FY27 assuming the share price remains stagnant. The grossed-up yield, which includes the benefits of franking is 5% and 5.7% respectively (100% franking applied).

Woolworths’ boasts a wide moat according to our analysts which is underpinned by cost advantages and a dominating 36% market share in Australia. Woolworths has an exemplary capital allocation rating which is reflected in its strong balance sheet and an appropriate historical dividend payout ratio of 75%.

Although a 5% grossed up yield is not the highest dividend yield on the list, an investor looking for solid dividend growth with high visibility of future earnings may find this a suitable income option. Woolworths falls into the growth dividend category as there is potential improvement in the yield over the long term.

Amcor PLC (ASX: AMC)

- Fair Value Estimate: $17.80 (27% discount at time of writing)

- Rating: ★★★★

- Moat: Narrow

Amcor is the largest global provider of plastic packaging with dominant positioning across the Americas, Europe and Asia. Our dividend report forecasts a dividend yield of 6.2% & 6.4% over FY26/FY27 respectively. With no franking credits, the dividend yield is still relatively high with even growth forecasted.

Amcor has a narrow moat which is driven by its cost advantages and sticky customer base. Our analysts assign a medium uncertainty rating due to Amcor’s increase in leverage following the acquisitions of Bemis and Berry (2019 and 2025).

Most of Amcor’s revenue is driven by food and beverage packaging which is considered defensive across the economic cycle. Amcor has a progressive dividend policy in which they generally increase the total dividends by at least USD $0.01 each year. Note the dividends are declared in USD and paid out to Aussie CDI shareholders in AUD. Amcor’s main listing is on the NYSE.

The dividend policy ensures two things. One that the company maintains its inclusion in the US dividend aristocrat list of companies that have raised dividends for 25 years. Secondly, for income investors it suggests continued growth in dividends for shareholders over the long run. Like Woolworths, Amcor is a good example of an income stock with room to grow its yield over time.

Source Morningstar: Stock Pitch | Amcor Out with the old, in with the new. Niche businesses drive future growth. November 2025

Woodside Energy (ASX: WDS)

- Fair Value Estimate: $45 (41% discount at time of writing)

- Rating: ★★★★★

- Moat: None

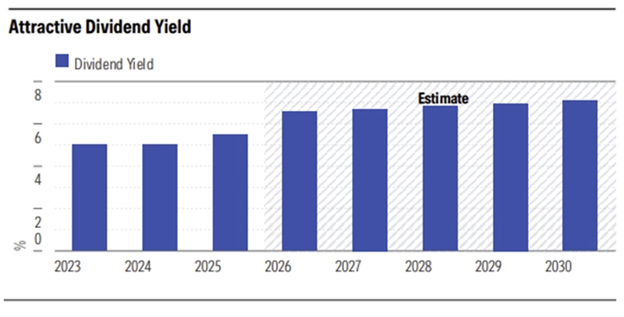

Woodside operates in the energy industry delivering oil & gas across the globe. The company is known for its higher dividend yields, with a policy to maintain a minimum 50% payout of underlying earnings to shareholders (current payout is around 80%). Our analyst sees Woodside yielding 7.7% in FY26 & 6.2% in FY27.

With 100% franking, we arrive at 11% gross yield for FY26 & 8.9% in FY27. This is the second highest yield on the list when adjusting for franking. Despite a forecasted reduction in yield to 6.2% (8.9% gross) in FY27 income investors would still receive a comparatively high yield.

An investor looking to capture a higher yield in the short term may find an option such as Woodside more attractive. Resource companies are price takers and lack the same visibility on future cash flows in comparison to other business models but higher oil & gas prices may lead to future dividend growth.

What is the trade off?

The trade-off between current yield and future dividend growth prospects will be based on your investment strategy. Factors such as your investment timeframe, personal goals and cashflow needs will all play a part. For example, at 25 years old I have a longer investment timeframe to build income. The biggest threat to my income is inflation, so ensuring that my dividends are growing over time while preserving capital is prioritised.

Alternatively, an investor with a shorter investment timeframe is less likely to care about the long-term growth of dividends. In the case of Woodside, even with a declining year on year dividend, over the short term an investor would still achieve a higher yield in comparison.

Final Point

The point of picking 3 stocks from the list today was to demonstrate that there is far more than just the current dividend yield when considering your options. Considering the context of the current yield of individual shares allows investors to pair them with their own investment strategy. In addition, asking questions about the competitive advantage, cash flow visibility, capital allocation and dividend policy will assist you in finding a company that can sustain or grow the dividend yield over time.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 17 November 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.