Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Once-hot US software stocks are lagging. Are they good buys?

Sarah Hansen | Morningstar

Excitement around artificial intelligence has propelled many technology stocks to record heights, except for one notable group: software. In fact, many of the biggest software stocks are posting significant losses for the year. And by Morningstar equity analysts’ metrics, some look like bargains.

Driving the losses is a persistent fear that AI will upend the software industry, either by reducing licensing revenue by making it easier and less labor-intensive to perform tasks without human input or by rendering traditional software applications totally obsolete. “There is a lot of concern,” says Morningstar senior equity research analyst Dan Romanoff. “No one really knows how this is going to play out.”

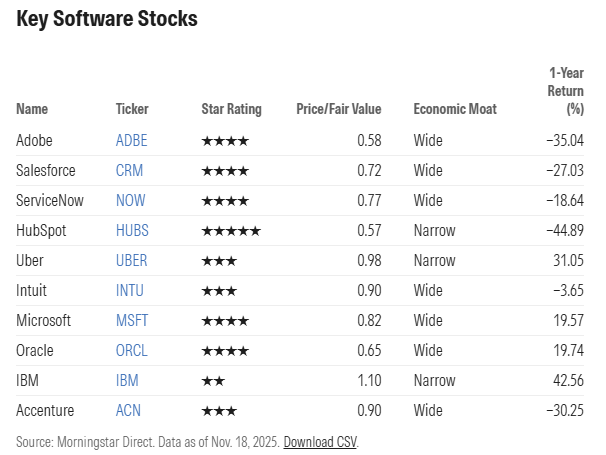

Combine this with the fact that software firms are generating little revenue from AI, a changing forecast for interest rate cuts, and long-tail slowdowns after the covid-era software boom, and you have a recipe for a “brutal” selloff that has accelerated since July and intensified over this past week as the tech sector fell. A side effect of those losses has been a steep drop in valuations, with major software names like ServiceNow (NOW), Salesforce (CRM), and Adobe (ADBE) trading at discounts of 20% or more.

With several quarters of strong earnings in the books, Romanoff says there’s plenty of upside to be found. While a pandemic-driven surge in revenue has faded, software stocks regularly beat the S&P 500 Index in terms of revenue growth. “They offer a lot of attractive elements to me that haven’t really changed all that much,” he says, even amid new advancements in AI.

The software selloff

While tech stocks generally have had a red-hot run, software has struggled. Adobe is down 35% over the past 12 months and down 27% so far in 2025, putting it on track for its worst quarter since the bear market in 2022. Salesforce is down 27% over the past 12 months and is also on track for its worst year since 2022. HubSpot (HUBS) shares have fallen 45%. Accenture (ACN ) stock is down 30%. Shares of ServiceNow are down 18%.

The exception is Microsoft (MSFT), which is up 19% over the past year. The company was an early investor in OpenAI and is benefitting from the lift AI is giving its cloud business, Azure.

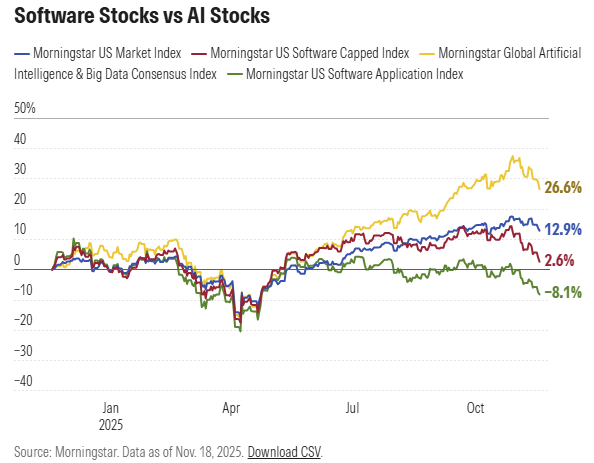

The Morningstar Global AI & Big Data Consensus Index—which includes stocks that are widely held by funds and ETFs focused on the AI theme—is up 26.6% over the past year. The Morningstar Software Index has gained just 2.6% over the same period. Both indexes include Microsoft, which has invested heavily in AI, along with other mega-cap tech firms, like Alphabet (GOOGL/GOOG) and Meta Platforms (META).

The Morningstar US Software Application Index—which includes software infrastructure firms as well as Microsoft—is down more than 7% over the past year. Meanwhile, the Morningstar US Market Index has climbed 12.9%.

Romanoff says that under the hood, many software stocks have solid fundamentals and are attractive for investors. That’s true even as the AI craze muddies the outlook. “It’s almost like the inverse of the internet bubble circa 2000, when everything was sort of going through the roof for no real reason,” he says. “Now, software is falling through the floor.”

Why are software stocks falling?

One of the immediate concerns for investors when it comes to AI and software is how the new technology will affect the traditional seat-based pricing model that many software-as-a-service companies use. Customers typically pay per license, per month for access to the application. If AI leads to efficiency gains for a business, that business might need fewer seats. “If there are fewer seats being licensed, your revenue as a software company is lower,” Romanoff explains. Another concern is more existential: If AI can make a business more efficient, maybe it could replace the need for a software application altogether.

And even as investment and revenue figures on the order of hundreds of billions of dollars are swirling around AI firms like Nvidia (NVDA) and OpenAI, Romanoff says that software companies’ monetization of AI is “generally uninspiring” so far. Among the companies he covers, excluding Microsoft and Amazon (AMZN), he estimates that just 1% of revenues are derived from AI. “If everyone’s building out these giant data centers and everyone’s announcing these $100 billion deals but software companies are eking tiny incremental revenue streams from AI, that’s not good for software in general,” he says. On the flip side, those paltry revenue figures may also be a sign that a wholesale takeover of the industry by AI isn’t yet happening.

There are also broader macroeconomic forces weighing on software stocks. Romanoff cites investor expectations for faster and larger interest rate cuts than the Federal Reserve has delivered. Software firms tend to be high-growth companies, with much of their cash flows expected in future years.

Finally, there has been a slowdown in software revenues in the aftermath of an enormous surge during the covid-19 pandemic. Investors searching for that explosive growth can now find it elsewhere in the market. “That has weighed on software stocks,” says Romanoff.

Software stocks post strong earnings, good guidance

Even as those fears persist, software firms have shown strong revenue growth and encouraging guidance over the last few quarters. “Results are generally good across the board,” Romanoff says. “Lots of beats, lots of guidance above expectations.” But though “things are going pretty well from a fundamental perspective,” share prices haven’t rebounded.

For instance, Adobe’s third-quarter results exceeded analyst expectations for revenue growth, operating margins, and guidance. The company also reported growing momentum for its suite of AI solutions. Even so, the firm’s stock has continued to plummet.

Software stocks look deeply undervalued

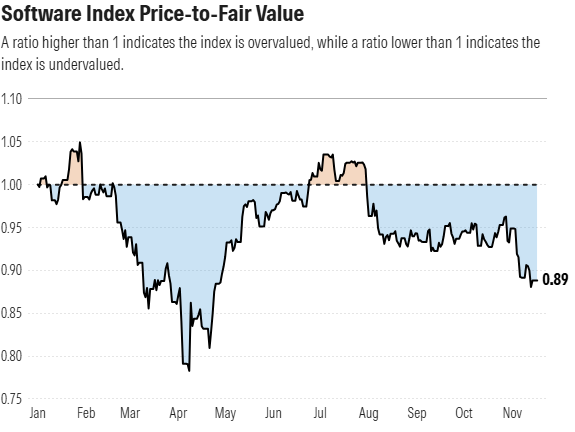

As software stock prices have slid, so too have their valuations. As of Nov. 17, the Software Index carried a price/fair value ratio of 0.89, meaning the average stock was trading at an 11% discount to its fair value estimate. At the beginning of the year, the index was trading at a premium of as much as 5%. The Morningstar US Market Index is trading at a discount of 6%.

Source: Morningstar

Some firms carry even deeper discounts. Adobe stock is roughly 40% undervalued, as are shares of HubSpot. Salesforce shares are trading 28% below their fair value estimate. ServiceNow stock is 23% undervalued. Overall, Romanoff estimates the median stock he covers is undervalued by about 30%. “That is pretty extreme.”

Are software stocks good buys?

With sticky revenues, high switching costs, and high free cash flow margins, Romanoff says that “software is very attractive.” He particularly likes SaaS platform ServiceNow, thanks to its high revenue growth compared with competitors. The stock is trading in 4-star territory and has a wide economic moat.

And then there’s Microsoft, which has a robust software sales arm and is part of a small cohort of AI “hyperscalers.” Romanoff says the stock, which he considers undervalued even accounting for its 20% rally this year, is well-positioned to benefit from AI over the long term.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 25 November 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.