Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

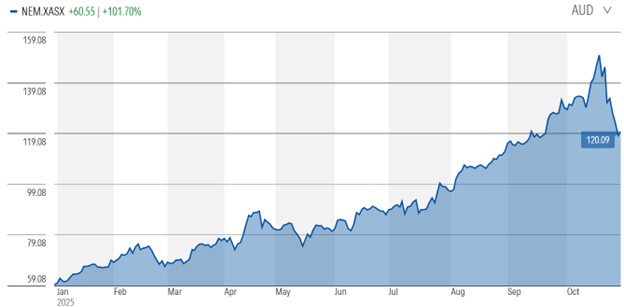

Newmont’s golden run

Jon Mills, CFA | Morningstar

Newmont’s (ASX: NEM) third-quarter earnings were once again strong. Higher gold prices and reduced unit cash costs more than offset lower sales volume. Adjusted EBITDA rose about 70% to USD 3.3 billion, and the USD 0.25 quarterly dividend is unchanged. Shares were down 5% after the release.

Why it matters

While Newmont reiterated 2025 volume and unit cash cost guidance, we think investors were disappointed by moderately lower 2026 volume guidance due to mine plan sequencing. Also, 2026 capital expenditure will be higher as a portion is deferred from this year.

- We still expect around 5.8 million attributable ounces in 2025, or 5.6 million excluding volume from six smaller, higher-cost mines that are now sold. But we now forecast 5.4 million attributable ounces in 2026, down from 5.6 million previously, with 2027 and 2028 volume also down slightly.

- Lower near-term volume is offset by our reduced forecast for near-term all-in sustaining costs before byproduct credits, which are tracking lower than we expected so far in 2025. Our longer-term volume and unit cash cost forecasts are broadly unchanged.

The bottom line

We reiterate our USD 62/AUD 95 fair value estimate for no-moat Newmont. The shares appear materially overvalued, thanks to euphoria in the gold markets.

- At about USD 4,100 per ounce, the spot gold price is double our assumed midcycle price of USD 2,000 based on our estimate of the long-run marginal cost of production.

Long view

We expect sales volume to rise to around 6.3 million ounces in 2029. The increase is driven by higher production from Newmont’s 38.5% and 40% stakes in the Nevada Gold Mines and Pueblo Viejo joint ventures with Barrick as well as Lihir, Tanami, and Boddington.

Between the lines

The balance sheet is very strong, with essentially no net debt at Sept. 30. However, we think the company should consider hedging a portion of future sales volume to take advantage of gold prices rising about 55% in 2025 to near historical highs.

Source: Morningstar

Higher gold prices drive an increase in our fair value

Newmont is the world’s largest gold miner, with a portfolio reflecting three major deals in recent years. First, it acquired fellow gold producer Goldcorp for a relatively mild premium in 2019. Not only did it avoid paying a high price, Newmont also extracted better performance at mines where Goldcorp struggled.

Second, it combined its crown jewel Nevada assets with Barrick Gold’s in a joint venture called Nevada Gold Mines, also in 2019. With Barrick as the operator, Newmont owns 38.5% of the partnership, which reduced costs given the proximity of mines owned by the joint venture. Newmont also acquired Australian-based gold miner Newcrest in 2023.

We forecast Newmont to increase attributable gold sales volumes from its core mines to around 6.4 million ounces in 2029, up from roughly 5.5 million in 2024. The increase is driven by higher gold production from its 38.5% and 40% stakes in the NGM and Pueblo Viejo joint ventures with Barrick, respectively, Lihir, Tanami, and Boddington. As part of bedding down the Newcrest acquisition, Newmont sold a number of its higher-cost, smaller mines. These mines accounted for around 20% of total volumes in 2024.

It also produces material amounts of copper, silver, zinc, and lead as byproducts from its various gold mines. Newmont had about two decades of gold reserves along with significant byproduct reserves at end December 2024.

In aggregate, the company sits around the middle of the cost curve but we expect some improvement.

The company has a pipeline of attractive development projects, including the Tanami Expansion 2 project in Australia, Ahafo North in Ghana, and the Cerro Negro District Expansion 1 project in Argentina.

Bulls say

- Newmont is the world’s largest gold miner, with copper and other byproducts providing some diversification, representing around 15% of forecast midcycle revenue from 2029.

- The Nevada joint venture with Barrick has allowed the companies to extract significant synergies from their assets through the creation of the largest gold producing area in the world.

- Gold companies tend not to follow general economic cycles. They can also provide a hedge to inflation risk.

Bears say

- Bigger is not always better in gold mining. Newmont’s operations span four continents, increasing complexity and difficulty managing the assets.

- Newmont’s unit cash costs are around the industry average, meaning it is more affected by falling gold prices than its lower-cost competitors.

- Gold is subject to the whims of investors, who can move as a herd and affect the gold price.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 27 October 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.