Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

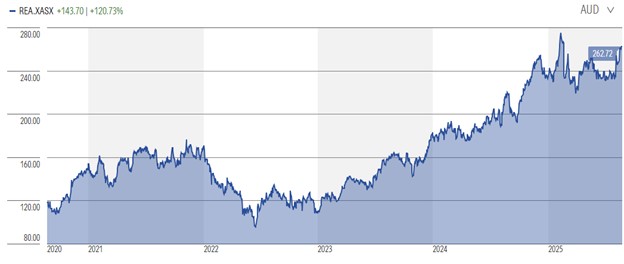

REA: Skating on thin ice

Roy Van Keulen | Morningstar

REA Group’s full-year results saw EBITDA from the group’s property and online advertising segment exceeding AUD 1 billion for the first time.

The company also committed to further double-digit price hikes for buy-listings for the next two years and the foreseeable future.

Why it matters

REA Group (ASX:REA) is increasingly attracting regulatory scrutiny for its market dominance and pricing practices.

Continued price increases are likely to court further regulatory scrutiny and raise the probability action is taken. The market appears to be disregarding the chance of a regulatory hit to profits.

The bottom line

We increase our fair value estimate for wide-moat REA Group by 3% to $134 per share, reflecting the time value of money.

REA Group shares now screen as wildly overvalued, as the market seems to expect price hikes to continue for much longer than we think is likely or reasonable.

We believe REA Group’s commitment to continue double-digit price hikes courts regulatory intervention. Our forecasts are for mid- to high-single-digit price increases over our 10-year explicit forecast period.

Source: Morningstar

The big picture

REA believes it is “entitled” to higher prices, citing its expectation for property prices to increase due to lower interest rates. We disagree with this view, as it implies the company would own a share in any of the profits Australian homeowners may make, without sharing in any of the risk.

A new graph from REA showed the average price to advertise on its website has remained at a similar percentage of the sale price over the past six years, despite strong house price growth. This suggests listing fees have tracked property prices, rather than productivity improvements.

Given the company is under active investigation by the Australian Competition and Consumer Commission, we believe it is courting regulatory risk with its pricing policy and commentary. The company’s public commitment to continue hiking prices over the next years could be even riskier if its forecast for property price increases does not come to bear.

Take rates at historic high

Per company disclosure, its take-rate of property sales is now at its highest point in recent history. Continued double-digit price increases will set new records if property prices don’t rise at the same rate.

Moreover, even with expected interest rate cuts, mortgage repayment affordability—defined as mortgage payments based on the median mortgage rate for a median house price with a median income—will remain significantly worse than trend.

Currently, this ratio stands at around 50%, which is well above the long-term trend of 30%-35%. New Zealand and Canada, which saw similar affordability issues before, have since seen house prices fall close to 20%.

We don’t expect REA Group to lower its listing fees in such a scenario, meaning such falls would quickly raise its take-rate, risking social- and ultimately regulatory ire.

We do believe REA Group has earned the right (from a social license perspective) to increase its prices over time. The company reported that it has extended its lead over narrow-moat Domain (ASX:DHG) in terms of audience share to 4 times in fiscal 2025, from 2.5 times in fiscal 2017. Similarly, the company estimates that it has doubled its unique audience over the same period.

Although changes in the number of listings, visit duration, and buying intent may negate these audience share gains somewhat, we expect the company has delivered a large increase in the number of views per listing, which we consider as the ultimate value driver for home sellers.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 7 August 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.