Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

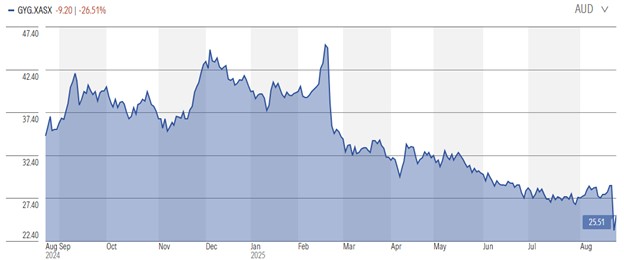

GyG: Where to next?

Johannes Faul, CFA | Morningstar

Guzman y Gomez’s GYG underlying earnings jumped 152% to $14 million in fiscal 2025. Global network sales rose 23% and operating margins expanded. However, mounting losses in the nascent US market and slowing Australian sales momentum disappointed the market’s expectations, sending shares down 18%.

Why it matters

Underlying NPAT beat our estimate of AUD 10 million, on greater EBITDA margin expansion and higher interest income. However, same-store sales growth decelerated significantly in the first seven weeks of fiscal 2026, in line with our unchanged full-year estimate of 4%.

- We expect Australian same-store sales growth to average 4% over the medium term, driven by volume and price growth. This is a step down from the three-year average of 11%. But we think the benefits from extended trading hours and price rises are likely to decline.

- We don’t expect a clear verdict on the US expansion in the medium term. So far, the US looks unlikely to generate meaningful contributions for the next decade. The US lost AUD 13 million in EBITDA, and management expects similar losses in fiscal 2026, as it builds presence.

The bottom line

Our fair value estimate for no-moat Guzman stands at $16. Shares are materially overvalued. It is early days, and we are hesitant to thoroughly bake in management’s aspiration of 1,000 Australian stores in 20 years. Still, we credit solid earnings growth with a 10-year CAGR of 24%.

- We expect higher average royalty rates and operating leverage with increasing scale to drive significant EBITDA margin expansion. We forecast Australian margins as a percentage of network sales to expand over 200 basis points to 8% over the next decade—an average uplift of 20 basis points.

- Management targets much greater margin improvement. If we assume 10% EBITDA margins in Australia by fiscal 2030, our valuation increases by 40% to AUD 22, all else equal. In fiscal 2026, guidance is for a 20-basis-point to 50-basis-point improvement to 5.9%-6.3%. We forecast 5.9%.

- Our thoughts on GYG Management’s 1,000 store aspirations

- Guzman y Gomez operates a hybrid store ownership model, running corporate-owned restaurants and licensing its brand to franchisees. The company expects around 40% of stores will be corporate-owned over the long run. Most stores are in Australia, but Guzman also has a nascent presence in Singapore and Japan through master franchisee agreements and runs a handful of corporate stores in the United States.

- Rolling out stores under a franchise model significantly reduces Guzman’s capital investment and funding needs. Franchisees are responsible for new store capital expenditure and ongoing maintenance. The more capital-intensive corporate stores provide Guzman with greater control over customer experience and serve as a testing ground for new ideas to optimize operations and improve its offering.

- In return for using its brand and operating model, Guzman collects a royalty fee from franchisees. The royalty rate flexes with store turnover and averaged about 8% of global franchisee sales in fiscal 2024. This is a higher royalty rate than KFC-franchisee Collins Foods pays Yum Brands. However, after adjusting for other fees, we estimate a franchisee’s total payments to the brand owners, as a share of sales, are on par.

- Based on recent return metrics, we think Guzman franchisees will support the rollout of around 40 new stores per year for the next decade—of which, on average, we estimate franchisees open 24, and the company operates the other 16. However, because the brand is still relatively young and its strength is yet to be fully tested, the planned expansion may need to slow in the longer term if store economics diminish. Beyond our 10-year explicit forecast horizon, we think the rollout will become more challenging as Guzman pushes into less lucrative catchments and faces more competition from quick-service restaurant operators with stronger brands, including McDonald’s, KFC, and Domino’s.

Source: Morningstar

Bulls say

- It is early days, but Guzman’s Australian restaurant economics rival that of best-in-class brands KFC and McDonald’s. This is the key metric for a durable, franchisee-driven store rollout.

- The Australian QSR market is highly fragmented, and larger brands like Guzman could keep taking share from independent operators.

- Guzman is demographically well-positioned. It has a young, health-conscious customer base and sees higher average spending per transaction than major QSR peers.

Bears say

- Guzman needs to ensure store economics hold up as its ambitious rollout progresses. Overly aggressive expansion could destroy value.

- Guzman isn’t the only Mexican-inspired QSR chain with ambitious rollout plans in Australia with home-grown Zambrero and global brand Taco Bell key competitors.

- Very few international brands have found success in the US, and Guzman’s US expansion could wind up as a costly distraction from the Australian business.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 25 August 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.