Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Structural growth meets cyclical opportunity: why this sector looks mispriced in 2025

Jacob Celermajer | Cordis Asset Management

As equity investors, we’re always on the lookout for the trifecta of structural growth, durable competitive advantages, and compelling valuation. But finding all three at the same time is rare.

Right now, I believe that’s exactly what we’re seeing in medical technology, a corner of the market that has quietly de-rated to levels not seen in a decade, as its fundamental tailwinds continue to drive earnings in the face of this multiple compression.

1. Structural growth: Secular demand that defies cycles

Medical technology is powered by some of the most predictable, long-duration tailwinds in global markets:

- Aging populations

- Rising chronic disease prevalence

- Expanding access to diagnostics, devices, and surgical innovation

For many leading medtech companies, these forces translate into mid-to-high single-digit top-line growth through the cycle and in many cases, faster bottom-line growth due to high gross margins and operating leverage. Whether global GDP is at 2% or 4%, patients still need insulin pumps, pacemakers, neurostimulators, and surgical robots. These are need-to-have technologies, not nice-to-haves.

2. Moats that matter in a changing world

In a market obsessed with disruption and disintermediation, medtech stands out for its barriers to entry:

- Deep clinical trust built over decades; Edwards Lifesciences (NYSE: EW)

- Multi-year regulatory approvals and capital-intensive R&D cycles; Boston Scientific (NYSE: BSX)

- Network effects within health systems; Abbott (NYSE: ABT)

- Sticky install bases and razor/razorblade models; Intuitive Surgical (NASDAQ: ISRG)

Even in an AI-infused investment world, these moats remain intact. In fact, many of the sector’s leaders are actively leveraging AI to expand their advantage, such as DexCom’s (NASDAQ: DXCM) real-time glucose monitoring platforms or Edwards’ AI-enhanced diagnostic capabilities.

Unlike many industries where AI threatens to compress margins or displace incumbents, in medtech it is an enabler, not a disruptor.

3. Valuation: The mispricing few are watching

Here’s where it gets interesting.

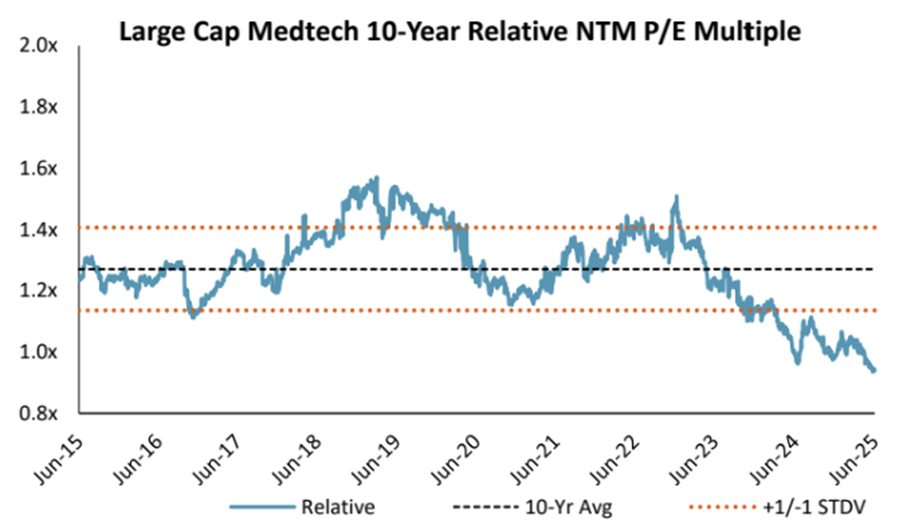

After years of outperforming, the medtech sector has de-rated sharply over the past 3-years. The chart below shows the sector’s 10-year NTM P/E multiple relative to the S&P500, which is now approaching 1.0x versus the broader market, which is close to -2 standard deviations from its 10-year average.

Source: Cordis Asset Management

Source: Cordis Asset Management

Throughout this de-rate period, earnings growth has persisted, driving many companies market caps higher even in the face of compressed multiples. Balance sheets remain strong and large-cap companies are alert to M&A opportunity. Yet investor positioning remains light, as the market continues to crowd into megacap tech and AI beneficiaries.

In our view, this disconnect creates opportunity. You're paying market multiples for a sector with above-market growth, better returns on capital, and stronger downside protection.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 15 July 2025. This document was originally published in Livewire Markets on 15 July 2025. This information has been prepared by Cordis Asset Management Pty Ltd is a Corporate Authorised Representative, No. 1282680, of Avenir Capital Pty Ltd (ACN 150 790 355, AFSL 405469).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.