Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Palantir stock has surged, but some see growing reputational Risks

Leslie Norton | Morningstar

Palantir Technologies PLTR stock has seen a meteoric rise. Shares are up 13-fold since trading at $10 a share in September 2020, and they’ve surged 80% this year alone. The catalyst for the recent jump is the company’s expertise in applying artificial intelligence to data sorting, particularly for governments like the United States.

But that same focus is raising renewed concerns among some observers that the company is taking a greater reputational risk for its work, especially in today’s highly charged political environment. “Palantir’s surveillance capabilities have really been a source of controversy since its founding,” says Beth Williamson, head of sustainable equity research at Calamos Investments.

The spotlight on Palantir intensified Tuesday, as the New York Times reported that 10 Democratic lawmakers had sent a letter to the company inquiring about its US government contracts and compliance with federal laws, and requesting that it preserve emails and records.

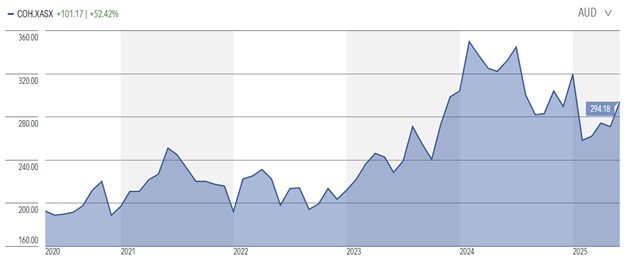

Source: Morningstar

Palantir’s Data Prowess

The investment thesis around Palantir’s stock centers on its business of software for Big Data analytics. Morningstar analyst Mark Giarelli writes: “The company can aggregate and clean the world’s most complex datasets … Over time, Palantir’s systems continuously improve, enabling automated, machine-learning-based solutions that drive efficiency gains across entities in any industry.” He thinks Palantir “continues to impressively penetrate the US government and commercial segments,” with potential demand from the Department of Government Efficiency, the US missile defense system, and a national security budget that could top $1 trillion.

Palantir’s work has included providing tools for US Department of Defense counterterrorism efforts. Corporations also use Palantir products. The company has also been a leader in bringing AI into its products. “Thanks to the 2023 release of the Artificial Intelligence Platform, Palantir now provides a layer for large language models to help nontechnical users understand its work,” says Giarelli.

Palantir’s Future May Include Risks to its Reputation

The firm’s relationship with the government may bring it new reputational risks. Palantir stock has surged through a series of media reports that have raised concerns among some observers, including an extensive May 30 story in The New York Times that claims the company is working with the US government to help it share data across agencies and is expanding its role under the Trump administration. According to the Times, such information could be used to “advance [President Trump’s] political agenda by policing immigrants and punishing critics.”

Last month, NPR reported that some former employees were criticizing Palantir over its work with Immigration and Customs Enforcement. In addition, following up on the New York Times article, Semafor reported that some House Republicans are concerned about potential abuses related to a “interagency database that would merge huge sets of government information on Americans.” It quoted Ohio Rep. Warren Davidson as saying, “When you start combining all those data points on an individual into one database, it really essentially creates a digital ID. And it’s a power that history says will eventually be abused … I hope to turn it off, fundamentally.”

It isn’t the first time Palantir has faced controversy. In 2017, a report by the Intercept alleged that Palantir “helped expand and accelerate the NSA’s global spy network … [and] sold its services to make one of the most powerful surveillance systems ever devised.”

A separate Intercept report said that Palantir’s Investigative Case Management product “allows ICE agents, including those in the agency’s primary deportation force … to query information across several large government databases simultaneously.” In 2020, a report from Amnesty International said Palantir’s contracts with ICE “raise serious questions about the company’s actions to uphold its responsibility to respect human rights. The US government must take responsibility for its role in creating and maintaining a harmful environment for the treatment of migrants and asylum-seekers. However, Palantir also has a responsibility to avoid causing or contributing to human rights abuses, and to address human rights impacts in which they are involved.”

Palantir’s Defence

The company has robustly defended itself. In an exhaustive response to the New York Times article, Palantir denied that it “is actively collecting data or otherwise providing infrastructure for some ‘master list of personal information in order to surveil the American public.” The firm also denied “the recurring insinuations in this article … that Palantir has the ability to 1) proactively share data across federal government sources; or 2) access, scrape, or otherwise compile data on American citizens for its own purposes.” Both assertions “are in direct contradiction with our company’s founding mission and our commitment to privacy and civil liberties,” Palantir said.

Palantir also said it doesn’t own or control data, direct the collection of data, or provide data mining as a service. Instead, it operates as a “data processor” whose software “is used by customers to manage and make use of their data.”

Assessing Palantir’s Risks

For some investors and conventional funds that consider environmental, social, and governance metrics as part of their risk analysis, Palantir is tricky to assess.

Williamson looks for “materiality issues,” which if not managed correctly could result in negative financial performance. These risks may be associated with actions by its clients. For Palantir, she says, “that’s potential reputational risk related to surveillance of the US population. Palantir’s surveillance capabilities have really been a source of controversy since its founding.” In addition, “there are questions about the ethics of mass data collection.” While Palantir denies it’s doing anything of the sort, the fact that some Republicans are concerned “is the first inkling that reputational risk is manifesting.”

Jennifer Vieno, a director of ESG research at Morningstar Sustainalytics, says Palantir’s two largest material issues are human capital and data privacy and cybersecurity. Sustainalytics gives Palantir a medium risk rating.

Data privacy risks often increase with the volume of data a firm handles, especially data containing sensitive personal information. The risks include the potential for misuse and unauthorized access. “Given Palantir’s technology will be used to process and analyze vast amounts of data, which includes highly sensitive personal information, it is exposed to these risks and will need to ensure these are managed appropriately,” says Vieno. She notes that Palantir has clarified that it’s a data processor and its software includes audit logs and transparent data flows, which regulators and governance bodies can use to verify the software is used legally and responsibly.

Vieno says reputational risks could also arise if the software is associated with human rights violations or “the company is held accountable for actions of the government agencies with which it has contracts, especially if those actions are negatively viewed by the general public.”

Giarelli notes that Palantir has a Very High Uncertainty Rating, related to uncertainty about the addressable market, the chance that a new entrant or juggernaut like Google develops rival software, or “considering the sensitivity of the data that Palantir ingests, there is a privacy-related ESG risk should a hack materialize.” He continues: “Fortunately, Palantir’s Cipher service allows for advanced encryption techniques and there has not been a major data breach to date.”

In an email to Morningstar, a Palantir spokesperson said: “We do not conduct surveillance, we do not provide surveillance services, nor do we sell our software for the purposes of enabling unlawful surveillance. Our software enables our customers to interact with data to which they have lawful access in ways that minimize risks of privacy and civil liberties harms.” He also directed attention to the company’s responsible business page, which includes its code of conduct and human rights policy.

Palantir trades at a 33% premium to Giarelli’s fair value estimate of $100 a share. Combined with its lofty valuation of 69 times 2024 revenue and 378 times 2024 earnings, that could give investors pause.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 18 June 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.