Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

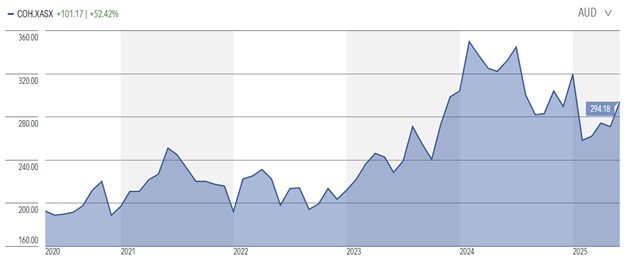

Expensive ASX star looks vulnerable to slowing sales growth

Shane Ponraj | Morningstar

Cochlear is the market leader in cochlear implants, with consistent share of roughly 60% across developed markets. Cochlear implants became the standard of care many years ago for children in developed markets with profound hearing loss or deafness.

With this market segment largely penetrated, the company is looking elsewhere for growth with developed-markets adults the next primary focus and emerging-markets children after that.

Updated guidance disappoints

Cochlear downgraded fiscal 2025 NPAT guidance by 6% at the midpoint to AUD 390 million-AUD 400 million. Services revenue declined more than expected and cochlear implant sales in developed markets have slowed. The firm is also launching the Nucleus Nexa Cochlear Implant system in June 2025.

We lower our fiscal 2025 net profit after tax forecast by 3% to AUD 398 million as we forecast a larger sales decline in services as the Nucleus 8 matures in its product life cycle after a successful launch in 2023.

The firm reiterated fiscal 2025 cochlear implant volume growth of 10% but growth is weighted to lower priced emerging markets. Cost-of-living pressures and small market losses are slowing growth in the more material US market. We forecast group sales growth to moderate to 7% by midcycle.

The new Nucleus Nexa implant features upgradeable firmware and the smallest and lightest sound processor on the market. New product cycles help maintain consumer demand and we leave our long-term estimates broadly unchanged.

We expect group sales growth to moderate as Cochlear implants sold to children are slowing and average selling prices are holding largely flat. We forecast a five-year group revenue compound annual growth rate of 8% compared with the trailing three-year group revenue CAGR of 14%.

Source: Morningstar

Opportunity from ageing population?

The adult developed market is more difficult to penetrate, and we expect required investment to expand this segment will restrain significant operating margin expansion. Currently, penetration is still estimated to be under 5%, and Cochlear is at a pivot point as it invests to be adopted more widely by seniors with profound hearing loss.

Prevalence of profound hearing loss increases over 65 years and has a steep increase over 80 years of age. As such, an ageing population and low penetration suggest a large opportunity. However, hearing aids, not cochlear implants, are the standard of care.

Cochlear is investing significantly to increase awareness as well as funding research to support payer reimbursement. But we see two main challenges to accessing this market fully: first, the relatively low willingness of older candidates to undertake such invasive surgery, and second, the improvements in hearing aids. The hearing aid market is increasing its penetration in the severe hearing loss category, leaving only the smaller profound hearing loss as the cochlear implant niche.

Bulls Say

- There are signs Cochlear is looking to expand beyond the hearing market with the investment in Nyxoah, a company focused on development of a hypoglossal nerve stimulation therapy for the treatment of obstructive sleep apnea.

- The annuity like revenue stream from sound processor upgrades and accessories is an increasingly important component of the revenue stream.

- Cochlear earns ROICs well ahead of the cost of capital even in our bear-case scenario, which is testament to the high quality of the company.

Bears Say

- Growth in the cochlear implant market is becoming more costly to achieve, limiting the potential upside to earnings.

- The arrival of low-cost competitor Nurotron could disrupt markets other than China should it seek to expand and this could trigger price deflation.

- A quick recovery in emerging markets such as India and Latin America is largely dependent on a smooth vaccination rollout, which might prove challenging.

Shares look overvalued

Shares are overvalued with earnings growth rates from recent years unlikely to be repeated.

Our AUD 235 fair value estimate factors in a revenue compound annual growth rate of 8% to fiscal 2029 and operating margins expanding to 26% by fiscal 2029, resulting in adjusted earnings per share growth of 11%.

In the core implant segment, we assume units sold per year grow at 8% and revenue growth of 8%, assuming a flat US dollar/Australian dollar exchange rate of 0.65.

Less than 10% of Cochlear’s revenue is earned in Australian dollars and approximately half of the costs are in Australian dollars. Therefore, a weakening Australian dollar is beneficial to Cochlear’s bottom line.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 18 June 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.