Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Tariffs, stagflation and picking the winners: 3 key portfolio themes for FY26

Tamara Haban-Beer Stats, Director and ETF Specialist, BlackRock

Policy uncertainty has driven global equity markets to an unusual degree this financial year, with wild swings in sentiment across asset classes and regions.

But as we look towards FY26, the team at BlackRock believe long-term opportunities abound in a global economy that is undergoing a profound transformation driven by mega forces – and now accelerated by US trade policy.

These are the key themes BlackRock think will drive market dynamics in the coming financial year – and how investors can use ETFs to zero in on the markets, sectors and strategies that may benefit.

Theme 1: Diversify broadly1

The current uncertain environment favours diversification, and we think investors should be mindful of overconcentration, whether it’s in specific market, sectors or investment styles.

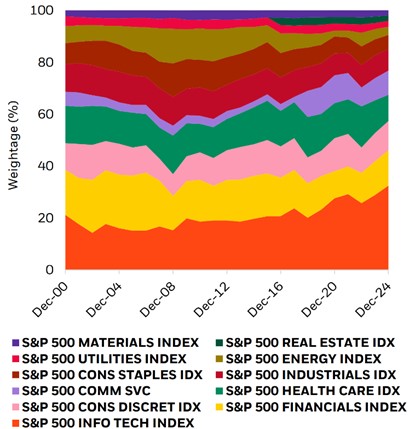

BlackRock sees value in diversifying across geographies and sectors, given the outsized surge in US technology names in recent years, which may have left some investor portfolios with unintended overweights (see chart below).

Tech and comms services make up almost half of the S&P 500 Index

Source: S&P data as of 31 December 2024

To provide some balance, consider leaning into sectors with a value tilt that have helped to provide balance to portfolios in recent months.

One of these is consumer staples, which investors can access through the iShares Global Consumer Staples ETF (IXI). Companies in this sector typically have steady demand and stable earnings, making them appealing as the US economy faces uncertainty.

US tariffs are also likely to impact sectors and industries differently, so investors should consider being active and selective in equity allocations.

With one of the lowest supply chain exposures to China, and the strongest earnings growth of all sectors in the Q1 US earnings season2, the team at BlackRock see healthcare – accessed through the iShares Global Healthcare ETF (IXJ) - as a resilient exposure to consider while trade uncertainty continues.

Healthcare also taps into one of BlackRock’s key long term mega forces to watch – demographic divergence, which is driving increasing demand for surgical innovations and new longevity treatments as developed market populations skew increasingly towards old age.

Theme 2: Capture tactical opportunities

As tariff negotiations progress, opportunities are emerging as winners from trade conflicts evolve. BlackRock think markets and sectors driven by long-term domestic tailwinds, that are relatively insulated from global trade dynamics, look the most promising.

Looking to economies like India – the biggest geographic weighting in the iShares Emerging Markets ex China ETF (EMXC)3 - that earn most of their revenue locally and are supported by easing inflation and dovish monetary policy4. Through other key emerging market economies like Taiwan, investors can also tap into the AI mega force while diversifying outside US tech.

Wage and inflation growth, combined with ample household cash savings, provide investors a domestic tailwind for Japanese equities. Accessing Japanese equities through an unhedged exposure like the iShares MSCI Japan ETF (IJP) makes it worth reviewing given rising domestic interest rates and the potential for the yen to appreciate.

Theme 3: Manage stagflation and recession risks

Growth concerns have reared their head in the market, with the historic increase in US protectionism likely to have a significant effect on supply chains worldwide.

Investors should look to diversify across strategies that don’t closely follow broad market trends and can potentially provide a hedge against further bouts of volatility5.

Infrastructure provides investors with long-term, stable cash flows with the potential for inflation mitigation, and has a low correlation to other asset classes, making the iShares Global Listed Infrastructure ETF (GLIN) a useful portfolio diversifier in a stagflation era6.

A resurgence in inflation could also limit central banks’ ability to cut interest rates. In this scenario, investors can look to take shelter with cash-like exposures like the iShares Enhanced Cash ETF (ISEC). With little interest rate risk, this option can help protect investors from rate changes while still offering the potential for good returns.

With more than 380 exchange traded products now available on the ASX from multiple managers, it’s never been easier for investors to build a dynamic portfolio across different asset classes, markets, sectors and investment styles. With the new financial year likely to bring ongoing uncertainty to markets, investors can consider using ETFs to navigate the storm through defensive exposures, and markets and sectors likely to benefit from the current environment.

iShares Global Consumer Staples ETF (IXI)

https://www.blackrock.com/au/products/273429/

This product is likely to be appropriate for a consumer:

- who is seeking capital growth

- using the product for a core component of their portfolio or less

- with a minimum investment timeframe of 5 years, and

- with a medium to high risk/return profile

iShares Global Healthcare ETF (IXJ)

https://www.blackrock.com/au/products/273430/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a high to very high risk/return profile

iShares MSCI Emerging Markets ex China ETF (EMXC)

https://www.blackrock.com/au/products/337684/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares MSCI Japan ETF (IJP)

https://www.blackrock.com/au/products/273434/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares Core FTSE Global Infrastructure (AUD Hedged) ETF (GLIN)

https://www.blackrock.com/au/products/331650/

This product is likely to be appropriate for a consumer:

• who is seeking capital growth and/or income distribution

• using the product for a core component of their portfolio or less

• with a minimum investment timeframe of 5 years, and

• with a medium to high risk/return profile

iShares Enhanced Cash ETF (ISEC)

https://www.blackrock.com/au/products/287042/

This product is likely to be appropriate for a consumer:

• who is seeking capital preservation and/or income distribution

• using the product for a whole portfolio solution or less

• with no minimum investment timeframe, and

• with a very low risk/return profile

Opinions are subject to change and they are not a guarantee of future results. This information should not be relied upon as research, investment advice or a recommendation.

This information has been provided by BlackRock Investment Management (Australia) Limited (BIMAL) for WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.

Important Information: This material has been created with the co-operation of BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523 on 26 May 2025. Comments made by BIMAL employees here represent BIMAL’s views only. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) at blackrock.com/au to see if the products referenced are appropriate for you. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. Refer to BIMAL’s Financial Services Guide at blackrock.com/au for more information. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. MKTGH0525A/S-4524838