Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

oOh!media (OML) – oOh! la la

Phillip Hudak | Maple-Brown-Abbott

oOh!media (OML) is one of largest Out-of-Home (OOH) media companies in Australia and New Zealand (ANZ), operating a highly diversified network of over 35,000 advertising assets. These assets span key market segments including roadside, retail centres, airports, bus stops, train stations, and office towers, delivering comprehensive exposure to metropolitan Australians.

Key positive catalysts

OML is currently benefiting from a combination of structural and cyclical tailwinds.

- Structural shift in media spend: continued reallocation of advertising budgets from traditional media (TV, radio and print) to OOH, which offers better reach and ROI

- Cyclical upswing: lower interest rates and improving macroeconomic conditions are supporting an increase in overall media spend

- Operational turnaround: improving fundamentals with the rollout of new contracts and improved execution are enabling oOh!media to regain market share lost during the 2024 calendar year.

Despite a notable share price recovery since the beginning of the 2025 calendar year, OML remains attractively valued, with upside potential supported by both macro and company-specific catalysts.

OOH structural growth story remains intact

The long-term growth trajectory for OOH advertising remains strong. Over the past decade, OOH’s share of total media spend has increased from approximately 10% to 15%, interrupted only temporarily during the COVID-19 pandemic. This trend reflects the medium’s ability to deliver consistent and high-impact reach.

Source: Maple-Brown Abbott, oOh!media presentation, ASX release, Standard Media Index (SMI), which reports on agency media spend, analysing total OOH, sector spend as a % of total agency media spend, In Q1 2025 (typically the seasonal high point SMI share for OOH) share has increased to 17.0% versus 15.4% in the pcp, 15 May 2025.

We believe the OOH advertising market is well positioned to continue capturing share from traditional media, underpinned by several key industry drivers:

We believe the OOH advertising market is well positioned to continue capturing share from traditional media, underpinned by several key industry drivers:

- Cost efficiency: OOH delivers a lower cost per audience impression relative to other traditional and digital media formats.

- Higher ROI: advertisers are seeing superior returns on investment through OOH campaigns, making it an increasingly attractive channel.

- Enhanced measurement standards: the rollout of MOVE 2.0—the next generation of the Measurement of Outdoor Visibility and Exposure system—is expected to improve transparency and accountability through standardised digital audience metrics.

- Programmatic: increased shift to programmatic advertising which automates the process of planning, buying and delivering advertisements.

- Population growth: expanding metro populations are driving larger audience bases for OOH networks.

- Creative innovation: ongoing advancements in digital creative formats and content delivery are increasing audience engagement and campaign effectiveness.

Since 2021, OOH has been a standout performer, gaining media agency spend at the direct expense of newspapers, television, and radio. Notably, OOH has outpaced digital media in growth over this period, highlighting its strong competitive positioning in a rapidly evolving media landscape.

Source: Maple-Brown Abbott, oOh!media presentation, ASX release, Standard Media Index (SMI), which reports on agency media spend, analysing total OOH changes since 2021 indexed to 100, 15 May 2025.

Cyclical headwinds turning into tailwinds

Historically, the OOH industry has faced several structural and cyclical headwinds, including:

- Oversupply: a significant rollout of new OOH inventory in the late 2010s that outpaced advertiser demand.

- COVID-19 disruption: severe interruption in audience mobility and advertiser confidence during the 2020–2022 pandemic period.

- Macro pressures: elevated domestic interest rates throughout 2023–2024, which weighed on overall media spend.

These pressures are now evolving into supportive tailwinds. Industry capital expenditure has become more disciplined, with supply growth moderating in a more rational and demand-aligned market. Industry feedback indicates that JC Decaux, a player in the Australian OOH market, has deprioritised Australia for other global markets.

Additionally, expectations of further interest rate cuts in the second half of 2025 are likely to support a recovery in advertising budgets and media investment.

Source: Maple-Brown Abbott, FactSet, 30 May 2025, ASX, ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve, 30 May 2025.

As of May 2025, metro TV advertising spend remains in negative territory, according to Standard Media Index (SMI) data. In contrast, Out-of-Home advertising continues to gain market share, with industry spend up +15% year-to-date, accelerating from the +8% growth recorded in CY2024, based on Outdoor Media Association (OMA) figures. This growth has been broad based across a diverse range of industry categories.

OML reported Q1 CY25 total revenue growth of +13% year-on-year, with Australian media revenue growing by +16%, in line with OMA’s industry trends. Company management has guided Q2 CY25 performance to be broadly similar to Q1, supported by improved market share outcomes and successful revenue initiatives. This follows more modest growth in the back half of CY2024 (Q3: +2%, Q4: +5%), indicating clear momentum in early 2025. Furthermore, the company anticipates continued share gains over CY25 as additional high-value assets are deployed.

Given recent trading updates and supportive industry data, the consensus oOh!media revenue growth forecast of ~9% in CY25 appears conservative. We believe there is upside risk to these estimates, underpinned by:

- Strong early-year industry and company performance,

- Continued asset rollouts and market share recovery, and

- A supportive macro and industry backdrop.

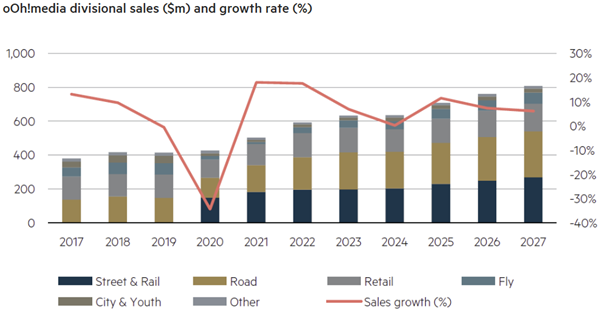

Looking ahead, we forecast OOH media spend in ANZ to grow at a compound annual growth rate (CAGR) of +6–8% over CY2026–27, driven primarily by a rising share of total advertising spend. There is further upside potential should broader advertising market conditions improve beyond current expectations.

Source: oOh!media data, Maple-Brown Abbott estimates.

Internal turnaround in place

The 2024 calendar year presented significant challenges for oOh!media, including:

- Material market share loss, primarily due to the loss of the Vicinity Centres contract.

- Elevated employee churn, impacting operational continuity and sales execution.

- Pricing underperformance on roadside billboards.

- Unfavourable asset mix, with overexposure to static formats in the Retail and Street Furniture segments.

- Slower-than-expected ramp-up of key contracts, including Sydney Metro and Woollahra.

- Upfront investment in reo infrastructure and platforms ahead of revenue realisation.

However, based on our industry feedback and year-to-date performance in CY2025, many of these issues have now stabilised. oOh!media has begun regaining market share, aided by improved execution. We expect further share gains to continue throughout the remainder of the year, as recently awarded contracts—including Sydney Metro, Waverley, and Woollahra—are fully deployed. The company is also expanding its reo partnerships with blue-chip clients such as Petbarn, Officeworks, and Australia Post, which should support both revenue and margin momentum.

We also see margin discipline and cost optimisation supporting medium-term growth. Despite bidding competitively for flagship contracts—which may create short-term gross margin pressure — oOh!media maintains a focus on contract discipline and margin preservation. Management expects adjusted gross margins in CY2025 to remain broadly in line with CY2023–2024, with any initial dilution from flagship awards offset by:

- The halo effect of premium contract wins on pricing power across the asset base.

- Enhanced sales team performance, driving improved revenue realisation.

Additionally, the company has made meaningful progress in cost base optimisation. Management is targeting net cost savings of ~$15 million, guiding for a CY2025 operating expense base of $153–155 million, with upside risk if performance incentives are triggered due to stronger-than-expected revenue. This restructuring is expected to result in significant operating leverage, setting the foundation for sustainable growth.

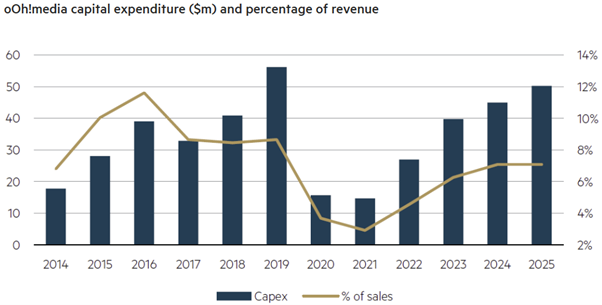

oOh!media remains disciplined with respect to capital deployment. Capital expenditure for CY2025 is forecast at $45–$55 million, primarily directed toward the rollout of new advertising assets. Actual spend will be contingent on development approvals, reinforcing a measured and returns-focused investment approach.

Source: oOh!media data, Maple-Brown Abbott estimates.

Valuation and risk considerations

oOh!media currently trades on a next-twelve-month (NTM) P/E multiple of approximately 12x, which is below its historical average. We believe this valuation does not adequately reflect the improving operational momentum, favourable industry dynamics, or potential upside from contract execution and cost discipline.

In addition, the combination of OOH with other media formats may be attractive to existing media players – the likes of Nine Entertainment (NEC) may be interested bundling its TV and publishing assets with the OOH format, particularly given the pending cash injection from the Domain Holdings Australia (DHG) divestment following the Co Star Group takeover.

However, key risks remain and should be monitored closely:

- Contract renewals: the outcome of high-profile tenders—such as the Auckland contract, which remains in process—could materially impact future revenue.

- Competitive landscape: ongoing shifts in the advertising ecosystem could intensify pricing pressure or impact market share.

- Landlord and regulatory: changes in landlord relationships or the regulatory framework surrounding OOH advertising could present downside risks.

Investment summary

In our view, oOh!media is well-positioned to benefit from a more constructive market backdrop that supports the structural shift toward OOH advertising. The business is showing clear signs of operational recovery, improved contract execution, and disciplined cost management. With increasing operating leverage, strong contract visibility, and upside risk to current consensus forecasts, we see valuation upside from current levels.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 30 June 2025. This document was originally published in Livewire Markets on 30 June 2025. This information has been prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL No. 237296 (“MBA”). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.