Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

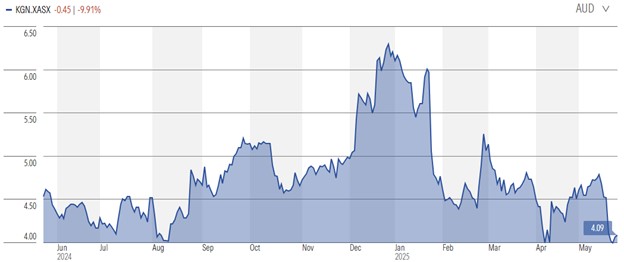

A cheap ASX leader prioritising market share over profits

Johannes Faul, CFA | Morningstar

Kogan (KGN) is rapidly increasing gross sales and taking market share in Australia’s discretionary e-commerce market. However, this is being driven by ballooning marketing expenses, and so comes at the expense of diminishing near-term profit margins. Further weighing on margins are losses in New Zealand.

Why it matters

Kogan is investing heavily in marketing to reignite top-line growth after two years of declining gross sales. Sales grew by 20% in the four months to April 2025, but the market seems more concerned with the almost 40% drop in group earnings before interest, taxes, depreciation and amortisation (“EBITDA”). Shares fell almost 10% on the update.

- In Australia, increased marketing costs are certainly attracting website visitors. Active customers of 2.7 million in April 2025 are up almost 40% on last year. However, despite a much larger sales base, EBITDA surprisingly declined by 14% on the same period a year ago.

- While gross sales growth was stronger than we expected, this is more than offset by the steep 40% increase in marketing costs in the period. We lower our fiscal 2025 EPS estimate by 32% to 15 cents. We also modestly reduce our medium-term EPS estimates on slightly higher marketing costs.

The bottom line

We maintain our $10.70 fair value estimate for Kogan, with shares screening as materially undervalued. We believe the market assumes higher marketing costs will persist, but without resulting in higher sales growth and accompanying market share gains.

- We don’t believe Kogan has a competitive advantage over larger international online pure-plays that would allow it to durably increase its market share without elevated marketing expenses crimping its margins.

- However, we expect competition to moderate as the Australian e-commerce market consolidates and for Kogan to retain its market share while gradually reducing marketing costs. We forecast adjusted EBITDA margins as a percentage of gross sales to expand some 600 basis points to 11% by fiscal 2028.

Source: Morningstar

New Zealand woes likely temporary

Kogan’s business strategy is broadly based on low-price leadership. However, as the competitive outlook intensifies from both Amazon and omnichannel retailers, Kogan is adjusting by launching a new online marketplace and building its product offerings in bulkier goods.

Compared with new entrants and most traditional retailers, while replicable we believe Kogan is far ahead on its supply chain, operational automation, IT, and sourcing capabilities. It outsources delivery and uses third-party logistics providers for warehousing, but has built a proprietary least-cost routing system that automatically calculates the best carrier depending on the article ordered.

Kogan’s strategy for its exclusive brands is largely data-driven, and seeks to identify and fulfil established demand for consumer products or categories at competitive prices. The firm analyzes Google search trends and product sales on competitor websites to identify strong consumer demand, and then manages and invites manufacturers to tender for new product contracts mostly through its Shenzhen sourcing office. Kogan is increasing private label exposure in bulkier goods including white goods, built-in kitchen appliances, and furniture with the bolt-on acquisition of Matt Blatt in fiscal 2020.

The firm also started delivering bulky goods to Brisbane, Perth, and Adelaide after expanding to 13 fulfilment centers in fiscal 2019. Although typically lower margin, we consider building a differentiated product offering around big-ticket items as a sound strategy. As fulfilment of bulky goods can be challenging to automate and usually requires dedicated handling, Kogan is competing less with Amazon’s fulfilment expertise, and in categories with generally less online competition overall.

We see great potential in Kogan’s relational business growth through its Kogan First membership model. Kogan First is a loyalty subscription service that allows users to pay less for products and delivery and gives access to exclusive offers. Kogan First has seen impressively fast user adoption since it launched in 2019. We estimate Kogan First members at around 500,000.

Kogan bulls say

- Kogan is well placed as a pure-play online retailer due to structural tailwinds from online migration.

- Kogan First has the potential to double its current subscriber base, growing the recurring income stream it generates and strengthening customer loyalty.

- Marketplace is expected to significantly improve margins as sellers cross-list on its marketplace for greater exposure.

Kogan bears say

- Current unprecedented growth is vulnerable to potential higher unemployment and physical retail reopening in the near term, and growing competition from Amazon and omnichannel retailers in the long term.

- The third-party brands business faces cannibalization from sellers migrating to marketplace, and increased price competition since GST laws were effective from fiscal 2019.

- Mobile is expected to remain challenged with improving postpaid plans longer-term.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 22 May 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.