Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

12 picks for an income portfolio

Mark LaMonica | Morningstar Australia

There is a lot going on in the world and many investors are anxious. I’m starting to see a lot more commentary about raising cash and cutting equity exposure. The justification for this approach is simple – Trump is scary, markets will drop and there will be plentiful opportunities in the future.

I understand why this argument is resonating with investors. I could make a compelling case to follow this approach. Yet when I get anxious I always try and ground myself with what I’m trying to accomplish as an investor. In my case it is to create a growing stream of passive income.

That is what this list of picks represents. And this isn’t an academic exercise for me. I own 11 out of 12 of these picks. The only exception is Soul Patts which is on my watchlist. Despite everything going on in the world I’m focused on me and what I’m trying to accomplish. That is a strategy that requires patience and consistency.

Maybe the ‘go to cash’ advocates are making the right move to accomplish their goals. Maybe they aren’t thinking about what they are trying to accomplish and just reacting to the news cycle. It isn’t really any of my business.

My advice to all investors is to focus on what you are trying to accomplish and the best way to do that. There aren’t many investment goals that are best served by playing the short-term market timing game.

My original premise

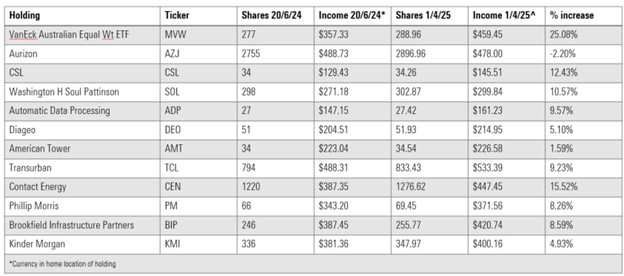

I had two long-term goals for the shares and ETFs I included on my list on June 20th 2024. For the more growth orientated bucket I wanted to achieve average income growth of 10% per year. For the higher yielding shares I was targeted average income growth of 8% annually.

In both cases this income growth comes from a combination of dividend reinvestment and dividend growth. In providing this update I used the following assumptions to calculate the results:

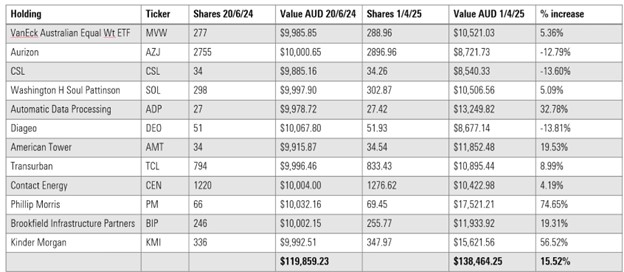

- Equal weighted portfolio: I assumed that each of the 13 picks received an equal allocation of $10,000. For the US holdings I used the exchange rate on the 20th of June which makes a $10,000 local investment into $6,654 US. I am going to assume no rebalancing so the equal weighted portfolio is only a day one exercise and the weights will fluctuate over time.

- Dividend reinvestment: I am assuming that dividends are reinvested at the closing price on the day of the dividend payment. This may vary slightly from how a broker processes any automatic reinvestments or how an investor might manually reinvest dividends. In all but the most extreme situations the price will not vary significantly under these scenarios from my approach.

- Income on 20th of June: This represents the dividends and distributions in the preceding 12 months on the 20th of June multiplied by the number of shares held on the 20th of June.

- Income on the 1st of April: This represents the dividends in the proceeding 12 months on the 1st of April multiplied by the number of shares held on the 1st of April.

In the following chart you can see the results of this exercise.

Things are going well. Although I must again point out this is an extremely short time-period. An increase in total income of 8.90% in constant currency terms after nine months is ahead of my goal. Accounting for the weakening Aussie dollar since June 20th income is up 11.84% in local currency terms.

Currency matters and there will always be fluctuations. However, since this is a long-term portfolio I’m more interested in what is happening in constant currency terms. I included companies that I thought would grow their dividends. The constant currency view answers this question.

How are individual picks performing?

The first place to start is with Aurizon. Out of all 12 picks this is the only one where total income has fallen. Since I published the original picks article both of Aurizon’s dividends were down from the level in the previous year. Not ideal.

To grow a dividend a company needs to grow earnings and Aurizon is struggling. The results reported in February showed net profit after tax dropping by 14% on weaker grain volumes, cost inflation, and bad debt provisions.

Despite the current struggles our analyst Adrian Atkins who covers Aurizon still forecasts a five-year earnings per share compound annual growth rate of close to 8% on improved haulage earnings and the share buyback.

As I’ve mentioned previously I own every one of the picks with the exception of Soul Patts. I’ve been frustrated by the performance of Aurizon for a while but this is a case where I’m going to continue to be patient.

Other than Aurizon I’m pleased with the other picks. American Tower has had slow overall income growth but with a recent dividend raise I’m confident dividend growth will return after a year spent paying down debt associated with the acquisition of the CoreSite data centre business. Our analyst recently raised his fair value estimate and the shares are up 17.53% year to date which reflects investor optimism.

This quarter CSL raised their dividend by 15% and Soul Patts and Contract Energy raised by 10%. Over in the US Brookfield Infrastructure raised their quarterly dividend by just over 6%.

How did the portfolio perform?

I’m an income investor. But that doesn’t mean I don’t want my portfolio to increase in value. I don’t think those goals are mutually exclusive. The current environment is likely a positive one for more defensive income plays.

Overall the performance of the picks has been strong as the return of 15.52% exceeds the S&P 500 which was up 9.36% in Aussie dollar terms and the ASX 200 which was up 2.93% over the same time frame.

There are going to be environments that a defensive income portfolio performs well in and ones it doesn’t. The first quarter of 2025 was an environment it will perform well.

I don’t read too much into this since it has been less than a year since I made the picks. The last thing I would ever suggest is for an investor to try and rotate their portfolio.

This is how I invest all the time and I know from experience there are times that it will underperform. I wrote about this in my article on what I’m giving up as an income investor. I am trying to grow passive income and in that respect the picks are doing well. That is what matters to me.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 1 April 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.