Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Nasdaq's recent drop is a reminder to look for opportunities outside of the Magnificent 7

Garry Laurence | Profeta Investments

The Nasdaq recently dropped 3% in a day, following the release of DeepSeek’s AI model. The Chinese start-up’s model boasts to be on par with OpenAI’s latest model at 5% of the computing costs, or only $5.6 million. This has reminded investors of the risks of investing in semiconductor companies and over-inflating valuations.

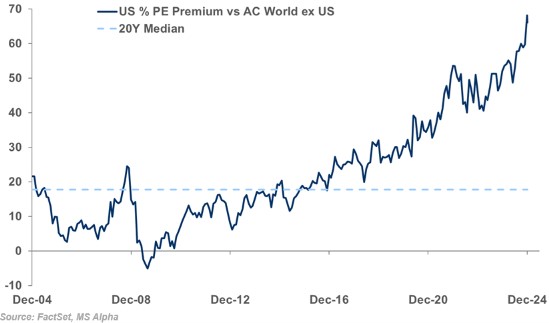

International equities trading at steep discounts to the US market

The US market currently trades at a 60% premium valuation to the rest of the world, compared to historical averages of 20%.

Source: FactSet, MS Alpha

We are benchmark unaware investors, looking for quality businesses trading at attractive valuations. This has meant that we have found much more exciting opportunities outside of the US market, with 77% of our portfolio outside of the US. While the MSCI ACWI index has a 67% exposure to the US and the MSCI World Index has 74% exposure to the US, we only have 23% of our portfolio in US domiciled companies. These indexes are also highly concentrated in the “Magnificent 7” stocks (Apple, Nvidia, Microsoft, Amazon, Meta, Tesla, Alphabet), which make up 24% of the MSCI world index.

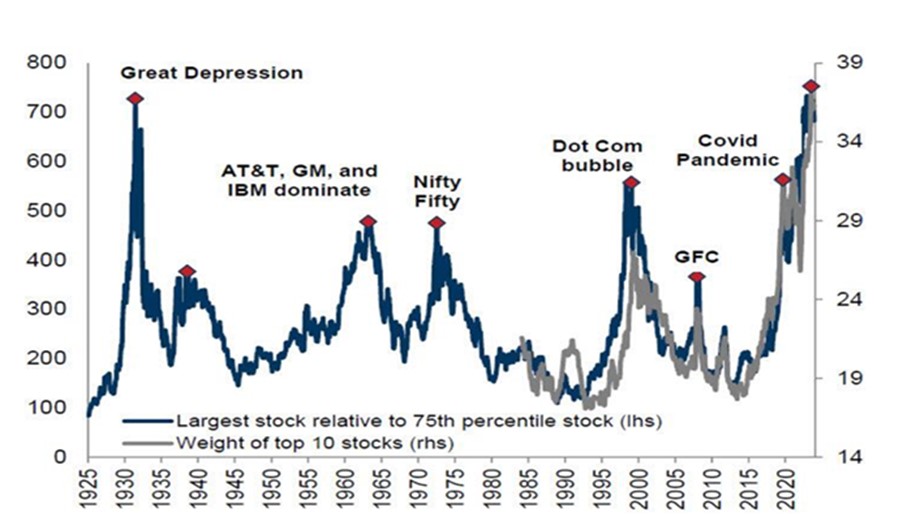

S&P 500 concentration has never been this high

Source: Profeta Investments

Source: Profeta Investments

We are finding value in Asia, Europe and Latin America

I spent several weeks in Asia this quarter and remain excited about the upside potential of our investments there. While the S&P 500 is trading close to all time high valuations, Asian markets like Hong Kong are trading close to all time low valuations. Latin America is also an area of significant opportunities.

While the world has been trying to bet on US companies that benefit from Donald Trump’s reforms, they have ignored wonderful companies operating in Latin America.

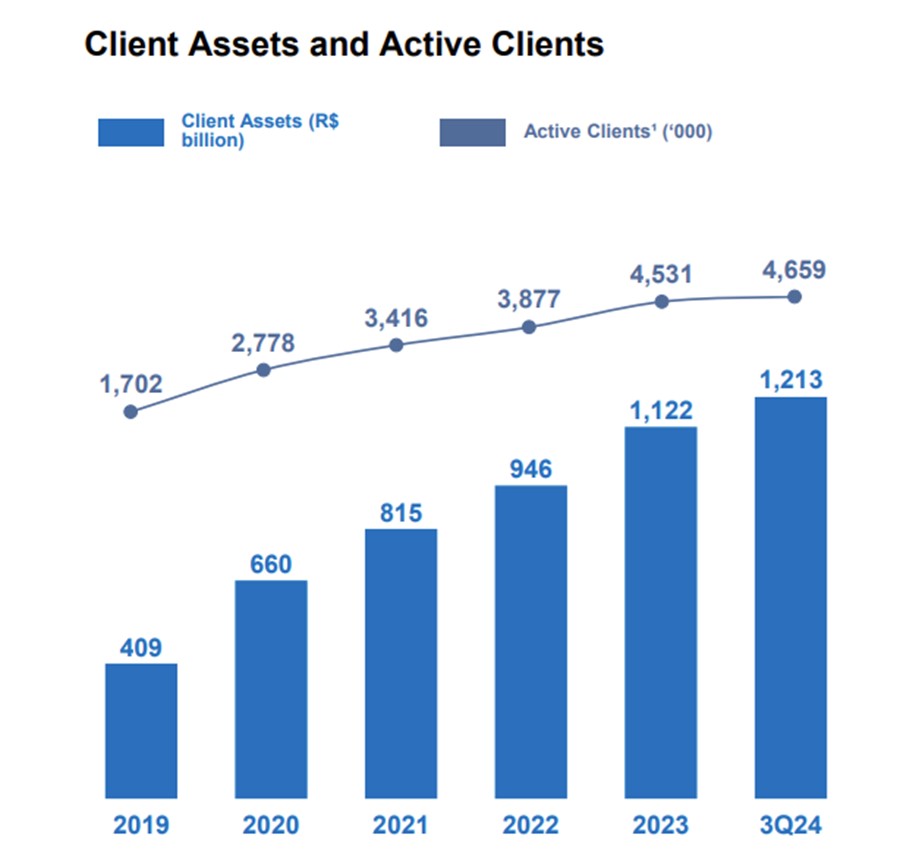

XP (NASDAQ: XP)

XP is Brazil’s leading technology-driven financial services platform, providing this platform to independent financial planners, its own financial planning network as well as retail and institutional investors. It has often been described as the Charles Schwab of Brazil and is led by its entrepreneurial founder and Chairman, Guilherme Benchimol. We have been following the company since its IPO in 2019 and have been amazed at the significant de-rating the stock has seen despite increasing earnings per share by 4x over this short period. The company has been swept up in the sell-off in Brazilian shares as the central bank has lifted interest rates to 12.25%.

We have been accumulating shares in the recent sell off as it is rare that we see such a high-quality company trading at an all-time low valuation of only a P/E of 7x. This compares to Charles Schwab in the US at 23x.

I visited XP at their offices in Brazil in 2023 and met their CEO, Thiago Mafra, at a conference in London last September. Thiago has done a wonderful job since becoming CEO in 2021. Over the past three years the company has built a number of new verticals and revenue streams including foreign exchange and credit. They currently have 5 million active retail clients serviced by them directly or through 14,000 independent financial planners in Brazil. Irrespective of the macro, the company expects to win 1% of market share each year and they expect their operating margin to improve from 28% to 30-34% by 2026. We expect this to deliver continued strong earnings growth and free cashflow and are happy shareholders, albeit puzzled by the current share price.

Source: Profeta Investments

Source: Profeta Investments

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 28 January 2025. This document was originally published in Livewire Markets on 28 January 2025. This information has been prepared by Profeta Investments Pty Ltd as trustee for the Profeta Global Investments Fund (ABN 98 644 534 216)(AFSL 527182). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.