Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Ask the analyst: Why has the market shunned APA Group?

Joseph Taylor & Adrian Atkins | Morningstar

Today’s question comes from Jamie, a self-directed investor in Queensland. Jamie wanted to know why APA Group has performed so poorly since 2022 and what might affect the company’s business going forward.

I put this question – and a few of my own – to Adrian Atkins, Morningstar’s APA Group analyst. We’ll hear from Adrian in a moment. But first, some context on APA and how it makes money.

How does APA Group make money?

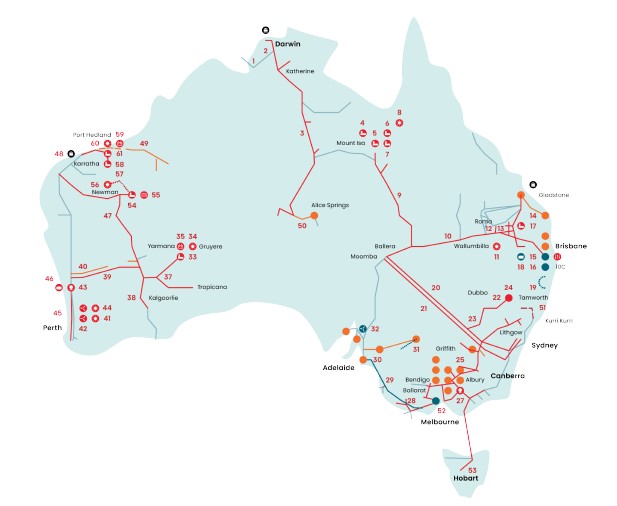

APA Group owns a swathe of power generation, electricity transmission and gas infrastructure assets across Australia. These images from the company’s latest annual report from August 2024 makes the extent of this footprint clear.

Source: Morningstar

Source: Morningstar

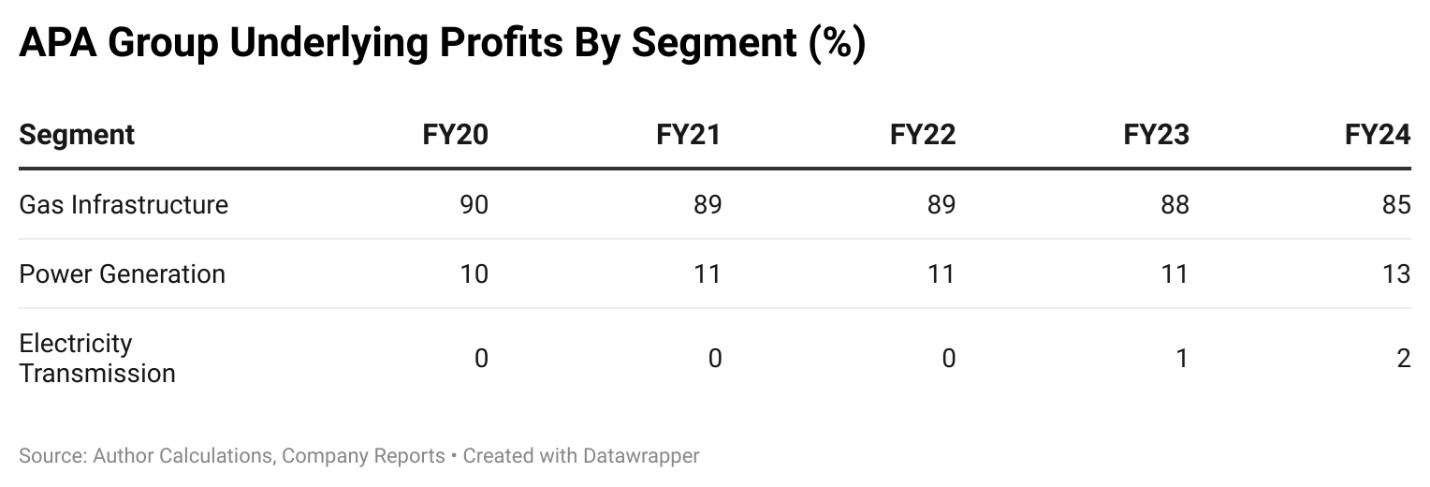

APA’s investments in power generation, especially renewable power, have increased markedly in recent years. Yet gas pipelines, storage and distribution still speak for the vast majority of underlying profits.

Net profit figures have the potential to mislead

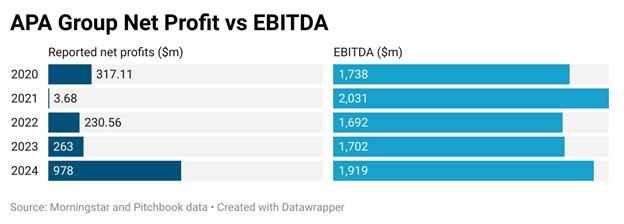

Something you have probably already picked up by now is that APA is an incredibly asset heavy business. This is reflected by the value of plant, property and equipment on APA’s balance sheet - some $12.5 billion as of their fiscal 2024 numbers - and huge annual depreciation charges.

Depreciation is a non-cash line in the accounts that spreads the cost of past investments in hard assets over the useful life of those assets. For APA, this charge was $687 million in fiscal 2024. Plus another $232 million in amortisation charges from past acquisitions and investments in intangibles.

These amounts are taken out of APA’s operating profits before it reports net profits. As you can imagine, this doesn’t leave much left over for reported profit. Small changes in revenue can lead to big swings in reported net profit figures.

It is vital to remember, however, that depreciation and amortisation charges don’t actually represent a cash outflow. To understand how profitable an asset heavy infrastructure business like APA is, you are better focusing on other metrics like EBITDA or free cash flow per security.

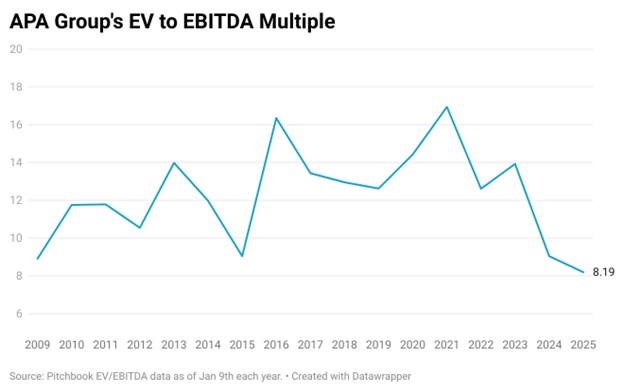

This means that using a P/E ratio (which uses net profits as the denominator) to gauge APA’s valuation doesn’t make much sense either. Something like Enterprise Value to Earnings Before Interest, Tax, Depreciation and Amortisation might be more useful.

EV brings net debt into the equation to show how much, based on today’s stock price, it would cost to buy the whole company and all of its obligations. Meanwhile, EBITDA removes those hefty non-cash charges to the income statement that we mentioned earlier.

When you look at APA’s valuation through this lens, the stock market is clearly assigning a far lower multiple to APA than it has in recent years.

Why have APA shares fallen?

Our analyst Adrian Atkins thinks that several years of tepid growth in free cash flow per share is the main reason for this. He puts this down to higher interest costs on APA’s large debt load, higher costs amid the push into power generation and the dilutive acquisition of Alinta Pilbara.

Atkins thinks the market may be concerned that APA will take on more higher cost debt in order to fund further acquisitions and developments. This is a concern he shares in part, with his Capital Allocation rating of Poor for the company mentioning both APA’s debt load and “aggressive” growth of its renewable energy footprint.

However, Atkins still sees plenty to like about APA’s competitively-advantaged gas infrastructure assets.

APA should have plenty of organic growth opportunities in its gas transmission network, which typically generate good risk-adjusted returns. Meanwhile, Atkins thinks the up-front cost of replicating APA’s assets would stop rational upstarts from entering the market.

An unappreciated win?

Most of APA’s contracts in its key pipelines segment are unregulated. Pipeline capacity is sold on long term “take or pay” contracts that net APA a return one or two percentage points higher than regulated contracts to compensate for demand risk once the contracts end.

A lingering concern has been the potential for these pipelines to face more regulation and therefore earn the company lower returns. In a potential boon for APA shareholders, Atkins says, there are signs that this risk may have lessened.

Atkins sees the recent draft decision not to regulate APA’s South West Queensland Pipeline as a case in point. Amid threats of regulation and likely lower returns, APA stopped capacity expansion on the route into Victoria. As this could possibly see winter gas shortages in the future, the regulator has seemingly backed down.

This decision looks important in a couple of ways. For one, the SWQP is a key asset having contributed almost 15% of APA’s underlying profits in recent years. More broadly, this could show that regulators are wary of deterring APA from making much-needed investments in Australia’s energy infrastructure.

Debt load may increase risk

Although the risk of gas market reform and greater regulation haven’t completely disappeared, Atkins does not think these pose the biggest downside risk to APA shareholders.

Instead, he sees this coming from the company’s heavy debt load. If bond yields and interest costs were to increase and worsen APA’s credit metrics, Atkins says an equity raise – which would dilute existing shareholders and weigh on cash flow per security – isn’t completely out of the question.

As a result, Atkins would ideally prefer to see more conservative leverage used at the company and a toning down of its acquisition and development drive.

Shares screen as undervalued

At a price of around $6.90 per security, APA traded almost 25% below Atkins’ Fair Value estimate of $9.30.

Based on Atkins’ forecasts for 2025, the shares also offer a prospective gross yield approaching 8%. This is underpinned by Atkins’ forecast that APA can deliver roughly 6% per year growth in underlying profits thanks to the Alinta Energy Pilbara acquisition and the firm’s expansion projects.

Operating cash flow per security, a key determinant of dividends that can be expected from APA, looks likely to be held back by higher interest and tax costs. Yet Atkins expects APA to eventually grow this at a low to mid-single digit annual clip.

Looking out a bit further, APA’s biggest single contributor to underlying profits – the Wallumbilla Gladstone Pipeline – can be expected to deliver far less (if any) profit from 2035 onwards.

APA’s 20-year contract to receive payments will have finished and the pipeline (which APA will still own) may or may not continue to be used by the customer. APA will want to make up for that shortfall, likely explaining its active acquisition and development activity in recent years.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at 10 January 2025. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.