Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

2 ASX stocks giving you access to a misunderstood but highly profitable commodities theme

Emanuel Datt | Datt Capital

Natural resources are vital for daily life and underpin global economic and social progress. Growing populations, urbanisation, and rising prosperity, especially within developing economies, are driving increased demand for minerals and energy.

As developed nations transition to renewable energy and electric vehicles, building new infrastructure creates investment opportunities. Meanwhile, constrained farmland, cautious mining investments, and oil companies focusing on debt reduction and stock buybacks strengthen the resource sector's supply dynamics.

Natural resource producers often have robust balance sheets, enabling them to navigate volatility and seize opportunities. Investment areas can include oil producers, gold, lithium, copper, and other industrial metals — sectors poised for growth as the world’s economies mature and transition. This alignment with global trends makes resource-focused investments increasingly attractive to investors.

Why should investors consider resource exposure in 2025?

The Resource sector provides attractive investment opportunities given its often highly inefficiently priced with a large, diverse investible universe on the ASX. This is because it’s a sector that is not well understood by the institutional market, especially outside the ASX 50 stocks.

Accordingly, there is the ability to generate consistent alpha via the right investment managers who can express global themes on local markets. Exposure to the sector itself may act as a natural hedge to adverse local conditions given Australia’s status as the world’s premier mining jurisdiction and its export-focused, US dollar-denominated resource endowment.

This globally advantage has may provide significant advantages to local investors relative to other local export sectors. For instance, China enacted hefty tariffs on a range of Australian export products such as wine in 2020 which significantly affected earnings for local companies. Over the same period, Australian iron ore and coking coal producers were entirely unaffected by the stoush between the respective governments.

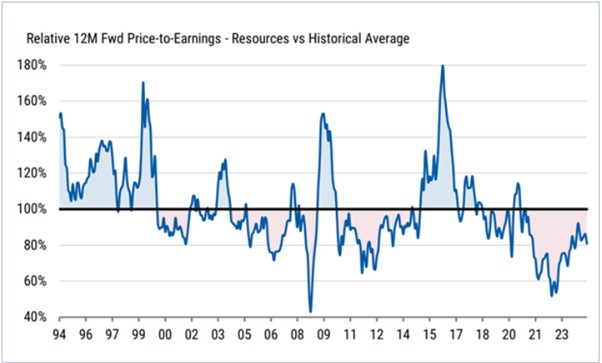

We believe the outlook for the resources sector in 2025 is positive albeit with some short-term challenges. Valuations within the sector remain attractive relative to other sectors and on a historical basis.

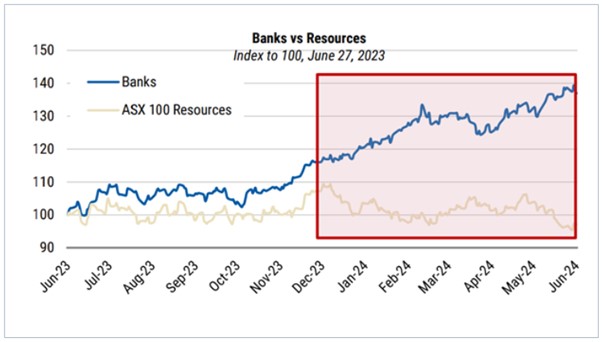

Figure 1: Banks vs Resources. Index to 100, June 27, 2023.

Source: RIMES, Morgan Stanley Research. Performance for the period Dec-31, 2023 through to and including June-27, 2024

Figure 2: Relative 12M Fwd Price-to-Earnings - Resources vs Historical Average

Source: RIMES, Morgan Stanley Research.

Where are the biggest opportunities likely to come from?

An increase in global energy demand

Global electricity demand is expected to grow by 4% in 2025, the fastest rate of increase in nearly two decades.

This growth is driven by a rise in economic activity driven by a rise in living standards within developing economies. Specifically, we anticipate greater adoption of air conditioning and heating over time within these economies as broader living standards converge towards conventional Western standards.

Within developed economies we expect continuing adoption of electric vehicles, albeit at a declining proportionate rate, to drive energy demand.

Renewable energy expansion

Governments worldwide continue to pursue the development of renewable energy sources, providing strong tailwinds for mineral consumption. In addition, as intermittent electricity generation becomes a larger proportion of the grid; this has an inflationary effect on electricity and energy prices overall.

Critical minerals

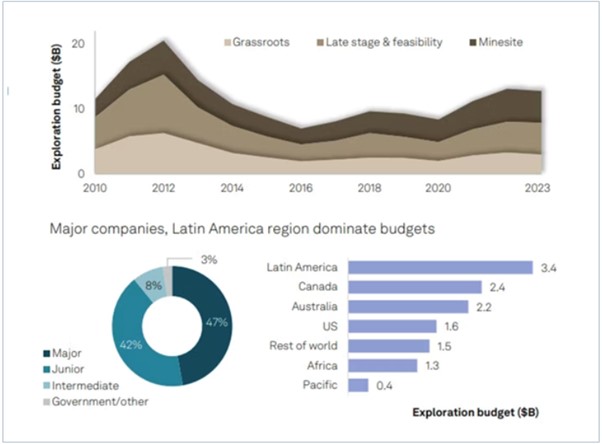

We anticipate higher demand expected for resources essential for low-emissions technologies, such as copper, aluminium, and lithium. However, care must be taken to select appropriate exposures along the cost curves given the highly cyclical nature of the sector. Also notable is the relative decline in grassroots exploration spend, underpinning the value of existing resources due to scarcity value.

Figure 2: Grassroots exploration at all-time low share

Source: Datt Capital

What are the biggest risks in 2025?

The Chinese housing market remains a significant risk for the resources sector, specifically due to uncertainty around the nation’s steel demand. Muted steel demand affects demand for steel-making commodities like iron ore and coking coal.

There has been a shift in the Chinese government’s focus towards addressing and de-stocking existing housing inventory rather than directly supporting property developers. In addition, there has been an onus on the restructuring of municipal debt; some of which has been used to support regional property developers. The success of these measures may have an impact on steel demand.

Whilst we anticipate that Indian steel demand will grow over time as the economy matures, somewhat shoring up global demand; there is no doubt that China will remain the largest influence on global demand in the near term.

What investments have you made recently to set your portfolio up for 2025?

One of our key investment thematics for 2025 is that structurally higher cost impositions will arise from changes in government policy, providing numerous opportunities for resource focused investors in 2025.

For instance, the Chinese government recently amended its VAT refund policies for a plethora of export products which will lift the cost base of a range of finished goods considerably given the nation’s status as the eminent manufacturing base of the world.

In addition, we anticipate significant changes in the USA’s tariff policy which will no doubt lead to many prospective opportunities.

What are your top positions?

WA1 Resources (ASX: WA1) are a mineral developer in the process of commercialising its world class Luni niobium project, located in Western Australia the world’s best mining jurisdiction. Luni has an incredible resource endowment that has the potential to support a multi-generational life of mine likely to be well in excess of 100 years, at grades similar to the world’s largest producing mine.

Niobium is an incredibly rare critical metal used primarily in high quality steels and has emerging uses in fast-charging battery technologies. Niobium is produced solely from three operating mines globally, two located in Brazil and one located in Canada.

Niobium is a highly strategic critical metal given its importance in advanced, emerging technologies and its scarcity in supply. It is listed within the top 3 most critical metals by all leading major economies including the US, EU, UK, Japan, India, Korea and Australia.

Luni is the only commercialisable niobium asset globally that has no Chinese stakeholders and represents an important source of future niobium supply wholly controlled by a single Western company. We anticipate positive returns as the company continues along its path of commercialising the project.

Alcoa (ASX: AAI) is a global vertically integrated aluminium business. Aluminium is one of the industries most affected by the change in Chinese VAT policies previously discussed. Alcoa, as a vertically integrated producer, are likely to benefit substantially from the significant rise in their competitors cost base. This suddenly ‘evens the field’ for their primarily western production bases, which have historically operated at relatively higher cost bases. Accordingly, we anticipate aluminium prices to rise over time and believe the company is well poised to benefit.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 17 January 2025. This document was originally published in Livewire Markets on 17 January 2025. This information has been prepared by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.