Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Becoming a Bunnings landlord on the cheap

Adrian Atkins | Morningstar Australasia

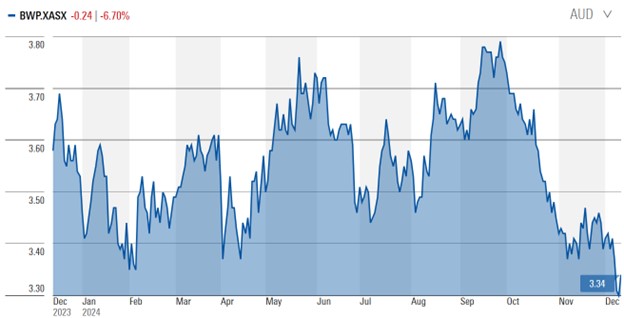

We retain our $3.80 fair value estimate for BWP Trust (ASX: BWP) and consider the REIT to be undervalued after recent unit price weakness. BWP trades at a discount to net tangible asset backing and offers a decent yield of 5.5%. While there are some headwinds from rising costs of debt and vacancies, we forecast distribution growth of 1.5% per year on average for the medium term. With a solid yield, moderate growth potential, defensive revenue, and conservative financial leverage, this small REIT appeals.

We forecast a relatively strong revenue compound annual growth rate of 7.1% for the five years to fiscal 2029, underpinned by the recent Newmark Property REIT acquisition and solid rent growth. Rents on roughly half of leases have fixed rental uplifts averaging 3% per year, and most of the rest are linked to the Consumer Price Index. These factors should offset vacancies from key tenant Bunnings leaving older stores. BWP’s average lease term is relatively short at 3.8 years as of June 2024, and it has a large number of lease expirations in fiscal 2026 and 2027. However, we think Bunnings will stay at most locations, and vacated properties can be redeveloped for other tenants or sold. This trend has been going on for a few years and is a modest headwind.

The other main headwind is rising borrowing costs, particularly after financial leverage increased with the Newmark acquisition. BWP doesn’t have much hedging, so we expect its cost of debt to rise to about 5.8% within a few years, from roughly 4.5% in fiscal 2024. This detracts from earnings and distribution growth.

Source: Morningstar

Business strategy and outlook

For over 20 years, BWP Trust has consistently applied a strategy of generating rental income from long duration leases over warehouse properties predominantly tenanted by home improvement retail business, Bunnings. Although BWP Trust is proposing to transition some Bunnings Warehouse stores to alternative uses, strategy is to have 80%-90% of rental income from Bunnings. Wide-moat Wesfarmers owns 100% of Bunnings and 23% of BWP Trust, and is the trust's responsible entity.

Concentration risk from having Bunnings as its primary tenant is less of a concern given the benefits from having a strong and growing tenant. Bunnings is well managed and dominates the industry in Australia. Also, home improvement retailing is typically resilient to the business cycle. We also like that Wesfarmers divested its Australian grocery business Coles and sold its home improvement business in the UK, making Bunnings its key growth business. Wesfarmers stated intention is to open 10 to 14 Bunnings stores per year into the foreseeable future and invest in upgrading its existing Bunnings properties, including those owned by the trust.

Rental income generally grows on a like-for-like basis a little over the Australian inflation rate as measured by the consumer price index, or CPI. Leases are typically for an initial period of 10 to 12 years, with multiple options to renew for a further five to six years. The lease terms provide for annual rental growth linked to CPI or for a fixed annual rate typically about 3%. They also provide for midlease market rent reviews, which usually have a cap-and-collar that limits the rent increase/decrease to 10%. Lease terms have been getting worse lately as Bunnings flexes its strong bargaining power over the trust.

BWP bulls say

- BWP’s core properties are key to Bunnings’ business, and provide the foundations for a defensive rental income stream that underpin growing distributions.

- Wesfarmers’ focus on its Bunnings business has the potential to lead to upgrades and acquisition opportunities which could foster further incremental rental income.

- BWP’s warehouse properties have low capital maintenance expenditures that allow the trust to maintain a high distribution payout ratio without the need to access capital markets.

BWP bears say

- BWP’s external management and fee structure may incentivize future management to acquire overvalued properties that destroy securityholder value.

- Bunnings continues to vacate some of BWP's older, smaller properties, resulting in higher vacancies and a drag on earnings.

- Higher interest rates also weigh on the distribution outlook.

Access this research and more at Morningstar. For a free four-week trial, click here.

All prices and analysis at December 12 2024. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.