Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

The compounding core: Five stocks growing into deep pools of opportunity

Adrian Ezquerro | Elvest Co

Buying and holding a group of businesses executing into deep pools of opportunity can do wonderful things for portfolio returns over time. Of course, this is often easier said than done. So in today’s wire, which is an excerpt from a recent client note written by Jonathan Wilson and I, we introduce five potential compounders worthy of investor attention.

Investors that have been with Elvest since its inception will probably be aware of our positive theses on Navigator Global Investments (NGI), RPMGlobal (RUL) and News Corporation (NWS). While these positions have performed solidly since their inclusion in the portfolio over two years ago, all stocks have drifted back by between 10-20% in recent months, for no substantive reasons.

We see this as all part of the normal ebb and flow of stocks, whereby prices over shorter periods may drift for little fundamental reason, despite the sound longer term trajectory remaining decisively intact. We re-introduce each company and provide an update on the respective theses below, before turning our attention to two dynamic companies taking on the US market (and winning).

Navigator Global Investments (NGI)

NGI is an ASX-listed asset management company exclusively focused on partnering with leading alternative asset managers globally. NGI has US$26b of total firm level assets under management (AUM), encompassing 11 partner firms and 199 products deploying over 42 alternative investments strategies.

Given the evolution in business model since 2021, the NGI of today is vastly different to the NGI of a few years ago. The group is on a reinvigorated growth trajectory, has a highly diversified earnings stream without any key person risk, and yet ostensibly remains completely off the radar for many investors.

Elvest’s variant perception encompasses two key factors. Firstly, most notably from 2022 to early 2024, NGI was perceived by the market as too complicated. Feedback from peers and analysts suggested the company was either not being looked at, or was swiftly being put in the ‘too hard’ basket, largely owing to substantial contingent considerations (longer dated liabilities) that were structured in a somewhat complex manner.

The sensible negotiation of an expedited settlement of the outstanding redemption payment owing to GP Strategic in late 2023 delivered several benefits. This principally included the simplification of NGI’s balance sheet and group structure, and means NGI now receives 100% of the distributions coming from the strategic portfolio (previously shared with GP Strategic).

Our research led to the formation of a decisively more positive view. In turn, this allowed the Fund to build a solid core position throughout 2022 and 2023.

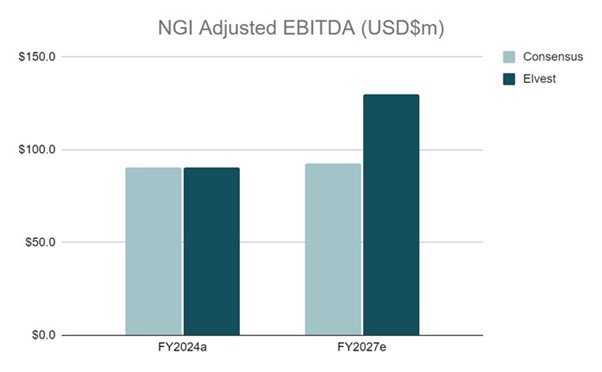

Secondly, and a particularly current variant perception, is that Elvest’s view of medium term (~3 year) earnings forecasts are far more constructive than consensus expectations. Elvest currently forecasts compound earnings growth of between 10-15% over the next three years (FY2024-FY2027), which compares to consensus at just 0.7%.

Figure 1: NGI Adjusted EBITDA (USD$m), Elvest vs Consensus, FY2024-FY2027e. Source: NGI, Elvest, S&P Capital IQ

Elvest’s more constructive view on medium term earnings growth is based on the following factors:

- Forecast 15%+ 3 year compound annual growth rate (CAGR) in NGI’s Strategic division, driven by a sound probable mix of organic and acquisitive growth

- Earnings delivered by ‘Private Market Partner’ firms, most notably Marble & Invictus, forecast to deliver growth in excess of current estimates

- Growth in the percentage of AUM generating performance fees ahead of consensus

- A higher probability of better than expected contributions from performance fees

In Elvest’s view, NGI is likely to deliver solid double digit compound earnings growth over the medium term, yet is not currently priced to deliver any growth at all. The stock currently presents as a compelling investment opportunity, trading on an attractive cash earnings yield of about 13%.

RPMGlobal (RUL)

RUL is a leading provider of mine planning and operations subscription software to global Tier 1 and 2 miners. RUL distinguishes itself by the breadth of its software suite. It also has clear dominance within the mobile equipment maintenance niche, which makes RUL highly relevant to all miners.

Over the past decade especially, RUL has transformed to now be a leading provider of software solutions to the global mining industry. Their software suite covers much of the mining operations from mine planning, shift management, haulage, and mobile asset maintenance, with a focus on above-ground mining operations.

As verified to us by third party mining software consultants, one of RUL’s key advantages is its breadth of offering, which enables the business to pursue a ‘land and expand’ strategy to good effect. The jewel in the crown, however, is the AMT mobile equipment maintenance software suite. Heavy machinery is the largest cost item for miners and AMT is essential for budgeting and maintenance. Most of the world’s yellow kit Original Equipment Manufacturers (OEMs) have adopted AMT, cementing RUL as the leader in this vertical. Consultants tell us that even SAP (ubiquitous ERP provider among miners) can't challenge AMT's lead in this vertical. So we see AMT as a strategically significant asset, which may soon also be the case for RUL's short term mine planning module, Xecute.

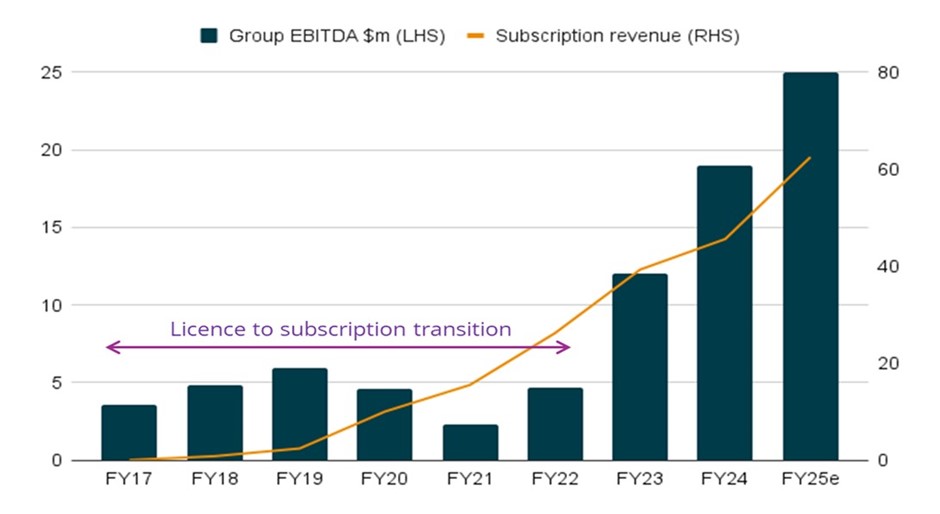

Flat earnings from FY17 to FY22 masked significant progress within the software division, reflecting a transition from upfront licence sales to software subscriptions, which meant contracted software revenues were spread over several years rather than received upfront. With this transition recently completed, earnings strongly inflected from FY23. In our view, the transition from upfront licences to subscriptions masked underlying software sales performance, ultimately providing the opportunity. Additionally, RUL has consistently maintained a net cash balance sheet (current net cash $34m), even while employing an aggressive buyback in more recent times.

The business added ~$10m of annual subscription revenues in each of the last 3 financial years, and with the sales model transition complete, we're seeing this incremental topline growth fall strongly to the bottom line. The picture below illustrates this dynamic. Note RUL expenses all software development; as such, EBITDA is a good proxy for pre-tax earnings.

Figure 2: RUL Group EBITDA and Subscription revenue, FY2017-FY2025e. Source: RUL, Elvest.

Figure 2: RUL Group EBITDA and Subscription revenue, FY2017-FY2025e. Source: RUL, Elvest.

In terms of market penetration, management indicates RUL has a long runway among Tier 1 miners, with growth accelerated by relatively recent Global Framework Agreements with Rio Tinto, Glencore, Anglo, Mineral Resources and BHP (for certain products). These agreements enable quick procurement of RUL's modules across the enterprise. Total recurring revenue of $58m still only represents approximately 6% of the $1 billion+ estimated addressable market.

Looking ahead, whilst prospective returns are lower than in previous years, we believe the stock remains attractive. On our estimates RUL trades on a free cash flow yield of approximately 4% (excluding net cash of $34m). In our view this represents a sound yield for a business that can compound earnings at strong double digit rates for several years.

We also note a bout of corporate activity in the mining software space in recent years. Most relevant to RUL was Sandvik’s 2021 $720m acquisition of Australian underground mining software specialist, Deswik, for ~20 times recurring revenue. We acknowledge its an aggressive benchmark, however on the same basis RUL could attract some interest at a significant premium to current prices.

News Corporation (NWS)

Complicated Murdoch family machinations and the challenges facing traditional news media appear to be obscuring the value hidden deeper within the NWS structure.

While the more casual observer tends to associate NWS with traditional news media, the company today actually encompasses five business units: Digital Real Estate, Dow Jones, Book Publishing, Subscription Video, and News Media.

NWS has been held since Fund inception, though has recently been upweighted to again become a top five holding. Many have been sensibly asking, why is this so?

It's an interesting question in that its valuation today is largely driven by divisions outside its news media heritage. The jewel in the crown is its 61.4% shareholding in REA Group (ASX: REA), which we view as one of Australia's best listed companies. REA is a dominant business, with 4x more visits than its nearest competitor. If you’re selling a house in Australia, and increasingly in India, you need to be advertising with REA. Commanding market share is reflected in immense pricing power, profitability and margins - most of the benefits of which flow through to NWS shareholders.

NWS has another fantastic business unit in Dow Jones, which includes the Wall Street Journal, Barron's, MarketWatch and a strongly performing Risk and Compliance division. The news and information part of this division has been rapidly digitising, so that most of its revenue now comes from recurring subscriptions. Further, its high quality content is only now just beginning to be leveraged by leading AI innovators, as evidenced by NWS' purported US$250m 5 year deal recently inked with OpenAI. We think this division is especially undervalued sitting within the NWS structure.

The closest peer for the Dow Jones business unit would be the New York Times Company (NYSE: NYT), which currently trades on an EV/EBITDA of 16.8x, and a market cap of US$8.8b. Dow Jones actually makes more money at slightly better margins, but perhaps conservatively, we think its true market value is somewhat comparable to NYT.

The balance of the NWS business comprises Book Publishing, Subscription Video and News Media. While these contribute solidly, when valued at between 3-5x EBITDA in aggregate, they are far less meaningful to the sum of the parts (SOTP) valuation. We present this below.

Figure 3: NWS sum-of-the-parts valuation. Source: Elvest, S&P Capital IQ.

As highlighted above, our SOTP valuation range is about $55 to $60 per share. In NWS, we see a collection of market leading businesses with pricing power and sound prospects trading at a healthy discount to fair value.

Life360 (360)

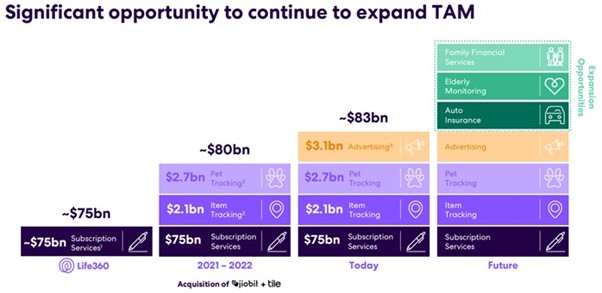

360 is a leading technology platform connecting tens of millions of people throughout the world to the people, pets and things they care about most. 360’s core offering, the Life360 mobile application, includes features like communications, driving safety, digital safety, and location sharing. The Life360 mobile application operates under a “freemium” model where its core family tracking offering is available to members at no charge, with three paid membership subscription options that are available (but not required).

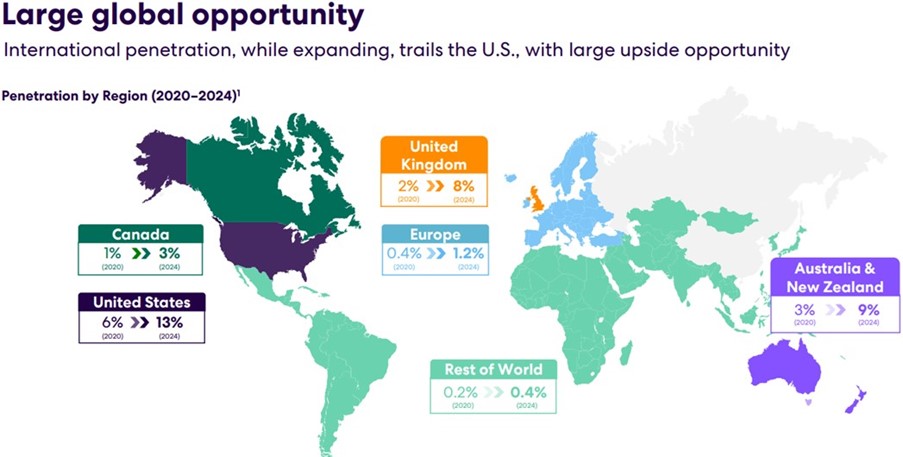

The company currently has over 70m monthly active users (MAUs), including over 2m paying subscribers, encompassing 40m users in the US and 30m internationally.

The platform is immensely scalable; 360’s user base has compounded at 32% since 2018, with 48% year on year growth in the international division highlighting the accelerating traction being achieved in markets like Canada, the UK and Australia.

Figure 4: 360's global opportunity. Source: Q2FY2024 Results Presentation.

Figure 4: 360's global opportunity. Source: Q2FY2024 Results Presentation.

With its highly engaged user base likely to eclipse 100m users in the near future, new monetisation opportunities are opening up. A globally recognised brand focused on location based safety and connection is especially appealing for advertisers, which represents the next substantial leg of opportunity in 360’s development. Of relevance here is Uber’s advertising launch success, a globally renowned brand with 140m MAUs. Within the space of four years, Uber’s advertising revenue went from year one revenue of US$11m to US$900m in year four. With 360 management determined to take its time to ensure sound execution, it's still early days, but it's clear the opportunity for monetising its free user base is an attractive one.

Figure 5: 360 TAM (USD). Source: Q2FY2024 Results Presentation.

As highlighted above, beyond subscriptions and advertising, several other verticals have been flagged as potential growth avenues. Elderly monitoring is a frequent request across 360’s user base, and, if implemented, would round out the application’s attraction for all age cohorts.

Having recently become dual listed on both the Nasdaq and the ASX, management is now driving towards a stated medium term target of 360’s ‘first’ US$1.0bn of revenue at 25%+ margins. Given the company has only recently inflected to strong cash flow positivity on guided CY24 revenue of ~US$375m, expected incremental margins are implied to be at least 35% (we think this could ultimately be much higher). Absent any acquisitive activity, this will also see the company’s A$240m net cash balance grow swiftly.

While technological and competitive risks bear monitoring in the coming years, we see potential upside to management’s revenue and margin targets and are excited about 360’s expanding global market opportunity.

ZIP Co (ZIP)

ZIP is a Buy Now Pay Later (BNPL) company with a well established Australian division and rapidly growing operations in the US.

Founded in 2013 by Larry Diamond, ZIP was a fintech pioneer in Australia, and spent its early years building a brand in its home market. In 2018 the company went on a global buying spree, spurred on by the BNPL revolution that kicked off in Australia and quickly spread globally. By 2021 the company had a presence in Europe, UK, Middle East, South East Asia, and the US.

This proved a highly risky strategy, as most of its acquisitions required heavy investment to achieve profitable scale. It didn’t take long for it all to unravel. In 2022 ZIP posted a $1.1bn loss, while shares fell from a $12.35 high in 2021 to a low of $0.26 in 2023.

In August 2023, ZIP refreshed its management team with one led by new CEO Cynthia Scott, whose background in investment banking and capital markets has been instrumental in rapidly turning the business around in just 12 months.

Having swiftly exited all loss making operations, ZIP is now solely focused on profitable operations in Australia, New Zealand and the US. The company also extinguished all remaining corporate debt facilities in July of this year, via a $267m equity raise. The company now has a clean balance sheet, with zero bank debt outside of its receivables funding facilities linked to BNPL products.

So what has gets us excited about ZIP going forward?

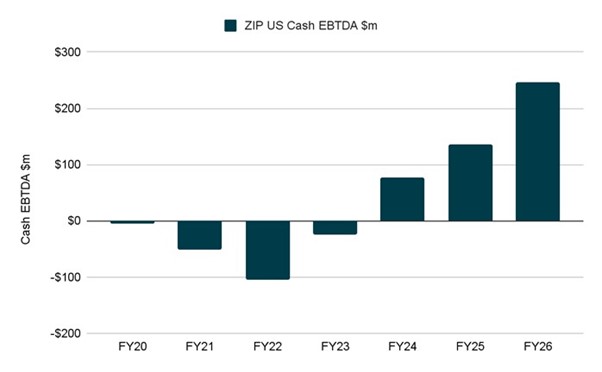

FY24 saw a strong financial turnaround for ZIP’s continuing operations with revenue growth (+28%) and cost discipline driving operating earnings from a $48m loss in FY23 to a $69m profit in FY24. Most of the turnaround can be attributed to the US operation, which transitioned from a $32m divisional loss to a $69m profit.

The US opportunity remains highly prospective for ZIP, despite strong competition from larger BNPL players including Afterpay (now a subsidiary of Block Inc), Affirm, and Klarna. As we have seen in Australia and the UK, where BNPL accounts for 15% and 20% of all transactions, respectively, BNPL growth comes largely at the expense of credit cards, which are fast becoming a legacy product for some consumers.

In the US, where the BNPL sector is growing at 30% per annum, BNPL has only 2% share, providing plenty of room for the “big 3” and ZIP to grow. Indeed, ZIP is currently outpacing the sector, delivering 38% revenue growth in FY24. These trends, when coupled with a broader opportunity set, also help inform a similarly positive view on Block Inc (SQ2).

We think the trend will continue, based on both ZIP’s partnership strategy and the early stage of BNPL in the US. This year, ZIP integrated with global payments giants Stripe and Adyen to provide Zip as a payment option at check out. It is also in pilot in the US with Google Pay, and there's some potential that Apple Pay may soon follow.

These partnerships effectively enable Zip to distribute their products across merchants and consumers in the US at low cost, setting the company up to deliver revenue growth while improving incremental margins.

Management expects to achieve above sector growth of 30% per annum over the medium term, while operating costs are forecast to rise only 6-10%, suggesting powerful earnings growth in coming periods.

Based on its 2-year outlook, we believe the company could deliver earnings close to $200m, which is very attractive against its current market cap of about $3bn.

Figure 6: ZIP US Division Revenue and Earnings, FY2020-FY2026e. Source: Elvest, ZIP FY24 Annual Results Presentation.

---

Disclosure: Adrian and Jonathan are exclusively invested in The Elvest Fund. Elvest may hold shares in any/all stocks mentioned above.

*This report contains some forward-looking statements which reflect the expectations of Elvest Co Pty Limited about the future prospects of companies held within the portfolios managed by Elvest. While considering its expectations to be based on reasonable grounds, there is no guarantee that those expectations will be met. These statements should therefore not be relied upon as an accurate representation or prediction as to any future matters.

All prices and analysis at 27 September 2024. This document was originally published in Livewire on 27 September 2024. This information has been prepared by Elvest Co Pty Limited (ABN 65 657 018 614), AFSL Number 547 262. The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.