With low expectations priced in, this ASX company could surprise on the upside

Sudhir Kissun | Allan Gray

As contrarian investors, we tend to shy away from popular and exciting stocks. By investing in companies that are out of favour, and therefore showing potential for better than average returns, we are often attracted to companies that might be described as downright boring.

There are not many industries more boring than packaging and the subject for this Quarterly Commentary is Orora Limited, a manufacturer and distributor in this industry. Orora has fallen out of favour with the market, but, as is often the case with out-of-favour companies, we believe the market has overreacted and there are reasons to be optimistic.

Orora Limited - Boring is beautiful

Orora (ASX: ORA) was formed in 2013 after its demerger from global packaging giant Amcor (ASX: AMC). Orora reports three segments, as follows:

Australasia – a manufacturer of aluminium cans and glass bottles. Its asset base comprises six manufacturing plants producing aluminium cans across major urban centres (the first of which was commissioned in 1974) and three glass furnaces, built between 2002 and 2010 and all located at Gawler in the heart of the Barossa Valley wine region. The Australasian businesses have a long history of market leadership, organic volume growth and solid financial performance.

North America – a business that distributes mainly paper-based packaging and designs point-of-sale displays.

Saverglass – a manufacturer of high-end decorated bottles for premium spirits and wine that Orora acquired in December 2023. Saverglass established its first furnace in France in 1969 and added two more furnaces over time, as well as furnaces in the United Arab Emirates, Mexico, and Belgium.

Figure 1 shows Orora’s main product categories within its three business segments.

Figure 1 - Orora’s business segments and products

Source: Orora, Allan Gray, 24 June 2024

Saverglass has given the market some indigestion

The long-term track record of acquisition activity is unequivocal – more often than not, acquisitions tend to destroy value for the shareholders of the acquiring company and large acquisitions have a worse track record than small, bolt-on acquisitions. When a private equity firm is a seller, buyers need to be particularly wary, as private equity firms are notorious for dressing up the businesses they are selling to make them look better than they are.

With this knowledge, it’s easy to see why the investment community took a particularly dim view of Orora’s acquisition of Saverglass. First, Orora acquired Saverglass from a private equity firm. Second, this was a huge acquisition for Orora and its size alone has completely changed what shareholders thought they owned before the acquisition. The acquisition price of $2.2 billion represented a whopping 60% of Orora’s pre-deal enterprise value. Market participants are also worried about Saverglass’s exposure to France, a challenging labour market in which Orora has precisely zero experience.

Saverglass’s operating environment also gives cause for concern. The two years leading up to the company’s acquisition were characterised by exuberant consumer spending in the premium spirits and wines categories globally, which lulled the distributors and retailers into overstocking these products. It is therefore likely that Orora bought Saverglass at the peak of its earnings cycle. This fear was confirmed in April 2024 when Orora downgraded its earnings guidance, with the bulk of the downgrade relating to Saverglass. The downgrade was triggered by the realisation that distributors and retailers were holding far more inventory than Saverglass expected, and the destocking process was likely to persist for a while.

The destocking trend is not unique to Orora. Many consumer facing companies globally have been grappling with this challenge. The Allan Gray Australia Equity strategy holds other companies, such as Ansell and Amcor, whose share prices have been punished (unfairly, in our view) due to uncertainties about destocking, which we believe to be a cyclical impost rather than a structural one.

Added to this operating leverage is a fair chunk of financial leverage that Orora has introduced into the business, with $0.9 billion of the $2.2 billion acquisition price being funded with debt.

There are also concerns over future capital requirements. Glassmaking is an energy-intensive process, and most of that energy is currently sourced from natural gas. Over time, this sector will need to decarbonise and that will require investment which might not yield an adequate return.

As if all this wasn’t enough, there is also the looming prospect of China imposing tariffs on imports of European brandy. While this would only impact 3% of Saverglass’s volumes, the market is worried that the tariffs could extend to other products in future.

We share these concerns, but much of the bad news is already in the share price

While it can be tempting to focus on the negatives as a justifiable reason to avoid investing in a company, we believe it’s important to weigh these negatives against the price we pay for the stock. Our decision to invest (or not) isn’t predicated on how bad the news is but on how much is already encapsulated in the market’s expectations and, therefore, reflected in the share price.

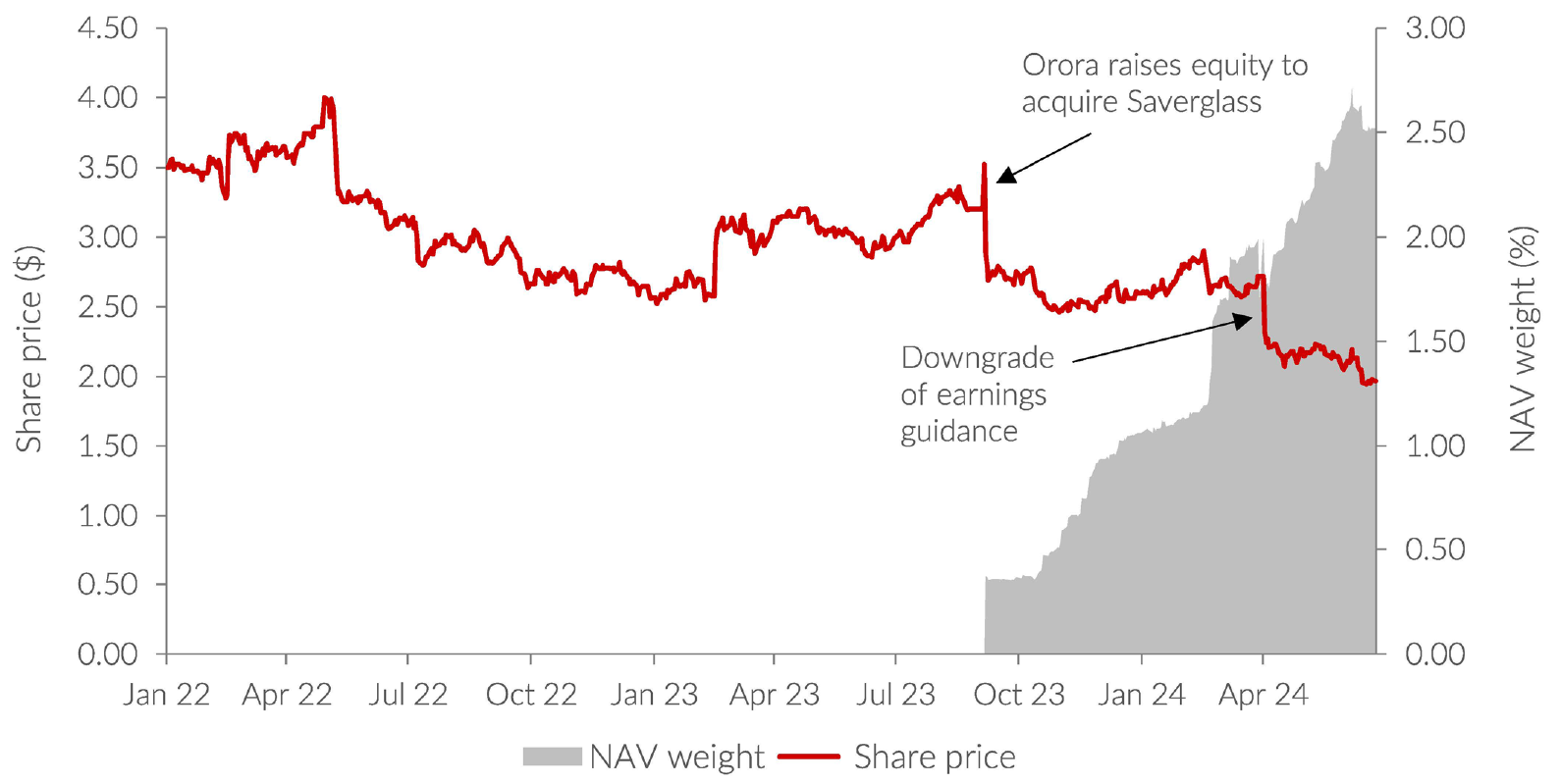

Graph 1 shows Orora’s share price and the Allan Gray Australia Equity Fund’s holding in the company. Today, Orora’s share price is 43% below the price it traded at before the Saverglass acquisition and 27% below the price at which it raised equity to pay for Saverglass. To us, it is clear that at least some of the negatives we’ve detailed above are already captured in the share price.

Graph 1 - Orora's share price and the Allan Gray Australia Equity Fund's holding

Source: FactSet, Allan Gray, as at 24 June 2024. The Allan Gray Australia Equity Fund is generally representative of the Equity Strategy portfolio, which includes institutional mandates that use the same strategy.

The multiple we pay looks attractive

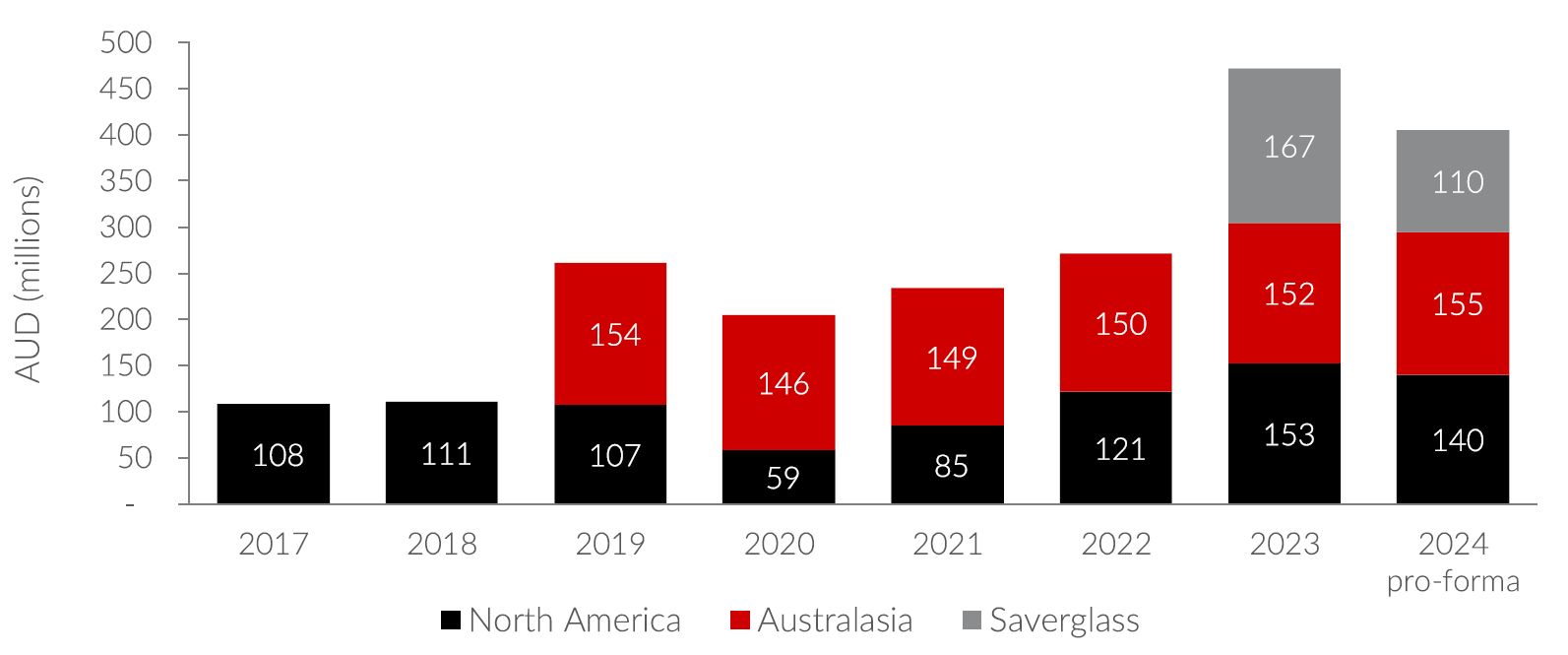

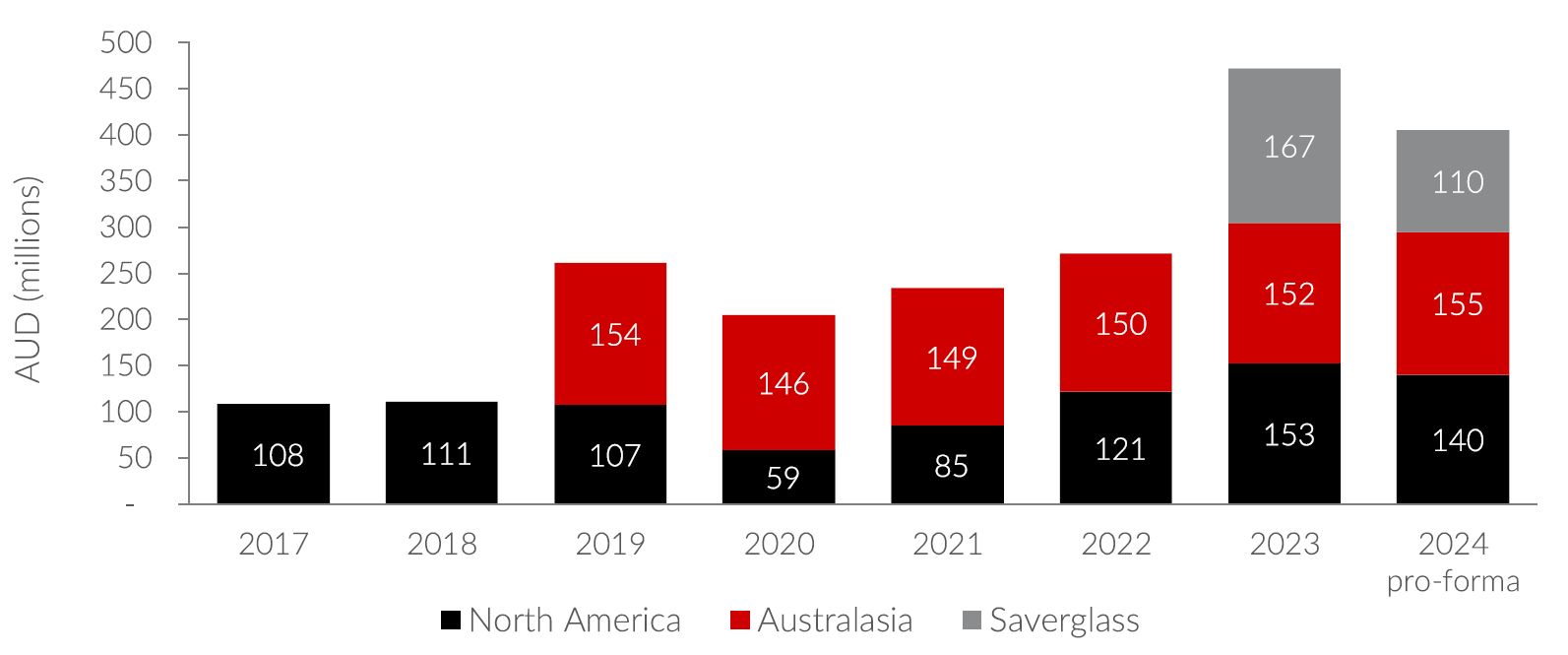

Graph 2 shows Orora’s historical earnings before interest and taxes (EBIT) by business segment and our pro-forma estimates for the 2024 financial year (FY24) based on Orora’s management’s guidance.

We estimate pro-forma EBIT of $405 million for FY24. After servicing its net debt of $1.7 billion and paying its taxes, Orora’s post-tax earnings should be approximately $200 million. With a current market capitalisation of $2.6 billion, Orora trades at approximately 13 times these earnings, meaningfully lower than the market’s price to earnings ratio of 17 times. We expect Orora’s organic earnings growth to be in line with the average earnings growth of the market and think it should trade at a similar multiple to the market.

In a downside scenario, if Saverglass earnings were assumed to be zero, then Orora would be trading at 22 times current earnings, which is not an outlandish multiple for what would be quite a pessimistic outcome. For these reasons, despite the abovementioned uncertainties, we believe we are buying Orora with a reasonable margin of safety.

Graph 2: Orora’s historical and guided EBIT by segment

Source: Orora, Allan Gray estimates, based on Orora’s most recent guidance from April 2024. Note: Saverglass’s EBIT for FY24 is the annualisation of management’s guidance for the last five months of FY24; Australasia EBIT before FY19 is not comparable because it includes the EBIT from its now disposed Fibre business, so we have omitted it.

There are other reasons to be optimistic

There are two reasons why our pro-forma earnings above might be too low. Firstly, we believe it’s reasonable to expect the ongoing destocking of spirits and wine to abate at some point in the near future. This should enable Saverglass to return to growth in volumes and earnings. With Saverglass operating at 75% of practical capacity, there is room to grow volumes significantly without investing further. This should result in significant operating leverage.

Secondly, Orora has invested heavily in new aluminium cans capacity which is underwritten by firm offtake from key customers. This will require a little over $100 million of incremental capital to reach completion within the next year and is likely to progressively ramp up to an incremental EBIT contribution of $30 million per annum by FY28.

Another reason we are optimistic is that we believe that Orora is being valued at a significant discount to the replacement cost of its fixed assets. If we assume that the asset-light North American business should be valued using Orora’s current depressed earnings multiple, then the implied value for the rest of the business is a 20% discount to the replacement cost of its fixed assets. This strikes us as rather pessimistic.

We believe the upside in Orora outweighs the downside

Investing always carries uncertainty; inherent in every investment are many possible future outcomes, some favourable, others not. Investing should therefore involve assessing the probabilities and allocating capital to investment opportunities in which the probability and magnitude of the favourable outcomes outweigh those of the unfavourable outcomes. Orora comes with its fair share of undesirable attributes. But at the price we pay today, we can buy Orora at 11 times our estimate of normal post-tax earnings. With low expectations priced in, it looks to us like the upside outweighs the downside at this point.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 9 July 2024. This document was originally published in Livewire Markets on 9 July 2024. This information has been prepared by Allan Gray Australia Pty Limited ABN 48 112 316 168, AFSL No. 298487.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.