Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Why we’re still bullish on the ASX (and 2 stocks we’ve been buying)

Michael Carmody | Centennial Asset Management

The Australian equity market (All Ordinaries Accumulation Index) has delivered an 18% rally since late October 2023. As a result, the market is currently trading close to all-time highs. Investors always get worried when markets hit all-time highs, but at Centennial Asset Management, we can see a universe of attractive investment opportunities.

We believe the investment outlook remains positive and expect the market to continue rallying over the next 12-24 months. Notwithstanding the recent rally, we are staying long this market and see the best opportunities outside the Top 50 stocks.

Should you invest when markets are at all-time highs?

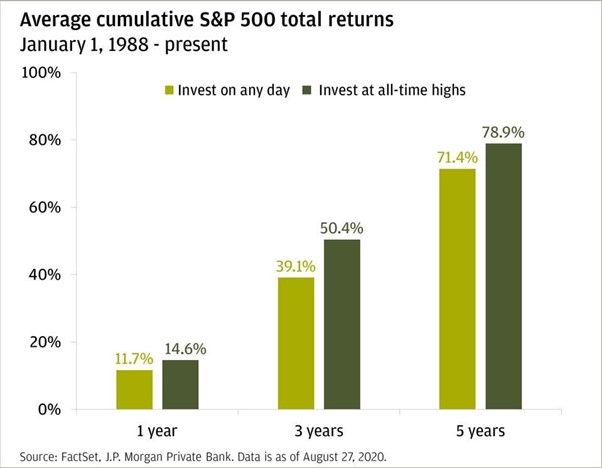

Historical US data supports a strategy of investing cash when the market is high. Specifically, investing cash when the market is high is unlikely to produce lower returns.

According to J.P. Morgan, investing on days when the S&P 500 closed at a new all-time high can actually produce better returns than investing on a day when the market didn't set a new record.

We argue that focusing on interest rates, company valuations, and earnings growth is more important than concentrating on the index level.

The market at an all-time high is a sign that investors have confidence in the future and the direction of the economy.

Without new all-time highs, markets cannot rally. While there are always arguments on both sides, it is important to recall that markets go up in the long term. Since 1900, the Australian market has delivered a positive yearly return 81% of the time and returned an average of 13.2% per annum.

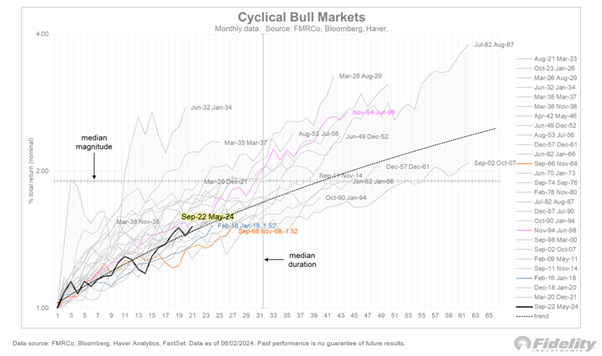

What does history tell us - The Bull market is likely to continue

A recent publication from Fidelity Investments (Jurrien Timmer) suggests the US secular bull market is set to continue. He specifically notes, “The current bull market cycle is now 20 months old and produced a 53% gain (from the October 2022 low to the most recent high). By historical standards, there seems to be plenty of life left for this bull, given the median 30 months and 90% gains that have been produced over the past 100 years or so.”

Focus on the future – not today's newspaper & TV headlines

Don’t be surprised to see ongoing negative TV and newspaper headlines regarding the economic slowdown associated with the elevated interest rates and prices. However, it is important to remember that markets are forward pricing instruments, and today's headlines have largely been priced 9-12 months ago.

Higher prices and “cost of living” pressures are impacting local consumer demand. Recent management commentary from JB Hi-Fi, Endeavour, Coles, Wesfarmers, Nine Entertainment, Baby Bunting and Bapcor confirm that demand is slowing. Price discounting and inventory management are contributing to a difficult trading environment.

Some bad news on the economic front is actually good news for equity investors and the case for lower interest rates.

The case for a further increase in interest rates now appears to be weak. We believe the next move is likely to be lower towards the end of 2024.

In the US, Fundstrat’s equity strategist Tom Lee expects, “inflation to fall dramatically through the rest of the year. He points to the recent CPI index as being a lag indicator, with real-time prices in the US economy starting to ease. He has recommended investors buy stocks as inflation is bound for a steep decline for the rest of 2024.

Corporate activity & investor confidence is growing

Increased Investor confidence is delivering a lift in market corporate activity compared to a year ago.

NextDC (NXT) announced a capital raising of $1.3B to fund future data centre development and Ansell (ANN) raised new capital ($400M) to fund the acquisition of Kimberly-Clark’s Personal Protective Equipment business. BHP unsuccessfully bid for Anglo-American. The proposed transaction was valued at approximately $60.0B.

In addition, small company retailer Nick Scali (NCK) announced a capital raising to fund the acquisition Anglia Home Furnishings (Fabb Furniture) in the UK. Macmahon Holding (MAH) announced a scheme implementation deed to acquire 100% of Decmil (DCG) for cash. Macquarie Technology (MAQ) raised $100M of fresh capital to acquire additional land and buildings at its existing data centre campus.

Another example is the recently announced acquisition of PSC Insurance Group (PSI) entered a Scheme Implementation Deed with The Ardonagh Group. While shareholder and court approval is required, the transaction delivered shareholders a 32.7 per cent premium to the three-month volume-weighted average share price (VWAP).

Two Investments we like...

GENERATION DEVELOPMENT GROUP (ASX: GDG)

Source: Market Index

Generation Development Group (GDG) is a specialist provider of tax effective investment bond product solutions and services. The company has a well-established track record for delivering consistent FUM growth (+25 per cent 3-year CAGR). The latest quarter (March 2024) delivered an increase in FUM of +29 per cent compared to the pcp.

GDG recently announced an equity raising to fund the acquisition of the remaining equity in asset research consultant and data provider, Lonsec, they do not already own. The decision to consolidate the Lonsec business will enhance the division’s growth aspirations and value. We expect the acquisition to be earnings and valuation accretive.

The stock remains a core holding in the Centennial Level 18 Fund portfolio. The management team has historically exceeded market expectations. As a result, the stock trades at a premium to the market and we expect ongoing above-market earnings growth. We all know that past performance is no guarantee for the future but we can see many reasons to stay long the stock at this point in the cycle.

GQG PARTNERS INC (ASX: GQG)

Source: Market Index

GQG recently concluded the acquisition of the minority interests in Avante Capital Partners, Proterra Investment Partners and Cordillera Investment Partners. These assets represent the foundation investments for the company’s recently launched GQG Private Capital Solutions division.

In addition, at the company’s recent AGM presentation, management confirmed strong investment returns and FUM inflows for the group. The company has robust momentum into the remainder of 2024. We expect GQG’s strong investment performance is likely to deliver ongoing FUM growth. Compared to the outlook and the market, we see the company as being inexpensive and expect the aligned management team to deliver share price outperform in the current environment.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 11 June 2024. This document was originally published in Livewire Markets on 11 June 2024. This information has been prepared by Centennial Asset Management (ABN 38 605 827 745)(AFSL 515 887). The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.