Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Who gets the gold stars this bank reporting season?

Hugh Dive | Atlas Funds Management

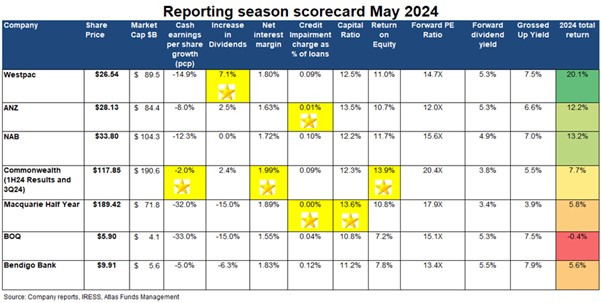

The May 2024 bank reporting season was the mildest and most boring in the past decade, with the major banks all reporting solid results, large share buybacks and very low bad debts. The major banks continue to show their resilience in the face of challenges such as the 2018 Royal Commission into Financial Services, Covid-19 lockdowns, system issues in 2021 from expected zero or negative interest rates, and the ‘fixed-interest rate cliff’ from late 2022 that was forecasted to put the country into a recession as discretionary spending collapsed, defaults spiked, and house prices plummeted.

In this piece, we look at the major themes that have played out over the May 2024 bank reporting season, including Commonwealth Bank's 2024 half-year results from February, and the regional banks, awarding gold stars based on their performance over the last six months.

Net interest margins trending down

Net interest margins are always a major topic during any of the banks' reporting season, with most investors going straight to the slide on margin movements in the Investor Discussion Packs. Banks earn a net interest margin [(Interest Received - Interest Paid) divided by Average Invested Assets] by lending out funds at a higher rate than borrowing these funds either from depositors or on the wholesale money markets. Generally, bank net interest margins have recovered from the lows seen in 2022, as when the prevailing cash rate is 5%, it is much easier for a bank to maintain a profit margin of 2% than when the cash rate is 0.1%.

Small changes in the net interest margin significantly impact bank profitability due to the size of a bank's loan book (which ranges from $700 billion to $1.1 trillion) and guide future profitability. Going into this reporting season, many in the market expected a significant fall in the banks' net interest margins due to stronger competition within the mortgage market and increased deposit funding costs. May 2024 saw some downward pressure on interest margins, but less than expected, with management teams reporting a moderation of mortgage competition. Commonwealth Bank again wins the gold star in 2024 with the highest net interest margin.

What fixed interest rate cliff?

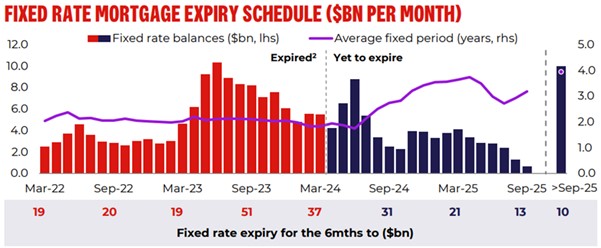

During the COVID-19 pandemic, Australian interest rates fell to record lows as the RBA established the Term Funding Facility (TFF) to offer low-cost three-year funding to banks. Between March 2020 and when the TFF closed in June 2021, Australian banks borrowed $188 billion at rates between 0.1% and 0.25%, which was then lent as fixed-rate mortgages in 2020 and 2021 at mortgage rates between 1.75% and 2.25% to around 800,000 borrowers. These low-rate mortgages began expiring in mid-2023, converting to variable loans around 5.5%.

With every cash rate hike, the questions became louder about the negative impact of this fixed rate cliff on retail sales, bank bad debts and house prices, with market experts predicting 2023 and 2024 to be very poor years for the banks and retail sales, as borrowers were unable to afford the higher mortgage payments.

However, in mid-2024, the economy has proven more resilient than expected, and unemployment remains close to all-time lows. Borrowers and the banks have managed this transition to higher rates far better than was expected, building up savings buffers. Indeed, despite increased financial pressures, RBA data shows that less than 1% of home loans are in 90-day arrears, a figure that is lower than before the pandemic - RBA Financial Stability Review.

Source: Westpac

Bad debts remain very low

Bad debts have remained low in 2024, with all the banks reporting extremely low loan losses. Macquarie Bank reported the lowest bad debts of 0.00%, with ANZ not far behind with 0.01% loan losses. The level of loan losses is important for investors as high loan losses reduce profits and erodes a bank's capital base. This reporting season has translated low bad debts into increased share buybacks and dividends.

Atlas see that the low level of bad debts is a combination of the bank's managing loan book, stronger than expected economic conditions and more conservative lending than we saw from the banks 2000-07. We believe that the loans to developers, property syndicates and troubled industrial companies that went bad in 2008-2010 now sit with non-bank lenders and private debt funds rather than the big four banks.

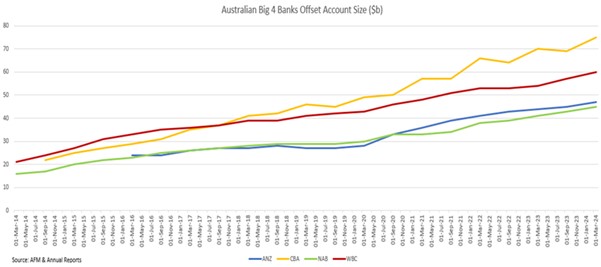

Offset accounts benefit everyone

With the narrative of the 'higher rates for longer' slogan slowly becoming the new normal, May 2024 saw a continuation of the trend of rising mortgage offset account balances. This has been a surprise as we would have expected that the fixed rate cliff would have seen offset account balances fall, not rise. Indeed, over the past six months, offset account balances increased by $13 billion to $227 billion.

Rising offset account balances means that banks are forgoing some interest income in exchange for more secure and resilient clients with lower bad debts. We continue to be very surprised by the growth in offset accounts despite rising interest rates, with offset account balances now 59% larger across the Big Four banks than they were pre-pandemic.

Dividends growing

A feature of the May 2024 banks reporting season was solid dividend growth, with ANZ, CBA, and Westpac increasing their dividends and NAB holding their dividend flat. In the first half of 2024, the big four banks generated $15.6 billion and will return $11 billion to shareholders through dividends or a 71% payout of profits generated throughout the half. Higher dividends reflect the combination of low write-offs from bad debts, minimal new investments (outside ANZ) and high capital levels.

The winner of the star was Westpac, with a dividend increase of 7% or 29% if a special dividend is included. In 2024, all major banks (including Macquarie) will be paying a dividend per share higher than in 2019.

Buybacks support share prices

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential for loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA), has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks, as has been done in the USA and UK.

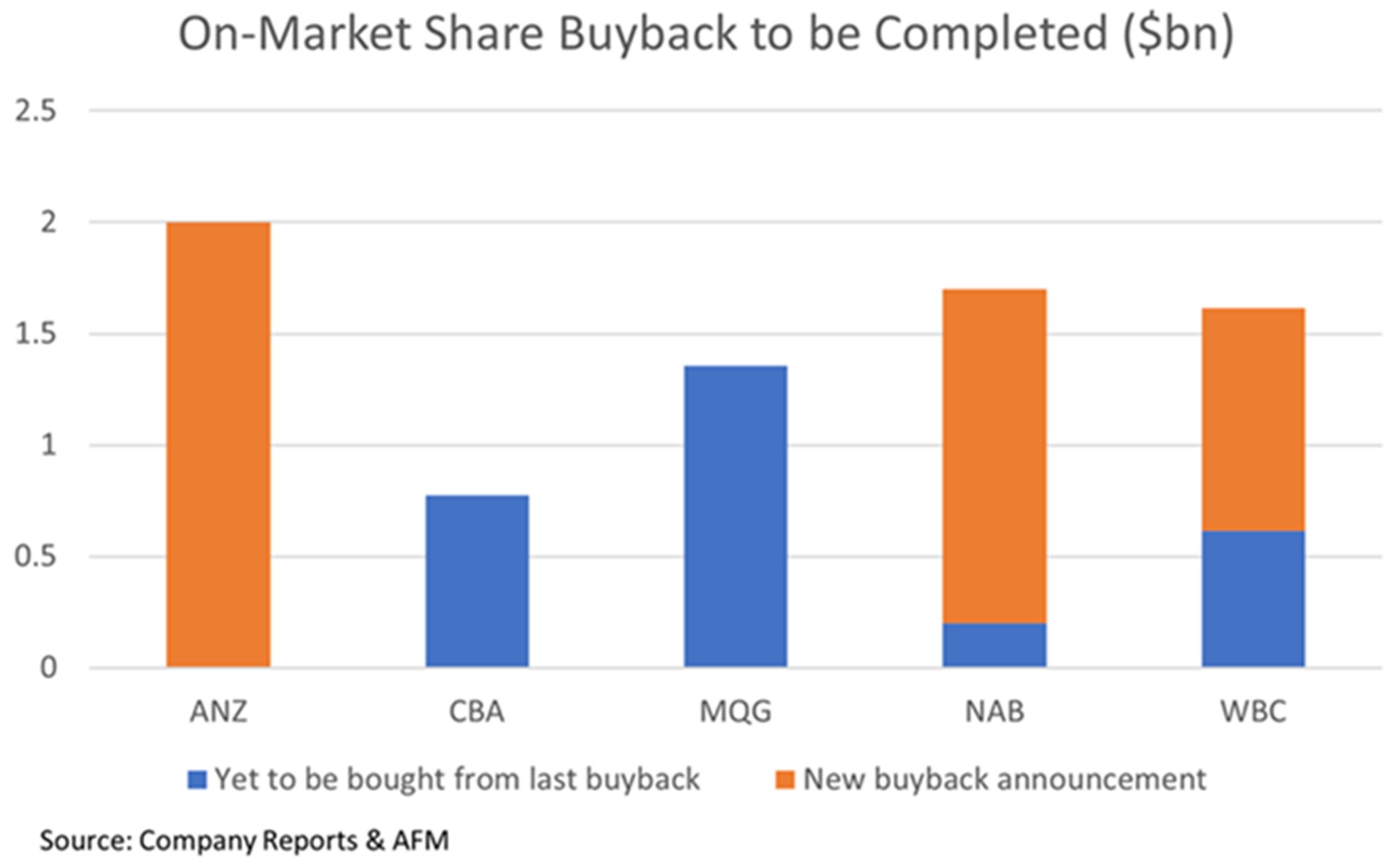

In 2024, the Australian banks are all extremely well capitalised, so much so that ANZ, NAB, and Westpac announced on-market share buyback extensions to return capital to shareholders. During the bank reporting season, NAB announced a $1.5 billion share buyback extension on top of their 200 million remaining from their previous buyback, Westpac announced a $1 billion extension on top of their $600 million remaining from their previous buyback, ANZ announced a new $2 billion share buyback and Macquarie announcing they still have $1.35 billion to buy back from their $2 billion buyback announced in November. For investors, this not only supports the share price in the coming months but reduces the amount of outstanding shares to divide next year's profits.

In addition to buying back shares to reduce capital, all the big banks, including Macquarie, have neutralised their dividend reinvestment plan (DRP), which allows shareholders to take their dividends in additional shares rather than cash. Neutralising the DRP sees the bank buyback shares on-market equivalent to the new shares issued to shareholders. In May 2024, Atlas estimates that this will see additional net purchases of around $900 million in shares from ANZ, NAB, Westpac and Macquarie.

While buying back shares on the market and then cancelling them is positive for shareholders as it reduces the divisor on future bank profits, bank management teams are awarded bonuses based on their return on equity (ROE). Obviously, buying back shares reduces the equity, thus boosting ROE.

The Vampire Kangaroo – Macquarie

Although Macquarie group profits and dividends were down, their banking and financial services business has been performing well, with their loan book and deposits increasing by 10% to $140 billion and $143 billion, respectively. Macquarie continues to take market share off the big banks but has not given up margins for growth, with Macquarie having the second highest net interest margin of 1.89%, only behind that of CBA with 1.99%. Only three years ago, the sell-side analysts were questioning Macquarie management on why they would want to be involved in this kind of business!

Outside of the bank, it was a more normal year for Macquarie, with the realisation of green energy assets and energy volatility remaining lower than previous years, leading to group profits being -29% lower than last year. But outside of this, Macquarie Capital profits were up 31%, driven primarily by a rotation of capital into their fixed income offering, alongside asset management growing their assets under management to a record high of $938 billion, providing stable base fees over the longer term.

Regional banks

In Australia, the big four banks dominate with a combined market share of 73%, soon to be 75%, once ANZ's acquisition of Suncorp Bank is complete. The closest to breaking into the market is Macquarie, with close to 5% of the market share, followed by the two regional lenders of Bank of Queensland and Bendigo Bank, with a 2% market share each.

As we have seen in the bank matrix at the top, the regional banks did not win a star across any of the segments, with decreased interest income and increases in operating expenses eating away at profit margins. The regional banks continue to see growth hard to come by as they have a higher cost of capital than the major banks. Here, wholesale funders require higher coupons on their bonds to offset their higher risks. Additionally, the regional banks have limited access to the large pools of corporate transaction account balances that have historically paid minimal interest rates. To be competitive against the lending products from the major banks, the regional banks need to accept a lower net interest margin across their loan book, leading to lower returns on equity for investors. Indeed in 2024 the return on equity earned by BoQ and Bendigo Bank of 7% is well below their cost of capital of 10%!

Our take

Overall, we are happy with the financial results from the banks. Our three main overweight positions, ANZ and Westpac, increased their dividends, and Macquarie Bank showed a 49% increase in net profits in the second half, which also guided to increased profits in FY25. All three announced significant on-market share buybacks, which will support share prices.

All banks showed solid net interest margins, low bad debts, and good cost control. Profit growth is likely to be tough to find on the ASX over the next few years, with earnings for resources and consumer discretionary likely to retreat; however, Australia's major banks continue to positively surprise the market with how they have been able to navigate turbulent market conditions. In 2024, the banks will all have cleaner loan books, minimal offshore distractions, and a greater margin of safety than they have had in the past.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.

All prices and analysis at 15 May 2024. This document was originally published on firstlinks.com.au on 15 May 2024. This information has been prepared by Atlas Funds Management (AFSL 491395)( ABN 83 612 499 528)

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.