Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Three quality stocks doing more with less

Anthony Golowenko | MLC Asset Management

A lot has been written about blows to living standards on the heels of the sharp rise in interest rates and inflation over the past few years. The Reserve Bank of Australia has termed what many Australians are enduring as a “painful squeeze.”(1)

Adapting has meant cutting back on things once taken for granted, to stretch pay-packets.

Few, if any, can escape the clutches of inflation and interest rates, including corporate Australia.

Businesses are grappling with higher labour, energy, and transport costs. Like households, they too are being impacted by rising rents and interest payments.

So, how are the country’s listed companies faring?

Recent profit results reveal an intriguing, even encouraging picture, at least from what we would term “quality” companies.

By “quality”, we mean companies with records of strong return-on-equity and profitability, unthreatening debt levels, good interest cover, and management teams that have demonstrated the ability to manage costs effectively and implement productivity boosting plans across operations.

Brambles Limited (ASX: BXB), Seven Group Holdings Limited (ASX: SVW), and Metcash Limited (ASX: MTS) are examples of what we regard as quality companies that have, up to now, succeeded in doing more with less by bending cost curves and improving margins.

Despite plentiful speculation over when Australian and global interest rates may be cut, we don’t expect to see cuts any time soon, and certainly not rapid-fire cuts when they do eventuate. That being the case, companies will need to keep doing more with less for some time yet.

The days of bullish top-line, or revenue growth, are likely to be some time away.

Brambles (ASX: BXB): profit growth ahead of sales revenue growth

Logistics is unglamorous but fail at it and there’s a fair chance a business will struggle. In that light, Brambles’ reusable pallets and containers form part of the backbone of global supply chains helping to efficiently move everything from fresh produce to consumer goods.

From an investment lens, a highlight of Brambles’ half-year financial results was a 19% rise in underlying profit, which was impressively ahead of a 10% rise in sales revenue and just a 1% increase in volumes.(2)

This achievement was made possible by “operating leverage supported by flow-through of pricing and commercial terms to recover cost-to-serve and transformation-linked productivity gains.”(3) In other words, getting more out of current business relationships by bearing down on costs as well as lifting operational productivity.

The company expects the “continuation of current operating conditions and trends”(4) so it will have to keep wringing more efficiencies to meet investor expectations.

Seven Group’s (ASX: SVW) multi-business model delivering

There was a time when Seven was just associated with the media industry – television and newspapers.

However, it has progressively changed and grown to become a diversified, multi-industry company through ownership of industrial services companies like WesTrac and Coates, and energy through a sizeable shareholding in Beach Energy (ASX: BPT) as well as other energy assets in Australia and the United States.

Seven is also a major player in Australia’s building materials industry through its majority ownership of Boral (ASX: BLD) (5). In February, Seven offered to buy the rest of Boral, a powerful endorsement, we believe, of the ongoing turnaround under the CEO appointed in December 2022.

At a group level, Seven reported a 28% rise in earnings before interest and tax (EBIT) on the back of a more than 20% lift in margins, and a 25% rise in operating cashflow that translated to a heady 31% gain in net profit after tax, for the half-year 2024.(6)

The numbers tell a tale of a well-run operation, in our view. As good as the numbers are, it’s what happened at companies in the Seven stable that especially interest us.

WesTrac, at its core, is an authorised dealer of Caterpillar construction, mining, and engineering equipment. It also services the equipment, which provides recurring income. The beauty of WesTrac is that its earnings are linked to mining production volumes, not commodity prices.

Commodity prices are volatile and the share prices of many mining companies reflect this as it means that margins can fluctuate significantly.

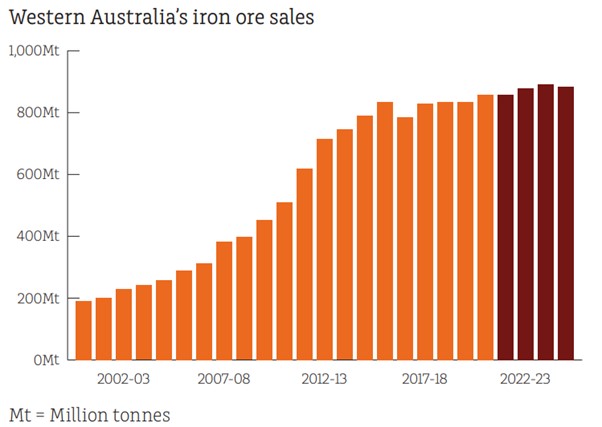

WesTrac, as an equipment provider and servicer, makes money irrespective of commodity price direction as evidenced by reporting a 31% rise in in its half-year 2024 results(7). While iron ore prices have softened over the past year, iron ore export sales volumes have continued to be both stable and high (Chart 1), which is positive for WesTrac.

Chart 1: Iron ore sales volumes have been stable, benefiting WesTrac

Source: WA Department of Mines, Industry Regulation and Safety, Resources Data Files (Bi-Annual); and WA Government. Mid-year Financial Projections Statement 2023-24 (December 2023)

Key phrases related to WestTrax, from Seven’s half-yearly results announcement, included “cost and efficiency initiatives delivering margin improvement; margin growth, cost discipline……”(8)

Coates’ industrial services business also reported similarly impressive metrics with a 28% EBIT margin and asset utilisation 60% above performance benchmark, again owing to “improving operating leverage and yield driven by pricing and cost discipline.”(9)

Investment industry people are familiar with the line, “past performance is not a reliable indicator of future performance” and so while companies like Coates may gain kudos for good, reported results, investors lookout for what the future may hold.

On that score the company had encouraging news for its shareholders with a $1.7 trillion infrastructure and construction pipeline and a “dominant and growing market share of Tier-1 infrastructure and construction customers.”(10)

Boral, the largest holding within Seven, is still in the early days of its turnaround but the signs, so far, are encouraging, in our view.

Led by Vik Bansal, a CEO with a formidable record of improving the financial and operating performance of companies he’s helmed, Boral is focused on “embedding the operating model to drive commercial, operational and financial rigour.”(11)

The company’s industrial services arm reported a whopping 111% EBIT and 196% operating cashflows uplifts while managing to pull down overheads 6% attributable to strong cost management(12). All this was achieved even as sales volumes only went “marginally up.”(13)

Talk about doing more, in fact much more, with the hand you’re dealt.

Metcash (ASX: MTS): challenging giants

Metcash represents a kind of second or third force in Australia’s structurally concentrated retail food, liquor, and hardware industries.

The company is a supplier to independent supermarkets trading under the IGA and Foodland brands. In liquor, its network is home to brands including IGA Liquor, Bottle-O and Cellarbrations, and its hardware brands Mitre 10 and Home Timber and Hardware take up the fight to Bunnings.

Metcash recently announced the acquisition of three businesses — Superior Food Group, Bianco Construction Supplies, and framing and truss operator Alpine Truss.(14)

In our view, this transaction makes strategic sense (Chart 2) as long-term trends point to the foodservice market growing faster than the grocery and supermarket sector, coupled with the hardware-orientated latter two businesses rolling into Metcash’s Independent Hardware Group (IHG), which has effectively built out Total Tools and amplified the core Home Hardware and Mitre 10 brands.

Chart 2: Metcash’s Super Foods acquisition makes strategic sense

When revenue growth across many industries is modest, buying growth through acquisitions is strategically sound, if you don’t overpay. Financial discipline is extremely important when high interest rates are squeezing corporate as well as household borrowers.

With that context, Metcash’s claims that the acquisitions are expected to be margin accretive and to boost earnings per share(15) will likely have reassured shareholders.

Superior Food is Australia’s third-largest food distribution business(16) and supplies aged care homes, cafeterias and canteens within universities and schools, hotels, hospitals, and mining sites, as well as fast food outlets like Domino’s, Hungry Jack’s, and Subway.

Our take on Metcash’s Super Food acquisition is that it will help the company reach new markets and also benefit from growing demand for ready-made and takeaway meals available from supermarkets.

Investors will have their fingers crossed for Brambles, Seven and Metcash over the rest of the financial year and beyond. Their recent performance has merited market participants’ support and continuing in the same vein by getting more from existing operations as well as value-accretive acquisitions will be important to future success.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

(1) Statement by Michele Bullock, Governor: Monetary Policy Decision. Media release number 2023-30, 7 November 2023, https://www.rba.gov.au/media-releases/2023/mr-23-30.html

(2) Brambles, half-year 2024 results presentation, 23 February 2024, https://www.listcorp.com/asx/bxb/brambles-limited/news/brambles-2024-half-year-result-presentation-2997607.html

(3) Ibid

(4) Ibid

(5) Australia's Seven Group offers $1.2 bln for full control of Boral. Scott Murdoch and Sameer Manekar, February 19, 2024, https://www.reuters.com/markets/deals/australias-seven-group-offers-12-bln-full-control-boral-2024-02-18/

(6) Seven Group Holdings HY24 Results Presentation, 14 February 2024, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://clients3.weblink.com.au/pdf/SVW/02772162.pdf

(7) ibid

(8) Ibid

(9) Ibid

(10) Ibid

(11) Ibid

(12) Ibid

(13) Ibid

(14) Metcash Investor Presentation. Acquisition of Superior Food, strategic hardware acquisitions and equity raising, 5 February 2024, https://www.listcorp.com/asx/mts/metcash-limited/news/strategic-acquisitions-and-equity-raising-presentation-2989865.html

(15) Ibid

(16) Ibid

All prices and analysis at 5 April 2024 (unless otherwise noted). This document was originally published in Livewire Markets on 5 April 2024. This information has been prepared by MLC Asset Management (ABN 38 055 638 474) (AFSL 230687)

(MLC Asset Management is a business division in the Insignia Financial group of companies) (ACN 167 859 332)(AFSL 503571).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.