Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

How to go global the easy way

Vanguard MSCI International Small Companies Index ETF (ASX: VISM) offers Australian investors incredibly cheap and highly efficient access to the global small-cap markets.

The global small-cap market is a broad and heterogeneous opportunity set. It is fraught with many incoherent idiosyncratic risks fostering inefficiencies, which has empirically led to a wide return dispersion.

Conventionally, these attributes would make any market segment a mecca for an active approach to generating significant alpha or excess return over the benchmark. But in reality, the evidence points to the contrary. The risk/reward fragmentation in the global small-cap landscape has been a demanding segment for active strategies.

The two primary challenges here are the extensive opportunity set and generally uncorrelated diverse risk elements present in the market. Specifically, for actives, the Achilles heel is scale rather than skill. An average active manager lacks the scale to deploy cross-sectional analysis weighing up both opportunities and threats at the global level across the different sectors and countries, putting them at a disadvantage relative to passive managers.

Being passive, Vanguard’s strategy doesn’t have stock-picking or risk-management flexibility, but it compensates more than enough by tracking an excellent index. The underlying MSCI World ex Australia Small Cap Index benchmark represents almost the full opportunity set of global small-cap shares available for active managers. For instance, against a quintessential global small-cap manager holding 850-900 stocks, the strategy is composed of 4,300 stocks. Albeit with a notable country skew (a common feature in any global index) to the United States, this strategy effectively and efficiently captures the overseas small-cap market.

We highly recommend this index for global small-cap exposure. Given the absence of strong active rivals, Vanguard MSCI International Small Companies Index ETF offers unbeatable value in a difficult to navigate market segment at a compelling price. The ETF has a total cost ratio of .33%.

Index composition

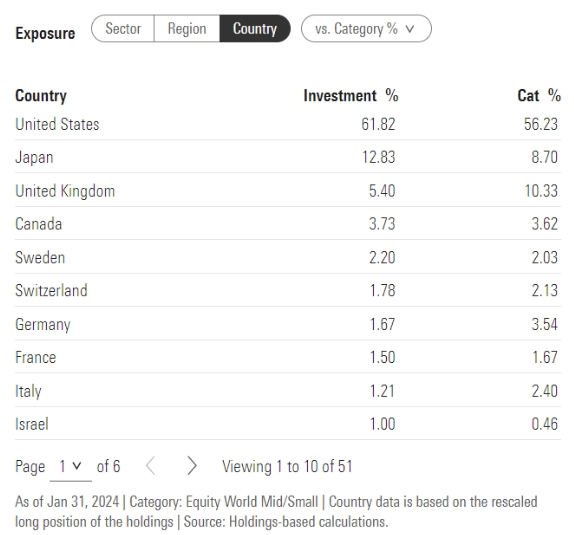

U.S. companies account for about 62% of the MSCI World ex Australia Small Cap Index. While many large U.S. companies have global footprints, small companies tend to be more domestically focused, implying a substantial bias to the U.S. economy.

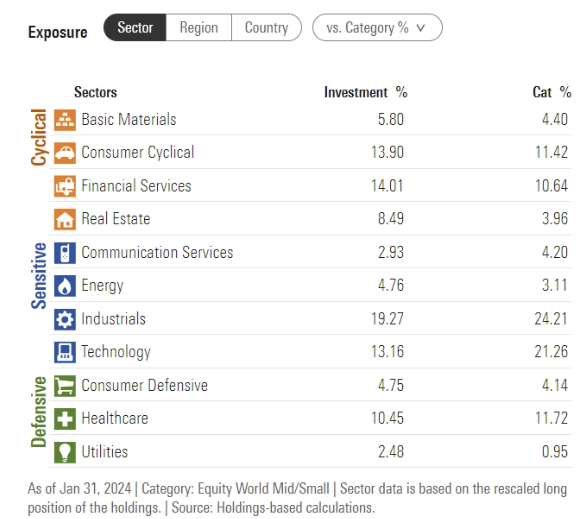

The benchmark has significant stakes in healthcare, industrials, and technology and only a modest allocation to resources, thus offering diversification for Australian investors. Global small-caps can add diversification to a local portfolio through exposure to foreign currencies and company-specific earnings drivers.

The Australian dollar often has acted as a "risk" currency, rising during buoyant conditions and coming under pressure when sentiment dips. This can reduce the volatility of global equity returns on an unhedged basis, compared with when currencies are hedged. However, it is worth noting that smaller businesses may be less mature than their large-cap counterparts and may thus display greater cyclicality, sensitivity to the business cycle, or volatility. For that reason, we believe this strategy is best used as a supporting player within a broader global equity sleeve of a portfolio.

Kongkon Gogoi is a Senior Manager Research Analyst for Morningstar.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 29 February 2024. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.