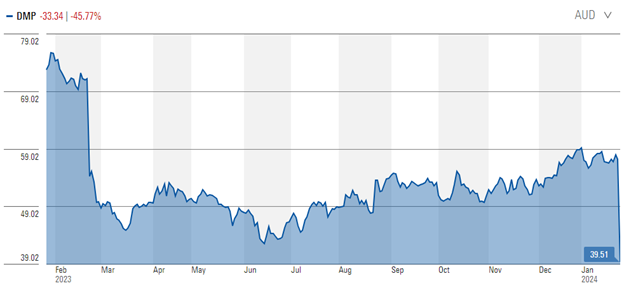

Domino’s Pizza: Is this an opportunity?

Domino’s (ASX: DMP) shares recently fell over 31% as management cut 2024 estimates. In response to the update, we lowered our fair value estimate for shares in narrow-moat Domino’s Pizza by 10% to $61.

Source: Morningstar

However, we think the market reaction looks overdone and shares in Domino’s screen as significantly undervalued. Surprisingly, Japan's performance was down, and performance in France continued to underwhelm; other parts of the group performed strongly in the first half of fiscal 2024.

We were surprised to see management walk away from full-year fiscal 2024 earnings guidance so soon after its recent update in November 2023. Christmas trading in Asia missed management’s expectations: same-store sales were down 9% in the first half of fiscal 2024 versus the previous corresponding period—and Asian earnings collapsed.

Compared with Domino’s other core markets, customers buy less frequently in Japan and it takes longer to get a clear picture of the success of its product offerings. This creates a timeliness issue for management and a risk of misreading performance, as appeared to be the case in this update.

We reduce our full-year fiscal 2024 net profit before tax forecast by 23% to $179 million, implying a second half broadly consistent with the $87 million to $90 million guidance range for the first half.

We have also lowered our midcycle net profit before tax forecast for Domino’s by around 10%, reflecting a downgraded midcycle earnings before interest and taxes (“EBIT”) margin assumption for the Asia segment of 300 basis points as we now believe Domino’s recent Asia acquisitions—outside Japan—will ultimately prove less profitable.

Although we are less optimistic about the new Asian markets, we think operational issues in Japan largely reflect execution missteps and not structural issues with the business. We believe Domino’s long-term growth runway is not in jeopardy and the longer-term rollout targets stand. Our midcycle store network forecast of some 6,300, compared with roughly 3,800 in fiscal 2023, remains intact.

Our moat rating

We believe Domino’s warrants a narrow economic moat, sourced from intangible assets and cost advantages. Intangibles are derived from very strong global brand recognition. A moat refers to a company that has a sustainable competitive advantage.

Domino’s was formed in 1960 and now extends to over 80 countries, with over 16,000 stores. Intangibles also stem from internally generated intellectual property, with the firm a leader in restaurant logistics and technology tools that build and maintain customer engagement and loyalty.

The majority of its global sales are sourced from digital channels. In Australia, over half of those digital sales come from its mobile app. Domino’s investment in streamlining its cooking and fulfilment process makes it the "go-to" location for individuals who covet the fastest and most reliable service.

We see durable cost advantages in advertising, as Domino’s gains far greater leverage from above-the-line advertising than smaller peers. Being one of the largest operators in each market means the firm can advertise at a lower average cost per outlet than smaller peers.

This helps elevate and keep the brand top of mind for consumers--for example, Domino’s Australia has over 1 million likes on Facebook. High brand awareness, longer trading hours, and sophisticated home delivery capabilities means Domino's stores have high sales productivity. This enables the firm and franchises to rent stores in better locations than less productive smaller pizza restaurants. We anticipate this as conducive to market share growth over the longer term.

Operating one of the largest global pizza franchises allows Domino’s to pool resources and outspend competitors on innovation. Technology innovation improves convenience, which next to value is the key sales driver.

The technological platform is shared globally and spans: a digital loyalty program enabling electronic redemption of "reward pizzas"; electronic customer profiling; geotracking of pizza being delivered to homes; and customer geotracking to have pizza ready just as they enter the store.

Other benefits in recent years of Domino’s innovation team include high-speed ovens and a re-engineered fulfilment process that appear best-in-class. Detailed monitoring of every aspect of the ordering, cooking, fulfilment, and deliver processes means bottlenecks and downtimes are minimised, enabling Domino’s to offer faster delivery times than competitors. Delivery times in Australia average 20 minutes, with the largest competitor, Pizza Hut, reportedly sitting at around 30 minutes.

The firm's large network gives it some cost advantages in the procurement of consumables. It also increases the proximity to markets and therefore improves customer convenience.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

All prices and analysis at 29 January 2024. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892. All prices and analysis at 29 January 2024. This article was prepared by Johannes Faul is Director of Equity Research, Morningstar Australia. The information contained in this article is of a general nature only. The author has not taken into account the goals, objectives, or personal circumstances of any person (and is current as at the date of publishing).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.