Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Can the Dogs of the ASX win again in 2024?

Hugh Dive | Atlas Funds Management

The last 12 months have been surprisingly good for equity investors, with the ASX 200 up +7.8% or 12.4%, including dividends, though this was admirably aided by one of the better "Santa Claus" rallies in recent years. Indeed, at the end of October 2023, the ASX 200 was underwater by 3.6% for the year.

When writing this Dogs piece in January 2023, like many, Atlas had a very cautious outlook for 2023. Twelve months ago, we had seen a 3% rise in the cash rate (from 0.1% to 3.1% with more to come in 2023) and the looming fixed interest rate cliff that was expected to see retail sales crater and house prices plummet. In November 2022, at their results, Westpac's forecast of a 3.85% cash rate resulted in their economic models predicting unemployment to rise to 4.5%, a 16% fall in house prices nationally, and a spike in bad debts. In 2023, consumer discretionary was one of the strongest sectors on the ASX, gaining +22%!

As always, at this time of the year, investors will be picking through the market's trash of 2022 to find some treasure to drive portfolio returns over the coming year. Invariably, several bottom-performing stocks will confound market expectations and stage remarkable comebacks, as we saw in 2023. Indeed, the equally weighted portfolio of the 2023 Dogs had a stellar year, up +26%, its best year since 2016.

In this first weekly piece of the year, we will look at the "dogs" of the ASX from 2023, see how 2022 Dogs performed and review Atlas' predictions made 12 months ago in January 2023 Dogs of the ASX.

Dogs of the Dow

Michael O'Higgins popularised a systematic strategy of investing in underperforming companies named "Dogs of the Dow" in his 1991 book "Beating the Dow." This approach draws on the same investment principles as deep value and contrarian investors. O'Higgins advocated buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average (DJIA) at the beginning of the year but restricting the stocks selected to those still paying dividends.

Restricting the investment universe to a large capitalisation index like the DJIA or ASX 100 improves the chance that the unloved company may have the financial strength or understanding of capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover over time.

The thought process behind requiring a company to pay a dividend is that its business model is unlikely to be permanently broken if it still pays a distribution. A company's directors are unlikely to authorise a dividend if insolvency is imminent.

The strategy then holds these ten stocks over the calendar year and sells them at the end of December. The process then restarts, buying the ten worst performers from the year that has just finished.

Why Retail investors have an advantage.

One of the reasons this strategy persists is that institutional fund managers often report the contents of their portfolios to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the "dogs" in their portfolio towards the end of the year as part of "window dressing" their portfolio before being evaluated.

For example, in early 2023, fund managers with Downer or James Hardie in their portfolios would have faced stern questioning from asset consultants about why they owned these companies with bleak outlooks for the coming year.

Downer had revealed to the market accounting irregularities that had inflated company profits in the previous four years and saw their CEO, CFO, and Chairman leave the company. The conventional wisdom in the case of accounting irregularities is that these practices are rarely isolated to one specific business unit but are likely to be prevalent across the whole organisation. Fibre cement manufacturer James Hardie was expected to face a tough 2023 with the US housing market expected to be weak and cost of living pressures likely to curtail consumer spending in the repair and remodel market. However, the share prices of these two companies rebounded strongly in 2023, Downer (+20%) and James Hardie (+104%) rewarding investors brave enough to add them to portfolios last January!

Here, retail investors can have an advantage over institutional investors. Their lack of scrutiny from asset consultants allows them the flexibility to pick up companies whose share prices have been under pressure late in the year that could see a rebound when the selling pressure stops in January and February. Furthermore, retail investors can afford to take a longer-term view of the investment merits of a particular company that may have hit a speed bump.

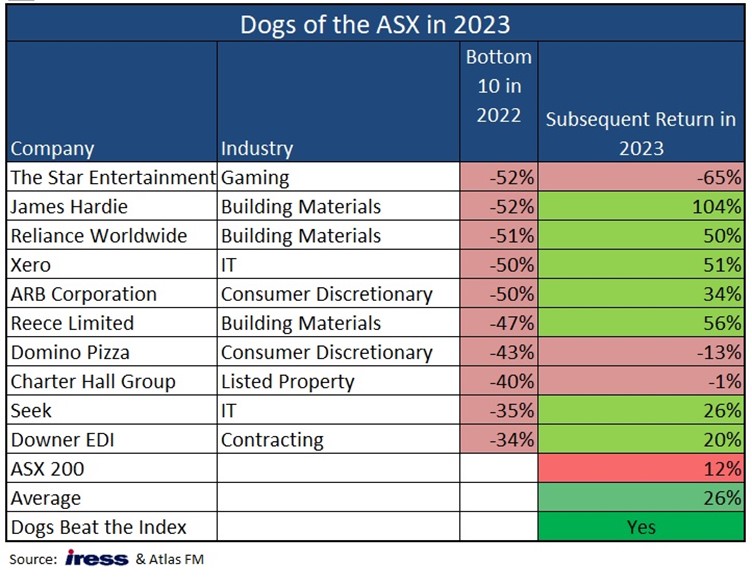

The Dogs of 2022 outperformed the ASX 200 again in 2023

Over the past year, the average equal-weighted return of Dogs from 2022 was an impressive +26%, outperforming the ASX 200 by 14%. Since 2013, the Dogs of the ASX Portfolio has beaten the ASX 200 seven times. Solid gains from building materials companies James Hardie, Reliance and Reece outweighed weaknesses in Star Entertainment and Domino Pizza. The key surprise was the continued strength in both the US and Australian housing markets, with US housing starts actually accelerating through the year, with December finishing at 1.56 million.

Automotive accessory retailer ARB saw sales fall by 3% in FY 2023 but posted a small increase in the last quarter, which was far better than market expectations twelve months ago. All retail stocks were expected to see large revenue declines as retail sales contracted due to the 'fixed-rate mortgage cliff, as cheap fixed-rate mortgages written in 2020 and 2021 rolled off and were refinanced in 2023 at rates 4% higher. However, retail sales were surprisingly steady in 2023. The IT sector rebounded well globally on signs that interest rate tightening had ended; this benefited Xero and Seek.

Predictions from January 2023

When we went through this exercise twelve months ago, Atlas correctly picked that Star Entertainment should be avoided in 2023, though, to be fair, we underestimated the issues that the embattled casino operator faced. Star's shareholders were asked to reach into their pockets twice in 2023 to keep the company afloat. In August, they posted a $2.4 billion loss after writing down the value of its casino assets by $2.2 billion.

Similarly, we correctly picked that Reliance would rebound in 2023, though our investment thesis for doing so was incorrect. The positive view towards Reliance was based on the non-discretionary nature of plumbing supplies rather than a rebound in the US housing sector.

Less successful was our pick that Domino's Pizza would recover in 2023 as stressed consumers rewarded themselves by substituting a night out at a local restaurant for two large pizzas, garlic bread and chocolate lava cake delivered for $36.95. The pain continued in 2023 for the pizza maker due to difficulties in passing on food inflation, closing 100 stores, and exiting the Danish market. Closing stores was poorly received by the market, which had rewarded Dominos with a high price-to-earnings ratio after consistently growing its store network in Australia and globally since listing in 2005.

Continuing on the negative side of the ledger, our caution towards the housing sector that caused us to overlook James Hardie and Reece was misplaced in 2023.

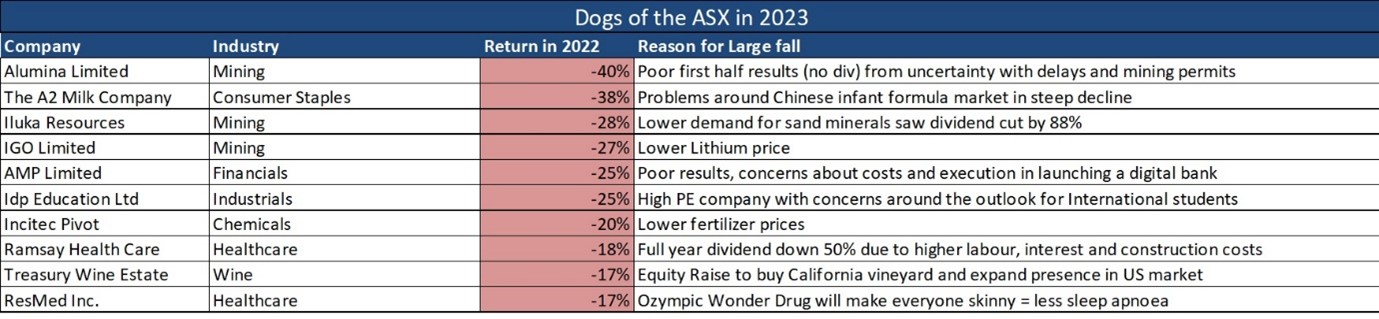

Unloved mutts from 2023 in need of a good home in 2024

The list of the Dogs of the ASX from 2023 is quite similar to the Dogs from 2022 in that it contains several generally considered high quality and would feature prominently in the portfolios of many growth-style fund managers such as ResMed, Treasury Wine and Ramsay Healthcare. Additionally, some companies have previously been featured on the Dogs of the ASX 100, such as AMP and A2 Milk.

The three key themes common to the companies whose share prices struggled in 2023 are:

- Falling Commodity Prices: Alumina, Iluka, Incitec Pivot and IGO.

- High price-to-earnings companies are de-rated based on a stock-specific factor that clouds outlook: ResMed, A2 Milk, and IDP Education.

- Poorly received corporate activity: Ramsay and Treasury Wine

Our picks for 2024

After analysing the Dogs of the ASX 100 each year since 2010, several poorly performing companies invariably stage dramatic turnarounds in the subsequent 12 months that confound the pessimistic market consensus. While 2023 was a great year for the Dogs, which on average gained +26%, this result pales in comparison to 2016, when the Dogs on average gained +74%, led by Fortescue (+223%) and BlueScope Steel (+111%).

Historically, finding the fallen angel amongst the worst performers seems to work best where the underperformance is due to stock-specific problems rather than macroeconomic issues beyond a company's control. Based on this thesis, we would be tempted to pick ResMed, one of the most discussed stocks on the ASX over the past year, which has seen its share price fall from $36 to $25. This fall was not due to declining earnings but rather the perception that GLP-1 weight loss drugs such as Ozempic on sleep apnoea and the upcoming re-entry of competitor Philips into the market after its June 2021 product recall. However, we are reticent to choose ResMed, based on Eli Lily's Mounjaro drug being in the final stages of a Phase 3 trial in the USA to evaluate efficacy for sleep apnea, with results expected in early 2024. This will likely have a binary outcome on ResMed's share price; success will see a sharp fall, and failure will see a solid increase.

The path for chemical company Incitec Pivot's share price to rebound in 2024 looks far clearer. After selling the company's Waggaman Ammonia Plant in Louisiana in 2024, the company is expected to conduct a 26-cent capital return as well as a $900 million on-market share buy-back, which equates to a 15% reduction in the number of shares outstanding and will mathematically boost the company's share price. Additional capital returns could result from selling the Australian fertiliser operations as the company becomes a pure-play explosives company.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 8 January 2024. This document was originally published on Livewire Markets website on 8 January 2024. This information has been prepared by Atlas Funds Management ABN 83 612 499 528 | AFSL 491395.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.