Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

3 stocks set for ‘takeoff’

As we step into 2024, we reflect on the year gone by that has been full of puzzles. Interest rates around the world have risen sharply, several geopolitical armed conflicts have broken out, and China’s economy has been suffering.

There is more than enough fodder to craft convincing narratives that explain why equities are risky and should be avoided – especially when cash can yield you 5% or more.

These narratives have created investor caution, no more evident than the fact that cash has moved to the sidelines in a significant way, over the last 12 months. According to the Investment Company Institute, US institutions and investors together have accumulated a record US$5.7 trillion in cash-like money-market funds (an increase of US$1 trillion from one year ago), many of which are yielding above 5%.

But despite this caution, we believe that now is a great time to be deploying money into the stock market. A number of factors have created conditions that are setting a handful of quality stocks for ‘takeoff’.

Low expectations ignite a ‘takeoff’

How do stocks set up for takeoff?

Stock prices routinely embed expectations that are simple extrapolations of recent history, which can create big opportunities around times of change.

‘Driving forwards while looking backwards’ is the saying that typically applies here.

During periods of lackluster earnings growth, the market often finds it difficult to believe growth is going to inflect upwards. The market is, in a sense, anchored to recent history.

For a company that is indeed on the brink of growth acceleration, the result of this dynamic is an undervalued stock price. This represents an investment opportunity.

And when growth finally does ‘surprise’ the market to the upside, the stock typically re-rates upwards quickly. It takes off.

Below, we look at three stocks that set for takeoff.

S&P Global — Awaiting the impending refinancing boom

S&P Global’s all-important Ratings business won big from the significant bond issuance that happened when interest rates were very low during the pandemic. Basically, the pandemic brought forward demand for ratings.

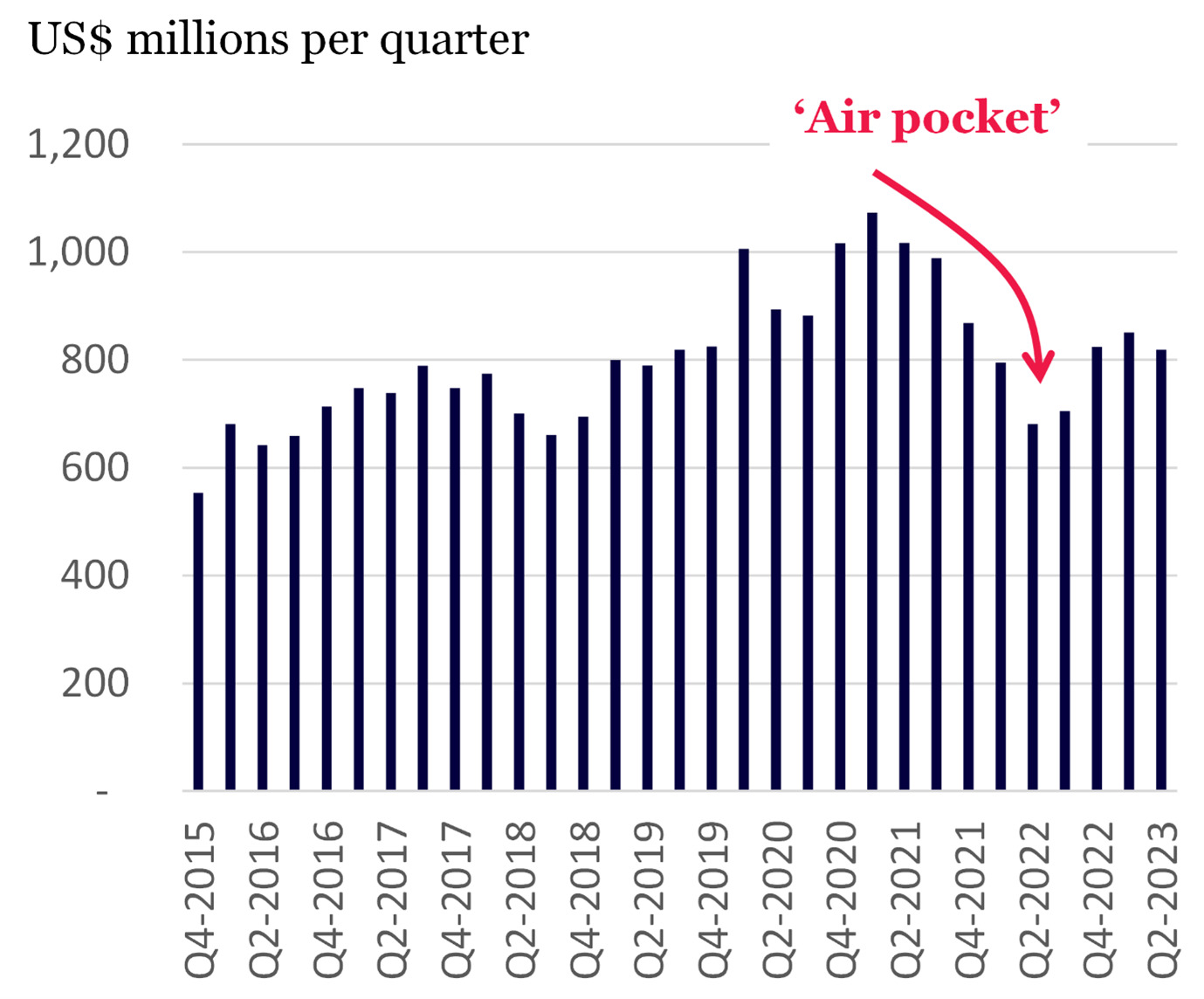

But when rates started to rise, S&P Global experienced an ‘air pocket’ and demand temporarily evaporated.

Source: S&P Global – Ratings Business Revenue

But what investors are ignoring is that substantially all of the bonds issued over the last three years need to be refinanced. The demand for S&P’s ratings is simply pent-up. It is coming. Indeed, between now and 2026, S&P Global expects that US$8 trillion in refinancings that will need ratings.

This substantial acceleration in revenue – which also comes in at very high profit margins of around 60% – is not being fully anticipated by the expectations implied by S&P Global’s current stock price.

S&P is therefore set for a takeoff when revenue growth resumes.

KKR (and Blackstone) — Awaiting the fruits of 2021 to ripen

KKR is also set for takeoff.

One thing investors underappreciate about an alternative asset manager’s business model is the delay between asset (AUM) inflows and future earnings growth.

The manager only begins to earn fee revenue when raised funds are deployed into investments.

Furthermore, there is a dynamic that takes place roughly 5 years later that substantially increases fee revenue again. When investments are ultimately harvested at much higher prices and returned to fund investors, most of this capital is simply ‘re-raised’ by the fund manager into new AUM. And this turbocharges fee revenue, yet again.

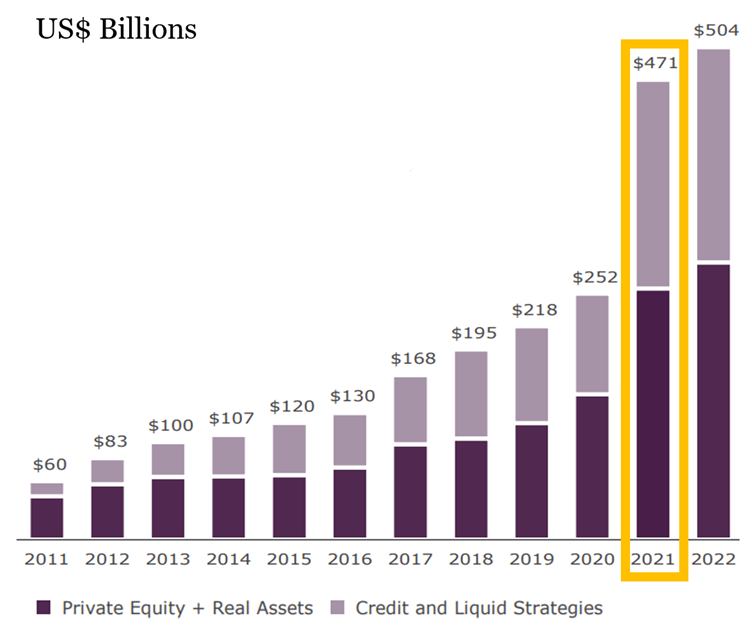

KKR’s AUM… 2021 really stands out

Source: KKR

In 2021, the world’s leading alts managers – including KKR and Blackstone – raised an unusually large pool of capital thanks to the enormous spike in global liquidity following the pandemic.

While this jump in AUM has given some support to fee growth in the subsequent years, it will be around 2026, or so, that we expect fee growth to really accelerate. This will follow the harvesting of many of these 2021 investments at much higher prices, and subsequent capital recycling that will boost AUM (and fees) even higher.

Said another way, KKR (and Blackstone) have significant future earnings growth essentially ‘locked in’.

But this future step-up in earnings power is currently not being fully anticipated in their stock prices, which is setting the stocks up for a ‘takeoff’ when these earnings start flowing.

Spotify — Revenues and costs are set to diverge

Spotify, still led by founder Daniel Ek, is another stock primed to launch.

The company is one of the few businesses that has the patience and tolerance to incur several years of short-term profit headwinds to set the business up for long-term success.

Spotify has invested aggressively in building out the world’s first (and largest) unified audio platform, which provides music, podcasts and audiobooks from a single unified app in uniquely personalized ways.

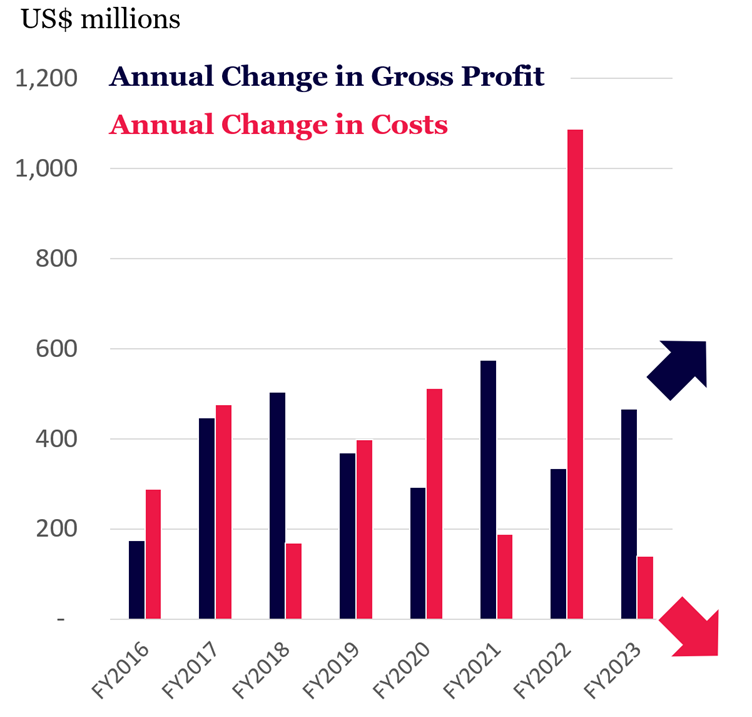

The company’s annual development and overhead costs have surged by eight times over the last eight years.

But today, the investments are largely complete, and costs have started to decline on a year-on-year basis (as of Q3 2023).

Spotify- Gross Profit Growth vs Cost Growth

Source: Company Filings

At the same time, monetisation is starting to ramp up. Spotify recently increased prices by approximately 10% in its largest market, the US. This will accelerate growth in revenues and gross profits, the effects of which will first be observed in the company’s Q4 2023 financials.

And yet, conditioned by years of mediocre profitability, the market appears to be underestimating the extent of the earnings growth that is just around the corner.

When this growth is delivered, we expect the stock to takeoff.

Window of opportunity

2023 has been a great test in what cognitive scientists refer to as ‘relevance realization’: our ability to ignore noise and zero in on relevant information.

Yes, there is a lot of caution around the market, but what is relevant right now is that there are great opportunities out there because investors have extrapolated recent history into the future and ignored looming inflection points on the horizon.

As we see it, that disconnect has set up a range of high-quality stocks for takeoff.

Investors who are cautiously sitting in cash could miss a vital window of opportunity to buy quality companies like S&P Global, KKR and Spotify at reasonable valuations before their performance and share prices takeoff.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

Note: Montaka is invested in Spotify, KKR, and S&P Global.

Andrew Macken is the Chief Investment Officer with Montaka Global Investments. All prices and analysis at 12 January 2024. This document was originally published on Livewire Markets website on 12 January 2024. This information has been prepared by Montaka Global Investments.

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.