Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

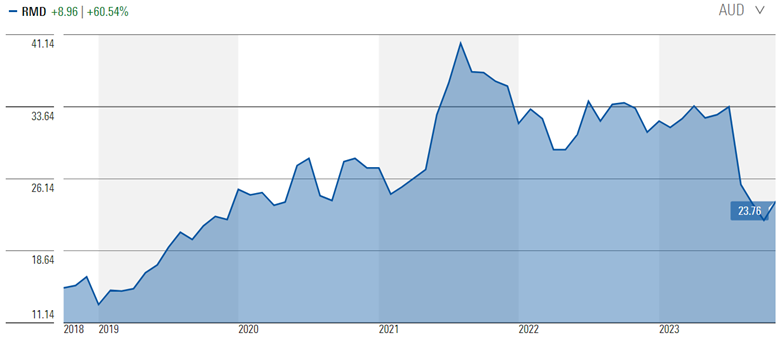

One materially undervalued ASX share

Resmed (ASX: RMD) is one of the two leading players in the global obstructive sleep apnea, or OSA, market. With cloud-connected devices, physicians can monitor patient compliance and encourage continued usage. Following first-quarter fiscal 2024 results, we maintain our USD $258 fair value, or AUD $40 per CDI at current exchange rates.

Source: Morningstar

Earnings results

Underlying EBIT of USD 319 million grew 4% sequentially on fourth quarter fiscal 2023, with sales down 2% but underlying EBIT margin expanded 1.5% to 29%.

While first-quarter gross margin expanded just 0.2% sequentially to 56% versus the fourth quarter, this is largely due to the firm still working through higher-cost inventory given historically higher component and freight costs.

Following the result, the firm also reduced its global workforce by 5% in October 2023, largely in noncore SG&A (sales, general and administrative) activities. Accordingly, management revised its prior guidance, now expecting fiscal 2024 SG&A expenses to be 18% to 20% of revenue from 20% to 22% prior, and fiscal 2024 research and development expenses to be 6%-7% of revenue from 7%-8% prior. In short, a reduction in costs to help with margin expansion.

How we view the share

We see the shares as materially undervalued. It’s currently trading at a 45% discount to fair value (as at 30 October 2023).

It has also been awarded a narrow moat. This means that our analysts believe that it can protect and grow its earnings for at least the next 10 years.

ResMed’s moat is based on switching costs and intangible assets, which have helped the company achieve high customer adherence rates and above-average industry growth.

In fiscal 2021, ResMed had over 15 million cloud-connected devices sold globally. These newer-generation devices enable physicians to remotely monitor the patient’s usage and breathing performance, entrenching ResMed as a preferred provider with both patients and physicians. For the patient, device feedback encourages usage and allows them to get individualized care from the physician, leading to better clinical outcomes. For the physician, trust in recorded data and grown familiarity with the software is likely to reduce switching to a different provider.

ResMed reports up to 87% adherence rates when the physician is using its cloud-based patient monitoring system, AirView, compared with the estimated industry average adherence rate of 50%. A higher adherence rate benefits both device upgrades as well as masks and accessories revenue as the physician reminds the patient of when they should be replaced.

ResMed’s intangible assets, namely its brand and patent portfolio, have also contributed to above-average industry growth and helped maintain its commanding market share. ResMed typically spends roughly 7% of revenue on research and development each year, which has ensured consistent product launches.

Despite growing off a much smaller base, Fisher & Paykel’s competing homecare segment has a trailing five-year revenue CAGR of 5%, lagging ResMed’s 10% over the same period. We think ResMed’s intangible brand has also enabled significant price premiums over less well-known peers.

Due to its significant market share and high gross margins in a structurally growing industry, ResMed has posted an average return on invested capital, or ROIC, of 20% over the last decade. We anticipate the company’s ROIC to far exceed its weighted cost of capital of 7.4% over our explicit forecast period, even in our bear-case scenario.

Access this research and more at Morningstar. For a free four-week trial, click here.

Shani Jayamanne is an investment specialist, Individual Investor, Morningstar Australia. All prices and analysis at 30 October 2023. This information has been prepared by Morningstar Australasia Pty Limited (“Morningstar”) ABN: 95 090 665 544 AFSL: 240 892 . The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.