Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

10 top ASX dividend shares – part 1

Mark LaMonica | Morningstar

In a recent article I tried to answer a question I hear frequently. Is it feasible to retire off dividends alone? In response to my article, I heard numerous success stories from retirees. These are real life examples of the premise of my article. You can retire off dividends. However, I looked at the risks of this income investing strategy and offered some suggestions.

A focus of the article was the Australian share market and the advantages and disadvantages of building a portfolio heavily tilted toward Aussie shares. The advantage is obvious. Australian companies pay a higher percentage of profits in dividends and therefore have a higher yield than most foreign markets. The tax advantages from franking credits make investing in Aussie companies even more attractive.

While acknowledging these inherent advantages to investing domestically I looked at two potential issues for retirees. The first was the concentration of the Aussie market in certain companies and in the financial services and basic materials sectors. The second was the lower historic growth in local dividends when compared to global markets.

I thought it would be worthwhile to look at the top contributors to the overall income in the Aussie market. These are companies that many income investors gravitate towards. A passive investor buying the index would receive a large portion of their income from these shares.

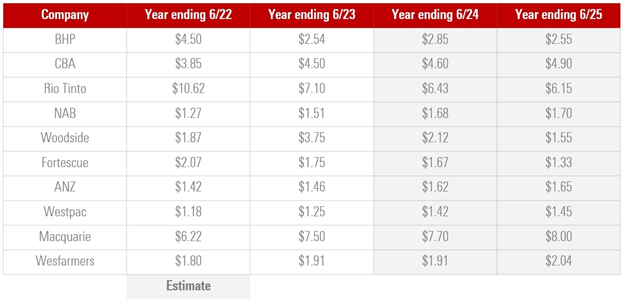

Our analysts project future dividends for each company they cover. Those estimates provide the opportunity to explore the estimated forward dividends for the ten biggest contributors to income generated from the ASX 200. In total these 10 companies pay out just under 60 percent of the total dividends an ASX 200 investor would receive.

The following chart shows the percentage of total income from the ASX 200 that comes from each of these shares, dividends over the last two financial years and our projection of dividends for the next two financial years by our analysts. This is followed by commentary on the top 5 contributors ASX 200 income. Next week I will explore the next 5 names on the list.

BHP (BHP: ASX)

BHP is the heavyweight of the ASX and makes up a little more than 10% of the ASX 200. This influence is even more pronounced with dividends as BHP paid out over 17% of the total income produced by ASX 200 shares.

BHP dividends have dropped in fiscal year 2023 after two strong years of dividends. Morningstar analyst Jon Mills was surprised with the size of the dividend that will be paid in September 2023 as it was 15% below his estimate.

BHP’s payout ratio came in at 64% compared to Mills’ estimate of 75%. Based on the lower payout rate Mills lower his forecast for fiscal 2024 dividends by reducing his assumed payout ratio from 75% to 65%. Despite the reduced payout ratio, the dividend is still expected to be higher than 2023 but the estimate is meaningfully lower than the levels reached in 2021 and 2022.

One piece of good news for BHP shareholders is that the company is in strong financial shape with modest debt levels. This financial flexibility should allow BHP to continue to return cash to shareholders provided earnings hold up.

Commonwealth Bank of Australia (ASX: CBA)

CBA is another dividend heavyweight in the ASX and makes up a little over 8% of total ASX 200 dividends. CBA’s dividend was 17% higher in 2023 than the previous year.

The outlook for higher dividends is positive in Morningstar analyst Nathan Zaia’s view. He expects continued dividend growth in 2024 and 2025.

CBA is committed to maintain capital above the regulatory minimum and does not intend to spend money on expensive or dilutive acquisitions or risky expansion plans. The bank is currently sitting on $3.1 billion in surplus capital which is above the top-end of CBA’s target range. That leaves plenty of cash for dividend payments and Zaia thinks the bank’s target dividend payout ratio of 70%-80% is reasonable.

Rio Tinto (ASX: RIO)

Much like BHP, Rio Tinto shareholders have experienced a significant drop in dividends following the spike in commodity prices in 2021 and 2022.

Rio Tinto’s balance sheet is sound, and we expect the company to run a relatively conservative balance sheet for the foreseeable future. Morningstar analyst John Mills expects dividends to continue to trend lower over the next two years. Rio is heavily dependent on China and Mills expects earnings to materially decline with demand for many commodities likely to soften with the end of the China boom. In particular Mills is forecasting lower demand for iron ore which has disproportionately benefited from the boom in infrastructure and real estate investment.

National Australian Bank (ASX: NAB)

National Australia Bank is well-capitalised, which supports Morningstar analyst Nathan Zaia’s modest dividend growth forecasts while supporting a buffer for a larger-than-expected rise in credit stress.

Zaia forecasts a near-70% dividend payout ratio. He thinks NAB has set an appropriate dividend payout range considering the capital position, outlook for loan growth, M&A opportunities, and loan loss provisions. COVID-19 was an opportunity for the bank to reset shareholder expectations and Zaia believes NAB won’t revert to its old aggressive payout ratios.

In the past NAB paid out too much of earnings in dividends and subsequently required equity raisings. The bank paid out close to 100% of earnings in fiscal 2018 and 2019. Even more recently, when National Australia Bank raised $4 billion in equity at a dilutive discount to Zaia’s fair value estimate, he thought it was counterintuitive to then pay dividends totalling $2 billion in fiscal 2020.

Woodside (ASX: WDS)

Woodside’s latest dividend was around 6% higher than Morningstar analyst Mark Taylor’s estimate. Fiscal year 2023 was a bumper year for Woodside dividends but Taylor expects payments to drop over the next two years.

Woodside maintains a sound balance sheet although Taylor believes that a payout ratio of 80% is too high. Woodside has had an 80% payout ratio since 2013 while LNG expansion plans have been on hold. The official policy is to maintain a minimum 50% payout of underlying earnings.

While Taylor believes it is appropriate to distribute funds if capital expenditures aren’t going to be undertaken, he thinks a better use of cash would have been to accelerate growth plans. Despite his misgivings Taylor notes that strong cash flows and a healthy balance sheet should support ongoing dividend payments.

First published on the Firstlinks Newsletter. A free subscription for nabtrade clients is available here.

Mark LaMonica is Director of Product Management, Individual Investor, Morningstar Australia. All prices and analysis at 20 September 2023. This document was originally published in Morningstar on 23 September 2023. This information has been prepared by Morningstar Australasia (AFSL 240892).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.