Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Megaport is seeing excellent momentum

After exceeding $21 per share in late-2021, Megaport Limited (ASX:MP1) experienced a very rough 17 months. The company now seems to have its mojo back from the trough in April 2023. Not only has the share price more than tripled to $12.15, but this has been accompanied by some very positive company announcements.

On 28 March, long-term Cisco executive, Michael Reid, was appointed CEO of Megaport, effective 15 May 2023. This was followed up with the March 2023 Quarter investor presentation (28 April) where Megaport announced normalised earnings before interest, taxes, depreciation, and amortization (EBITDA) forecasts to be materially above consensus, from $9 million to a mid-point of $17 million for FY2023 and from $30 million to a midpoint of $43.5 million for FY2024.

$30 million of annualised cashflow improvement was attributable, according to the company, to the reduced workforce, cloud VXC repricing, reduced cost of goods sold and reduced operating expenditure. The company finished the March Quarter with $48.6 million of cash and indications were that positive cashflow was imminent.

After exceeding $21 per share in late-2021, Megaport Limited (ASX:MP1) experienced a very rough 17 months. The company now seems to have its mojo back from the trough in April 2023. Not only has the share price more than tripled to $12.15, but this has been accompanied by some very positive company announcements.

On 28 March, long-term Cisco executive, Michael Reid, was appointed CEO of Megaport, effective 15 May 2023. This was followed up with the March 2023 Quarter investor presentation (28 April) where Megaport announced normalised earnings before interest, taxes, depreciation, and amortization (EBITDA) forecasts to be materially above consensus, from $9 million to a mid-point of $17 million for FY2023 and from $30 million to a midpoint of $43.5 million for FY2024.

$30 million of annualised cashflow improvement was attributable, according to the company, to the reduced workforce, cloud VXC repricing, reduced cost of goods sold and reduced operating expenditure. The company finished the March Quarter with $48.6 million of cash and indications were that positive cashflow was imminent.

On 11 July, Megaport announced that the June 2023 Quarter did in fact see positive cashflow of $2.3 million, inclusive of $2.6 million of redundancy payments, whilst the EBITDA forecast for FY2023 was increased from $17 million to $20 million (midpoints) on 40 per cent revenue growth to $153 million. Importantly, the annual recurring revenue by June 2023 was running 17 per cent above this figure at $179 million.

Pleasingly, operating expenses for FY2023 were down $1.9 million from $80.6 million in FY2022 to $78.7 million, and with the big boost to revenue, Megaport was finally demonstrating the hoped for scalability.

The cream on the cake was announced on Tuesday 22 August with the FY2024 EBITDA guidance jumping a further 24 per cent from $43.5 million (as per the 28 April announcement) to a midpoint of $54 million, with revenue up by 26 per cent from $153 million to $192.5 million (midpoint). Megaport also confirmed it expects to be net positive cashflow for the FY2024 year.

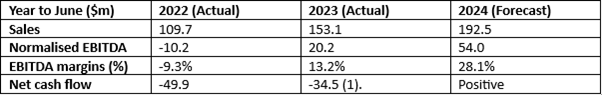

Below, I have illustrated the extraordinary turnaround from Megaport, covering FY2022, FY2023 and the current forecasts for FY2024:

(1). The June 2023 Quarter was positive $2.3 million, inclusive of $2.6 million of redundancy payments.

The Megaport ecosystem is now present across 800 data centres servicing many of the biggest industry players, and the demonstrated turnaround in the latter part of FY2023 now looks like an exciting launchpad for the Company’s medium-term outlook.

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

All prices and analysis at 24/08/2023. This document was originally published in Livewire Markets on 1 August 2023. This information has been prepared by Acorn Capital Pty Ltd (ACN 082 694 531)(AFSL 227605).

The content is distributed by WealthHub Securities Limited (WSL) (ABN 83 089 718 249)(AFSL No. 230704). WSL is a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited (ABN 12 004 044 937)(AFSL No. 230686) (NAB). NAB doesn’t guarantee its subsidiaries’ obligations or performance, or the products or services its subsidiaries offer. This material is intended to provide general advice only. It has been prepared without having regard to or taking into account any particular investor’s objectives, financial situation and/or needs. All investors should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation and/or needs, before acting on the advice. Past performance is not a reliable indicator of future performance. Any comments, suggestions or views presented do not reflect the views of WSL and/or NAB. Subject to any terms implied by law and which cannot be excluded, neither WSL nor NAB shall be liable for any errors, omissions, defects or misrepresentations in the information or general advice including any third party sourced data (including by reasons of negligence, negligent misstatement or otherwise) or for any loss or damage (whether direct or indirect) suffered by persons who use or rely on the general advice or information. If any law prohibits the exclusion of such liability, WSL and NAB limit its liability to the re-supply of the information, provided that such limitation is permitted by law and is fair and reasonable. For more information, please click here.