Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Henry Jennings’ reporting season outlook

Henry Jennings | Marcus Today

“A ship in harbour is safe, but that is not what ships are built for.” It is that time again!

Once again, we are entering treacherous waters. Reporting season is now upon us. To keep us informed, some companies have released quarterly reports and even confessions, under the cloak of continuous disclosure requirements and the Conference Season. There are always shocks though; these are inevitable. The smart companies are out ahead of the curve with their Investor Relations teams whispering sweet nothings in the ears of analysts to try to temper expectations. Most serious analysts do tend to run their research pieces by the company just to fact-check their work. It may not change their recommendations, but it stops the analyst from making fools of themselves from time to time. Sometimes they manage to do that by themselves, but at least the company can get a sense of the views.

Despite this, results season is often still full of surprises. In an era of algo trading and computers that read and digest headlines and react in lightning-speed, moves can be extreme on seemingly innocuous announcements. Remember the three-day rule too: usually after results and an emphatic move, there is a second-day effect as brokers make their pronouncement and then the third day as the institutions and the retail investors trade on the back of the results. It can be good to let the results wash through sometimes. No hurry to go against the crowd or be contrarian until the wave has passed. Missing the bottom is allowed. Getting on board a train heading in the right direction is a better outcome. Too many mixed metaphors perhaps?

What to Expect from Reporting Season

The Themes

- It is important to remember that we are looking in the rearview mirror. This is the past, the market will be focused on the future, so pay attention to guidance and outlook statements.

- We will also be looking for companies that have controlled costs and raised prices and margins. Not only to raise prices but get them to stick. Look for companies that have a strong moat or where there are few alternatives. We live in a land of duopolies and concentrated business: Coles (COL) and Woolies (WOW), Qantas (QAN) and Virgin, big four banks, Telstra (TLS) or Optus, CSR or Boral (BLD). You have little choice sometimes; it is what it is. Companies with pricing power and the ability to use it will do well.

- We may see many companies cautious about the outlook. We have seldom seen interest rates rise this quickly. We have seen them at these levels and this is more normal than zero. But the speed of the rise has the potential for the economy to overshoot on the downside, as it plays catch up. We will be looking for signs there.

- Retail companies will be closely watched. The whole sector has been sold off on warnings. It is possibly oversold and investors should remember that one retailer is not the same as another. Some will have been winners. Some have market segments that are relatively immune from consumer sentiment.

- Resource stocks will emphasise inflationary impacts on CAPEX. Labour shortages are still an issue. Production reports help guide us, but dividends will be more frugal than in the past. Delays and maintenance have been issues with some on quarterly reports. Commodity prices have not been buoyant enough or the Chinese outlook optimistic enough to warrant unbridled enthusiasm.

The Companies

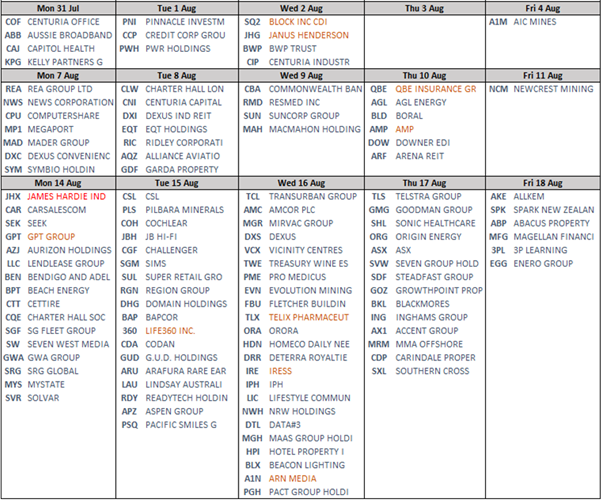

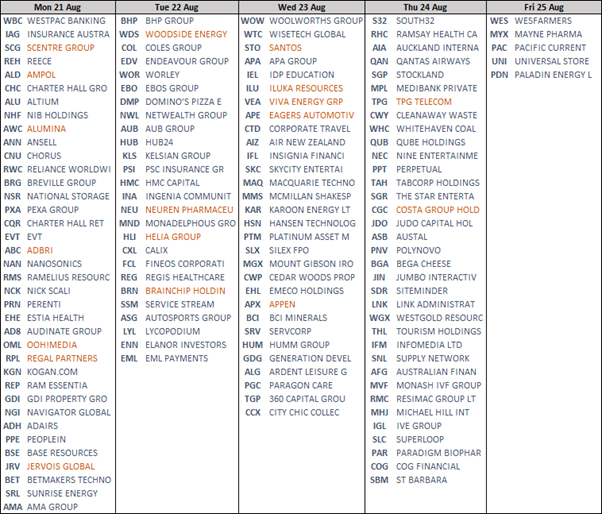

The Calendar – Best Effort basis as some can change.

If you want to confirm a results date, go to the company website and if they have confirmed, it will be on their website.

We can learn a little from the US earnings season.

- Positive earnings surprises.

- EPS, DPS and margin beats outperforming.

- Watch out for negative sales surprises.

- Margins better than expected.

- Interest costs are not as important as expected.

- Cash flows are better.

- Inventory surprises are no longer negative.

One observation is that stocks that run into the results have tended to beat expectations, however failed to fire hard after results, but ones that surprised and had been laggards, had performed post-results far better. Not really a surprise to be fair.

Expectations have been low, and so far, they have mostly been exceeded although if you miss you do so at your peril. On the ASX, the breadth of analyst downgrades is negative 14% in July after a negative 20% in June.

- Week 1 is a warm-up with Resmed (RMD) set to report and would expect to see a similar vein as past reports. The company has failed in my view to push home its advantage after the Philips recall. Consensus has been upgraded and it could well beat expectations but has done nothing for a while. Credit Corp (CCP) has already reported and from a macro perspective is good news. No signs of serious household stress. No sign at all. Few borrowers are either in arrears or default. From a CCP shareholder’s view that is a bad thing. Contrarian indicator.

- Week 2 is dominated by CBA with final numbers. And dividend. We also see QBE which should have been doing well on insurance price increases (we have all suffered from those). Boral (BLD) also should be a winner from margin increases and price stickiness. REA Group (REA) should also prove resilient given the unexpected strength in the housing market. Couple of retailers also in the spotlight, Baby Bunting (BBN) and Nick Scali (NCK) both niche markets. Could be telling on the retail sentiment though. Very oversold but is bouncing back before results.

- Week 3 things start heating up with Super Monday and Thursday. A deluge. In fact, so many that it will be hard to keep track of them and analysts will be burning the midnight oil.

- Week 4 things slow down and finish with IGO and Atlas Arterial (ALX). Flight Centre (FLT) will be interesting given its huge short position and the recent update. Travel seems to be one of the few things that we have not cut back on in the rate crunch.

You cannot escape all the surprises. It is the nature of investing that you will have risk. If you do not want any risk, then there are viable alternatives now with rates at elevated levels. Some surprises may come as pleasant, some not so. Unless you intend to sell everything before the season begins, you will suffer some slings and arrows. Focus on the horizon and try not to get caught up in the emotion of the moment. Computers will do their thing. No real investor can properly react that quickly to the news. The computers can get it wrong. Cool, calm heads and broker research after the knee jerk should help.

Expect the best, plan for the worse and prepare for the surprise. If you have done your research, and chosen well, August may prove to be more of an opportunity than a threat.

Let’s be careful out there.

A free trial of the Marcus Today newsletter for nabtrade clients is available here.

Analysis as at 3 August 2023. This information has been provided by Marcus Today (AFSL is 473383), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.