Security Alert: Scam Text Messages

We’re aware that some nabtrade clients have received text messages claiming to be from [nabtrade securities], asking them to click a link to remove restrictions on their nabtrade account. Please be aware this is likely a scam. Do not click on any links in these messages. nabtrade will never ask you to click on a link via a text message to verify or unlock your account.

Can this ASX tech stock keep rallying?

Joshua Peach | Morningstar

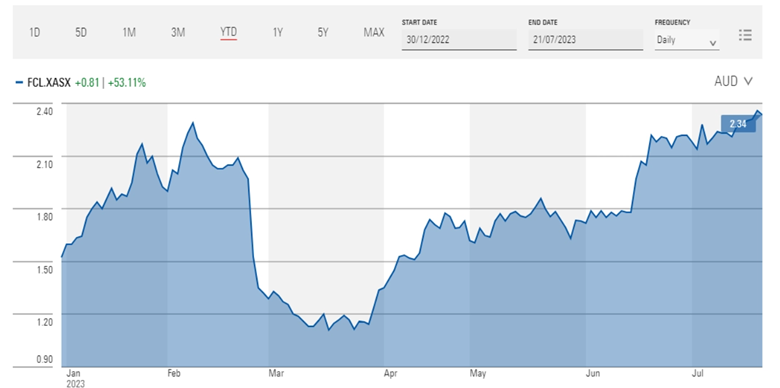

Shares in insurance software developer Fineos (FCL) have more than doubled in the last three months, rebounding following a horror 2022 performance. We recently went through a deep dive on the company on our podcast Investing Compass.

But despite the substantial year-to-date gains, there may still be meaningful upside in the Ireland -based company according to one Morningstar analyst.

The company, which was first founded in 1993, provides mission critical software for the life, accident, and health insurance industry.

Shares in the company fell by more than 60% during 2022, pulled down in part by a global tech selloff. The sector-wide sell-off was driven down by uncertain economic conditions, higher interest rates and high inflation.

However, in the first six months of 2023, tech stocks have globally rallied, with the tech-skewed Nasdaq Composite up more than 30% since the start of the year, and Fineos has rallied alongside to be up around 100% since hitting 52-week lows back in March.

Source: Firstlinks

Market 'underestimates' Fineos

Despite the major gains in the stock’s price in the last few months, Morningstar analyst Shaun Ler says Fineos remains undervalued.

“The market underestimates [Fineos’] ability to both expand margins and grow revenue,” he says.

Ler puts the market skepticism baked into the company’s share price down to a lack of near-term margin growth, relatively high reliance on revenue from services like product implementation, and slow customer acquisition rate culminated in investor pessimism, but says “these concerns are misplaced”.

“Important margin advances are underway, with continued migration of customers to the cloud, improving recurring revenue, and gradual headcount reductions.”

“Meanwhile, further product up- and cross-selling allow Fineos to capture a larger portion of customers' wallets, increasing switching costs for customers. A growing amount of case studies that showcase the value of Fineos' products to insurers also positions the firm to attract new customers.”

Further, Ler says that competition against Fineos is likely to be limited, noting that Morningstar has granted a “wide-moat” rating to the company, which denotes competitive advantages expected to fend off competition and earn high returns on capital for 20 years or more.

“For a prospective competitor, the payback period from entering Fineos' end insurance market is very long given Fineos is already established, upfront software development time and costs are significant, and the current profit pool is small.”

That said, Morningstar recently reduce its fair value estimate to $3.30 from $3.40, which Ler says incorporates Fineos' presently lower cash balance.

“We see considerable upside for long-term investors, with shares trading more than 30% below our intrinsic assessment and 60% below Fineos' long-term enterprise value/sales average and those of peers Guidewire and Duck Creek.”

Looking forward, Ler expects progressively higher software revenue from mix shift, headcount rationalisations, and cross-selling to help Fineos deliver net profits and free cash flows starting fiscal 2025.

“We forecast operating margins expanding to around 16% by fiscal 2032, from negative in fiscal 2022," he says.

“We also anticipate Fineos growing its share of the about US$10 billion in spending on external core systems software by life, accident, and health insurers to 2.3% by fiscal 2032, from 1.3% in fiscal 2022.”

Learn how the industry leaders are navigating today's market every morning at 6am. Access Livewire Markets Today.

Analysis as 2 August 2023. This information has been provided by Firstlinks, a publication of Morningstar Australasia (ABN: 95 090 665 544, AFSL 240892), for WealthHub Securities Ltd ABN 83 089 718 249 AFSL No. 230704 (WealthHub Securities, we), a Market Participant under the ASIC Market Integrity Rules and a wholly owned subsidiary of National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 (NAB). Whilst all reasonable care has been taken by WealthHub Securities in reviewing this material, this content does not represent the view or opinions of WealthHub Securities. Any statements as to past performance do not represent future performance. Any advice contained in the Information has been prepared by WealthHub Securities without taking into account your objectives, financial situation or needs. Before acting on any such advice, we recommend that you consider whether it is appropriate for your circumstances.